Republicans Take Aim at Bernanke, Fed’s QE Policy is on the Chopping Block

Politics / Quantitative Easing Aug 31, 2012 - 03:06 AM GMTBy: Gary_North

Politicians running for the US Presidency, and their surrogates, are fond of saying “that this election is the most important of our lifetime.” They invoke this cliché so reflexively and so often that it no longer has any meaning. The reason they say this election is so important is because they want listeners to believe, for whatever reason, that it pits two deeply contrasting visions for America against one another, with only one vision capable of winning.

Politicians running for the US Presidency, and their surrogates, are fond of saying “that this election is the most important of our lifetime.” They invoke this cliché so reflexively and so often that it no longer has any meaning. The reason they say this election is so important is because they want listeners to believe, for whatever reason, that it pits two deeply contrasting visions for America against one another, with only one vision capable of winning.

At their core, US-elections are simply fought over the competing interests of just two political parties, - the Democrats and Republicans that control the political system, with a seemingly unbreakable monopoly. Each side wants to tinker with regulations, spending, and taxes to influence the economy; and pay rewards to their constituents. But the truth is, politicians of both parties are corrupted by financial contributions to their election campaigns. It leads to an unfair playing field, in which big Business gets even bigger, through mergers and acquisitions, and overseas operations, and leaves US-consumers at their mercy. Today, only half of US-households are paying taxes, and the other half is receiving entitlements. The US-economy is at the tipping point of collapse, similar to bankrupted states such as Greece and Spain.

The Federal Reserve has stepped into the breach, trying to bridge the divide between a deeply polarized US-government that’s paralyzed on fiscal policy and a fragile US-economy, that’s teetering on the brink of a “double-dip” recession. In doing so, the Fed has essentially become the fourth branch of the US-government, and its interfering with the natural workings of the financial markets. Under the guise of the President’s Working Group on the Financial Markets, (aka the “Plunge Protection Team”), the Fed has adopted the most intrusive and interventionist stance in the US-capital markets in its history. Over the course of the past 3-½-years, the Fed has ruled over the US-capital markets with an iron fist, and is erasing the mantra of “Free Markets for Free Men.” Sadly, the US’s long-held tradition of “laissez-faire” (leave it alone) has been dumped into the trash bin of history.

Today, traders must operate under new rules of engagement, and the first question of the day is, what intervention tactics does the Fed have up its sleeve, and when is it planning to unveil its next move? “Quantitative Easing,” “Operation Twist,” and the “Zero Interest Rate Policy” (ZIRP), has become the “New Normal” on Wall Street. Furthermore, the invisible hand of the Fed is controlling the behavior of the capital markets and at the same time, increasing the US-government’s control over the US-economy.

With the polls showing a dead even race, the Republican challenger Mitt Romney, in unusually blunt terms, has warned the Fed to stay politically neutral ahead of the Nov 6th election, and avoid any radical actions that could influence its outcome. “I don't think QE-2 was terribly effective. I think a QE-3 and other Fed stimulus is not going to help this economy,” Romney told Fox News on August 23rd. “I think that is the wrong way to go. I think it also seeds the kind of potential for inflation down the road that would be harmful to the value of the dollar and harmful to the stability of our nation's needs,” Romney said. The Global Money Trends newsletter holds the opinion, that the Fed would pay heed to Romney’s public warning, and seek delay the launching of QE-3 until after Nov 6th.

At the upcoming Nov 6th election, there’s a last chance opportunity for US-voters to reverse the tide towards greater government control over the financial markets. Instead, voters can overthrow the Fed’s ruthless dictatorship and restore the tradition of “Free Markets for Free Men and Women.” The Republican ticket of Mitt Romney & Paul Ryan ticket, has publicly declared its support for a House bill, championed by Texas Congressman, Ron Paul that would authorize a forensic audit of the Fed’s balance sheet, and reveal its clandestine intervention tactics. For the first time, traders could learn about what’s goes on behind closed doors at the secretive Fed. “Doing an accounting of the Federal Reserve, finding out where the money’s coming and where it’s going is not a bad thing for our country,” said Reince Priebus, GOP chief, on August 26th. If true, traders could celebrate the return of free markets.

