Canada’s Housing Market – Boom Or Bust?

Housing-Market / Canada Aug 18, 2012 - 10:32 AM GMTBy: Vin_Maru

Bank of Canada may be ahead of all its peers in ensuring its banks meet the Basel capital requirements. And it may have done a better job in regulating the banking sector, but they are not innocent of allowing bubbles in Canada to form. Even Mark Carney feels that the housing market is overheated. Carney made recent comments about the health of Canadian banks.

Bank of Canada may be ahead of all its peers in ensuring its banks meet the Basel capital requirements. And it may have done a better job in regulating the banking sector, but they are not innocent of allowing bubbles in Canada to form. Even Mark Carney feels that the housing market is overheated. Carney made recent comments about the health of Canadian banks.

As for Canada's banks, Carney said they may have some exposure to record household debt levels and the overheated housing market, but he noted that high-risk mortgages are insured by the federal government.

The Canadian real estate housing bubble still seems to get inflated in some major cities like Toronto.

I recently heard a story of someone who bought a house pre-construction for $701K about 18 months ago. The house is now selling for $850K by the builder. Let’s say the buyer put down 25% or about $180K. Their $180K investment in the house provided a $149K return, or 82.78% profit on paper already in less than a year and a half. Annualized, this is a 55.19% return on the initial investment thanks to buying pre-construction, which is something you still don’t get in the regular real estate market by trying to buy and flip already built homes.

But even the homes that are already built and occupied are keeping up with real inflation. It still seems the average house is rising by 5% a year. Let’s say you own a modest $400k starter house in the suburbs, and have 25% down, or $100K. The house value is going up 5% a year or $20K/year on a $400K home, this would mean your equity portion of $100K is now worth $120K after one year and on paper, you just made 20% ROI on your house. The cost to carry a $300K mortgage at a 4% interest rate is about $12k if you’re paying just on a straight home equity line of credit (interest only). Even if you add $3000 for taxes, the cost of living in that house is only $15k a year. Yet your investment appreciates by $20K. So essentially, putting $100K down to buy a house, the Canadian market is paying you on paper $5K net (which is almost the same as the inflation rate) to live in a house for free.

Under this scenario, your initial investment in the house earns you the same rate as inflation, so your purchasing power of that investment remains constant. But because the value of the house is rising by 5%, the house price at $400k is rising by $20K a year of which $5k or 25% can be attributed to your investment ($100K down payment) and $15k or 75% is the bank’s mortgage. However, the banks portion of $15K appreciation does not go to them directly. It’s attributed to the market value of your house “on paper” and you are just making payments to them by way of $12K/year interest payments. So you pay the bank’s interest payments of $12K/year on real money you must first earn from hard labour and in return the inflation of the housing price pays you $20K a year on paper. Under this system, the paper inflation of the housing bubble is allowing a homeowner to live for free in that house and still make about 5% on your initial investment. What a great system we have in Canada, where the ongoing housing bubble is allowing the homeowner to live for free and pays him a return on his initial investment, which keeps up with inflation!

This scenario is a win-win for all parties involved. The homeowner lives for free (on paper) and earns a 5% return on their initial investment. The banks get paid 4% a year by issuing a mortgage almost out of thin air under fractional reserve and fiat banking. The government earns property taxes, income taxes, VAT and whatever other tax scams they create to steal wealth from the citizens. The only person who doesn’t win under this scenario is a person who doesn’t have enough down to pay for the deposit of an inflated house. But then there is a cure for that too.

The Canadian gov’t also has a program for insuring mortgages for people who can’t put enough down for a house. It’s called the Canada Mortgage and Housing Corporation (CMHC), similar to Freddy and Fanny down in the United States. So we don’t have to worry about these people not being able to afford a house. Their high-risk mortgages are insured by the federal government, which means the Canadian taxpayers are on the hook if the housing bubble ever burst (see Mark Carney’s statements above). Of course, Mark Carney is totally encouraging this privatization of benefits and socialization of costs. He is guaranteeing this boom will continue by leaving interest rates low in order to keep interest payments low on Canada's growing debt and help the export economy by preventing a stronger Canadian dollar.

