U.S. Economy on Soft Trajectory as Consumer Spending Falls

Economics / US Economy Aug 01, 2012 - 03:49 AM GMTBy: Asha_Bangalore

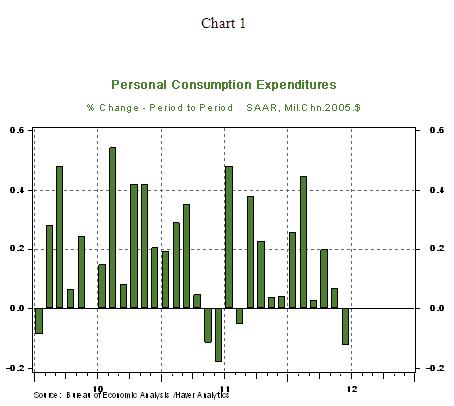

Real consumer spending declined 0.1% in June, after posting gains of 0.2% and 0.1% in April and May, respectively. Outlays of durable goods and services held steady in June, but that of non-durables fell 0.4%. We can discern the causes for a drop in consumer non-durables when the Commerce Department publishes complete details of consumer expenditures on Friday, August 3. More importantly, the level of real consumer spending in June ($9576 billion) is lower than the second quarter average ($9582 billion), which sets up the case of strong monthly gains in consumer spending in the third quarter if consumer spending has to make a noticeable contribution to real GDP. There are doubts about a strong trajectory of consumer spending in the second-half of the year, given the current worrisome labor market situation.

Real consumer spending declined 0.1% in June, after posting gains of 0.2% and 0.1% in April and May, respectively. Outlays of durable goods and services held steady in June, but that of non-durables fell 0.4%. We can discern the causes for a drop in consumer non-durables when the Commerce Department publishes complete details of consumer expenditures on Friday, August 3. More importantly, the level of real consumer spending in June ($9576 billion) is lower than the second quarter average ($9582 billion), which sets up the case of strong monthly gains in consumer spending in the third quarter if consumer spending has to make a noticeable contribution to real GDP. There are doubts about a strong trajectory of consumer spending in the second-half of the year, given the current worrisome labor market situation.

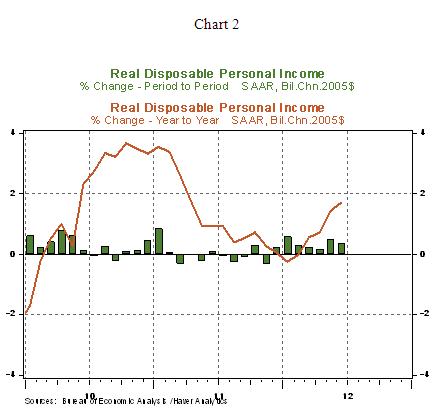

Personal income rose 0.5% in June, reflecting a 0.5% increase in wages and salaries. Real disposable income advanced 0.3% in June, putting the year-to-year gain at 1.7%. The reversal of the weak trend in real disposable income in the four months ended June is noteworthy.

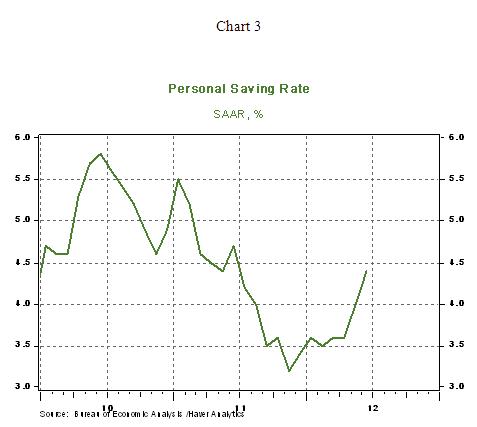

Saving as a percentage of disposable income increased to 4.4% in June, the highest reading since June 2011. The upward trend of saving and disposable income suggests that consumers have become less willing to spend and are focused on building their net worth.

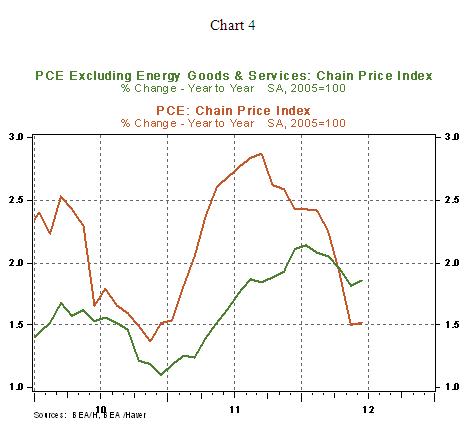

The personal consumption expenditure price index (+0.1% mom, +1.5% yoy) and the core personal consumption expenditure price index (+0.2% mom, +1.86%, yoy) are well within the Fed’s inflation target of 2.0%. Essentially, inflation measures are non-threatening and do not present a problem at the FOMC deliberations today and tomorrow (see Chart 4).

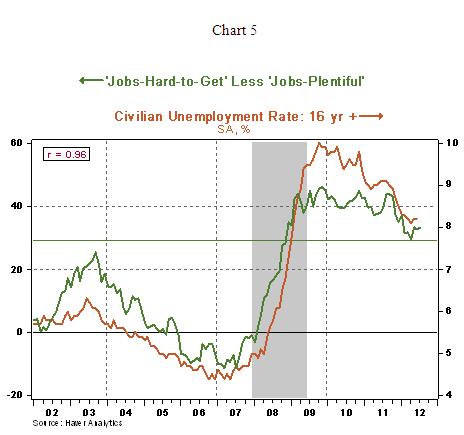

In related economic news, the Conference Board Consumer Confidence Index rose to 65.9 in July from 62.7 in the prior month. Among the two major sub-components of the index, the Present Situation Index (46.2 vs. 46.6 in June) fell, while the Expectations Index (79.1 vs. 73.4 in June) advanced. The difference between the “jobs hard to get” measure that of “jobs plentiful” index, has a strong correlation with the jobless rate widened slightly in July (33.0 vs. 32.9 in June) implying that the jobless rate could be higher than 8.2% in July.

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2012 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.