On August 23rd, in very blunt terms, Romney indicated that the first step towards restoring the rules of free markets would include some house cleaning at the Fed. Romney said he would fire Fed chief Bernanke. “I would want to select someone new and someone who shared my economic views” to the top spot at the US-central bank. “I want someone to provide monetary stability that leads to a strong dollar and confidence that America is not going to go down the road that other nations have gone down, to their peril,” Romney added. His sidekick, Paul Ryan doubled down on the idea of dumping Bernanke, and his radical QE policies, summarizing his viewpoint in just two words: “Sound Money.” “We want to pursue a sound-money strategy so that we can get back the King Dollar,” Ryan said.

Nowadays, the Fed has been stacked with hard core, addicted money printers, whose first knee jerk reaction to any sign of a rough patch in the economy, or a -5% pullback in the stock market, is to issue threats to the media, that another round of nuclear QE could soon be on its way. While the Republicans want to strip the Fed of its dual mandate, and simply have it focus on fighting inflation, the Bernanke Fed and the Obama White House have quietly adopted a third mandate- - to artificially inflate the value of the stock market, through the power of the printing press, and the rigging of long-term bond yields.

Overhauling the Fed, For advocates of free markets, and less government intervention - auditing the Fed’s activities would be a huge step in the right direction. Sacking Fed chief Ben Bernanke and installing a new Fed chief that pursues a sound US-dollar policy, would have a profound impact on the outlook for the US-capital markets, and by extension, would ripple across the world markets, including commodities and precious metals. Last week, Mr Ryan spoke with CNBC’s Larry Kudlow, and said he wants to eliminate crony capitalism and corporate welfare in the tax code. Auditing the Fed would break-up the nexus of crony capitalism that exists between the Fed and its partners, - the Wall Street Oligarchs.

A Romney – Ryan victory on Nov 6th is expected to trigger an audit of the Fed’s clandestine activities. It would also bring a halt to the Fed’s secretive intervention forays in the stock index futures markets that are designed to prevent natural market corrections from morphing into grizzly Bear market slides. It’s called the “Bernanke Put,” and risk takers in the stock market rely on the Fed’s timely purchases of stock index futures, that provide a safety net for speculators, when risky bets go sour, due to unexpected negative news.

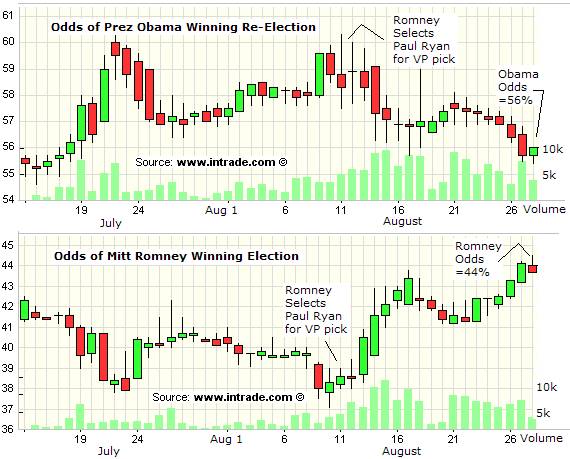

However, the Fed’s worst fears would only materialize, if the Romney – Ryan ticket prevails on Nov 6th. On August 27th – a poll published by Gallup showed Romney holding a slim 1-point lead, but Obama’s approval rating sinking to a dangerously low 43%. Yet the online bettors at Intrade.com have a different view, and give Obama a 56% chance of winning re-election, with Romney’s odds at winning at 44%. Still, since Romney picked Ryan as his VP on June 11th, Obama’s lead over Romney has almost shrunk in half, from �points to �points today.

An August 27th USA Today/Gallup poll of about 1,000 adults found that 58% expect Obama to be re-elected while just 36% think he will lose to Romney. The new poll also showed that 86% of Obama’s supporters expect him to win compared to 9% who expect him to lose, while just 65% of Romney’s supporters think he will win and 28% think he will lose. Pollsters say voter expectations are often skewed toward incumbents because they typically win reelection. Still, Romney has better odds of winning in the gambling parlors, since the same polls show that 2/3’s of voters say the US-economy is heading in the wrong direction, and that a clear majority of independents, say Romney is more capable to fix the economy. Yet polling data should be measured against a grain of salt, since it’s often used by media outlets that seek to form public opinion rather than to properly gauge it.

