Gold and Silver ‘Perfect Storm’ As MSGM Risks Align

Commodities / Gold and Silver 2012 Aug 24, 2012 - 05:41 AM GMTBy: GoldCore

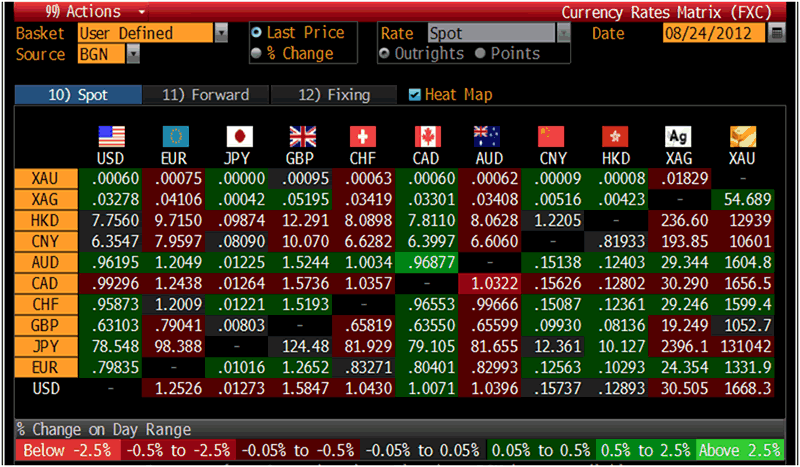

Today's AM fix was USD 1,666.50, EUR 1,329.16, and GBP 1,051.88 per ounce.

Today's AM fix was USD 1,666.50, EUR 1,329.16, and GBP 1,051.88 per ounce.

Yesterday’s AM fix was USD 1,662.50, EUR 1,324.07and GBP 1,047.57 per ounce.

Silver is trading at $30.37/oz, €24.36/oz and £19.25/oz. Platinum is trading at $1,541.00/oz, palladium at $642.50/oz and rhodium at $1,025/oz.

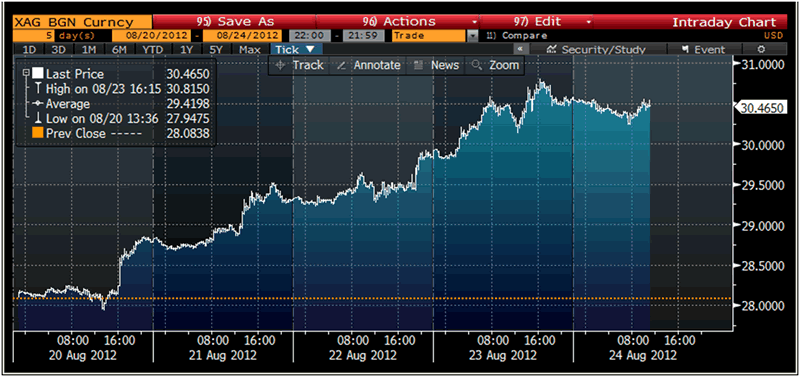

Gold climbed $14.60 or 0.88% in New York yesterday and closed at $1,669.40. Silver surged to a high at $30.81 and finished with a gain of 2.28%. The precious metals have broken out this week with sharp gains being seen in all four precious metals.

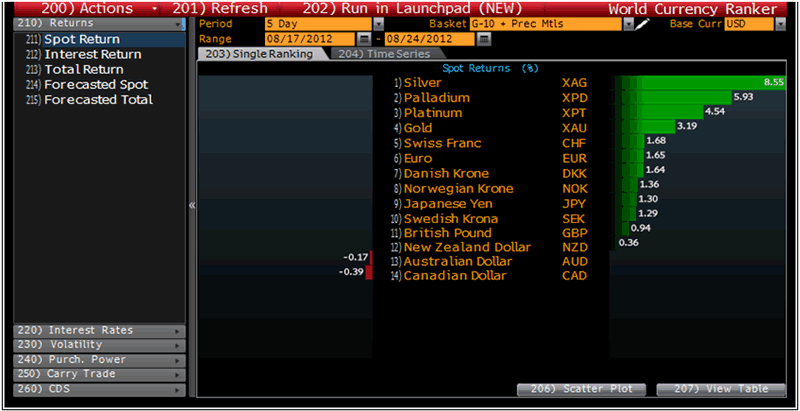

Silver as expected led the gains and surged 8.55% in the week, palladium is up 6%, platinum 5% and gold up 3%.

Currency Ranked Returns – (Bloomberg)

Gold gave back some gains on Friday but it’s still set for its biggest weekly rise in more than 2 months due to the very strong fundamentals.

Today, US durable goods orders are published at 1230 GMT and weakness would confirm weakness in the US economy and should lead to further safe haven demand for gold.

