Gold at ECB: Accident or Strategy?

Commodities / Gold and Silver 2012 Jul 31, 2012 - 07:28 AM GMTBy: Axel_Merk

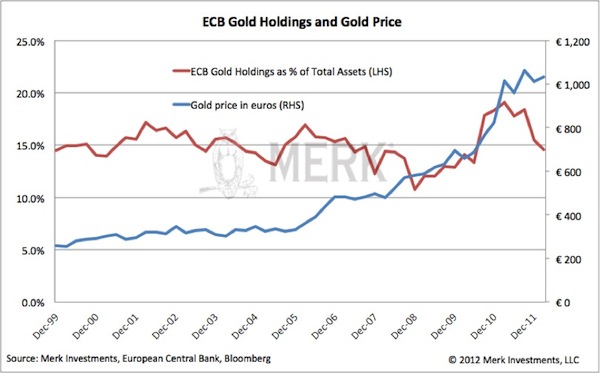

When the euro was launched, the European Central Bank (ECB) held approximately 15% of its assets in gold. That ratio has remained reasonably stable, giving rise to a variety of chatter, including suggestions that it may displace the U.S. dollar. We pursue the question on whether the ECB’s gold holdings are an accident or strategy.

When the euro was launched, the European Central Bank (ECB) held approximately 15% of its assets in gold. That ratio has remained reasonably stable, giving rise to a variety of chatter, including suggestions that it may displace the U.S. dollar. We pursue the question on whether the ECB’s gold holdings are an accident or strategy.

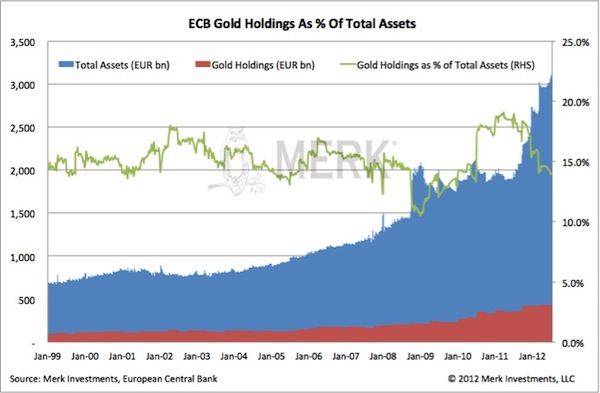

Let’s look at the numbers. Below is a chart depicting the percentage of gold relative to the ECB’s total assets. As one can see, the percentage has remained reasonably stable despite a significant growth in total assets.

Total assets of a central bank may be considered a proxy for the amount of money that has been “printed”; it’s a crude measure as it does not reflect physical money printed; nor does it reflect money in circulation; neither does it reflect sterilization activities that also show a rise in assets. Still, a central bank balance sheet is often referred to as the printing press as money is literally created out of thin air (by the stroke of a keyboard) when assets are purchased. Federal Reserve (Fed) Chairman Bernanke has referred to this fiat money feature as the printing press. We like to think of it as super-money, as central bank purchases provide cash to the banking system, allowing them to lend a multiple of the money that has been “printed”. While banks have been reluctant to lend (the velocity of money has been low), the analogy we like to give is that if you give a baby a gun, just because no one gets hurt does not mean it is not dangerous. That said, let’s look at total assets at the ECB:

The interpretation shows that while money can be printed, wealth cannot be created out of thin air: as money is printed, gold has appreciated versus the euro. So while inflation has not shown up in indicators such as the Consumer Price Index, monetary easing is rightfully reflected in the price of gold.

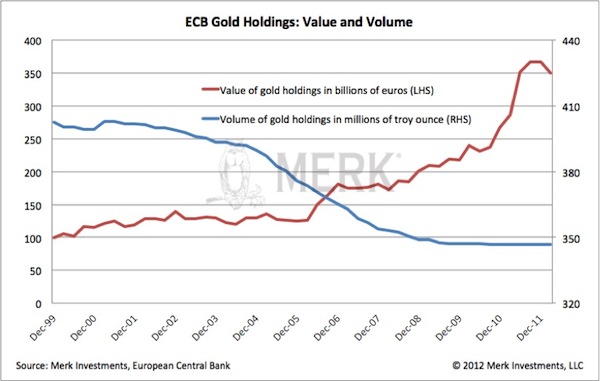

Diving a little deeper to determine how much of this is strategy versus accident, let’s look at the gold holdings at the ECB once more:

The ECB marks its gold holdings to market, i.e. uses market prices for gold. The ECB was selling gold from the inception of the euro until the onset of the financial crisis; since then, the ECB’s gold holdings have remained stable. To understand the motivation, one needs to note that when one refers to ECB gold holdings, one is actually talking about Euro area gold holdings. While the ECB holds some gold, most gold is held by the respective central banks (this is not a discussion of where such gold is physically located):

Relevant is that each nation in the Eurozone pursues its own agenda with regard to its gold holdings. Germany has resisted political pressure within Germany to sell gold, as Bundesbank (Buba) profits would need to be transferred to the government; the hawkish Buba has indicated that it would be considered selling gold to help finance the government’s deficit. Italy, as one can see, has not sold any gold. Conversely, as a percentage of their holdings, the Netherlands had been rather eager to sell gold up until the financial crisis; Portugal, too, was an aggressive seller. As one can see, gold sales are not particularly related to the financial health of a Eurozone nation, but more to the cultural attitude in the respective nations towards gold.

