U.S. 2012:Q2 GDP Growth Upward Revision Reflects Stronger Final Sales

Economics / US Economy Aug 30, 2012 - 05:26 AM GMTBy: Asha_Bangalore

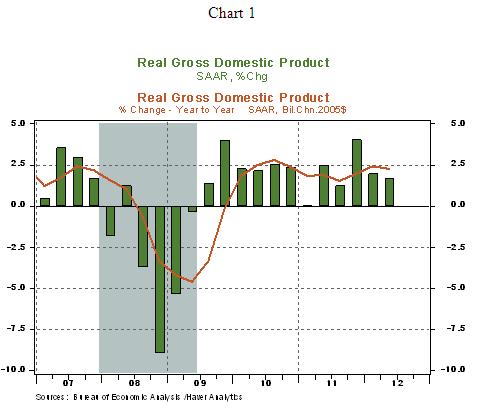

The real gross domestic product of the US economy grew at annual rate of 1.7% in the second quarter, slightly higher than the original estimate of a 1.5% increase. Stronger growth in consumer spending, a smaller trade gap, and an upward revision of government outlays more than offset reductions in business investment outlays and residential investment expenditures to result in a higher estimate of GDP for the second quarter. As a result of the revisions, final sales increased at an annual rate of 2.0% in the second quarter, previously reported as a 1.2% gain. (Details of GDP data are available here).

The real gross domestic product of the US economy grew at annual rate of 1.7% in the second quarter, slightly higher than the original estimate of a 1.5% increase. Stronger growth in consumer spending, a smaller trade gap, and an upward revision of government outlays more than offset reductions in business investment outlays and residential investment expenditures to result in a higher estimate of GDP for the second quarter. As a result of the revisions, final sales increased at an annual rate of 2.0% in the second quarter, previously reported as a 1.2% gain. (Details of GDP data are available here).

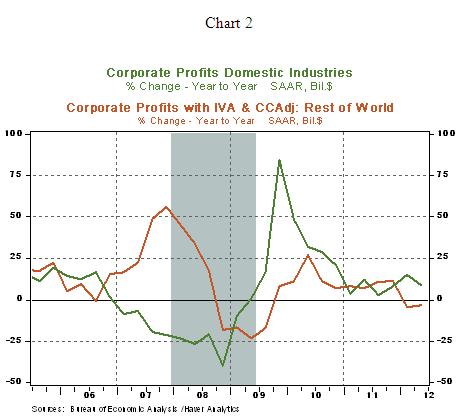

Today’s report includes corporate profits for the second quarter, which moved up 0.5% on a quarter-to-quarter basis reversing the decline seen in the first quarter (-2.7%). The trend growth of corporate profits appears to have settled in the single-digit range (+6.1% in 2012:Q2) driven by operations of domestic firms. Corporate profits from the rest of the world fell 3.3% from a year ago but they eked out a gain on a quarterly basis (+4.8%).

Going forward, real GDP is projected to grow around 2.0% in the second-half of the year, matching the performance seen in the first-half of the year. This sub-par pace of economic growth has held back hiring in the economy. Bernanke’s speech on August 31 is expected to address whether additional monetary policy changes could steer the economy toward a stronger momentum and lift employment.

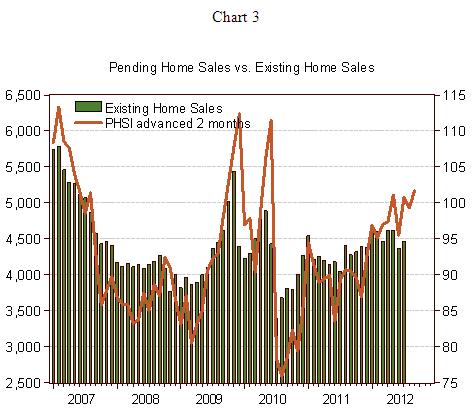

In related economic news, the latest Pending Home Sales Index (PHSI) of the National Association of Realtors supports expectations of an increase in home sales in the August-September period as it is a leading indicator. The PHSI of July moved up 2.4% after a 1.4% decline in June. Bernanke’s remarks on the housing sector in the upcoming speech will be insightful given that recent housing sector data point to improving conditions.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2012 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.