Over the past 14-months, Obama’s odds at winning re-election have mostly mirrored the direction of the Dow Jones Industrials. Since the pick of Ryan, Obama’s odds at winning have dropped -4-points to 56%, even though the Dow Industrials have held steady above the 13,000-level. That reveals a small sea change in bettors’ psychology. However, the US-stock market was a ghost town this summer, with trading volumes eerily shrinking to an average of just 5.5-billion shares per day, or -48% less than a year ago. In thinly traded markets, it’s easier for the Fed to artificially prop-up the stock markets’ value.

There’s a very wide disconnect between the euphoria on Wall Street, and its buoyant stock markets, and the general public’s dire outlook of a stagnant US-economy. According to pollsters, two thirds of Americans think the US-economy is still stuck in the Great Recession, and is headed in the wrong direction. Only 31% say it is moving in the right direction - the lowest number since December 2011. The dire outlook is explained by a recent analysis by the US Census Bureau and Sentier Research LLC, indicating that US-household incomes actually declined more in the 3-year expansion that started in June 2009 than during the longest recession since the Great Depression.

Median US-household income fell -4.8% on an inflation- adjusted basis since the recession officially ended in June 2009. That’s more than the -2.6% drop during the 18-month “Great Recession.” After the dust has settled, US-household income is still -7.2% below the December 2007 level. “Almost every group is worse off than it was three years ago, and some groups had very large declines in income,” the Census Bureau’s income and poverty statistics program, said. “We’re in an unprecedented period of economic stagnation.”

Although, Americans are increasingly pessimistic about the future, many voters don’t seem to be holding it against Democrat Obama. Instead, the embattled president is getting some slack because he inherited a very tough situation. In fact, Obama’s strongest base supporters are among also suffering the highest jobless rates and highest poverty rates in the country. Yet they conventional continue to buck conventional logic. Beyond Obama’s core of political support, many independents are under the spell of the Fed’s bag of magic tricks.

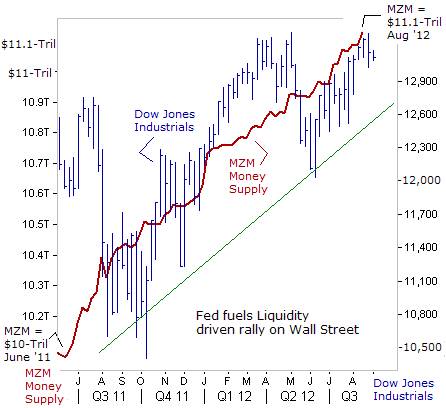

Over the past 14-months, the Fed has fueled the third leg of a liquidity driven rally on Wall Street, that’s catapulted the Dow Jones Industrials to a 4-year high, above the 13,000-level. The Fed has kept the stock market buoyant, by increasing the MZM money supply to a record high of $11.1-trillion today. The S&P-500 blue-chips continue to defy the law of gravity, largely due to the Fed’s radical money policies, even though growth in US-company earnings began to sputter out in the second quarter, falling -5% compared with a year ago.

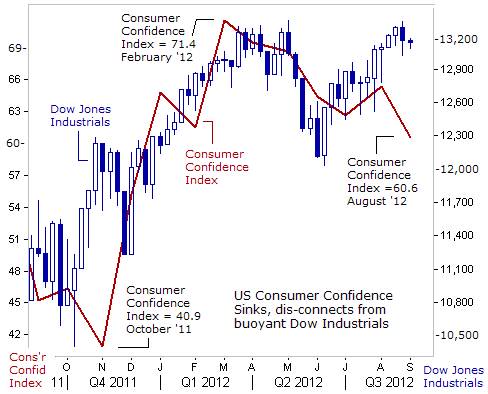

Historically, gyrations in the stock market have been a key driver influencing US-consumer confidence. However, since February, US-consumer confidence has been eroding, even though the Dow Industrials have stayed buoyant. Earlier this week, a survey of consumer confidence, taken by the Conference Board showed a drop to a reading of 60.6 in August, down sharply from 65.4 in July. The 4.8-point slide was the biggest monthly decline since October. Some 52% of Americans say jobs are not plentiful. Most ominously, expectations for the health of the US-economy over the next six months plunged to a reading of 70.5, from 78.4 in July. Rising gasoline and food prices, a U-6 jobless rate that’s hovering at 15%, combined with limited wage gains are keeping consumers glum.

