Middle Class Lost Decade, Who do You Blame?

Politics / US Economy Sep 02, 2012 - 05:06 PM GMTBy: Mike_Shedlock

The Pew Research center ponders The Lost Decade of the Middle Class.

The Pew Research center ponders The Lost Decade of the Middle Class.

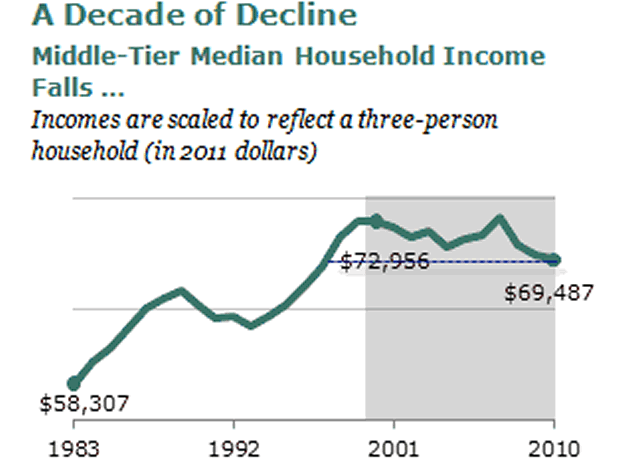

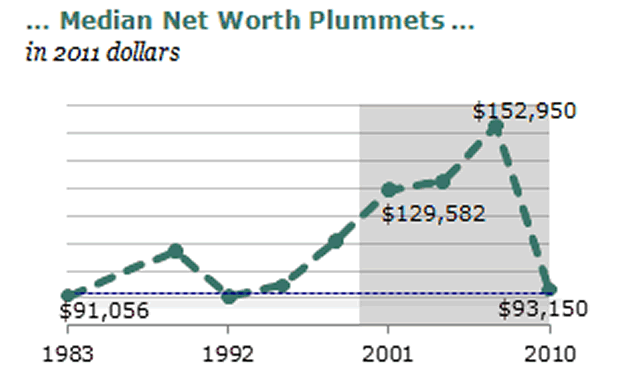

Since 2000, the middle class has shrunk in size, fallen backward in income and wealth, and shed some -- but by no means all -- of its characteristic faith in the future.

These stark assessments are based on findings from a new nationally representative Pew Research Center survey that includes 1,287 adults who describe themselves as middle class, supplemented by the Center's analysis of data from the U.S. Census Bureau and Federal Reserve Board of Governors.

Median Income

Median Net Worth

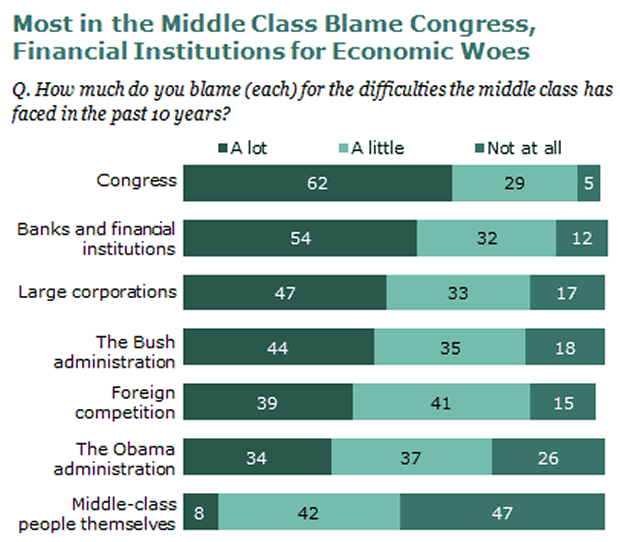

Fully 85% of self-described middle-class adults say it is more difficult now than it was a decade ago for middle-class people to maintain their standard of living. Of those who feel this way, 62% say "a lot" of the blame lies with Congress, while 54% say the same about banks and financial institutions, 47% about large corporations, 44% about the Bush administration, 39% about foreign competition and 34% about the Obama administration. Just 8% blame the middle class itself a lot.

Who Is To Blame?

Three Lost Decades!

Median net worth is back to a level first seen in the 1980s. By that measure, the US has had three lost decades. Wow.

62% Blame Politicians, Only 8% Blame Themselves

Note that 62% blame politicians and 54% blame financial institutions, but only 8% blame themselves.

Five Questions

-

Did banks force people to take out loans they could not pay back, or did people do so voluntarily?

-

Who elects congress?

-

Do people make enough effort to understand interest rates, debt, the economic policies of politicians, exponential math and its implications, the untenable nature of public union pension plans and promises?

-

Do a significant number of people (if not the majority) get their economic views (assuming they have any economic views) from The View, Oprah, The Talk, or CNBC? /li>

-

Why did PEW leave off the Fed and Fractional Reserve Lending from the list of answers?

Two Bonus Questions

-

Would the majority of respondents know anything at all about the Fed and Fractional Reserve lending had the PEW listed those options?

-

Who is really to blame for what is happening?

Read more at http://globaleconomicanalysis.blogspot.ca/2012/09/who-do-you-blame-for-woes-of-middle.html#stdpGRvdoYuHqYGF.99

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2012 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.