Gold and the Middle East Crisis

Commodities / Gold and Silver 2012 Aug 14, 2012 - 07:48 AM GMTBy: Clif_Droke

The year 2012 has been relatively peaceful compared with the past 10 years. The lack of military aggression on the part of the U.S. has led many to believe that the America's days of military adventures are over. But as we'll see here, 2012 is simply a temporary respite in a longer-term "theater" of war that has only just passed the opening act.

The year 2012 has been relatively peaceful compared with the past 10 years. The lack of military aggression on the part of the U.S. has led many to believe that the America's days of military adventures are over. But as we'll see here, 2012 is simply a temporary respite in a longer-term "theater" of war that has only just passed the opening act.

The past decade has indeed been one of near constant strife and turmoil. Starting with 9/11 and the U.S.-led NATO invasion of Afghanistan, and later Iraq, the 10 years between 2001 and 2011 were characterized by ceaseless warfare. The military invasions in the Middle East have been followed by civil and military uprisings in Egypt, North Africa and elsewhere in the region. By contrast, 2012 might be styled a "quiet" year for the Mideast. A withdrawal of U.S. troops from Iraq began in mid 2009 and formally ended in late 2011.

Meanwhile, the so-called "Arab Spring" revolts have subsided and revolutionary fervor has temporarily died down. Soldiers have returned from overseas and the nation has breathed a collective sigh of relief that the Middle East adventures of the past decade are apparently over. There is reason to believe, however, that the abandonment of Iraq and the proposed wind-down of U.S. involvement in Afghanistan is merely a brief intermission in a long and bloody theater of war. The second act will likely be the most intense one yet.

Already we've gotten a preview of the potential catalyst for next phase of the Middle East wars. A wave of violence recently swept through Iraq as al Qaeda terrorists reportedly detonated a series of bombs, killing 11 people in the country's deadliest day in two-and-a-half years. After the attack, al Qaeda warned it would reclaim territory and initiate new attacks. The power vacuum left over from the U.S. withdrawal is already being used as a rallying cry in the media for another occupation of Iraq.

Writing in the August 6 issue of Newsweek, Peter Beinart declares "it was our invasion that created the chaos that has allowed them [al Qaeda] sanctuary; the blood is partly on our hands." Beinart and others on both the right and the left sides of the political spectrum are calling for the U.S. to "own up" to the war it started in Iraq and re-assert a strategic presence there. If the violence in Iraq continues to escalate in the months ahead then we haven't seen the end of America's involvement in the Mid-East.

Before American can get involved in another war, however, it must first get through the latest presidential election. America has never commenced a military action during a presidential election year, a precedent that isn't likely to be broken this year. There's also the economic recovery to consider. With corporate profits still high, there's no rationale for an economic "rescue war" to help stimulate corporate profitability. This was a strategic concern in the 2002-2003 Middle East wars the U.S. initiated. As we'll see, however, there will almost certainly be an economic motive behind the next Middle East excursion as we draw closer to the long-term deflationary cycle bottom in 2014.

For all the saber rattling we saw in the early part of the year, a war against Iran is unlikely in 2012. War sentiment has been high mainly because the economy has recovered enough in the last couple of years to allow officials to finally turn their attention from economic concerns at home to military matters. As I pointed out in my article from February 17, entitled, "Gold and the next Great War," the current U.S. presidential election should detract attention from the Iran problem in the coming months.

I also previously noted that based on the yearly Kress cycles, the current recovery phase is a temporary phenomenon, and that by no later than the second quarter of 2013 deflationary pressures should return once the 4-year cycle has peaked. War duration deflation is primarily used by political leaders as an instrument of distraction to get the nation's mind off the economic depression. War is also a favorite tool of central banks during deflation since it offers the excuse to lend vast sums of money into existence. Major wars have been used by government to jump start the economy after a depression because war offers the ultimate excuse to spend billions of dollars into circulation and get money (the lifeblood of the economy) flowing once again.

Just such a scenario is already in the development stage in China. In the July 21 issue of his China Boom-Bust Analyst (www.dohmencapital.com), Bert Dohmen reported on the three-day riot of migrant workers in Shaxi, Guandong province. It was unofficially reported that 30 people were killed in the riot. Shaxi is a manufacturing town where most of China's textiles are made. Dohmen has warned that an acceleration of the global economic downturn will produce massive closures of factories, resulting in millions of Chinese workers being thrown out into the streets without jobs, food or a place to live. It's already happening in China.

"This will be a huge challenge for the [Chinese] government," writes Dohmen. "Historically, when governments face such a situation they start a war and put these people in uniform. They are dispensable."

I also noted in the February 17 article that "major wars are rarely commenced during deflationary winter," and that "wars involving the U.S. tend to begin after a major long-term cycle bottom (e.g. the 12-year cycle bottom year of late 2012 saw the start of the second war with Iraq)." The 12-year cycle is exactly one half of the 24-year cycle of war, both of which are scheduled to bottom in 2014 with the 120-year cycle. Accordingly, any major war involving the U.S., which could potentially involve Iran and other Middle East countries, is likely to begin at some point just before or after the 2014 long-term cycle bottom, but probably not before the year 2014.