A further pullback in household spending and could tip the fragile US-economy into a “double dip” recession in the months ahead. Still, the Fed’s radical monetary schemes are keeping the stock market afloat, in thinly traded conditions. Traders are so addicted to the hallucinogenic QE-drug that they downplay the sharp downturns in Asian and European economies that are likely to weaken S&P-500 earnings by about -1.5% compared with a year ago, - the first quarterly decline in 3-½ years. Tellingly, psyched-out traders are scared to death of being out of the stock market should the Fed announce the launching of QE-3. Nowadays, stock prices jump higher when negative news on the US-economy hits the wire, because traders reckon that bad news boosts the chances of more Fed intervention.

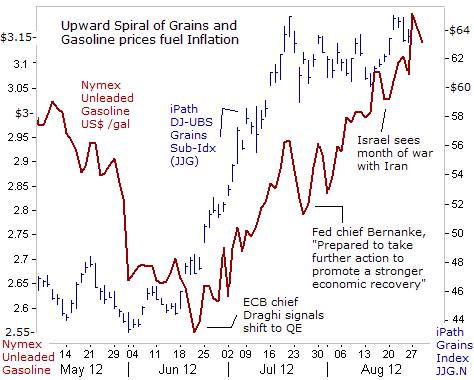

QE fuels Commodity Inflation, The launching QE-3 could backfire on the Fed and its political masters, if it ignites further big price increases in the grains and energy sectors. Ninety percent of Americans own very little or no shares of stocks at all, and wouldn’t benefit from QE-3, but would get stuck paying for the negative side-effects - sharply higher costs for the basic staples of life, - energy and food prices. That’s especially true for lower income wage earners in China, India, and many Middle Eastern nations, that spend more than half of their income on food and energy. Devastating droughts in the United States and Russia are already set to drive global stocks of corn and wheat to multi-year lows. Launching QE-3 could ignite a global food price crisis on a scale last seen in 2008.

Corn prices have jumped above $8 /bushel, and soybeans above $17 /bushel, amid the third hottest and driest summer in the seven major producing US-states since 1895. Only 22% of the US-corn crop and 30% of the soybean crop is rated good to excellent, - the worst since 1988. That’s catapulted the iPath Dow Jones Grains index (ticker symbol JJG.N), which includes the three top US-grains, +50% higher since June 4th. Sharply higher grain prices also increases the cost of raising livestock and poultry, and distilling ethanol.

At the same time, gasoline prices have surged 60-cents /gallon higher, from above their June 22nd lows, fueled by threats of war in the Persian Gulf and more importantly, central banks threatening to unleash new rounds of nuclear QE. Nationally, the average US-gasoline price has risen to $3.78 per gallon, the costliest year ever at the pump in the month of August, with little relief through Labor Day. Still, the radical extremists at the Fed want to pour even more fuel on the flames of inflation. On August 27th, Chicago Fed chief Charles Evans urged the Fed to begin buying unlimited amounts of Treasury bonds, until the US-jobless rate declines for at least six months. Evans believes that printing vast quantities of money can create jobs, and gives little thought to the deleterious impact of squeezing consumer’s disposable income.

However, Obama’s approval rating could take a serious hit, if the national average price of gasoline approaches $4 /gallon, as a result of QE-3. Recognizing this threat, the Obama administration has already sent signals to the marketplace, that’s it’s preparing to release crude oil from the US’s Strategic Petroleum Reserve (SPR) in the month of September, in order to put a lid on the price of gasoline between now and Election Day.

Bank of England Plays the QE Card, - In England, the “free trade” mantra and “non-interference” slogan were first coined during the 17th century. The French phrase “laissez faire” started to gain popularity in English-speaking countries in the late 18th century. In Britain, in 1843, the newspaper The Economist was founded and became an influential voice for laissez-faire capitalism. However, since March of 2009, the Bank of England (BoE) has been trampling on the tradition of laissez faire, and instead, is following the same blueprints that’s utilized by the Fed, and the Bank of Japan, - the original pioneer of QE.