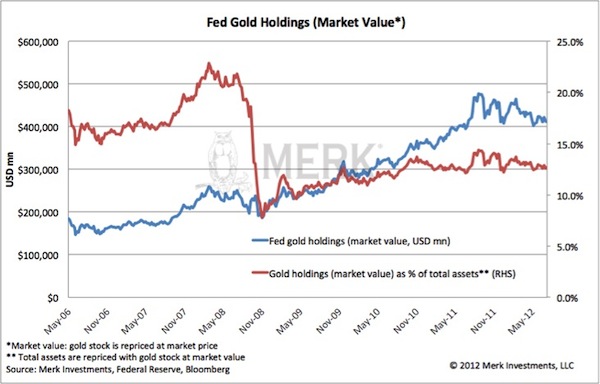

Let’s cross the Atlantic to see whether the ECB’s gold strategy is undermining the U.S. dollar. The Fed’s gold stock is valued at $44.22 per fine troy ounce. For purposes of the chart below, we adjust the Fed’s gold holdings to market prices:

Note that the chart above starts in 2006, so as to focus on the period of the financial crisis. The Fed has been more aggressive than the ECB in printing money. As such, the percentage of gold in relation to total holdings has declined at the Fed in a more pronounced fashion. There is clearly no perfect relationship between the size of the balance sheet and the price of gold, as other factors also influence the supply and demand of gold; however, increasing the supply of fiat money (dollar, euros) may decrease its value when measured in real assets, such as gold. We have in the past referred to the Fed as the champ in printing money (as measured by the percentage balance sheet growth since August 2008), although the Bank of England has, as of late, taken on that title. But we digress.

Click here to stay informed as we publish information about the gold space

From what we see, central banks have been scared into holding gold since the onset of the financial crisis. Beyond that, we don’t see an active strategy at the ECB to keep its gold reserves at 15% of total assets. Instead, the ECB’s comparatively measured approach has simply lead to a reasonably stable percentage of gold reserves. Of course that was before ECB President Draghi said on July 26, 2012, that he shall do “whatever it takes to preserve the euro.” (an interpretation of that may be that more money printing is on the way). For now, the cultural differences in responding to the financial crisis (Europe: think austerity; US: think growth) suggest that the euro should outperform the U.S. dollar over the long term, assuming the not-so-negligible scenario of a more severe fallout from the Eurozone debt crisis won’t materialize.

It may help to keep in mind that historically inflation is the response to a deflationary shock. If market forces were left to themselves, we believe the credit bust of 2008 would have caused a major deflationary shock. It’s the reaction of policy makers that fight market forces that may lead to inflation. Bernanke as of late brushed off such pessimism. As the charts above show, however, gold has been a sensitive – and sensible I might add - indicator to the trigger-friendliness of our central bankers.

Please sign up to our newsletter to be informed as we discuss global dynamics and their impact on currencies. Please also follow me on Twitter to receive real-time updates on the economy, currencies, and global dynamics.

Manager of the Merk Hard, Asian and Absolute Return Currency Funds, www.merkfunds.com

Axel Merk, President & CIO of Merk Investments, LLC, is an expert on hard money, macro trends and international investing. He is considered an authority on currencies. Axel Merk wrote the book on Sustainable Wealth; order your copy today.

The Merk Absolute Return Currency Fund seeks to generate positive absolute returns by investing in currencies. The Fund is a pure-play on currencies, aiming to profit regardless of the direction of the U.S. dollar or traditional asset classes.

The Merk Asian Currency Fund seeks to profit from a rise in Asian currencies versus the U.S. dollar. The Fund typically invests in a basket of Asian currencies that may include, but are not limited to, the currencies of China, Hong Kong, Japan, India, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Taiwan and Thailand.

The Merk Hard Currency Fund seeks to profit from a rise in hard currencies versus the U.S. dollar. Hard currencies are currencies backed by sound monetary policy; sound monetary policy focuses on price stability.

The Funds may be appropriate for you if you are pursuing a long-term goal with a currency component to your portfolio; are willing to tolerate the risks associated with investments in foreign currencies; or are looking for a way to potentially mitigate downside risk in or profit from a secular bear market. For more information on the Funds and to download a prospectus, please visit www.merkfunds.com.

Investors should consider the investment objectives, risks and charges and expenses of the Merk Funds carefully before investing. This and other information is in the prospectus, a copy of which may be obtained by visiting the Funds' website at www.merkfunds.com or calling 866-MERK FUND. Please read the prospectus carefully before you invest.

The Funds primarily invest in foreign currencies and as such, changes in currency exchange rates will affect the value of what the Funds own and the price of the Funds' shares. Investing in foreign instruments bears a greater risk than investing in domestic instruments for reasons such as volatility of currency exchange rates and, in some cases, limited geographic focus, political and economic instability, and relatively illiquid markets. The Funds are subject to interest rate risk which is the risk that debt securities in the Funds' portfolio will decline in value because of increases in market interest rates. The Funds may also invest in derivative securities which can be volatile and involve various types and degrees of risk. As a non-diversified fund, the Merk Hard Currency Fund will be subject to more investment risk and potential for volatility than a diversified fund because its portfolio may, at times, focus on a limited number of issuers. For a more complete discussion of these and other Fund risks please refer to the Funds' prospectuses.

This report was prepared by Merk Investments LLC, and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute investment advice. Foreside Fund Services, LLC, distributor.

Axel Merk Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.