Good Intentions Create Bad Behaviours

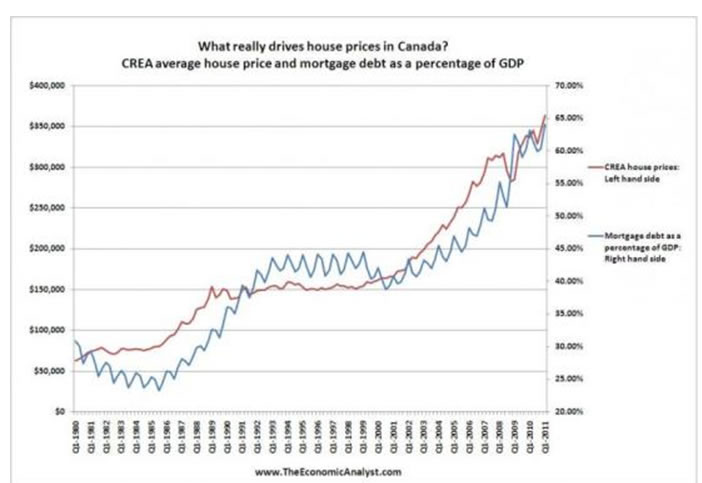

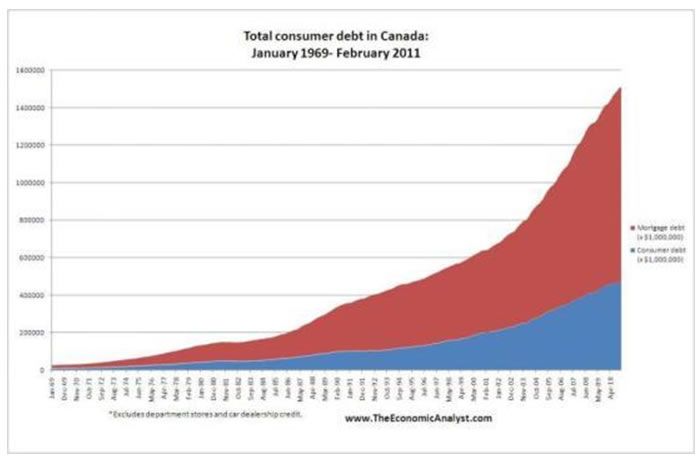

While the concept of owning a house sounds good, especially given the housing inflation scenario above, is it really sustainable? The record debt levels by Canadians are on average just as high as all other western nations. The average salary or wage earnings are not rising and in a world of global competition the westerns salaries should continue to deteriorate with economic slowdown.

The artificial affordability of houses despite inflated prices makes it more difficult to enter the real estate market as a first time home buyer. Why? Everyone is now a real estate investor because it keeps rising in certain markets, thus pushing the prices higher and fuelling the boom. Given the scenario above, why not become a real estate investor? On paper, you get paid to own a house and the prices keep rising as more and more investors continue to bid up real estate. The average Canadian real estate investor now owns multiple properties which were acquired with very little down and they’ve made out a like bandits while prices keep rising. And then there’s the fact they can collect rent from people who can’t afford to buy inflated houses.

The real estate agents are also making out like bandits in the Canadian real estate boom. Many of them were buyers in preconstruction deals, so they bought really cheap and saved on the real estate commission. They also cashed in from the buying and selling real estate for clients and lately their job has never been easier. They simply list the homes on the MLS and collect commissions with very little effort on their part since the houses and condos literally sell themselves in a real estate boom. The agents on average are making 5-6% helping investors buy and sell houses as an investment, so their motive to keep the boom going is clear.

With rising and elevated home prices, their incomes continue to rise as long as the boom continues. With the advent of technology such as the internet and MLS, their job is even easier. An average $500K home yields $25K in commissions at a 5% rate, which is split between the buying and selling agent. This is a great payday for simply listing a house on the MLS, then doing a one day showing and waiting for a willing and eager buyer to show up (which is not difficult in boom times). Then do some simple paperwork to close the deal. Being a real estate lawyer surely doesn’t pay off like that, however. Real estate lawyers only make about $1500 for either involvement in the transaction. They are definitely in the wrong field.

All this goes back to a question we have been asking for years.

How Long Can The Real Estate Boom In Canada Last?

The real estate boom will last as long as we have the same environment that created and maintains this boom lasts. We still have low interest rates, a stable and strong economy and buyers believing that real estate prices will continue to rise. This real estate boom in Canada has gone on much longer than we would have thought, but here we are and the prices are still trending higher. The boom will last until there is triggering event that will turn it into a bust. All booms and busts are usually created by a triggering event which is mostly a result of central bank actions such as the increase or decrease of the money supply or interest rate manipulation.

The housing boom in the US came after the tech bust and a drop in interest rates and a loosening of lending policies. The US real estate bust came with the subprime scandal. The US bankers’ fraud in bundling mortgages came to light and blew up in their faces. Who paid for that bust? Everyone in the world paid for it with the financial meltdown we saw in 2008. Since then most real estate markets around the world have gone bust. In fact I can’t think of many countries around the world that haven’t had a decent correction in real estate. Most have corrected or are in the process of correcting. Yet certain markets in Canada seems to defy economic gravity. These Canadian real estate markets haven’t gotten sucked down like the rest of the world.

Why? Because no one is willing to prick this bubble. After all it’s a win-win for everyone. The investor wins with appreciation on their investment and gets to live for free. The banks win with continued interest revenues. Government win with continuous tax revenues. The central bank looks like a hero for maintaining a stable banking system and everyone working in the industry wins with continuous record incomes and commission. Why would anyone want such a wonderful party to end?