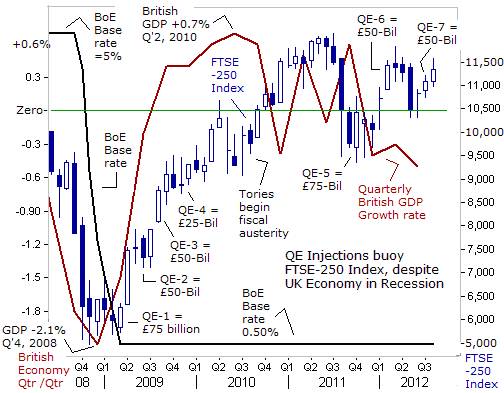

The British economy has been in recession for much of the past four years. Like much of the world, it suffered a deep 18-month contraction during the financial crisis. That ended in Q’4 of 2009. Since then, Britain’s GDP has fallen in five of the last seven quarters. Between April and June of this year, - the UK-economy shrank -0.5%, and follows a -0.3% contraction in the first quarter and -0.4% in Q’4 of 2011, - meaning it’s contracted for nine straight months. Output is still -4.5% below its pre-crisis peak in the first quarter of 2008, and -0.9% below its level in Q’3 of 2010, when the Conservative coalition government began its fiscal austerity plan.

However, even though the UK-economy is suffering through a mild recession, the UK’s Footisie-250 Index, including smaller companies that earn their revenue in the local economy, wasn’t negatively impacted by the economic downturn. Instead, the FTSE-250 index divorced itself from the traditional script of Macro-Economic thinking, and climbed +10% higher since the start of Q’4 of 2011. London traders have put their faith in BoE chief Mervyn King, who publicly says the central bank will do whatever it takes to pull the UK-economy out of recession, signaling further purchases of Gilts, using freshly printed British pounds.

On July 5th, the BoE launched its seventh installment of QE that will inject a further £50-billion into the London money markets, thus adding to the £325-billion already swirling in the marketplace. If nothing else, QE-7 is designed to artificially boost the value of the local stock market and keep government borrowing costs near historic lows, through a scheme known as “financial repression.” “It’s fair to say that we haven’t done enough,” King said on August 6th, referring to QE. “I don’t accept the argument that asset purchases are having a diminishing effect.” King underscored his determination to boost the UK-economy, saying the central bank “will continue to do all it can to bring about a recovery.”

On August 26th, the BoE admitted that the biggest winners under its QE-schemes are the top-5% of the richest Britons that own 40% of the UK’s financial assets, - while it failed to prevent a “double-dip” recession for the general public. Pumping £375-billion into the London money markets since March 2009 has delivered an estimated windfall profit of £870-billion to the wealthiest 10% of British households, while the poorest 10% of households gained only £3.5-billion. Thus, the wealthiest 10% of British households gained an average of £350,000 each from QE, while the poorest gained an average of £1,400, or 240-times less.

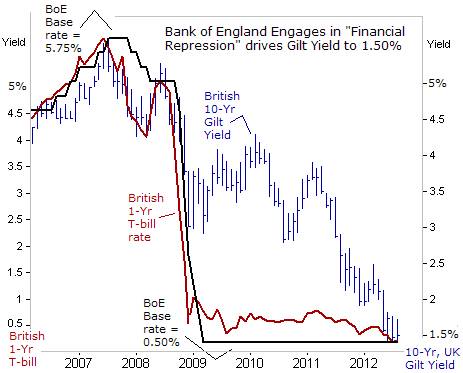

The Bank of England is engaging in financial repression, by keeping short-term interest rates locked near 0.50%, and driving 10-year Gilt yields towards 1.50%, a historic low. Locking these interest rates below the official rate of inflation hasn’t energized the UK-economy, because wealthier UK-households have lower propensity to spend their capital gains. Still, on August 28th, Adam Posen, a member of the BoE, called for the Trans-Atlantic central banks, - the Fed, the European Central Bank (ECB), and BoE to up the ante even higher, by launching another coordinated round of QE in the weeks ahead. “It could be very effective and the Fed should act as if there was no election. If the world is in slowdown, they should be trying to stimulate demand at home,” Posen said.

