Four Ways To Not Lose Money In A Bubble Economy

Stock-Markets / Liquidity Bubble Jul 27, 2012 - 10:38 AM GMTBy: Money_Morning

Many experts claim we're not in a bubble economy because they can't see the "bubble."

Many experts claim we're not in a bubble economy because they can't see the "bubble."

Why is beyond me.

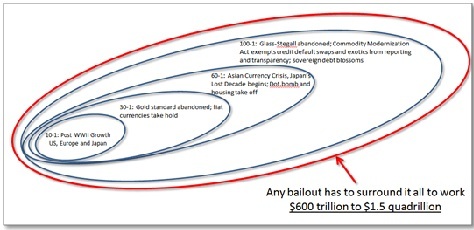

The bubble is so enormous right now that any serious bailout attempt would have to encompass the entire shootin' match or roughly $600 trillion to $1.5 quadrillion ($1,500,000,000,000,000) in order for it to work.

That's the total estimated amount of outstanding derivatives, credit default swaps and exotics outstanding at the moment according to various industry sources.

I say estimated because nobody actually knows for sure. Nearly five years into this crisis, the derivatives markets still remain almost entirely unregulated.

And, that's why the well-intentioned but completely misguided onesey-twosey's bailouts we've seen so far won't cut it despite the fact that they're already into the trillions of dollars.

I say this because, despite what most politicians and central bankers think, we are not staring at a series of independent bubbles blown into the wind, but a single, massive all-encompassing monster bubble that surrounds us all.

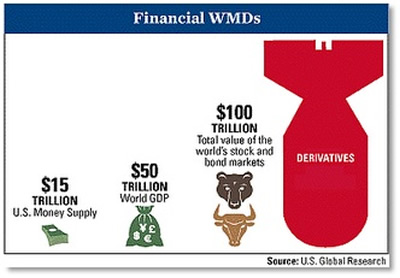

To put this into perspective, the total value of the United States' economy is approximately $15 trillion. The world's GDP is around $50 trillion while the total capitalization of world stock markets is only $100 trillion.

You can see the problem as easily as I can...there literally isn't enough money on the planet to bail us out, and I don't care who's got the keys to the printing presses.

How We Got Here is a Story in Itself

Bubbles this big don't form overnight.

What we've been handed is an overlapping bubble that's gotten progressively larger over time as our legislators, bankers and regulators have progressively "improved" the system over time.

Following World War II, we levered up approximately 10 to 1 as the U.S., Europe and Japan recovered. Then, in the 1970s, the United States moved away from the gold standard. Other nations followed, taking global leverage higher; 30 to 1 became the new standard.

Following the Asian currency crisis and the beginning of Japan's Lost Decade, things jumped to 60 to 1 as ChinIndia, the Dot.bomb boom and housing took off.

In 1999 Congress tore down Glass-Steagall with the Gramm-Leach-Bailey Act, and in the process removed many of the limits between commercial banking and securities firm affiliations.

Shortly thereafter, it passed the Commodity Futures Modernization Act in 2000 which specifically exempted credit default swaps and other exotic derivatives from reporting. That created a Wild West-like atmosphere for traders and their firms using leverage that jumped as high as 100-1.

With each progression down the slippery slope, the bubble simply grew and grew...and grew.

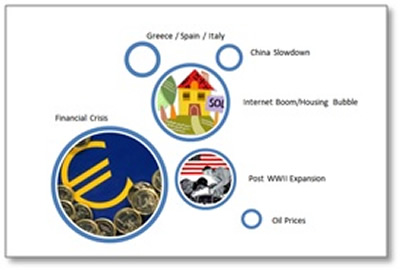

And it's not just in one market either...but in every market. I believe this is precisely what our leaders and bankers are missing. To them, the crisis appears like a bunch of independent bubbles each with its own unique set of causal factors and solutions.

Take your pick: the housing bubble, the credit bubble, the EU, China-- you name it, only they're not so independent.

