The Federal Reserve, Gold, Oil, and U.S. Dollar’s Demise

Stock-Markets / Financial Markets 2012 Jul 31, 2012 - 03:52 AM GMTBy: Chris_Vermeulen

“We have, in this country, one of the most corrupt institutions the world has ever known. I refer to the Federal Reserve Board. This evil institution has impoverished the people of the United States and has practically bankrupted our government. It has done this through the corrupt practices of the moneyed vultures who control it”. ~ Congressman Louis T. McFadden in 1932 (Rep. Pa) ~

“We have, in this country, one of the most corrupt institutions the world has ever known. I refer to the Federal Reserve Board. This evil institution has impoverished the people of the United States and has practically bankrupted our government. It has done this through the corrupt practices of the moneyed vultures who control it”. ~ Congressman Louis T. McFadden in 1932 (Rep. Pa) ~

The above quote coming from the Honorable Louis T. McFadden is a quite prescient statement as it relates to arguably the most evil enterprise in American history.

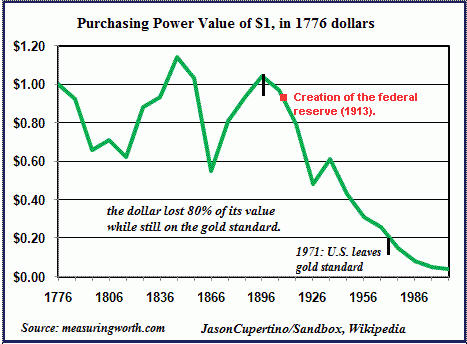

The Federal Reserve through its various monetary mechanisms has a major impact on the value of the U.S. Dollar and over time has destroyed the purchasing power of the fiat base currency used in the United States.

Interestingly enough, the following quote comes directly from the Federal Reserve’s website regarding one of its primary mandates, “In setting monetary policy, the Committee seeks to mitigate deviations of inflation from its longer-run goal and deviations of employment from the Committee’s assessment of its maximum level.”

The chart below illustrates the horrific job the Federal Reserve has done of protecting the purchasing power of the U.S. Dollar since its creation.

In light of the longer-term malaise seen above, the Dollar Index futures have recently rallied sharply higher as Europe continues to flail in a slow and agonizing decline which will ultimately lead to a complete fiscal disaster.

Sovereign debt concerns continue to mount regardless of what the European technocrats spew publicly and the U.S. Dollar has been the primary beneficiary of these seemingly growing concerns.

This brings me to the purpose of this article. Most of the articles I write are focused on option based trades, but I decided it was time to put forth a more comprehensive scenario that could unfold over the next few years as a result of excessive monetary stimulus through various quantitative easing mechanisms developed by the Federal Reserve Bank. “A mild change” to say the least . . .

As discussed above, the U.S. Dollar Index futures have moved higher throughout most of 2012. Any significant increase in the U.S. Dollar is a growing concern among central bankers as it correlates toward deflation. Deflation is the Fed’s biggest enemy, besides themselves of course.

Next week the Federal Reserve will release statements relating to the economic condition of the United States. Furthermore, the Fed also will discuss if it will initiate another dose of monetary crack for a capital market place that is addicted to cheap money and zero interest rates. At this point, the so-called marketplace is the antithesis of free by all standard measures.

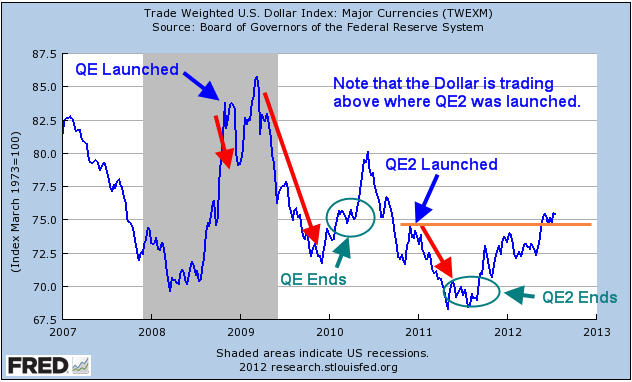

Consider the long-term monthly chart of the U.S. Dollar Index futures illustrated below:

The U.S. Dollar Index futures are in an uptrend that dates back to mid 2011. The orange line illustrates the uptrend and represents a key price level for the U.S. Dollar Index. For those unfamiliar with basic technical analysis, the rising orange trendline will act as buying support until the Dollar eventually breaks down through it signaling the bullish move higher has ended.

This brings us to a rather interesting potential observation. Today Mario Draghi, Chairman of the European Central Bank (ECB), made public comments regarding the readiness of the ECB to act if need be to safeguard the European Union. The Dollar Index Futures plummeted on the statement and remained under selling pressure most of the trading session on Thursday.

