The Fiat Currency World and Fake Gold Medals

Politics / Fiat Currency Aug 17, 2012 - 05:36 AM GMTBy: Jeff_Berwick

Today, the power of the state has corrupted society absolutely.

Today, the power of the state has corrupted society absolutely.

This week, fund manager Bill Gross tweeted how unhappy he is that Mitt Romney's VP selection is in favor of stealing less from citizens. He is calling for more theft and yet not a person at the cocktail parties he attends will slight him or call him a violent thief.

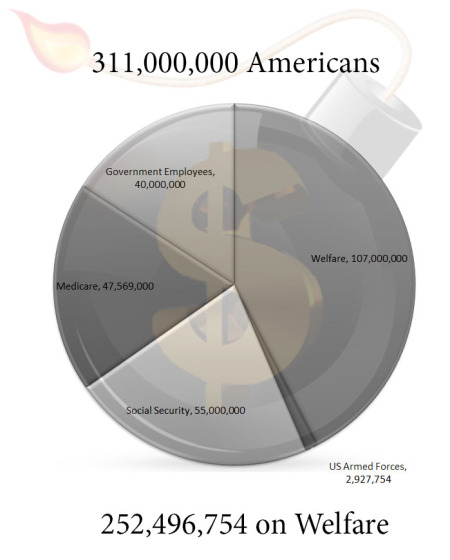

The corruption isn't just at the upper echelons of society either. It's everywhere. Almost everyone and everything in the US today suckles at the teat of the state.

[Note: The number of people on welfare including food stamps and other welfare stamp programs was taken from this link; to this we added those on Socialist InSecurity; those on Medicare; government workers who produce nothing; and those in the Department of Offense - on right wing welfare. While we recognize that there is probably some significant overlap... the total came to 252,496,754 US unproductive US citizens who need the payouts from the fasco-communist state]

Not only that, but thanks to decades of public indoctrination camps that would make Vladimir Lenin jealous and an onslaught of television programming most people today don't even realize that almost everything has been stolen from underneath them and they are left holding worthless items instead.

The Olympics were held in the UK this month and the number of items we can point out about the country that provided the inspiration for the book, 1984, are lengthy.

Look no further than the currency used in the UK, the British Pound Sterling. Not one in a million English citizens see the irony of calling a piece of paper with no backing a "pound" of sterling.

The original pound originated over 1200 years ago, born about AD 785. Back then 240 silver pennies equaled one pound. The pennies were made with the purest silver available and were as much as 99.9% silver. Later in 1158 King Henry II introduced much more durable 92.5% silver pennies into circulation. Today these are known as sterlings since they have the same percentage of silver as sterling metal.

Debasement came to the silver currency during the reigns of criminals Henry VIII and Edward VI. The pound was redefined as a "troy pound" which contained just 12 ounces. The troy ounce is smaller than the avoirdupois ounce and the troy pound is smaller than the avoirdupois pound.

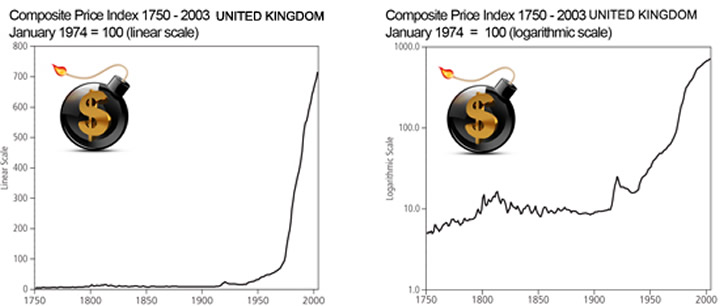

Without getting too bogged down in that, let's just look at the modern paper "pound" in terms of the original pound. At today's silver price of £17.75 per ounce, and with 16 ounces in a pound, the value of one pound sterling (assuming 92.5% silver) today would be worth £262. (Just look at the astronomical money supply growth)

Instead, the modern paper "pound" is only worth its £1 face value and there is no silver nor gold at all backing it. It is literally worth only 1/284 or so of the original pound...which is even less than the original silver penny which was worth 1/240 of the original pound. Yet people are so brainwashed that they still call a piece of paper a pound.

The same goes for many other things. People carry around "gold cards" but the only bank card that we know of that is actually backed by gold is through Peter Schiff's EuroPac bank in St. Vincent (see our Special Report on Euro Pac Bank written in January of 2012 here). For all other cards, they are only gold in color not in substance.

And, look no further than the Olympics where athletes competed for gold, silver and bronze colored metals! The last time the gold medal was made out of gold was at the Stockholm Olympics in 1912... a year before the financial coup of the US and the institution of the Federal Reserve crime organization. The timing is likely not a coincidence.

In 2012, the gold medals handed out have a makeup of 1.34% gold! The rest is 92.5% silver and 6.16% copper. The resulting medallion is worth about $500. For the silver medal, the gold is replaced with more copper, for a $260 make-up of metals. The bronze medal is 97% copper, 2.5% zinc and 0.5% tin. That's about $3, worth less than most trinkets.

Yet, look how the slaves bite their gold medals as though they were the real thing.

It is an age-old tradition to bite gold to test its authenticity. Gold is relatively soft and you can leave impressions in it if you bite it with a little steady pressure. Watch out ladies, you are going to chip a tooth on that near worthless medallion.

Of course, in the fiat world we live in, winning a gold medal also comes with a fiat currency prize... something most slaves prefer anyway as it has been decades since gold has circulated in their society. For winning gold, athletes are awarded $25,000 USD.

But, being slaves, US athletes have to then pay not only $8,750 in a "prize tax" to the extortionist IRS but, in perhaps the biggest slap in the face of them all, the IRS even has a "medal tax" and taxes them $236 on a "gold" medal worth only $500... more than 50%!

Yet, they will still cry as they sing their national anthem and well up with pride for winning for their country, the land of the free!

Of course, the very fact that all the gold is gone from backing all the currencies - and even from the Olympic medals - and that people think gold colored plastic credit cards are actually something with which to impress others... are signs that we are nearing The End Of The Monetary System As We Know It (TEOTMSAWKI).

Jeff goes on to tell of more proof that TEOTMSAWKI is not decades but years or months away and the rest of the August Issue goes to offer solutions, advice and analysis on surviving it. Don't be a slave and think your gold card means you own gold. Find out the truth today.

The Federal Reserve will only end when it ends in the tears of a hyperinflation within 3-5 years. Protect yourself now. Subscribe to The Dollar Vigilante, the only newsletter whose express focus is info, news, analysis and advice on how to survive The End Of The Monetary System As We Know It (TEOTMSAWKI).

The Dollar Vigilante is a free-market financial newsletter focused on covering all aspects of the ongoing financial collapse. The newsletter has news, information and analysis on investments for safety and for profit during the collapse including investments in gold, silver, energy and agriculture commodities and publicly traded stocks. As well, the newsletter covers other aspects including expatriation, both financially and physically and news and info on health, safety and other ways to survive the coming collapse of the US Dollar safely and comfortably. The Dollar Vigilante offers a free newsletter at DollarVigilante.com.

© 2012 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.