US in Recession - Rising Unemployment and Slowing Consumer Spending

Economics / Recession Feb 02, 2008 - 03:53 PM GMTBy: John_Mauldin

What Does a Recession Look Like?

What Does a Recession Look Like? - The Starbucks Index

- Consumer Spending Slows Down

- Rising Unemployment Starts to Show Up

- It is All About Valuations

- Phoenix, Prime Rib and My Conference

What does a recession look like? How does it feel? What does it mean for your life and your investments? We explore these questions and more in this week's letter. I have been working on this letter all week, and think you will find it interesting.

The Starbucks Index

But first, one interesting observation and a request for help on a fun project. Last week, I was in Europe. I walked across the street from my hotel in Geneva and was delighted to see a Starbucks. While I initially made fun of people who overpaid for a nickel cup of coffee (the price of my youth, which dates me), eventually I became hooked. I now have a venti decaf every morning on the way to work (venti being the Starbuck's code word for large). When I am feeling particularly adventurous I live on the edge and get a venti half-caf (half regular caffeinated coffee). The price in Dallas recently increased 5% to $1.95 or $2.11 after tax.

I ordered the same thing in Geneva and paid 6.7 Swiss francs which is like $6.43 or three times what I pay in Dallas. The fancy drinks were over $10. And the place was packed at 10 am in the morning. (Memo to returning Starbucks chairman and CEO Howard Schultz, the coffee was decidedly inferior.)

Then I traveled on to Barcelona. Father and son partners Antonio and Kai Torella of Interbrokers (and my new Spanish business associates) indulged me by walking to a Starbucks which was a nice hike away, but on a weather perfect day. There that same venti decaf was roughly $5.70, depending on which exchange rate you use, as it is jumping all over the place. The coffee was better. And the place was busy.

The next day in London I went to the Starbucks right next to the office of London partners Absolute Return Partners. I again ordered my usual venti decaf late in the afternoon. It was a bargain at 2 pounds or roughly $3.96 (although the cost to exchange currency runs it to over $4). The large store was crowded. And the coffee was perfect, except after repeating three times that I wanted decaf and being assured that was what I was getting, it turns out I got the full dose of caffeine. I am quite sensitive to the drug (caffeine), and was soon really, really wired, as my associates will attest for the rest of the night. It made for an interesting business planning meeting, and more than a few jokes at my expense.

Now I am curious. Everyone knows about the Big Mac Index as a way of comparing purchasing power parity comparisons from country to country. I want to create a Starbuck's Index for the 44 countries they are in. I am curious as to what people pay for a totally self-indulgent product that is offered right next door nearly everywhere at much lower prices. So, I would like readers outside of the US (I've got the US covered) to drop into a local Starbuck's and find out what a venti (the largest size) cup of coffee is. No latte's or fancy drinks. Just the basic cup of coffee. I will have my assistant put it into a spreadsheet and will post it in a later letter. Thanks. It should be fun.

What Does a Recession Look Like?

I have had a few emails (and lots of questions) like the following from readers the last few months. How can I still think the economy is simply going to be Muddle Through?

"What are the differences between the current state of the economy from that of the 1930s that would allow us to have a 'muddle through' instead of a deflationary depression? There seem to be many technical and fundamental similarities. We westerners having been living above our means for a long time and something is going to have to give. If history repeats itself then the cure to our addiction requires us to go 'cold turkey' with a deflationary depression. Is there hope that perhaps we could have room-temp turkey instead?" - Dr. John E.

Ok, John, let's see if I can get your heart rate down and make you feel better about the future.

I have long contended that a recession is a normal part of the business cycle. But it takes a major policy mistake by a government or central bank to create a depression. And while there is no doubt that there have been and will be mistakes, they are likely to be of a minor sort (as these things go) rather than something which would bring an out and repeat of the 1930's. And given the causes and problems attendant with the current slowdown, I think Muddle Through is a perfect description of the economy we will see over the next year or so. So, with that in mind, let's look at what a recession looks like.

First, I have already lived through 5 recessions. And every one was different in nature and cause. It is likely most of my readers, all except the youngest, have lived through at least 2 recessions, although the last two were rather mild, for reasons we will go into later. And this next recession, if we have one (and I think we are already in one) will be different than the past recessions.