The European Central Banker is fighting to save the European fiscal union and quantitative easing seems certain in Europe. Investors will wait to see if central bankers are coordinating their efforts and announce further QE at the same time.

Reuters reported increased demand for bullion in Hong Kong with one bullion dealer reporting “purchases by investors in the physical market.”

There are even signs of a pickup in physical demand in India with strong buying being done by stockists ahead of the busy marriage season.

The use of the term “perfect storm” by market participants is a bit clichéd and over used at this stage however it is appropriate with regard to looking at the fundamentals driving the precious metal markets and particularly gold and silver.

GoldPrices in Dollars – (Bloomberg)

All of the recent focus has been on the Fed and the will it or won’t it engage in QE3 saga. Many of us said long ago that some form of QE on a significant scale is inevitable. However, it is important to realise that the Fed is just one factor driving precious metals higher.

The Fed is not the be all and end all and while the Fed can jaw bone and manipulate prices higher and lower in the short and medium term - in the long term the free market and forces of supply and demand will dictate prices.

Silver Prices in Dollars – (Bloomberg)

There is a frequent tendency to over state the importance of the Fed and its policies and ignore the primary fundamentals driving the gold market which are what we have long termed the ‘MSGM’ fundamentals.

As long as the MSGM fundamentals remain sound than there is little risk of gold and silver’s bull markets ending.

What we term MSGM stands for macroeconomic, systemic, geopolitical and monetary risks.

The precious metals medium and long term fundamentals remain bullish due to still significant macroeconomic, systemic, monetary and geopolitical risks.

a) Macroeconomic risk is seen in the risk of recessions in major industrial nations with much negative data emanating from the debt laden Eurozone, UK, Japan, China and U.S. in recent days.

It remains difficult to pinpoint the nature of the coming recessions and possibly a Depression and whether it will be deflationary, inflationary, stagflationary or the less likely but possible none the less ‘Black Swan’ of hyperinflation.

Deflation remains the primary concern of most policy makers, politicians, bankers and investors.

However, the risk of deflation is a short term one and the monetary policy response or M means that various forms of inflation remain the medium and long term threat.

b) Systemic risk remains high as little of the problems in the banking and financial system have been properly addressed and there is a real risk of another 'Lehman Brothers' moment and seizing up of the global financial system.

The massive risk from the unregulated “shadow banking system” continues to be underappreciated.

‘Financial weapons of mass destruction’ in the world wide shadow banking system are now estimated at over $60 trillion in late 2011.

Globally, a study of the 11 largest national shadow banking systems found that they totalled to $50 trillion in 2007, fell to $47 trillion in 2008 but by late 2011 had climbed to $51 trillion, just over its estimated size before the crisis.

c) Geopolitical risks are elevated - particularly in the Middle East. This is seen in the serious developments in Syria and between Iran and Israel. There is the real risk of conflict and consequent affect on oil prices and global economy.

There are also simmering tensions between the U.S. and its western allies and Russia and China.

Recent days have seen massive industrial unrest in the platinum sector in South Africa, the largest producer of platinum in the world (some 80% of supply) and fifth largest gold producer. There are genuine concerns that unrest in the platinum sector could spread to the gold sector with a consequent impact on gold supply.

Resource nationalism is being seen throughout the world and some developing nations look set to demand higher prices in terms of debased fiat currencies for their finite natural resources.

d) Monetary risk is high as the policy response of major central banks to the first three risks continues to be to be ultra loose monetary policies, ZIRP, NIRP, the printing and electronic creation of a tsunami of money and the debasement of currencies.

Should the MSG risk increase even further in the coming months than the central banks response will again be by monetary and further currency debasement which risks currency wars deepening.

This risks the devaluation of all fiat currencies and serious inflation in the coming months and years.

Cross Currency Table – (Bloomberg)

Conclusion

Therefore, we remain bullish in the long term and advise that investors and savers should have a healthy allocation of their wealth in gold in a portfolio to protect against the MSGM fundamental risks.

However, as ever markets are unpredictable and in the short term can do anything. This is particularly the case today with financial markets seeing significant volatility. Euro/dollar has been more volatile than gold in recent days.

We caution that gold could see another sharp selloff and again test the support at €1,200/oz and $1,550/oz.

If we get a sharp selloff in stock markets in the traditionally weak ‘Fall’ period, gold could also fall in the short term as speculators, hedge funds etc . liquidate positions en masse.

To conclude, always keep an eye on the MSGM and fade the day to day noise in the markets.

We remain bullish in the medium and long term and those who maintain an allocation to gold will be rewarded. However, we caution that there is the possibility of further weakness in the short term.

This seems unlikely due to the bullish technicals having aligned with the fundamentals however “event risk” is high and it would be foolish to completely discount the risk of yet one more sell off

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.