On August 28th, Senator Bob Corker (R-Tenn.) blasted Fed chief Ben Bernanke, in a Financial Times op-ed, and sending a message that the Republicans want to the Fed to stay on the sidelines, during the upcoming election campaign. “We must demand a Fed that serves as a utility institution in our economy, and not an enabler of some perverse financial system addiction. It would be helpful to have a Fed chairman who acted with a greater sense of humility about what monetary policy can achieve. Mr. Bernanke’s comfort with managing long-term interest rates and his unwillingness to stand up and say that there are limits to what monetary policy can accomplish is disturbing, to say the least. The Fed’s asset purchase programs have empowered runaway spending by the federal government, hurt savers and forced investors to hunt for yield in asset classes to which they are not suited,” Corker writes. It’s a stern message that the Fed chief isn’t expected to ignore, especially if the polls are tight, and show that Romney – Ryan have a chance to win the keys to the White House.

Unfortunately, the Americans and the Brits have strayed far from their free market principles. Central banking has turned into central planning, from smoothing the business cycle to micro-managing the daily gyrations in the stock markets, to financial engineering the level of interest rates. Nowadays, the Fed is most concerned about the next 100-point move in the Dow Industrials. Price discovery in the stock market is no longer a function of the opinions of millions of individual investors, but rather is dictated by the central bank.

On November 6th, the fate of the Bernanke Fed and its radical QE-scheme is on the chopping block, and the scope of government control over the US-financial markets is on the ballot.

This article is just the Tip of the Iceberg of what’s available in the Global Money Trends newsletter. Subscribe to the Global Money Trends newsletter, for insightful analysis and predictions of (1) top stock markets around the world, (2) Commodities such as crude oil, copper, gold, silver, and grains, (3) Foreign currencies (4) Libor interest rates and global bond markets (5) Central banker "Jawboning" and Intervention techniques that move markets.

By Gary Dorsch,

Editor, Global Money Trends newsletter

http://www.sirchartsalot.com

GMT filters important news and information into (1) bullet-point, easy to understand analysis, (2) featuring "Inter-Market Technical Analysis" that visually displays the dynamic inter-relationships between foreign currencies, commodities, interest rates and the stock markets from a dozen key countries around the world. Also included are (3) charts of key economic statistics of foreign countries that move markets.

Subscribers can also listen to bi-weekly Audio Broadcasts, with the latest news on global markets, and view our updated model portfolio 2008. To order a subscription to Global Money Trends, click on the hyperlink below, http://www.sirchartsalot.com/newsletters.php or call toll free to order, Sunday thru Thursday, 8 am to 9 pm EST, and on Friday 8 am to 5 pm, at 866-553-1007. Outside the call 561-367-1007.

Mr Dorsch worked on the trading floor of the Chicago Mercantile Exchange for nine years as the chief Financial Futures Analyst for three clearing firms, Oppenheimer Rouse Futures Inc, GH Miller and Company, and a commodity fund at the LNS Financial Group.

As a transactional broker for Charles Schwab's Global Investment Services department, Mr Dorsch handled thousands of customer trades in 45 stock exchanges around the world, including Australia, Canada, Japan, Hong Kong, the Euro zone, London, Toronto, South Africa, Mexico, and New Zealand, and Canadian oil trusts, ADR's and Exchange Traded Funds.

He wrote a weekly newsletter from 2000 thru September 2005 called, "Foreign Currency Trends" for Charles Schwab's Global Investment department, featuring inter-market technical analysis, to understand the dynamic inter-relationships between the foreign exchange, global bond and stock markets, and key industrial commodities.

Copyright © 2005-2012 SirChartsAlot, Inc. All rights reserved.

Disclaimer: SirChartsAlot.com's analysis and insights are based upon data gathered by it from various sources believed to be reliable, complete and accurate. However, no guarantee is made by SirChartsAlot.com as to the reliability, completeness and accuracy of the data so analyzed. SirChartsAlot.com is in the business of gathering information, analyzing it and disseminating the analysis for informational and educational purposes only. SirChartsAlot.com attempts to analyze trends, not make recommendations. All statements and expressions are the opinion of SirChartsAlot.com and are not meant to be investment advice or solicitation or recommendation to establish market positions. Our opinions are subject to change without notice. SirChartsAlot.com strongly advises readers to conduct thorough research relevant to decisions and verify facts from various independent sources.

Gary Dorsch Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.