But the operative words are "lived through." The US economy will come through this recession and enter a new period of growth, just as we have in the past. As will, by the way, the European economy, which I also think will encounter a recession. Again, recessions are a normal part of the business cycle. Congress can't repeal them, and central banks can only fight them, but not prevent them entirely. Clearly, though, they can mitigate the immediate problem (although the Austrian school of economics, otherwise known as the take-your-medicine-now school, contends that any such actions simply postpone the Day of Reckoning).

Consumer Spending Slows Down

Recessions are generally accompanied by a slowdown in the growth of consumer spending, although the last recession of 2001-02 saw consumer spending continue to grow at a very healthy pace, making that recession one of the mildest (and strangest) recessions in history, not just in the US, but in the history or the world (to my knowledge).

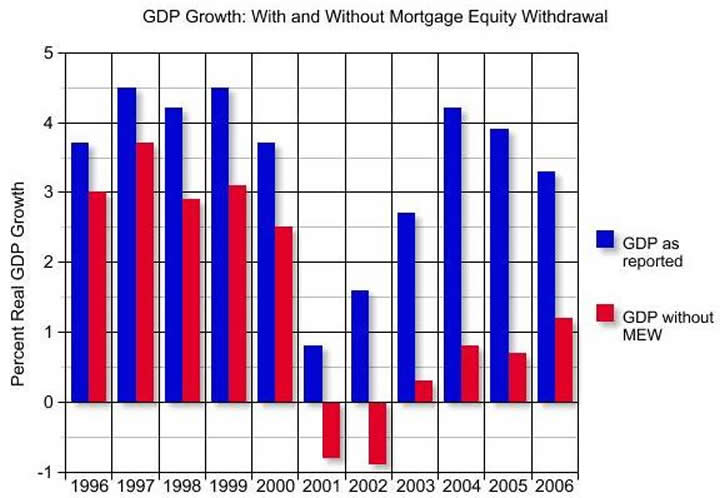

Of course, we now know why consumer spending did not slow down in the last recession. Consumers leveraged their homes to continue their spending growth, as well as increased their credit card debt. However, in the current cyclical slowdown, it is going to be harder to use mortgage equity withdrawals to bolster consumer spending, as home values are dropping. The piggy bank of increasing home values is shrinking.

While long time readers have seen this chart on a few occasions, it bears review. Notice that mortgage equity withdrawals (MEWs) accounted for 2-3% of the growth of overall GDP in 2001-6. Without MEWs we would have seen two solid years of recession (the red bars) rather than a few quarters, and a decidedly below trend economy. Such large MEWs were possible because of the bubble in housing prices and the availability of cheap and easy mortgages.

Today we are watching a slow motion bursting of the housing bubble. In data released this week, we learn that home values are down almost 8% nationwide, with many areas in double digit declines. And it is likely to get worse. 1.3 million homeowners are in some state of foreclosure, or about 1% of homeowners nation wide, and the numbers grows each month. Predictions of 2,000,000 homes in foreclosure made in late 2006 in this letter no longer look ridiculous. No wonder that many (including your humble analyst) forecast a drop of 20% or more in home values.

Further, there are 2.18 million homes that were vacant and for sale in the 4 th quarter. That's 2.8% of all homes. We are edging ever closer to a national average of 12 months supply of homes for sale this spring, with many more home owners who would like to sell simply not bothering to list their home. The good news is that if you want to buy a home, you are likely to find a very willing seller at a very good price.

Sidebar: my daughter is quite happy about the house she and her fiancé are buying and getting close to a 5.5% 30 year mortgage rate! My father bought a home in 1966 and I am pretty sure they got a 5% mortgage, paying the home off in 1996. Interestingly, she now pays attention to the 10 year bond yield, cheering each time it drops as the closing date for her home gets closer. (There is a close correlation between the ten year bond and 30 year mortgages.)

But the point is that while MEWs will not go away, especially with low rates coming back, they are not going to be the consumer spending force they have been. So chalk this current recession into the slowing consumer spending category. One caveat. The Bush/congressional plan to air drop $150 billion into the economy should add about 1% of GDP into the economy over the last half of the year, and maybe even this spring if they can get it done fast enough, and that will be a boost to consumer spending.

(Quick aside: is it only me that sees the irony in that it is Congress that is dropping virtual $100 bills from the proverbial helicopter and not Bernanke?)