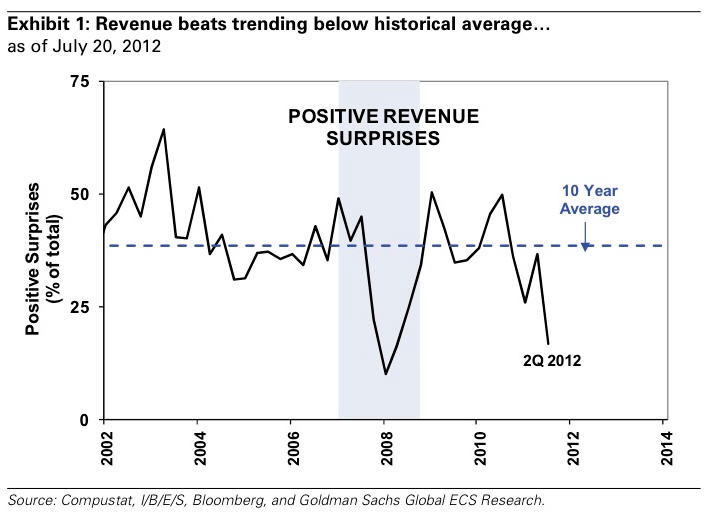

We've already mentioned corporate profits still being fairly strong. Earnings momentum has already started dissipating, however. Positive revenue surprises are declining, while negative revenue surprises are increasing. These developing trends point to the coming end of the earnings/economic recovery that began in March 2009. Two possible turning points are worth mentioning: the peak of the 4-year cycle this fall, and the first quarter of 2013 when a major quarterly cycle peaks. I want to reiterate that I'm mentioning this not because I believe the recovery bull market is over now, but only to emphasize that we're drawing closer to its eventual end.

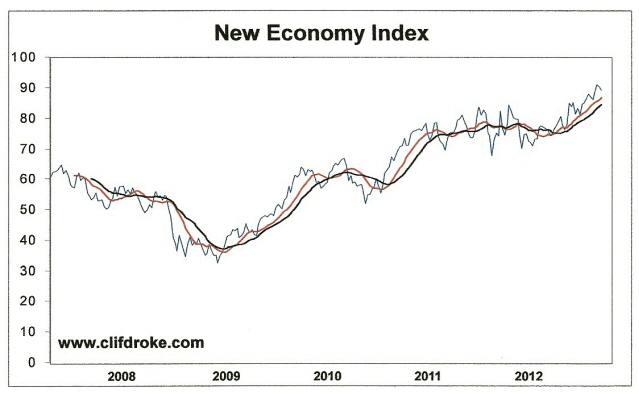

What's keeping overall corporate earnings relatively buoyant for now, besides the 4-year cycle, is the strength of the U.S. retail business economy. This strength can be clearly seen in the New Economy Index (NEI), which is just under a new all-time high and still above its rising 12-week and 20-week moving averages. NEI is my favorite barometer for the overall condition of the domestic U.S. economy.

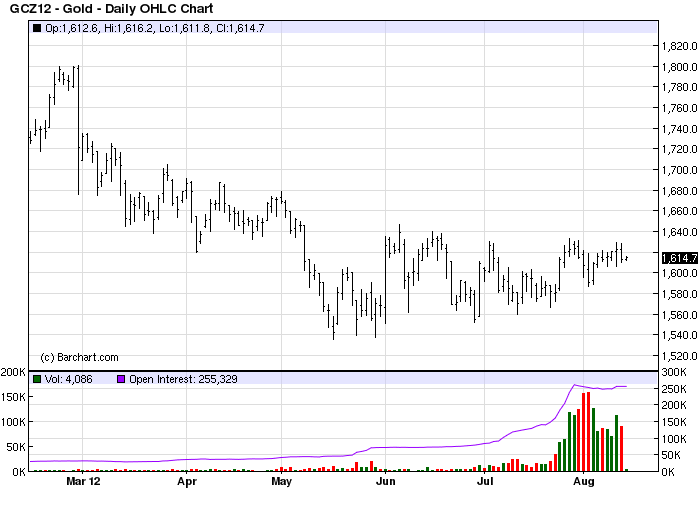

Gold is another excellent barometer of, among other things, military aggression. The gold price will typically spike significantly higher for at least two months prior to the outbreak of war. As you can see here, gold has been in a relatively comatose state for the last several months since peaking last September. Gold clearly doesn't smell war as yet.

For gold to commence another explosive bull market of the type we witnessed from 2002-2008 or from 2009-2011, gold needs one of two things: the threat of war or another central bank "easy money" policy. The odds definitely favor one or both of these two prerequisites by not later than 2014 as we head closer to the final "hard down" phase of the long-term deflationary Kress cycle. Policy makers will be forced to react aggressively to the onset of runaway deflation in 2013 just as they did during the 2008 financial crisis. This is how gold strongly benefits from deflation, just as it does from runaway inflation. The runaway deflation of 2013-2014, of which we got a preview in 2008, will set the stage not only for America's next war but also of gold's final bull run.

2014: America's Date With Destiny

Take a journey into the future with me as we discover what the future may unfold in the fateful period leading up to - and following - the 120-year cycle bottom in late 2014.

Picking up where I left off in my previous work, The Stock Market Cycles, I expand on the Kress cycle narrative and explain how the 120-year Mega cycle influences the market, the economy and other aspects of American life and culture. My latest book, 2014: America's Date With Destiny, examines the most vital issues facing America and the global economy in the 2-3 years ahead.

The new book explains that the credit crisis of 2008 was merely the prelude in an intensifying global credit storm. If the basis for my prediction continue true to form - namely the long-term Kress cycles - the worst part of the crisis lies ahead in the years 2013-2014. The book is now available for sale at: http://www.clifdroke.com/books/destiny.html

Order today to receive your autographed copy and a FREE 1-month trial subscription to the Gold & Silver Stock Report newsletter. Published twice each week, the newsletter uses the method described in this book for making profitable trades among the actively traded gold mining shares.

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.