Gold Shaping Up for a Major Uptrend

Commodities / Gold and Silver 2012 Jul 23, 2012 - 06:55 AM GMTBy: Clive_Maund

Most would be investors and speculators in the Precious Metals sector at this time look and behave like the raw recruits at the start of the film An Officer and a Gentlemen - listless and muttering pathetically "This might not be the bottom - it could go down again" - so listen up you 'orrible lot and pull yourselves together - by the time you are done reading this you are expected to have cleaned yourselves up, straightened yourselves out and be ready for action - and insubordination will not be tolerated.

Most would be investors and speculators in the Precious Metals sector at this time look and behave like the raw recruits at the start of the film An Officer and a Gentlemen - listless and muttering pathetically "This might not be the bottom - it could go down again" - so listen up you 'orrible lot and pull yourselves together - by the time you are done reading this you are expected to have cleaned yourselves up, straightened yourselves out and be ready for action - and insubordination will not be tolerated.

Now that I've got your attention we will start by looking at the 3-year chart for gold. On this chart we can see that following the peak attained last August, gold has been consolidating/reacting in some sort of triangular pattern. Some see this pattern as a bearish Descending Triangle and a top area. There are various reasons why this is not thought to be so. One is that there has been no speculative mania phase involving high public participation in this gold bull market so far, and as pointed out by Richard Russell, major bull markets of the type we have seen in gold typically end with such a phase. Secondly, the pattern has the attibutes of a 3-arc Fan Correction, breakout from which will be signaled by gold breaking above the 3rd fanline shown on the chart, which should trigger a powerful uptrend. The support at the bottom of the pattern is clear, important and obvious - so obvious in fact that we should not be surprised to see Big Money force a false break below it in order to trigger stops to run the little guy out of his remaining positions ahead of a surprise reversal to the upside. Nevertheless, buying here has an extraordinarily favorable risk/reward setup, as risk can be strictly limited by placing stops below the support, and upside potential from here is very substantial. What if Big Money does stage the stunt of crashing the support and your stops ARE triggered. We've got an answer to that too - buy back if the price subsequently rises back above the breakdown point, which will be evidence that the move was phoney, and accept the whipsaw loss as the price of the game.

The 6-month chart is useful as it reveals that gold has been trending slowly lower since March beneath a very important downtrend line that is embedded within the Fan Pattern. The importance of this downtrend should be clear from the fact that the price has been repelled from it no less than 8 times already either on contact with it or on close approaches. What this means is that clear move above this trendline will constitute an important breakout that should lead to the price going on to surmount the resistance at the 3rd fanline not far above soon after, and thus a breakout above this trendline will be a major buy signal, although from the evidence we are reviewing today, we don't need to wait for that to happen before establishing positions.

Alright, so why would we remain bullish even if gold crashed the key support at its September and December lows? - wouldn't the failure of such obviously important support lead to a plunge? - well, it probably would but it would also be expected to be followed by a rapid reversal to the upside - here's why..

As the Hulbert Gold Sentiment chart shown below makes plain, the masses are extremely bearish on gold, and when they are it is almost always at, or close to, a significant bottom.

Chart courtesy of www.sentimentrader.com

Next we look at the chart showing the Rydex Traders Precious Metals assets. The Rydex Traders specialize in holding low quantities of Precious Metals at price bottoms for the sector, as this chart makes plain. What we are seeing here is thus a good omen for gold and silver prices.

Chart courtesy of www.sentimentrader.com

Now we turn our attention to the dollar, for if gold and silver are poised to rally we would expect to see signs of impending weakness in the dollar - and we do, not so much on the price chart, but on indicator charts.

The 6-month chart for the dollar index shows that a second wave up is underway, following the reaction after the big 1st wave up in May, but it also shows that the dollar is having trouble following through and making significant further progress, so far at least. The MACD indicator at the bottom of the chart additionally shows momentum failure on the new high for this move about a week ago, that could be the precursor to a breakdown from the potential bearish Rising Wedge shown, although going on this chart alone it is still too early to say, as what could happen is that momentum improves significantly soon on further strong gains that take the index up out of the potential wedge pattern. However, there is strong evidence on dollar sentiment charts suggesting that such strength will not manifest and that instead the dollar will turn lower and break down soon. We will now look at this evidence.

The following chart shows that the public are now very bullish on the US dollar, with public optimism being very close to its most extreme readings, it also shows that when the public gets like this it is a sign of a top and an imminent reversal. The vertical bars drawn on the chart show the times when the public got it wrong in a big way both on the long and short side, just in past several years. Quite obviously, if the dollar soon turns tail and heads south, it will likely drive a strong rally in gold and silver.

Chart courtesy of www.sentimentrader.com

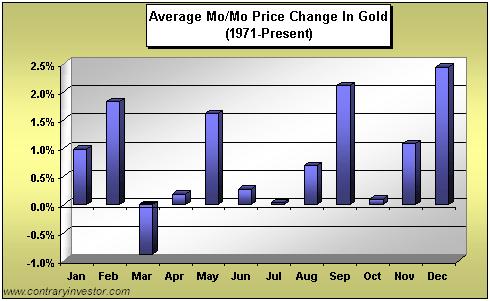

Finally, we are now approaching a seasonally bullish time of year for the Precious Metals that will a exert a positive background influence and provide a tailwind for any advance, as the following chart shows...

So there you have it - everything appears to be shaping up for a major uptrend to begin in gold soon. The 2 most effective strategies at this point are as follows; you have the choice of buying now (adding) to take advantage of the current highly favorable price/time setup, placing protective stops beneath the strong support at the September and December lows - if these stocks are triggered, possibly due to an orchestrated campaign to run people out of positions, then you stand ready to jump back in if the price breaks back above the support, accepting the minor whipsaw loss. The other approach is to wait until the price makes a clear breakout above the important trendline within the Fan pattern shown on our 6-month chart - this approach is safer but would involve sacrificing some gains.

So now that you are looking shipshape and Bristol fashion you know what to do - don't just stand there - get on with it!!

By Clive Maund

CliveMaund.com

For billing & subscription questions: subscriptions@clivemaund.com

© 2012 Clive Maund - The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maunds opinions are his own, and are not a recommendation or an offer to buy or sell securities. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications.

Clive Maund Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.