If a mere comment from the ECB can have such a damaging impact on the valuation of the Dollar, what would happen to the Dollar if the Fed initiated a new easing mechanism?

The answer is simple, the U.S. Dollar would immediately be under selling pressure. Selling pressure in the U.S. Dollar Index generally leads to a rally in risk assets such as equities and oil futures. Over the longer-term, a weak Dollar is also positive for precious metals and other hard assets.

As an example to illustrate the power of Quantitative Easing as it relates to the price of both gold and oil, consider the following chart:

Obviously the price action is pretty clear that Quantitative Easing has a positively correlated impact on the price performance of hard assets, specifically gold and oil. Now consider a price chart of the Dollar Index shown below courtesy of the Federal Reserve Bank, the annotations are mine.

The chart above tells an interesting story about the impact that Quantitative Easing has on the Dollar. How can the Federal Reserve claim to be protecting the purchasing power of the U.S. Dollar when its actions have a direct negative correlation to the greenback’s price?

Furthermore, based on the chart above I am of the opinion that Quantitative Easing III is a foregone conclusion. The current price of the Dollar Index is clearly above the previous high where QE2 was launched.

So far, the rally in the Dollar Index has not pushed equity prices considerably lower. However, should the Federal Reserve refrain from initiating additional easing measures it is likely based on the chart above that the U.S. Dollar Index will rally.

Upon the conclusion of both QE and QE2, the Dollar Index rallied sharply higher. With the Fed announcement coming closer by the hour, financial pundits will attempt to predict the future action of the Fed.

I have no interest in making predictions about what the Fed will do. It is a certainty that QE3 will take place at some point in the future whether it be sooner or later.

The Federal Reserve simply has no choice, otherwise the Dollar would continue to rally and we would begin to go through a deflationary period which the Federal Reserve simply cannot tolerate.

The scenario that I would urge inquiring minds to consider would be as follows. If the Fed does nothing we can likely assume that the U.S. Dollar Index will continue to rally to the upside.

Based on the price chart of the U.S. Dollar Index shown above, we can expect that sellers would certainly step in around the 86 – 88 price range based on previous resistance.

If the U.S. Dollar makes it anywhere near the 86 – 88 price range without the Federal Reserve initiating QE3 it would be expected that risk assets would be under considerable selling pressure somewhere along the way.

Should the Fed act to break the Dollar’s rally either through more easing or “other” mechanisms, the result would be a potentially monster rally for risk assets, at least initially.

Equities, oil, and precious metals would rally on a falling Dollar as shown above. The question then becomes what if this is the last gasp rally before a monster selloff ensues in the Dollar Index?

If the Fed breaks the rally early or initiates a monster-sized easing program, the initial reaction will be quite positive, especially for equities. As the selloff in the Dollar Index worsens, equities would eventually begin to underperform as oil prices would surge putting pressure on the economy.

In addition to oil rallying on the weaker Dollar, we could also see sellers start to show up in droves dumping U.S. Treasury’s to any buyer left standing. International debt holders would especially have incentive to sell Treasury’s as the real purchasing power of the bonds’ interest payments would decline as the Dollar fell in value.

The way I see it, whether the Fed launches QE3 now or later, the outcome will not change. An extremely weak Dollar could wreak havoc across a variety of assets and the broader economy. Imagine where gasoline prices would be if oil prices hit $125 / barrel. The average price in the U.S. would be well above $5 / gallon based on current prices and possibly higher.

What happens to the economy if interest rates start to react violently to the price action in the Dollar? What if Treasury’s start to sell off viciously and interest rates start to rise wildly and volatility among bond holdings runs rampant?

Are we to believe that the very entity that has created boom and bust cycles through easy monetary policies and has been oblivious to the bubbles that it has created is capable of solving the issues that would potentially arise from a currency crash in the U.S. Dollar?

The track record of the Federal Reserve is quite clear. They are generally late to the party and rarely are able to forecast events in the future with any clarity. Do you really think they will know what to do? The free market wants to destroy debt through deflationary pressure and price discovery and the Federal Reserve continues to get in the way.

The free market will win as it always does, but the American people will lose. This process may take months, years, or even decades to play out. Eventually the game will end.

There is only one certainty should any portion of the scenario discussed above come to fruition, when the Dollar is inevitably broken the only safe place to hide during the potential currency crash will be in physical gold and silver. Paper money and paper assets will come under extreme selling pressure and in some cases will simply . . . disappear.

Here’s to hoping I am totally wrong!

If you would like to receive my free weekly analysis like this, be sure to opt-in to my list: http://www.thegoldandoilguy.com/free-preview.php

By Chris Vermeulen

Chris@TheGoldAndOilGuy.com

Please visit my website for more information. http://www.TheGoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 6 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.