The Gilded Age of Bankers or Banksters

Politics / Banksters Jul 23, 2012 - 06:38 AM GMTBy: Richard_Mills

Between 1865 and 1898 the US economy grew at the fastest rate in its history with real wages, wealth, GDP, and capital formation all increasing rapidly:

Between 1865 and 1898 the US economy grew at the fastest rate in its history with real wages, wealth, GDP, and capital formation all increasing rapidly:

- Wheat production increased by 256%

- Corn production increased by 222%

- Coal production increased by 800%

- Miles of railway track increased by 567% - railroad mileage tripled between 1860 and 1880 and had tripled again by 1920

- American steel production surpassed the combined total of Britain, Germany, and France

All of this tremendous growth yet in 1880 11 million of the nation's 12 million families earned less than $1200 per year - their average annual income was $380 which was well below the poverty line.

There were several reasons why the US economy grew so fast in the period between the end of the Civil War and the turn of the century, among them were:

- The opening of the Western frontier

- The discovery of rich mineral resources

- The increasing population

- The ability to attract capital

A modern industrial economy based on a new national transportation and communication network was being created. By the beginning of the 20th century per capita income and industrial production in the United States exceeded that of any other country except Britain.

By 1906 the annual rate of US capital formation was running at $5 billion. This rapid expansion went hand in hand with the creation of enormous industrial and financial monopolies. In 1893 Drexel, Morgan & Company became J.P. Morgan & Company, America's premier investment bank. By 1904, more than 1,800 companies had been consolidated into 93 corporations, a financial consolidation led by J. Pierpont Morgan.

J.P. Morgan created United States Steel in 1901 - the first American corporation with a capitalization exceeding one billion dollars. Morgan was also responsible for General Electric, International Harvester and the reorganization of American Telephone & Telegraph Company (AT&T).

The Mellon brothers - Andrew and Richard - were major stockholders in Gulf Oil Corporation and Aluminum Company of America. With an aggregate wealth exceeding one billion dollars before the stock market crash of 1929 they were the wealthiest bankers of the era.

Moses Taylor made himself a 40 million dollar fortune by building City Bank into New York's largest.

James Stillman built the assets of National City Bank to one billion dollars.

George Fisher Baker became the largest shareholder of First National Bank of New York (today known as Citicorp) and was head of the bank from 1877 until his death in 1930.

August Belmont was one of the most influential Jewish bankers in America and an agent of the Rothschilds.

The Seligmans established J & W Seligman & Company, an international banking house.

Founded by Abraham Kuhn and Solomon Loeb in 1867, Kuhn, Loeb & Co of New York was the largest and most influential of the American Jewish banking houses. Kuhn, Loeb & Company was related to the house of M.M. Warburg of Hamburg, Germany.

Gild - to cover with, or as if with a thin layer of gold, to give an often deceptively attractive or improved appearance to.

Mark Twain called the late nineteenth century the "Gilded Age" - meaning that the period was golden on the surface but underneath the thin veneer was a cesspool of banksterism, greed and graft, shady business practices, scandal plagued politics and overt displays of upper class consumerism and materialism.

If we stop looking in the rear view mirror right here and fast forward to the future we're struck by the many similarities to today's present conditions.

We have at least equaled or exceeded the extremes of inequality achieved by our late 19th century predecessors. The comparisons between Twain's Gilded Age and our present circumstances are numerous: crony capitalism and government, the mortgage and banking crisis, big business tax breaks, the creation of complex financial instruments, small factories and workshops closing, unemployment exploding, unemployed workers demonstrating, corruption, ostentatious spending, wage depression, massive urbanization and the use of police, armed force, to break up demonstrations.

But something stands head and shoulders above the rest - income disparity.

"For at least the last 30 years, it has been assumed by almost everyone -- economists, politicians, civil servants -- that if the finance industry is doing well, that must mean customers (and society more generally) were benefiting." The Civitas think-tank, You're On Your Own

Unfortunately the United States is the most economically stratified society in the western world. As of 2008 the top .01 percent, or 14,000 American families hold 22.2 percent of the country's wealth - the bottom 90 percent, or over 133 million families hold just four percent of the nation's wealth - collectively the top 300,000 Americans have almost as much income as the bottom 150 million.

The average pay per employee - which takes in secretaries, clerks, tellers and janitors - at the five biggest American banks last year was $336,000.

Below is the total compensation, for 2007, for some top bank executives whose banks received the first government aid monies given out through TARP.

