Gold Market Sentiment Increasingly Positive

Commodities / Gold and Silver 2012 Jul 30, 2012 - 05:15 AM GMTBy: GoldCore

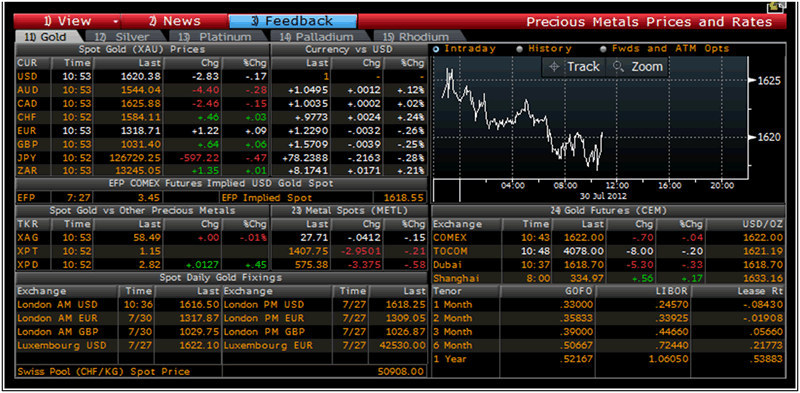

Today's AM fix was USD 1,616.50, EUR 1,317.87, and GBP 1,029.75 per ounce.

Today's AM fix was USD 1,616.50, EUR 1,317.87, and GBP 1,029.75 per ounce.

Friday’s AM fix was USD 1,618.75, EUR 1,321.43 and GBP 1,031.51 per ounce.

Silver is trading at $27.66/oz, €22.65/oz and £17.68/oz. Platinum is trading at $1,409.50/oz, palladium at $571.15/oz and rhodium at $1,125/oz.

Gold climbed $7.80 or 0.48% in New York on Friday and closed at $1,623.40/oz. Silver rose to a high of $27.839, edged off a few times, and ended with a gain of 0.98%.

US GDP results were 1.5%, which beat the expected 1.2% for the second quarter. This hurt short term outlook that the US Fed would embark on more QE after their meeting this week. However, it still highlights that US GDP slowed sharply from Q1 (2%) and Q4 in 2011 (4.1%). Gold hit a high of $1,628.60/oz ahead of the report.

This week’s US data: Tuesday - Personal Income and Spending, Core PCE prices, the Employment Cost Index, the Case-Shiller 20-city Index, Chicago PMI, & Consumer Confidence. Wednesday - ADP Employment, the ISM Index, Construction Spending and FOMC Rate Decision. Thursday - Initial Jobless Claims and Factory Orders. Friday - July’s jobs data and ISM Services.

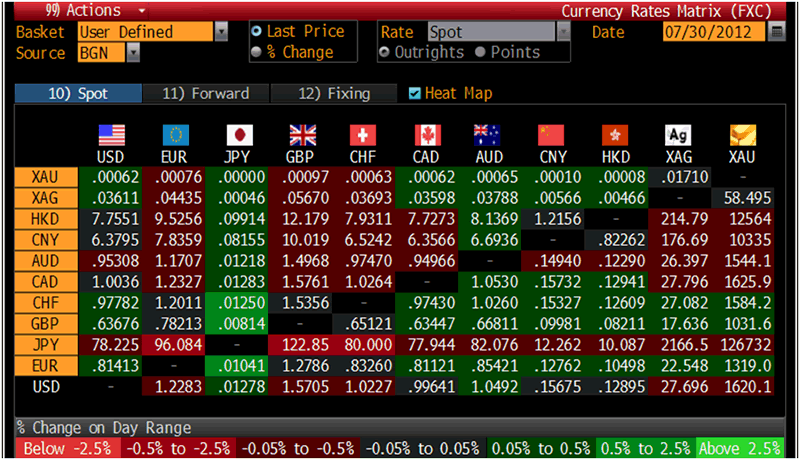

Cross Currency Table – (Bloomberg)

The euro is under pressure today ahead of the Eurozone business sentiment data (results -0900 GMT) which is expected to show further weakness in July. Ahead of the Fed meeting, investors will keenly watch the meeting between Mario Draghi, the ECB President and Timothy Geithner, the US Treasury Secretary, scheduled today in Frankfurt. Geithner will first meet with German Finance minister Wolfgang Schaeuble on the North Sea island of Sylt, where Schaeuble is on holiday.

Gold held steady above $1,620/oz on Monday, as investors wait for the central banks from Europe and the US to give definite signs on their plans for more QE.

QE3 would be bullish for gold and increase the inflation outlook which would benefit gold as a hedge against the rising prices.

The public is now interested in the yellow metal again, with investors adding to their physical positions. Market watchers will take their clues from the data out this week.

More investors are trading euro gold than ever before and using euro gold as the barometer of internal health of the gold market right now, says analyst Edel Tully of UBS. Euro gold is up 9% this year versus US dollar gold's +3% performance.

The markets await the Fed’s move. Certainly some form of QE3 is inevitable whether it is announced this week or at the next FOMC meeting scheduled in early September.

Gold Prices/Rates/Fixes /Volumes – (Bloomberg)

The US gold futures contract for August delivery inched up 0.2% to $1,620.70/oz.

Spot gold prices have moved between $1,530/oz - $1,640/oz over the past two months.

The European Central Bank has its policy meeting on Thursday and after Mario Draghi’s pledge to do everything to protect the Eurozone it has fuelled expectations of more policy action.

Gold ETF shares have been contracting. SPDR shares have been decreasing for a month and fell to 1,248.606 tonnes on Friday, its lowest level since the beginning of November.

In Asia, Vietnam looks set to tighten their gold legislation. Vietnamese and foreigners may soon be banned from taking gold bullion out of the country, and possibly even raw gold like nuggets and gold dust. Jewellery weighing more than 300g would have to be declared with customs and taxed.

Permits to remove gold would require 15 days for processing.

Vu Ngoc Lan, deputy director of the SBV's Legislation Department, said the circular (only a draft) will strengthen the management of gold bullion and raw gold to keep the market stable

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.