August 2012: Gold and Platinum Up 2.7% And 6.4% While Silver Surges 9%

Commodities / Gold and Silver 2012 Aug 31, 2012 - 06:59 AM GMTBy: GoldCore

Today’s AM fix was USD 1,657.75, EUR 1,319.03 and GBP 1,047.68 per ounce.

Today’s AM fix was USD 1,657.75, EUR 1,319.03 and GBP 1,047.68 per ounce.

Yesterday’s AM fix was USD 1,657.00, EUR 1,320.21 and GBP 1,046.48 per ounce.

Silver is trading at $30.61/oz, €24.42/oz and £19.39/oz. Platinum is trading at $1,516.00/oz, palladium at $617.00/oz and rhodium at $1,025/oz.

Gold fell $0.80 or 0.05% in New York yesterday and closed at $1,655.30. Silver hit a high of $30.90 then edged down to $30.215 and surged higher, but finished trading with a loss of 1.04%.

G10 & Precious Metals Currency Ranked Returns 1 Month (31/07/2012-31/08/2012) – Bloomberg

Gold is hovering today near the 4 ½ month high hit during the week as investors await the US Fed Chairman Ben Bernanke’s speech at 1400 GMT from the Jackson Hole Symposium.

Bullion will benefit as an inflation hedge if Bernanke announces more bond buying and additional monetary stimulus measures for the US economy. However, there is the real possibility that Bernanke merely hints at more QE again today prior to launching QE in September.

Bernanke is likely to wait for the August US jobs data due next week and use that as the reason to announce further QE and money printing measures at the Fed’s policy meeting on September 12-13.

Bernanke merely hinting at such measures today could result in a bout of risk off that sends equities lower and the precious metals lower – in the short term.

Gold has been gradually trending higher over the traditionally weak summer months. It is on track for a nearly 3% gain in August (see table above), continuing its 3rd consecutive month of gradual gains. This sets gold up for a strong few months ahead in the traditionally stronger autumn months.

Silver surged 9% in August and is also well positioned for the autumn months when it tends to move higher with gold. The gold silver ratio at 53 remains favourable to silver and we believe it could revert to levels closer to 30 again in the coming weeks and again outperform gold.

Combine an inflation adjusted high gold at $2,400/oz by a gold silver ratio of 30 to 1 and one gets a silver price of $80/oz which remains quite possible in 2013.

The mining tragedy and ongoing serious difficulties in the mining sector in South Africa saw platinum rise 6.4% while palladium was 4.8% higher.

The Norwegian krone was the strongest fiat currency in August while the Aussie and Kiwi dollars and Japanese yen all came under pressure.

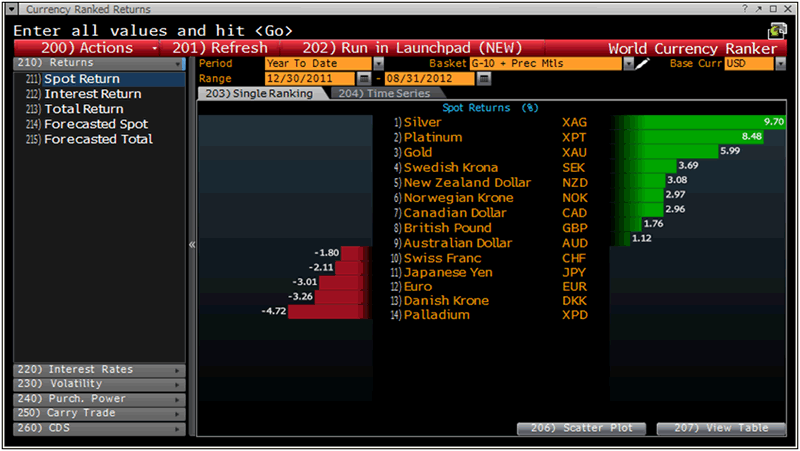

G10 & Precious Metals Currency Ranked Returns YTD (30/12/2011-31/08/2012) – Bloomberg

August strong gains for the precious metals mean that gold, silver and platinum are now respectively 6%, 9.7% and 8.5% higher year to date.

Palladium remains the laggard and remains down 4.7% year to date.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.