Gold Sat in the Waiting Room

Commodities / Gold and Silver 2012 Aug 01, 2012 - 07:00 AM GMTBy: GoldCore

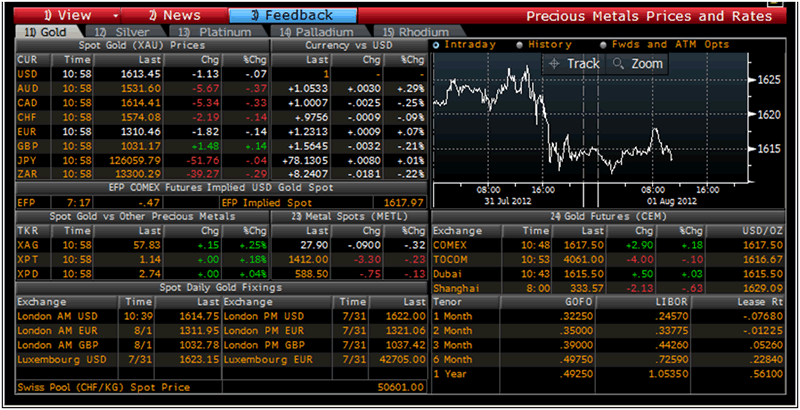

Today's AM fix was USD 1,614.75, EUR 1,311.95, and GBP 1,032.78 per ounce.

Today's AM fix was USD 1,614.75, EUR 1,311.95, and GBP 1,032.78 per ounce.

Yesterday’s AM fix was USD 1,622.75, EUR 1,323.29 and GBP 1,034.46 per ounce.

Silver is trading at $28.92/oz, €22.78/oz and £17.94/oz. Platinum is trading at $1,414.20/oz, palladium at $587.70/oz and rhodium at $1,100/oz.

Gold dropped $8.80 or 0.54% in New York yesterday and closed at $1,613.30/oz. Silver edged down as low as $27.89 and ended with a loss of 0.92%.

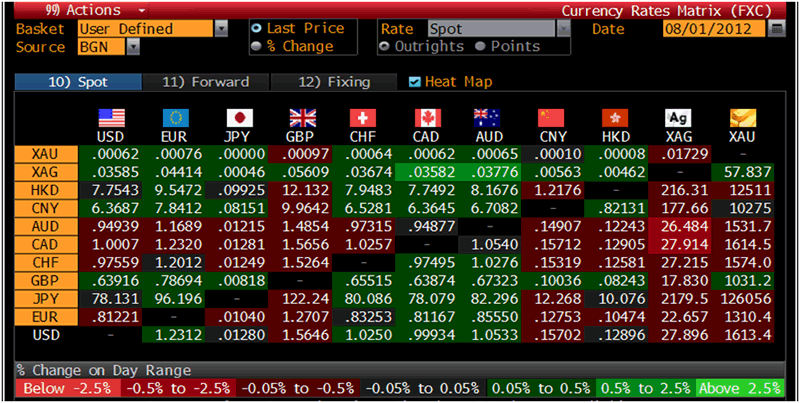

Cross Currency Table – (Bloomberg)

Gold was still hovering in a narrow range on Wednesday, as investors await monetary policy decisions from the US Federal Reserve (1815GMT) and the European Central Bank (tomorrow), which will determine the direction of markets.

A Fed decision to launch QE3 would increase the yellow metal’s appeal as an inflation hedge and bolster prices.

US house prices increased for their 4th month in a row suggesting that the US housing market recovery may be underway which dampened further hopes of any immediate easing in the US Fed’s monetary policy.

The markets are playing a waiting game and investors are cautious. Thursday’s ECB policy meeting will determine if President Mario Draghi will have the backing he needs to embark on significant policy changes to rescue the region’s financial woes.

Yesterday, German Finance Minister Schauble said in an email response to a newspaper, “The rules of the European Stability Mechanism don’t foresee a banking license to allow refinancing at the European Central Bank”. Schauble’s comments fell like a penny in a wishing well that rippled to curb the market’s enthusiasm. Since Draghi’s initial comments to “do anything it takes” gold has increased by nearly $50/oz.

Gold Prices/Rates/Fixes /Volumes – (Bloomberg)

China's PMI (Purchasing Managers' Index) dropped to an 8 month low of 50.1 in July from 50.2 in June, showing further contraction. It shows that the global economic slowdown is not just contained to the shores of the Atlantic.

Since March gold has not been able to hold its 100 day moving average for more than 3 days and closed just under it again yesterday.

A boost from the US Fed will allow more people to look at gold as an investment alternative. The average Joe public still doesn’t have a position to hedge against other investments. When QE begins ETF inflows will increase, physical buying will return after monsoons in Asia, the Indian government get’s their power grid in order, and it will be the brave early adopters that could be rewarded.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.