Stock Market Complacency Hits 5 Year High, Calm Before the Storm

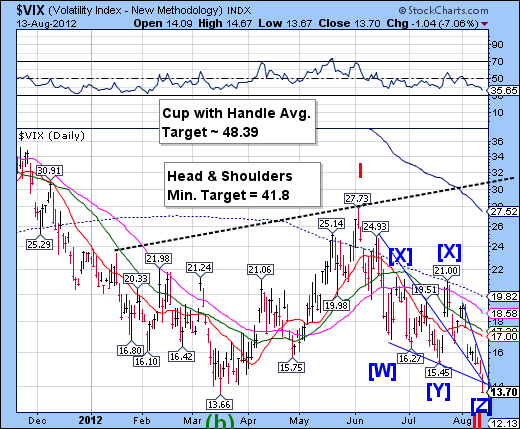

Stock-Markets / Stock Markets 2012 Aug 14, 2012 - 06:26 AM GMT VIX declined within .01 of the March 16 low on an intraday basis. Tomorrow is the next Pivot Date for the VIX and it is probable that the VIX may gap up at the open. The VIX/SPX futures are in agreement. This has been quite a ride and changes the landscape for the decline in equities that has already begun.

VIX declined within .01 of the March 16 low on an intraday basis. Tomorrow is the next Pivot Date for the VIX and it is probable that the VIX may gap up at the open. The VIX/SPX futures are in agreement. This has been quite a ride and changes the landscape for the decline in equities that has already begun.

FYI, the March 16 low is the lowest reading for the VIX since December 6, 2006. It occurs to me that I may be misrepresenting the Elliott Wave Structure, which I currently have labeled Cycle Waves I and II of a Supercycle Wave (c). If my analysis is correct, we may be launching Grand Supercycle Wave (c). So far this is just a hunch, because the Waves and Cycles suggest something larger appears to be happening here.

From ZeroHedge, “VIX clattered down to a 13 handle into the close - the lowest close in over 5 years - but notably unlike March when we were down here - the term-structure is considerably steeper.” Tyler, make that almost 6 years.

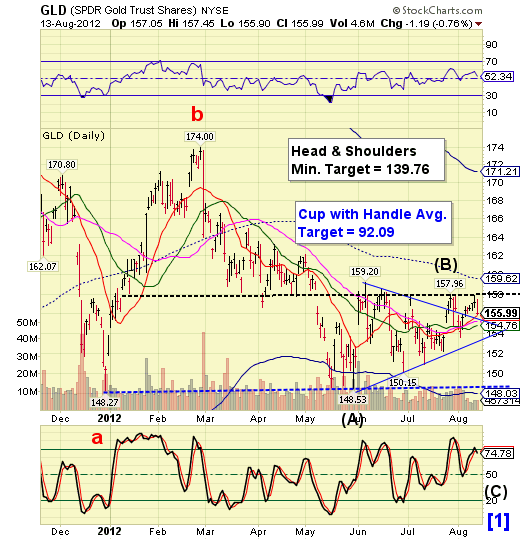

GLD may have been the first ETF to cut loose from the pack and begin its decline.

We are still seeing articles about how attractive gold is and how it will be a safe haven. I don’t get it.

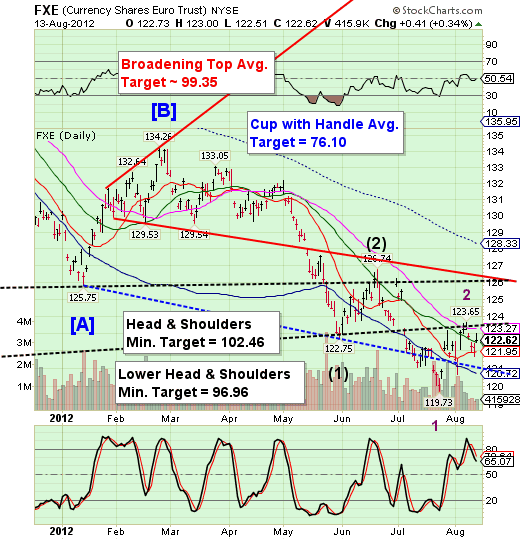

FXE appears to have completed a 66% retracement of its decline from the neckline. Although it closed positive for the day, it appears to be on its way lower. FXE (EURUSD) appears to be ready for an extended 3rd wave, due for its first low in about 2 more weeks. The Elliott Wave pattern calls for wave 3 of (3) of [C]. That appears to be a deadly combination for the longs.

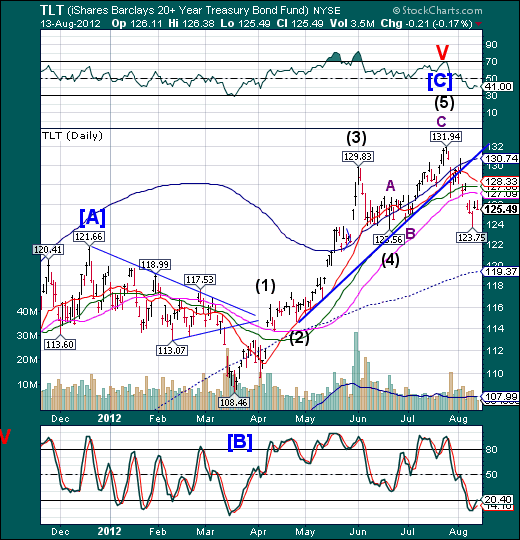

TLT has resumed its decline with a 5th wave target near 121.00. However, mid-Cycle support at 119.37 is acting like a magnet, which may draw it closer. This is the wave that confirms the Grand Supercycle reversal.

Shorts should be looking for an exit near 121.00 (stay on the alert for a possible shorter wave 5, as well) with the expectation of a very strong retracement. The most likely target for wave 2 may be Cycle Top resistance at 130.74, so this is not a short position to hold onto.

Last Tuesday’s top at 140.92 is still holding. It is too early to tell what will happen in the morning from the overnight futures market. However, there is a very strong chance of a gap down at the open that may not be recovered.

Complacency is at 5-year highs. Realized volatility, especially after last week's small range and low volume markets, has fallen but implied volatility is now at its most 'complacent' relative to realized vol since the end of LTRO - as it appears anticipation of the fully-expected printing-press euphoria is priced into both asset and vol markets.

Folks, this is just the calm before the storm

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.