September And November Best Months To Own Gold

Commodities / Gold and Silver 2012 Sep 04, 2012 - 07:16 AM GMTBy: GoldCore

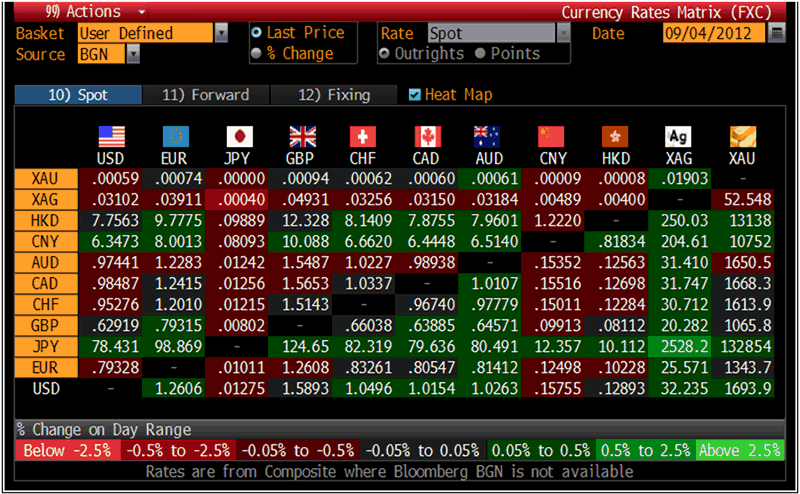

Today’s AM fix was USD 1,691.50, EUR 1,342.25, and GBP 1,067.44 per ounce.

Today’s AM fix was USD 1,691.50, EUR 1,342.25, and GBP 1,067.44 per ounce.

Yesterday’s AM fix was USD 1,686.00, EUR 1,341.72 and GBP 1,061.65 per ounce.

Silver is trading at $32.06/oz, €25.56/oz and £20.27/oz. Platinum is trading at $1,557.00/oz, palladium at $630.40/oz and rhodium at $1,025/oz.

Yesterday the markets were closed in USA for a national holiday. Gold’s PM fix yesterday in London was USD 1,691.50, EUR 1,345.45, and GBP 1,065.176 per ounce.

Gold inched up to its highest level in 5 months after poor manufacturing data from across the globe increased speculation that central banks will again vainly employ quantitative easing measures in order to prevent recessions and or depressions.

The heightened scepticism shown towards precious metals in recent months is slowly giving way to more positive sentiment and investors are diversifying into gold and the much smaller silver market to hedge against inflation and currency risks.

Hopes are high that Mario Draghi’s speech on Thursday at the ECB’s policy meeting will help solve the 3 year old debt crisis facing the euro currency bloc. These hopes are likely to again be dashed and investors are best served ignoring the central banks and bankers siren call which will again lead to a false sense of security.

Moody's Investors Service has downgraded its outlook in Europe from Aaa rating to a negative warning it may downgrade the entire region if it cut’s its rating on the EU’s 4 financiers: UK, France, Germany and The Netherlands.

This will happen – it is only a matter of time before all AAA rated government debt is downgraded as contagion deepens.

Cross Currency Table – (Bloomberg)

The increasingly positive investor sentiment towards gold is seen in the gold ETF’s growing to a record high of 71.729 million ounces on Friday. August inflows were 1.8 million ounces, up 3% and the biggest monthly rise since November.

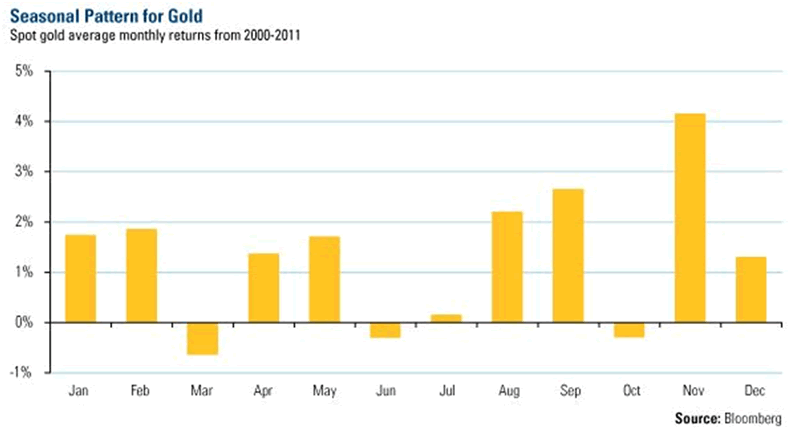

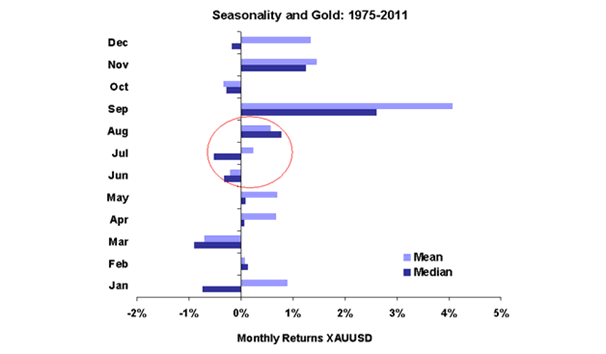

Price data on gold in recent years, from 2000 to 2011 (see chart above), and over the long term, from 1975 to 2011 (see chart above), shows that September and November are the best months to own gold.

The summer months normally see seasonal weakness and it is thus a good time to buy on the seasonal dip. Gold’s traditional period of strength is from late August into the winter and early spring and the traditional March dip.

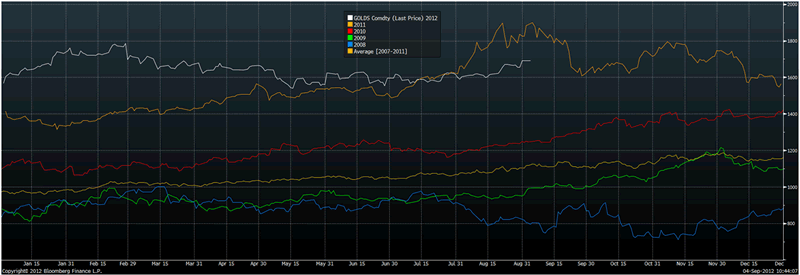

Gold's Seasonality Chart (5 Years) - Bloomberg

Gold’s seasonality is seen in the above charts which show how March, June and October are gold’s weakest months with actual losses being incurred on average in these months.

Buying gold during the so-called summer doldrums has been a winning trade for most of the last 34 years. This is especially the case in the last eight years as gold averaged a gain of nearly 14% in just six months after the summer low.

We tend to advise a buy and hold strategy for the majority of clients.

For those who have a bit more of a risk appetite, an interesting strategy would be to buy at the start of September, sell at end of September and then buy back in on October 31st.

This is obviously more risky as one will incur extra costs and risk the possibility of missing out on capital gains in October.

We caution that the monthly strength of gold in September and November while proven is not guaranteed and price falls in these months are also possible.

We also caution that a core position should always be held in gold in order to protect against the risk of currency devaluation or a systemic event.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.