U.S. Economic Facts and Consequences of Growth in Government Jobs vs. Private Jobs vs. Population Growth

Economics / US Economy Aug 13, 2012 - 04:06 AM GMTBy: Mike_Shedlock

Keynesian clowns are concerned about the decline in government jobs in the past few years. They want the government to step up spending and hire more workers to make up for the loss of jobs in the private sector.

Keynesian clowns are concerned about the decline in government jobs in the past few years. They want the government to step up spending and hire more workers to make up for the loss of jobs in the private sector.

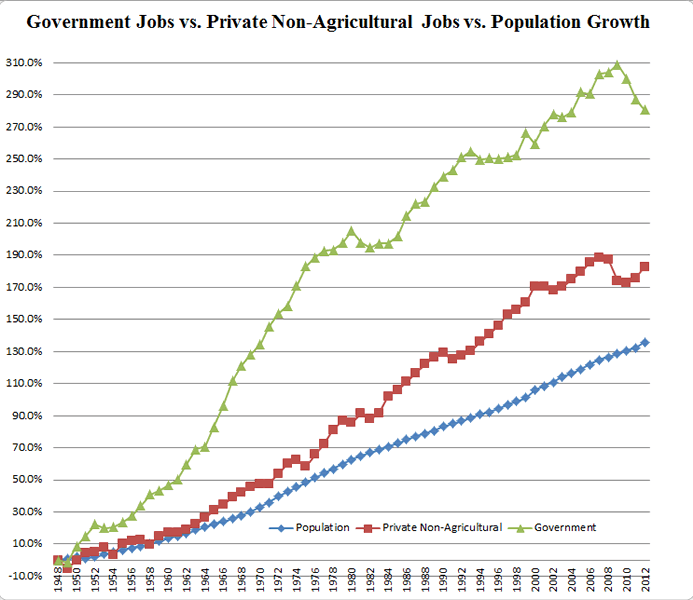

Here is a chart from reader Tim Wallace that will help put the recent loss of government jobs in a better perspective.

Percentage Job Growth vs. Population Growth

The growth in government jobs is not sustainable nor is there any genuine excuse for it other than political pandering and vote-buying operations.

The deviance between private bobs and population growth is easily explained by the entry of women in the workforce.

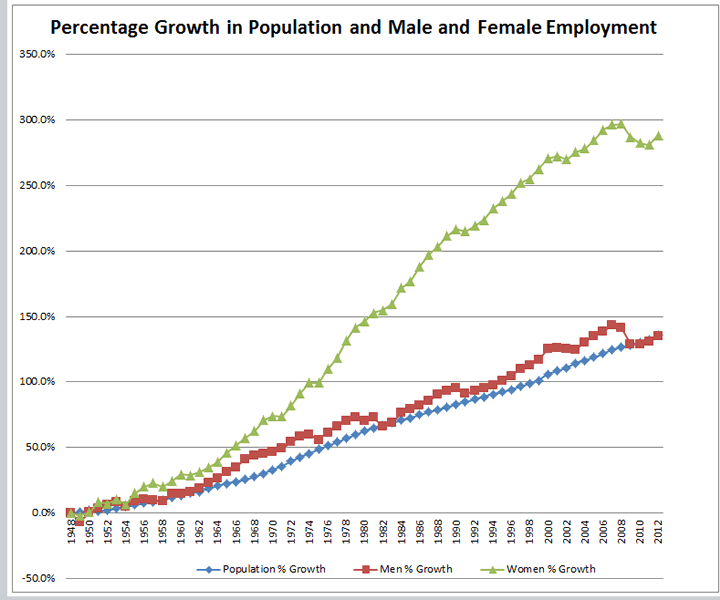

Percentage Male and Female Job Growth vs. Population Growth

Note how the percentage growth of men in the labor force closely tracks population growth the percentage growth of women in the workforce has skyrocketed.

