Will History View ECB's Drahgi as the Currency Forger of Europe?

Commodities / Gold and Silver 2012 Aug 27, 2012 - 07:46 AM GMTBy: GoldCore

Today the London Bullion Market is closed for a national holiday.

Today the London Bullion Market is closed for a national holiday.

Friday’s AM fix was USD 1,666.50, EUR 1,329.16 and GBP 1,051.88 per ounce.

Silver is trading at $30.91/oz, €24.77/oz and £19.62/oz. Platinum is trading at $1,550.00/oz, palladium at $647.90/oz and rhodium at $1,025/oz.

Gold climbed $0.80 or 0.05% in New York on Friday and closed at $1,669.80. Silver surged to as high of $30.71 and finished with a gain of 0.52%. On the week gold climbed 3.3% and silver gained a whopping 9.3%.

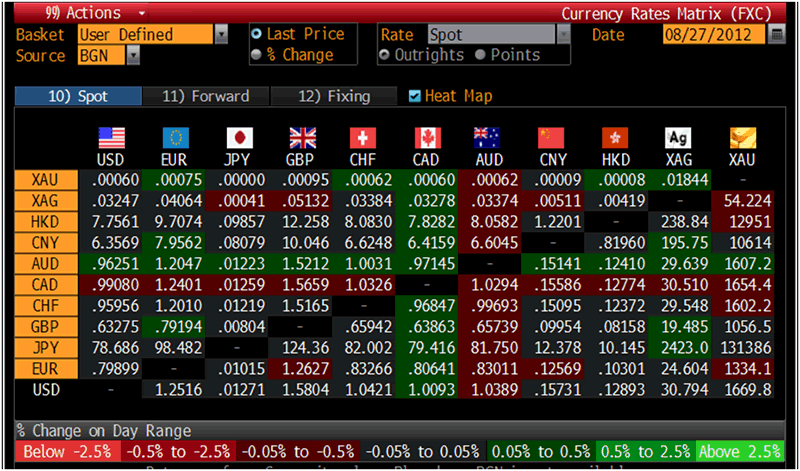

Cross Currency Table – (Bloomberg)

Gold hit a high not seen since mid April on Monday, continuing the momentum from last week’s gains as investors expect further monetary stimulus from central banks and become increasingly concerned about inflation.

Consumer price inflation data in the US is due Friday and is expected to move higher on higher fuel and food costs.

There may be more hints of further cheap money from the Jackson Hole Symposium later this week as finance chiefs gather to discuss economic policy behind closed doors.

Monetary risk remains high especially in the euro zone after Jens Weidmann, head of the Bundesbank, sent a shot across the bows of the ECB’s Draghi and likened the mooted ECB bond-buying plans to a dangerous drug.

Merkel praised Weidmann for speaking out about his doubts and said she saw strong Bundesbank influence within the ECB as positive. But she took care not to voice any support for his criticism of Draghi's policies.

Weidmann rejected suggestions that he was isolated on the ECB Governing Council in having such reservations. "I hardly believe that I am the only one to get a stomach ache over this," he said.

Alexander Dobrindt, a senior German politician who has been the Executive Secretary of the Christian Social Union of Bavaria since 2009, was more direct, saying Draghi risked passing into the history books as the "currency forger of Europe".

A conservative ally of Merkel, Dobrindy echoed Bundesbank’s Weidmann that Greece should leave the currency bloc by next year.

The comments show the huge divisions in Germany over the debt crisis now in its 3rd year and the understandable concerns of inflation and even hyperinflation.

The Bundebank and senior politicians and allies of Merkel may thwart Mario Draghi’s big plans to do “whatever it takes” to solve Europe’s financial collapse.

One way or another, the euro is certain to fall in value in the long term.

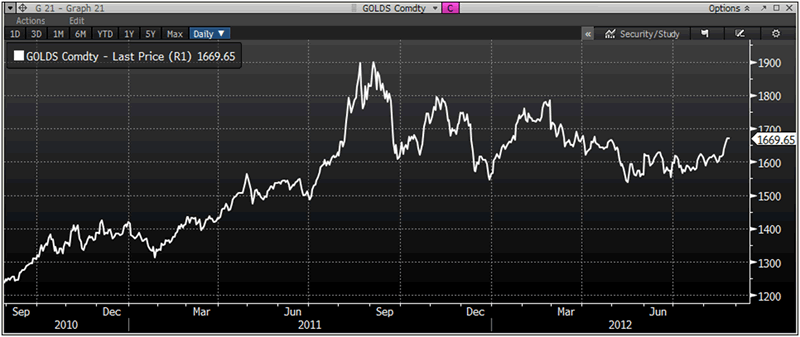

Gold in USD 2 Years – (Bloomberg)

As was pointed out by Merryn Somerset Webb at the weekend (see commentary) the euro has defied negative commentary but the question is for how much longer.

The fundamentals of the euro are appalling – just to keep eurozone broad money supply from contracting alone will take a whopping €3 trillion.

“The euro is clearly a bad currency by any definition.” While some fund managers advocate shorting the euro, we believe this is a high risk strategy for investors as in the short term the euro could stage a strong rally – should for example Grexit happen. A ‘core euro’ could and would likely become stronger.

Therefore, investors and savers best way to protect against a fall in the value of the euro and indeed other fiat currencies is to have an allocation in physical gold.

US economic data published this week follows. Today is the Chicago Midwest manufacturing index for July at 1230 GMT. Tuesday is the Case-Shiller 20-city Index and Consumer Confidence. Wednesday is GDP, Pending Home Sales, and the Fed’s Beige Book. Thursday is Initial Jobless Claims, Personal Income & Spending, and Core PCE Prices. Friday is Chicago PMI, Michigan Sentiment, and Factory Orders.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.