Silver Price Forecast: Big Breakout Just Around the Corner?

Commodities / Gold and Silver 2012 Aug 05, 2012 - 04:55 AM GMTBy: Investment_U

Mike Kapsch writes: Ahhh… The smell of quantitative easing (QE) is in the air..

Mike Kapsch writes: Ahhh… The smell of quantitative easing (QE) is in the air..

And another round of money printing and bond buying from the European Central Bank (ECB) in the coming weeks would almost certainly mean big things for silver prices in the near term.

Earlier this week, President Obama gave his seal of approval to the ECB, adding how important it is that it acts swiftly to get Europe’s economies and currency in check.

But this is really just the beginning. And silver prices could be in for the ride of a lifetime as one indicator shows prices are primed to climb to heights never seen before.

Even Rarer Than Gold… On the Earth’s Surface

A few days ago, I touched on how gold prices are likely to head higher for the remainder of the year as soon as the ECB or the Federal Reserve cranks up the printing presses.

Well, silver prices are also set to breakout, perhaps even higher than gold.

You see, the under appreciated metal isn’t just a commodity that people hoard for monetary value. It’s also used in a number of industrial and medical applications.

For instance, it has the highest electrical conductivity of any metal. So it’s not surprising that it can be found in things like CDs, cellphones, cameras and televisions.

In addition, silver kills bacteria and it’s used as a disinfectant and antiseptic. It’s also incorporated in bone prosthesis.

But here’s what’s really exciting.

Historically, gold prices have been 16 times greater than silver.

Currently, gold prices are just about $1,620 per ounce. Meanwhile, silver is sitting at $28 per ounce.

Just using this price ratio, silver should actually be just over $100 today. That’s more than three and a half times the current price.

So what’s the best way to play this massive discount?

Simply put, own bullion.

Choosing the Right Coins and Dealer

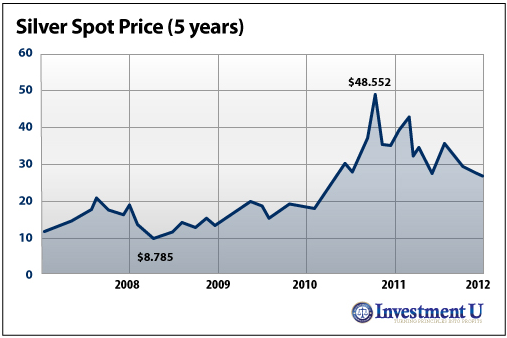

While silver prices over the past five years have been volatile, notice they’ve still doubled.

Today, given the high deficits in Europe and the United States, the potential onslaught of inflation from quantitative easing, the unstable state of politics, and the fact there are no known major stockpiles of silver anywhere in the world, prices have no reason to go anywhere back up to $50, and beyond.

By owning silver bullion, you’re best set to capture the maximum amount of gains possible once the metal starts to soar higher once again.

The Canadian Silver Maple Leaf is the purest – 99.99% – silver coin available on the market.

However, the American Silver Eagle is actually the most trusted, known and liquid silver bullion coin in the world.

There are also several other government and privately minted silver bullion coins available on the market that also make for great investment coins, including the Australian Silver Kookaburra and Lunar, the Austrian Silver Philharmonic, and the Chinese Silver Panda.

With the exception of maybe China, all of these coins will have a fineness of .999%.

If you’re looking for a reputable dealer, the first place to start is a local coin shop near you. Just do your research and make sure to ask around if your local store is trustworthy.

Investment U also recommends Asset Strategies International as a trusted coin and precious metals dealer. Their representatives don’t operate on commission so you can be sure they aren’t trying to knock you over the head on a sale.

You should however, always expect to pay a premium on these minted coins.

But, despite this, silver prices are primed to jump for years to come. And paying a few extra dollars more today for quality silver bullion won’t hurt you when, and if, prices double again in the not-too-distant future.

For those looking for a cheaper alternative though, consider buying junk silver coins as Luke Burgess explains in detail here.

Good Investing,

Mike

by Mike Kapsch, Investment U Research

Copyright © 1999 - 2012 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Investment U Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.