Sorry Mario Draghi, But Spain is Finished, Here’s Why!

Stock-Markets / European Stock Markets Jul 30, 2012 - 12:13 PM GMTBy: Graham_Summers

As I’ve outlined in earlier issues of Private Wealth Advisory, Spain will be the straw that breaks the EU’s back. The country’s private Debt to GDP is above 300%. Spanish banks are loaded with toxic debts courtesy of a housing bubble that makes the US’s look like a small bump in comparison. And the Spanish government is bankrupt as well.

As I’ve outlined in earlier issues of Private Wealth Advisory, Spain will be the straw that breaks the EU’s back. The country’s private Debt to GDP is above 300%. Spanish banks are loaded with toxic debts courtesy of a housing bubble that makes the US’s look like a small bump in comparison. And the Spanish government is bankrupt as well.

Indeed, in the last two weeks alone we’ve seen:

1) Spain request a €300 billion bailout from Germany (the original bailout was only €100)

2) The regions of Catalonia, Valencia, and Marcia (and three others) hinting at needing or requesting bailouts.

Indeed, the following story reveals more than I think Spain would like… but it’s clear that EU political leaders are prepping for something VERY nasty.

Spain in crisis talks with Germany over €300bn bailout

Germany’s finance minister, Wolfgang Schäuble, will meet his Spanish counterpart, Luis de Guindos, for crisis talks on Tuesday amid fears that spiralling bond yields in the eurozone’s fourth biggest economy will force it to seek a €300bn bailout from the European Union and the International Monetary Fund.

Interest rates on Spain’s 10-year borrowing rose to 7.59% – the highest since the euro was created – and the stock market in Madrid fell by 5% in morning trading following fresh bad news about the financial health of the country’s regions.

Hints from politicians in Berlin that Germany is preparing the ground for Greece to leave the single currency also unsettled markets, with hefty falls in equity prices on European bonuses and the euro under pressure on the foreign exchanges. London’s FTSE 100 index was down 100 points at midday, at 5551.

Dealers were unimpressed by de Guindos’s claim that Spain would not become the fourth eurozone country to require a formal bailout, after Murcia on Sunday became the second Spanish region to request financial assistance from the government. The Spanish finance minister categorically denied that a bailout was imminent, but media reports from Spain suggest up to six regions could require financial aid, with Catalonia next in line.

http://www.guardian.co.uk/business/2012/jul/23/spain-crisis-talks-germany-bailout-eurozone

This story tells us several important items:

1) Germany IS the money for the EU (Spain went to Germany, NOT the ECB or IMF)

2) The original bailout request for €100 was an outright lie or a covering up of the facts (why does Spain now need €300 billion only one month later?)

3) Spain as a country is broke. As in BROKE. Its sovereign Debt to GDP of 70% is not the issue, the issue is the hundreds of billions of Euros worth of debt hidden amongst the various regions and its banking system.

If you need more info on Spain, the bullet items from them that you need to know are that:

1) A huge portion of Spain’s banking system (representing over 50% of mortgage loans AND deposits) was totally unregulated up until just a few years ago.

2) Spanish banks are drawing €337 billion from the ECB on a monthly basis to fund their liquidity needs.

3) Every political figure and bank in Spain is HIGHLY incentivized to lie about the true nature of the Spanish banking system (a private text message from the Prime Minister claimed the REAL capital needs were closer to €500 billion… which is assuming he knows what he’s talking about/ the banks were honest with him… which I HIGHLY doubt).

Indeed, the markets have figured out the Spain is DONE. After all, if the IMF and ECB are refusing to fund Greece anymore, how on earth could they fund Spain whose problems are many multiples of the size of Greece’s?

Indeed, the yield on Spanish ten year bonds is now well above the “we need a bailout” 7% level. Moreover, Spanish Credit Default Swaps (bets that Spain will default) are at record spreads.

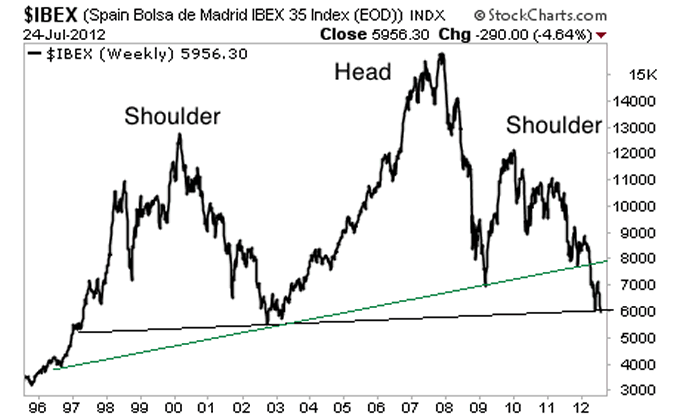

And Spain’s Ibex has broken its 15-year bull market and is now on the verge of confirming a Head and Shoulders pattern with a downside target of nearly ZERO:

European political leaders can play their little games, but the markets have a way of figuring out the truth sooner or later. And the truth is that Spain is in as bad a shape as Greece if not worse. Expect things to get very, very ugly soon.

The reason is two fold:

1) Spanish banks need to roll over (meaning renew terms on) more than 20% of their bonds this year.

2) Spanish sovereign bonds are collateral for hundreds of billions of Euros’ worth of trades.

With interest rates spiking throughout Spain (meaning Spanish corporate, bank, and sovereign bonds are falling in value), Spanish bank bondholders are going to be demanding much higher rates of return when it comes time to renew their positions.

With Spanish banks already under severe funding stress (again, they drew €337 billion from the ECB last month), they’re in no position to start paying out higher interest payments to bondholders.

And with investors realizing that Spain’s banks are all lying about the state of their balance sheets (remember, Bankia was talking about paying a dividend just one month before it collapsed and revised its €41 million 2011 profit to a €3.3 billion LOSS), we’re going to be seeing plenty of bank failures this year.

Remember, Spain’s initial request was for the EU to bail out its banks NOT the country itself. However, with some six Spanish regions (probably more) looking for bailouts Spain is now facing both a sovereign debt AND a banking crisis.

Those investors looking for actionable investment ideas could also consider our Private Wealth Advisory newsletter: a bi-weekly detailed investment advisory service that distills the most important geopolitical, economic, and financial developments in the markets into concise investment strategies for individual investors.

To learn more about Private Wealth Advisory… and how it can help you navigate the markets successfully…Graham Summers

Chief Market Strategist

Good Investing!

PS. If you’re getting worried about the future of the stock market and have yet to take steps to prepare for the Second Round of the Financial Crisis… I highly suggest you download my FREE Special Report specifying exactly how to prepare for what’s to come.

I call it The Financial Crisis “Round Two” Survival Kit. And its 17 pages contain a wealth of information about portfolio protection, which investments to own and how to take out Catastrophe Insurance on the stock market (this “insurance” paid out triple digit gains in the Autumn of 2008).

Again, this is all 100% FREE. To pick up your copy today, got to http://www.gainspainscapital.com and click on FREE REPORTS.

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2012 Copyright Graham Summers - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.