Gold And Platinum Surge As Mining Unrest Spreads

Commodities / Gold and Silver 2012 Aug 23, 2012 - 06:53 AM GMTBy: GoldCore

Today's AM fix was USD 1,662.50, EUR 1,324.07, and GBP 1,047.57per ounce.

Today's AM fix was USD 1,662.50, EUR 1,324.07, and GBP 1,047.57per ounce.

Yesterday’s AM fix was USD 1,640.50, EUR 1,315.87 and GBP 1,038.49 per ounce.

Silver is trading at $30.36/oz, €24.30/oz and £19.31/oz. Platinum is trading at $1,543.75/oz, palladium at $628.10/oz and rhodium at $1,025/oz.

Gold surged $17.10 or 1.04% in New York yesterday and closed at $1,654.40. Silver surged to a high of $29.91 and finished with a gain of 1.91%.

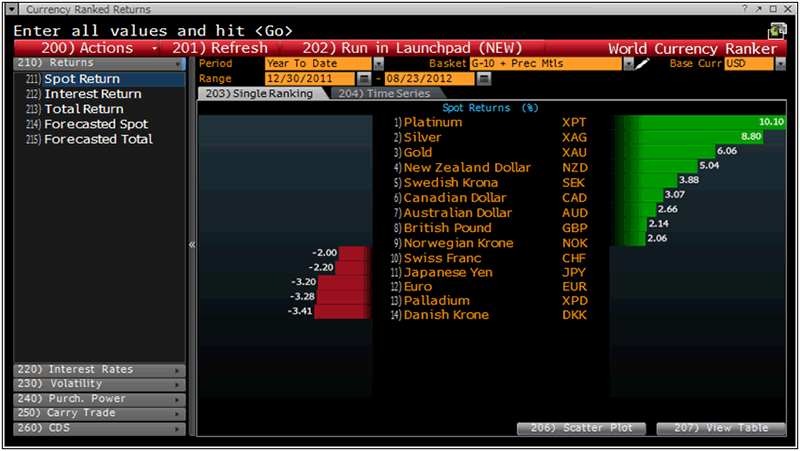

Currency Ranked Returns – (Bloomberg)

Gold rose by over 1% to over $1,665/oz late Wednesday hitting prices not seen since early May as minutes from the US Federal Reserve meeting convinced market participants that QE3 is imminent.

"Many members judged that additional monetary accommodation would likely be warranted fairly soon unless incoming information pointed to a substantial and sustainable strengthening in the pace of the economic recovery," according to the minutes from the July 31-Aug. 1 meeting.

Bullion prices have rallied for six days, moving through the technical resistance of the 150-day and 200-day moving averages. Gold hit the top of a 4 month trading range when it broke $1,640/oz.

Platinum and palladium also rallied for a 5th straight day on growing fears that violence due to labor issues will spread to other mines in South Africa and create increased supply shortages.

Year to date, despite much negative sentiment towards gold, dollar gold is up nearly 6%. In January the yellow metal surged nearly 15% after the US Fed said it could unveil more stimulus and expected to keep interest rates near zero until 2014.

Similar moves may be seen again soon given the fundamentals.

Industrial unrest hobbling the South African platinum industry deepened yesterday, prompting fears of a broader mining crisis in one of the main platinum and gold producing countries.

Platinum and gold prices continued to soar partly due to real concerns of supply disruptions after 44 people died during strikes at a pit owned by Lonmin.

About a fifth of global platinum production capacity is idled in South Africa today as the nation holds a day of mourning for 44 miners and policemen killed in the deadliest police violence since apartheid ended (see Newswire).

Massive discontent has spread to two other important platinum mines.

Amplats, the world’s largest platinum producer that is 80% owned by Anglo American, disclosed it had received demands for pay rises at its Thembelani mine. Meanwhile, another miner, Royal Bafokeng, said about 500 people were protesting outside its Rasimone mine, and preventing others from going to work.

It seems likely that the protests will spread from the platinum sector, to other sectors, including the gold mining sector.

Cross Currency Table – (Bloomberg)

A primary problem is that the price of platinum remains low from an inflation adjusted perspective and when compared to the massive cost increases to operate mines – in terms of fuel, electricity, machinery etc.

Higher prices would mean that companies could pay their staff higher wages and alleviate some of the deepening industrial unrest in South Africa.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.