Figure 1: Fitz-Gerald Research Analytics

The Problem with the "Smartest Guys in the Room"

So why do guys like Ben Bernanke, Paul Krugman, our Congress, the ECB, and nearly every leader in the EU except Angela Merkel like the idea of printing their way out of this mess?

Three reasons:

- They want to get reelected and/or maintain their own power base in a dramatic demonstration of Parkinson's Law;

- They have failed to understand the lessons from Japan's experience (and 2,000 years of recorded monetary history before that);

- They cannot comprehend that this crisis was caused by too much money rather than too little so they won't admit what they are doing isn't working and pursue another course of action.

- Force banks to decide...either they are commercial or investment banks. No in-betweens, no hybrids and no accounting gimmicks. Break up those who will not cooperate by legislative force if we have to. No taxpayer should be liable for their transgressions. Period.

- Reinstate Glass-Steagall or some variation of it. Dodd-Frankenstein won't work. The system is broken so scrap it and begin anew.

- Let failure happen. History is littered with the bones of failed financial institutions. Things may change, but finance is a process of evolution and it always has been. The key is not allowing mutants to have their run of the planet when what the public trust requires is security, integrity and honesty.

- No netting. Enact global standards that require big banks to report the true value of their exposure. People are upset about JPMorgan's loss and have a hard time understanding how the bank's trading losses ballooned from an initial $2.1 billion figure to what's now approaching $5.8 billion...until they comprehend that Bruno Iksil, (a.k.a. the "London whale") may have had total exposure exceeding $130 billion, according to industry insiders familiar with the trade.

- Let the markets decide how much is too much. Don't use policy instruments to play God. Some sources suggest that firms like JPMorgan may still hold hundreds of billions in trading assets that remain exposed to liquid asset markets. Assuming the world's big banks remain levered in line with historic capital ratios, a 20% correction in global markets could literally wipe them out. With the taxpayer now on the hook for downside risk, that's hardly an appealing thought.

How to Beat the Bubble Economy

But, in terms of what we do as investors, there are certainly easy choices.

First, the return of your money has to be more important than the return on your money. Period. Any investment you make has to be made with the concept of safety in mind and the preservation of value at hand.

To me this means shifting focus from what the world wants to what the world needs, particularly when it comes to energy, inflation-resistant choices, and dividend-producing stocks with high free cash flow.

Second, don't walk but run away from long-term bonds and fixed-rate investments. I know this will piss a bunch of people off, but that includes many annuities and whole life insurance at this point. Any rise in interest rates will crater the value of these instruments and subject your wealth to unnecessary volatility.

Short-term bonds and variable-rate instruments are a different story. There you have at least a limited capacity to absorb the changes that will come from rising interest rates and a changing global financial system by continually recycling into new, higher rate instruments as they become available.

Third, make sure you are equipped to "buy and manage." Buy and hold has been dead for years and is unlikely to ever return. Sadly most people don't realize this and continue to confuse it with buy and "hope."

A lot of people don't like them, but I am a big fan of trailing stops. I encourage any investor who's serious about their money to use them as a means of capturing profits and protecting their hard-saved capital from serious market hiccups. Put options are a good choice for those with a more sophisticated toolset.

And fourth, you've got to know when to step back in.

I know that sounds like a contradiction given the stage I've just set in this article, but knowing when to buy is critical in markets like those we're living through now.

Don't confuse this with market timing.

What I am suggesting is that the markets have an upward bias over time, therefore outstanding performance over time becomes a matter of identifying relative weakness and buying into it rather than running the other way.

You can see that quite clearly in charts like this one:

So don't give up the ghost.

Understanding the big picture as I have laid it out will help you comprehend the world we live in and how to use the mistakes policymakers are making to your advantage. It may not be easy to deal with emotionally nor pleasant to think about. But that doesn't make it any less important.

Believe it or not, the global financial crisis is actually helping us approach a point where market conditions will again favor buying more than selling, and even our policy makers won't be able to screw that up.

Source :http://moneymorning.com/2012/07/27/four-ways-to-not-lose-money-in-a-bubble-economy/

Money Morning/The Money Map Report

©2012 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.