While there have been some recent efforts to contain the bubble, such as higher deposit requirements and shortening of the amortization period of mortgages, that doesn’t seem to be enough of a deterrent to cool down the real estate bubble. For the most part, having the low interest rate policy still makes being a real estate investor a profitable endeavor, especially if the properties can continue to provide cash flow. The investor in real estate still wins because he makes good cash flow from a renter who cannot afford to buy at these prices and so must pay rent, which goes to paying off the investor’s mortgage. If a first time homeowner is able to scrape up the 10% deposit and get the CMHC, he will most likely buy even at these inflated prices because he has very little choice... either he is paying inflated rental prices or inflated home prices. His income has not risen significantly, but he is still forced to pony up a higher percentage of his income just to live in Canada because of the inflated real estate prices.

This turns out be a vicious cycle that benefits only the investor/owners/bankers/government and everyone else who is involved in gaming the system with ever increasing real estate prices. As a result of this inflationary real estate policy the percentage of income that goes toward rent or homeownership keeps rising for new entrants to the market. If you purchased a home a while ago, you are fine. But good luck to a young couple or a new immigrant who is looking to be a first time home buyer. They have been priced out of the market by everyone that has an interest in keeping the real estate inflation game alive and well. Frankly, they should have gotten into the real estate racket earlier on in the cycle.

Canada’s Ponzi Real Estate Market

Like most bubbles or ponzi schemes, the real estate bubble will continue as long as new entrants/buyers are willing to buy from the people who got in earlier. When it comes to investing, asset prices will continue to rise as long as there are new entrants to the market and the belief holds that the asset class will continue to reward everyone involved. Real Estate is probably the most heavily invested asset class there is in Canada so everyone involved would love to see the status quo maintained. As long as you are involved in the ponzi scheme and it continues to pay you, you have no motivation in wanting to see it collapse.

For someone who is new to the RE market as an investor, my suggestion is to look at other markets or countries which have already corrected. You will find much more value than in Canada’s over inflated RE market. The ponzi scheme here still continues and you don’t want to be the investor stuck at the bottom of the pyramid with an over inflated investment hoping to sell it to some other sucker later on down the road. What happens if that sucker wises up and realizes he is being played for a fool in a market that continues to get inflated because it’s rigged to benefit only the people already involved?

The other real estate ponzi schemes around the world have already busted, but Canada’s real estate market continues to inflate because no one is willing to burst it. When it comes to a world of ponzi investing with fiat paper, you want to be at the top of the next great ponzi scheme. You want to be rent/income collector and not the payer. It’s tough entering today’s RE market in Canada as in investor. You would be at the bottom of the ponzi pyramid, so your chances of success get limited. In fact there is a lot of evidence that the ponzi real estate market in Canada is already popping. It seems like a few pockets of RE such as Vancouver and in Alberta are already cooling off, more so because they got way more over inflated than the average real estate market during the commodities boom and influx of money from China. Yet many areas in southern Ontario and especially GTA Toronto are still seeing price rises similar to the scenario mentioned above. Still, these markets are probably closer to busting than continuing down this ponzi path.

In a world where central banks create booms and busts, you are better off finding another ponzi scheme they are creating and get in early. The real estate market in Canada may continue to rise, but in our opinion you are already too late to this party and more than likely it is ready to burst. If you are heavily invested in real estate, you may want to take profits while they are still available or create a hedge.

The central banks and governments around the world have created another massive bubble in the government bond market which continues to grow. This will most likely be the next bubble that will pop in the next few years. Once it starts bursting, easy profits will be made shorting the bond market, something we will keep readers aware of when the time looks right. Once this bond market starts to burst, we expect the gold market will start rising significantly. While many media outlets claim that gold is in a bubble, it has not even come close to bubble territory. The average investor hasn’t even considered gold as an investible asset class. He doesn’t own any and probably hasn’t even considered owning any. This will all change and everyone will rush into gold over the coming years once the government debt bubble bursts. While one bubble bursts (bonds), money rushes into another asset class and the only bubble that hasn’t been fully inflated is precious metals.

If you enjoyed reading this article and are interested in protecting your wealth with precious metals, you can receive our free blog by visiting TDV Golden Trader.

The Dollar Vigilante is a free-market financial newsletter focused on covering all aspects of the ongoing financial collapse. The newsletter has news, information and analysis on investments for safety and for profit during the collapse including investments in gold, silver, energy and agriculture commodities and publicly traded stocks. As well, the newsletter covers other aspects including expatriation, both financially and physically and news and info on health, safety and other ways to survive the coming collapse of the US Dollar safely and comfortably. The Dollar Vigilante offers a free newsletter at DollarVigilante.com.

© 2012 Copyright Vin Maru- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.