Bank of America Kenneth D. Lewis Chairman and CEO $24.8 million

Citigroup Gary Crittenden Chief Financial Officer $19.4 million

Citigroup Charles Prince Former Chairman and CEO $15.1 million

Goldman Sachs Lloyd C. Blankfein Chairman and CEO $70.3 million

Goldman Sachs Gary D. Cohn President and Chief Operating Officer $72.5m

Goldman Sachs Jon Winkelried President and Chief Operating Officer $71.5m

Goldman Sachs David A. Viniar Chief Financial Officer $58.5 million

Goldman Sachs Edward C. Forst Chief Administrative Officer $49.1 million

JP Morgan Chase James Dimon Chairman and CEO $27.8 million

JP Morgan Chase Steven D. Black Co-CEO Investment Bank $20.9 million

JP Morgan Chase James E. Staley CEO Asset Management $16.7 million

JP Morgan Chase William T. Winters Co-CEO Investment Bank $21.2 million

Merrill Lynch John A. Thain Chief Executive Officer $17.3 million

Merrill Lynch Gregory J. Fleming President & Chief Operating Officer $27.4m

Merrill Lynch E. Stanley O'Neal Former Chief Executive Officer $24.3m

Merrill Lynch Dow Kim Former Executive Vice President $14.5 million

Morgan Stanley Colm Kelleher Chief Financial Officer $21 million

Morgan Stanley David H. Sidwell Former Chief Financial Officer $14.6 million

Morgan Stanley Robert W. Scully Co-President $15.2 million

Morgan Stanley Gary G. Lynch Chief Legal Officer $11.9 million

New York Mellon Bank Robert P. Kelly Chief Executive Officer $20.1 million

New York Mellon Bank Thomas A. Renyi Executive Chairman $22.2 million

New York Mellon Bank Gerald L. Hassell President $11.8 million

New York Mellon Bank Steven G. Elliott Senior Vice Chairman $19.7 million

New York Mellon Bank Ronald P. O'Hanley Vice Chairman $11.5 million

State Street Corp. Ronald E. Logue Chief Executive Officer $28.3 million

State Street Corp. Joseph L. Hooley Vice Chairman $10.3 million

Wells Fargo Richard M. Kovacevich Chairman $22.9 million

Wells Fargo John G. Stumpf President & Chief Executive Officer $12.6 million

aflcio.org

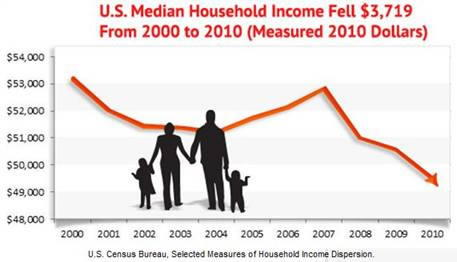

In 2010, the top 20% of Americans earned 49.4% of the nation's income.

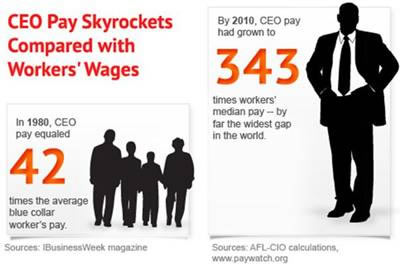

According to a AFL-CIO analysis of 299 companies in the S&P 500 Index CEOs of the largest companies received, on average, $11.4 million in total compensation for 2010. CEOs of the 299 companies in the AFL-CIO Executive PayWatch database received a combined total of $3.4 billion in pay in 2010, enough to support 102,325 jobs paying the median wages for all workers.

In 2011, Brian Moynihan of Bank of America, Vikram Pandit of Citigroup and Jamie Dimon of JPMorgan, have seen annual pay raises averaging 11.9 percent. The top fifteen bank CEOs total compensation for 2011 averaged $12.8 million.

Jamie Dimon's pay in 2011 was $23.1 million, that's up $3.5 million from the $19.6 million he made in 2008.

aflcio.org

"Americans have the highest income inequality in the rich world and over the past 20-30 years Americans have also experienced the greatest increase in income inequality among rich nations. The more detailed the data we can use to observe this change, the more skewed the change appears to be ... the majority of large gains are indeed at the top of the distribution." Economist Timothy Smeeding, Social Science Quarterly

Income disparity and the fact some things never change should be on every ones radar screen. Are these issues on your radar screen?

If not, maybe they should be.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com

Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector.

His articles have been published on over 400 websites, including:

Wall Street Journal, Market Oracle, SafeHaven , USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2012 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.