And all the recent data does indeed point to slower consumer spending. Foreclosures, increased credit card delinquencies and lower same store sales suggest that the consumer is getting closed to tapped out. Further, as housing values slide, I think it will slow even more. There was a positive wealth effect on the way up, and we will see the reverse on the way down.

Plus, the need to save more for retirement as homeowners realize that they cannot count on their homes to be their retirement plan. While saving more is a good thing for individuals, it means that for the economy as a whole there is less consumer spending. If we go simply back to trend it will mean that GDP will face at least a 1% drag over long term trend. Just one more reason why the next few years will be Muddle Through.

Rising Unemployment Starts to Show Up

Recessions are also associated with rising unemployment, and this one will prove to be no exception. We saw a large rise in unemployment applications this week to 371,000. Unemployment is at 4.9%, about 0.6% above the peak. That level of rise has always been associated with a recession in the post-WW2 period. It is likely unemployment will rise to over 6%, and 7% is certainly possible.

Now, I recognize that the old joke is still true: a recession is when your neighbor loses his job, and a depression is when you lose yours. But we have to keep in mind that 4% or so unemployment is "structural" or quite close to full employment. That is the normal level of people changing jobs, etc. This would suggest a rise of only 3% in unemployment, which is not a lot in the grand scheme of things, unless it is your job.

Why so low? Why won't we go back to the 9-10% unemployment of recessions in the 70's and 80's? Because we have shipped the cyclical manufacturing jobs offshore. In past recessions the US had a much larger percentage of its job tied to manufacturing. Now manufacturing jobs account for just 20% of the economy. Even if in the unlikely event that 10% of manufacturing jobs were lost, that would mean just a 2% rise in unemployment. And I say unlikely, because many manufacturing companies with large export components to their sales are experiencing growth due to a weak dollar.

This is just not the economy your father grew up in. It is quite different, and trying to go back and look at past recessions to figure out precisely what is going to happen in this one is futile. One can only hope to get the general direction right.

It is All About Valuations

And speaking of direction, let's return to a theme I spent almost six chapters on in Bull's Eye Investing, and numerous e-letters. It is my contention that there are very long term cycles in the stock market. But rather than look at bull and bear cycles in terms of price, we should look at them in terms of valuations. Markets go from high valuations to low valuations back to high valuations, as nauseum. You can measure it in price to book or price to earnings or whatever metric you want. The affect is the same. There has never been a time where markets started out from high valuations that they did not eventually end up with lower valuations. These cycles lasted on average for 17 years, with the shortest being 13 years (so far).

And this is important. There has never been a time when valuations dropped to the mean and then went back up again without visiting a much lower valuation. Never. Not one time. Zip.

We are now back to the mean P/E ratio. Now maybe this time it is different. But those are dangerous words.

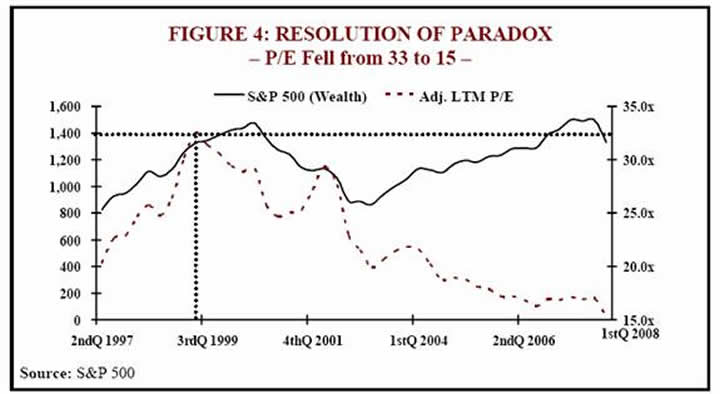

Let's take a look at a chart from Dr.Woody Brock, of Strategic Economic Decisions ( www.sedco.com ) one of my favorite economists as well as one of the smartest I know.

If you invested in 1999, you are essentially where you were 8 years ago in terms of price. Note that Woody uses the third quarter of 1999 as his comparison, as the market was close then to where it is now. But earnings, as Woody points out, have risen by 110% since 1999. P/Es are now in the 15 range. But I contend they will go lower. How can we get to the low P/E ratios that have prevailed in all previous cycles?

