Gold vs Stocks, Are You The Market’s “Sucker”?

Commodities / Gold and Silver 2012 Aug 24, 2012 - 03:25 AM GMT The investment world is filled with misleading “facts” and flashy “materials” that cause investors to lose money. If one blindly follows what the average investor thinks and does, they are likely to wind up being the “sucker” in the market. If, on the other hand, an investor digs a little deeper and attains a unique insight on the market or “edge”, then the probability of profitability increases dramatically.

The investment world is filled with misleading “facts” and flashy “materials” that cause investors to lose money. If one blindly follows what the average investor thinks and does, they are likely to wind up being the “sucker” in the market. If, on the other hand, an investor digs a little deeper and attains a unique insight on the market or “edge”, then the probability of profitability increases dramatically.

For Example:

Is there really a “can’t lose”, “best” asset class? Is it really “impossible” to time the market? Let’s take a look:

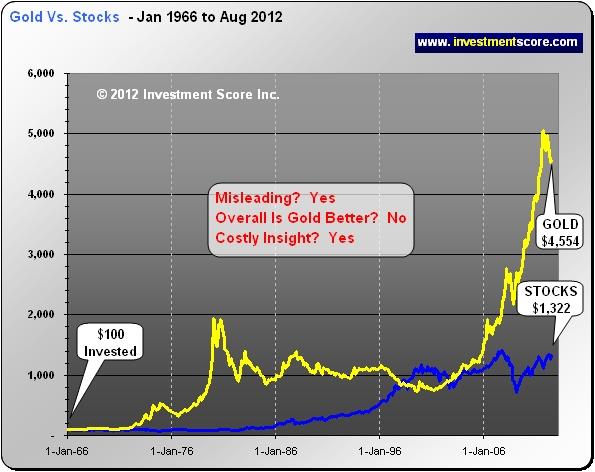

According to this chart, on the surface it appears there is a “best” asset class.

On the surface:

- Stocks appear to be a far better investment over a very long period of time.

Why it is misleading:

- The timing of the $100 investment is the most important factor as it greatly affects the end result. You will notice an opposite result in the chart below.

- The distorting effects of inflation make these assets harder to analyze.

- The extremely long timeframe is not realistic for most investors.

But according to the above chart, stocks must qualify as the best “Long Term” investment; right? Wrong. Consider the following longer term chart.

Example 2:

On the surface:

- Gold appears to be a far better investment.

Why it is misleading:

- The timing of the $100 investment is the most important factor as it greatly affects the end result. Note the opposite result from the first chart.

- The distorting effects of inflation make these assets harder to analyze.

- The extremely long timeframe is not realistic for most investors.

We can see from the above chart that over an even longer period of time Gold appears to be a better investment, but this too is misleading. Most people don’t have a 46 year investment time horizon, and sitting through a twenty year bear market from 1980 to 2000 would be very costly.

What did we learn from the above examples?

Less Important: Which is a better investment long term?

Most Important: TIMING

What happens if you don’t have 46 years to invest? Does it make sense to invest mainly in a long term bull market or should you simply invest in your “favorite” investment?

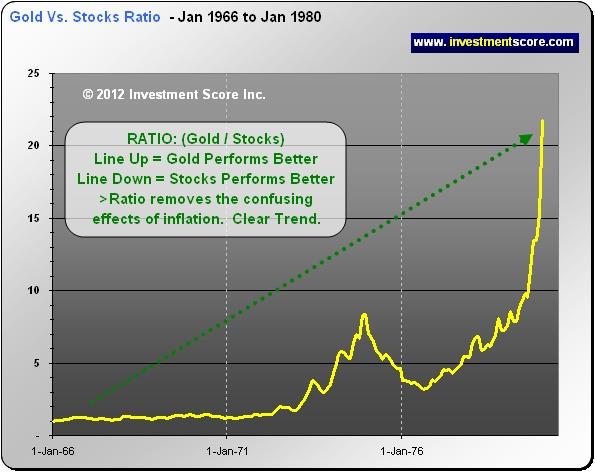

In the following examples we will remove the effects of “inflation” by creating a “ratio” out of our $100 gold investment and $100 stocks investment made in 1966. This way we can clearly see which asset is over or under performing simply from the line on the chart moving up or down.