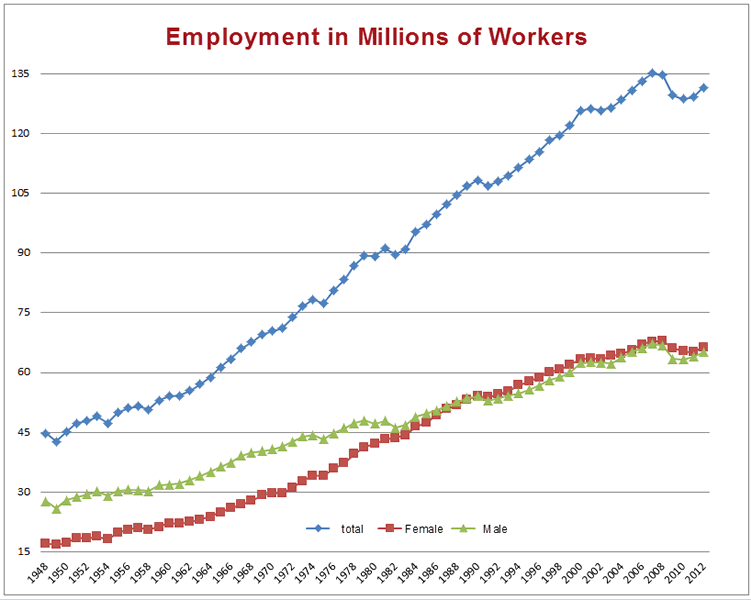

Employment in Millions

Entry of women in the workforce allowed much higher household debt levels than ever before.

Now what?

I'll tell you what. Ability of households to take on more debt has peaked. There are no more female workers to add to the pool. Everyone male or female is working (or is looking for work) whether they really want to or not.

Women actually overtook men in the work force way back in 1990.

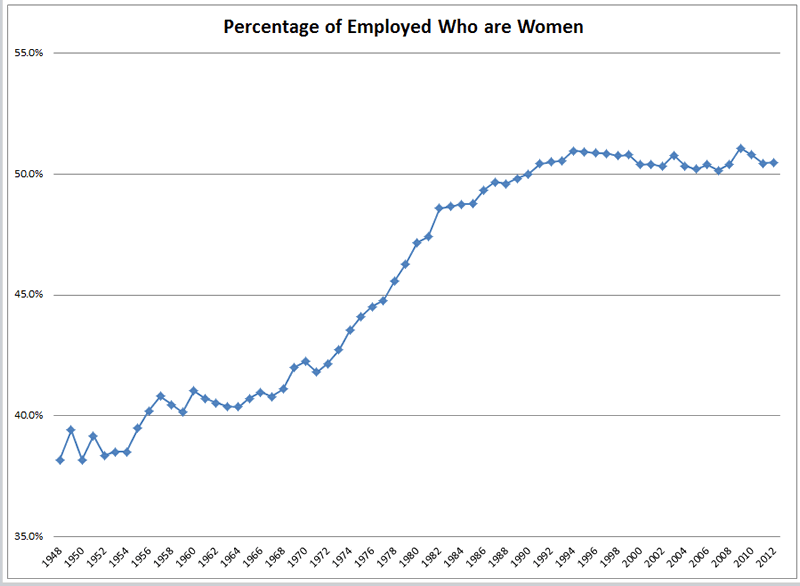

Percentage of Total Workforce That is Female

Unfortunate Facts

- The unfortunate fact of the matter is everyone need to work to pay off accumulated debts and meet living expenses, but the jobs are not there.

- The second unfortunate fact is we cannot afford and do not need all of the existing government jobs.

- The third unfortunate fact is demographics are no longer favorable. Indeed, there are too few jobs, too much student debt, and too few workers supporting too many retirees on Social Security.

-

Those unfortunate facts happen to be highly deflationary.

Demographic Time Bomb

For a graphical representation of point number three above, please see Demographic Time Bomb ...

- Much pain awaits the US.

- Public worker pension promises have been made that cannot possibly be delivered.

- The US simply cannot afford to be world's policeman. Military spending must come down or it will destroy us.

- Medicare and Social Security problems must be addressed as well.

- Upcoming generations are highly likely to see a drop in standard of living vs. the baby boomers. This has never happened in US history.

Please consider Heartaches by the Number

- Just 14% expect today’s children to be better off than their parents

- Just 31% believe the U.S. economy will be stronger in one year

- Just 27% think the country is heading in the right direction.

- Just 24% of American Adults believe the job market is better than a year ago

- 44% think the job market is worse, up 15 points from June

I happen to agree with the majority who think those now graduating from high school will not be better off than their parents.

There are too few jobs, too much student debt, and too few workers supporting too many retirees on Social Security.

Who Will Address the Problems?

As I look out on the political landscape, I see little hope that either Republicans or Democrats will address these problems.

Republicans refuse to address the income side of the balance sheet, and Democrats refuse to address the spending side.

Neither party is willing to tackle military spending.

How long the market lets these can-kicking exercises continue is anyone's guess, but the longer this goes on, the more pain there will be.

The culmination will be a currency crisis at some point down the road. Timing is very problematic. Japan proves debt-to-GDP ratios may go on much further than anyone thinks possible.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2012 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.