Either one of two ways. The market can drift sideways for a long time while earnings continue to grow, or the market can drop enough to get us to lower valuations. And that is precisely what I wrote in this letter and my book 4-5 years ago. I said it would likely take two recessions (at least) to get us back to low valuations to set up the next bull market where the primary driving factor is expanding P/E multiples. Remember in the last bull market, 80% of the increase in the price of stocks can be explained as the P/E ratio rising from a low of 7 to a cycle high of 42.

If the stock market were to drop 20%, then the P/E ratio gets to 12, assuming earnings don't fall. Of course, they will, but they are also likely to rebound as quickly as they did after the last recession.

Now, let me speculate. Go back to 1974. Were we at the low in terms of valuations at that time? No, the P/E was 11, which is admittedly low, but it was going to 7 in 1982 (note that took another EIGHT years).

But the recession drove the S&P 500 to its cyclical price low, an average of 82, and a relatively young Richard Russell (he was just 48 or so) famously said a new bull market was beginning. It was another 8 years and two recessions until the absolute bottom in terms of valuation was reached, but the price bottom made its entrance in 1974.

Could that happen again? Could this current recession drive the market down enough to set a price low, even though it will take some time for valuations to reach their cycle lows (and who knows what that number is?) That is very possible. There is a buying opportunity in our future.

As I said in my annual forecast, I expect to turn modestly bullish on the stock market when this recession has played its course, and seriously bullish when valuations get lower. I am looking forward to it. It is more fun to be bullish. You get invited to more parties.

Why don't we just hit the mean P/E ratio and just bounce back on up? It is mostly psychology, and I spent a great deal of time in my book and in this letter trying to demonstrate the reasons behind these cycles. But in a nutshell, if you disappoint the market once, you get a small reaction. Disappoint investors again and the reaction is more pronounced, and don't even go there a third or fourth time.

Recessions produce earnings disappointments for a variety of reasons: reduced consumer spending, higher marginal cost of sales ratios, reduced business investment, etc. I think we are in for a few quarters of disappointment.

That being said, there is always a tug of war between the bulls and bears, as the data is rarely one sided. Let's go back to Woody's recent letter, which I think captures the spirit of the debate perfectly:

"First, the magnitude and indeed the nature of the credit market crisis is very hard to assess.... No one has a clue as to the extent of write-downs that will be incurred in the future. Also, from a Main Street perspective, no one seems to know how much the current or future financial crisis will impede the flow of credit needed to maintain real economic growth. The combination of diminished bank capital and tighter lending standards could prove fatal to credit creation.

"Second, the behavior of the economy—the consumer in particular—is completely paradoxical. On the one hand, the economy has not been that bad at all. As former Fed Chairman Greenspan pointed out on the 25th of January, there is still no hard evidence that a recession is underway. Indeed, personal income was up 6.1% for the year ending in November. Consumption growth in the fourth quarter of 2007 was up 2%, far higher than many bears predicted. Finally, the unemployment rate has not risen very much at all. Importantly, these conditions hold true two years after the advent of the housing crisis and four years after the advent of sharply rising oil prices.

"On the other hand, in contrast to this reassuring picture of macro-stability, the rate of loan delinquencies and defaults of household debt of all kinds is arguably at its highest level in history—and this is true before the unemployment rate has risen cyclically, and before a recession has occurred. Specifically, delinquency/default rates have soared across the board on auto loans, credit card debt, home equity loans, prime mortgages, and of course subprime mortgages. All this suggests that certain bears may be right in arguing that the consumer has reached a breaking point."

"How might we read such confusing tea leaves? Economic bulls claim that macro-stability is once again in evidence, and that bears about the economy have been too pessimistic, as indeed they have been for a quarter of a century. But such bulls cannot explain the loan delinquency and default rate phenomena. Bears on the other hand have proven much too pessimistic in their forecasts to date. They were shocked by the 4.9% third quarter GDP growth rate, and cannot explain why the economy has remained as buoyant as it has been. Yet they can claim "I told you so!" when it comes to the household debt crisis."

So, John, back to your original question. Will we see a depression? The answer is it is very unlikely. Most of the economy is just fine. Yes, we have a housing bubble that will take at least another 12-18 months to work through the excess inventory. And yes, we do have a credit crisis that is the worst since the Depression.