As we can see in the chart above, if you invested in the 1970’s, the clear long term trend was in Gold. When the yellow line heads up Gold is clearly outperforming stocks. We can see that big picture market timing is the key to success here.

In this chart we can clearly see that the long term trend is in stocks. As the yellow line heads down stocks is out performing gold. During this 20 year trend investors fell in love with stocks as a “favorite” asset class. Big picture market timing is once again the key to success here.

In the above chart we can clearly see that gold has been outperforming stocks. Once again recognizing the big picture, long term trend is the key.

We just demonstrated that timing a bull market is likely much more important to success than which asset class an investor thinks is the best long term investment. Unfortunately most investors have been lead to believe that it is “impossible” to time these “mega moves” and therefore it should not even be attempted.

If investors are aware that they can identify and time long term trends then:

- The playing field with those in the “know” will be a little more even. The average investor will be more of a “player” in the investment game.

- The average investor may better understand “cycles” and the affects of “inflation” on their investments. This understanding may not benefit some entities such as governments, banks and other large institutions, but it would probably benefit the individual investor.

But can an investor “time” the market? Will investors be doomed to suffer magnificent losses if they attempt to “time” the market? How can an investor locate a “long term trend”? What if the long term trend has already started? How can an investor identify when a trend may be nearing an end? At www.investmentscore.com we strongly believe in the power of timing the long term trends. To address the above questions we will release a follow up article through our free newsletter service. You can subscribe to our free newsletter to catch our updates at www.investmentscore.com.

By Michael Kilback

Investmentscore.com

Investmentscore.com is the home of the Investment Scoring & Timing Newsletter. Through our custom built, Scoring and Timing Charts , we offer a one of a kind perspective on the markets.

Our newsletter service was founded on revolutionary insight yet simple principles. Our contrarian views help us remain focused on locating undervalued assets based on major macro market moves. Instead of comparing a single market to a continuously moving currency, we directly compare multiple major markets to one another. We expect this direct market to market comparison will help us locate the beginning and end of major bull markets and thereby capitalize on the largest, most profitable trades. We pride ourselves on cutting through the "noise" of popular opinion, media hype, investing myths, standard over used analysis tools and other distractions and try to offer a unique, clear perspective for investing.

Disclaimer: No content provided as part of the Investment Score Inc. information constitutes a recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. None of the information providers, including the staff of Investment Score Inc. or their affiliates will advise you personally concerning the nature, potential, value or suitability or any particular security, portfolio of securities, transaction, investment strategy or other matter. Investment Score Inc. its officers, directors, employees, affiliates, suppliers, advertisers and agents may or may not own precious metals investments at any given time. To the extent any of the content published as part of the Investment Score Inc. information may be deemed to be investment advice, such information is impersonal and not tailored to the investment needs of any specific person. Investment Score Inc. does not claim any of the information provided is complete, absolute and/or exact. Investment Score Inc. its officers, directors, employees, affiliates, suppliers, advertisers and agents are not qualified investment advisers. It is recommended investors conduct their own due diligence on any investment including seeking professional advice from a certified investment adviser before entering into any transaction. The performance data is supplied by sources believed to be reliable, that the calculations herein are made using such data, and that such calculations are not guaranteed by these sources, the information providers, or any other person or entity, and may not be complete. From time to time, reference may be made in our information materials to prior articles and opinions we have provided. These references may be selective, may reference only a portion of an article or recommendation, and are likely not to be current. As markets change continuously, previously provided information and data may not be current and should not be relied upon.

Investmentscore.com Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.