But the monetary and regulatory authorities are quite aware of the problems. You are already seeing banks being allowed to borrow at special "windows" (the TAF or Term Auction Facility) to meet reserve requirements. Banks are being given time (as I understand it) to meet SIV problems. The Fed is lowering rates at a rapid pace.

There is a serious effort to figure out how to capitalize the monoline insurance companies. I think it is not unlikely that public money will eventually be brought into play, much like the Savings and Loan Crisis on the late 80's. In short, and no matter what your view is, the Fed and the Treasury are going to do what they have to do to keep the game going. My bet is that the Sovereign Wealth Funds have just begun their fire sale investments, as there may be another few hundred billion to write down. So be it.

But it will mean that we Muddle Through in the meantime. It will probably not be pretty or elegant. It may not be fun. No one is going to guarantee your 401k accounts. Shareholders in large financial institutions that still have large write downs in their future will not be happy as some banks will just keep disappointing.

I still maintain the Fed is only marginally interested in the stock market. But the banking system is on their watch, and it is in a full blown crisis. They are paying attention. Can they do enough to avoid a recession? I don't think so. But they can keep it from becoming a major recession or depression.

In the meantime, 93% of people will have jobs (at the worst). There will be the usual lowered expectations, and businesses will have to adjust. New businesses will be started that will change the world. Entrepreneurs will see opportunity. Investors will see the auctions of foreclosed homes as opportunities to own rental property at once in lifetime values. Well, ok, maybe twice in my lifetime, as the above mentioned S&L crisis did create some great opportunities in specific locales.

It will take some time to work through the after shocks of two bubbles bursting. But we will. And thus, Muddle Through will be the operative words to describe the economy. And then things will return to "normal."

Remember, new opportunities will present themselves, just as they have after every recession. In fact, they are often the best ones, as you can find them at lower costs.

Breathe deep, Dr. E. It is just a recession. This will pass. Besides, you are a doctor. There will be no recession in health care. Party on.

Phoenix, Prime Rib and My Conference

I and my daughter Tiffani have spent the last few days with Jon Sundt and his management team from Altegris Investments. Jon has a retreat home at the Hollister Ranch north of Santa Barbara, high up in the mountains overlooking the ocean. It is one of the more beautiful places I have ever been to. I always look forward to going. We took turns cooking, and my prime was special as always. Sundt's wine cellar took a well-deserved beating. Good times.

We talked about the alternative investment world, and I have to admit I am pumped about the future. (I just came back from Europe with my partners there, and the general prospects are just as good there.) While there are always problems here and there when you deal with alternative investments (as with any investments), in general there are just so many good opportunities right now.

Our conference is shaping up to be one of the best. Don Coxe has just agreed to attend, and if you have not had the pleasure of hearing him, you are in for a treat if you can make it.

My Strategic Investment Conference is April 10-12 in La Jolla. As well as Don, Paul McCulley, Rob Arnott, George Friedman of Stratfor and another powerhouse speaker who I am going to personally strong arm into coming this week will be there. Plus 10 or more specially selected hedge funds will be presenting. Everyone who comes to one of these conference say they are the best they have been to.

Sadly, because of regulatory reasons, we have to limit attendance to investors with a net worth of over $2 million. It is frustrating to me, but we do follow the rules. If you are interested in knowing more, you can go to www.accreditedinvestor.ws and sign up and someone will contact you. Also, if you can't come, but would like to know more about the world of hedge funds, commodity funds and private offerings, just fill out the form and we will show you what is behind "curtain #3." (As I date myself.)

I will be in Phoenix this next weekend speaking several times at the Cambridge House Resource Investment Conference. This is a large, free conference with an outstanding line-up of speakers, mostly focused on natural resources and gold. If you are in the area, or simply looking for more information on gold and natural resources, you should consider attending. As noted, the conference is free if you pre-register. You can find out more by going to: http://www.cambridgehouse.com /mauldin/access.html and clicking on "Phoenix."

It is time to hit the send button. I started this letter on Wednesday in California, worked on the plane coming back and am finishing it in my home. If there are any mistakes, let's just blame it on too many time zones. Have a great week.

Your wishing the Cowboys were in the Super Bowl analyst,

By John Mauldin

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2008 John Mauldin. All Rights Reserved

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors before making any investment decisions. Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staff at Millennium Wave Advisors, LLC may or may not have investments in any funds cited above. Mauldin can be reached at 800-829-7273.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.