The Spanish Inquisition 2012

Economics / Eurozone Debt Crisis Jul 20, 2012 - 01:03 PM GMTBy: Asha_Bangalore

Our daughter studied in Spain, and our whole family fell in love with the country when we visited. Ever since, we’ve cheered for La Furia Roja, the wonderful national soccer team. Unfortunately, Spain is dealing with a much less pleasant Furia at the moment.

Our daughter studied in Spain, and our whole family fell in love with the country when we visited. Ever since, we’ve cheered for La Furia Roja, the wonderful national soccer team. Unfortunately, Spain is dealing with a much less pleasant Furia at the moment.

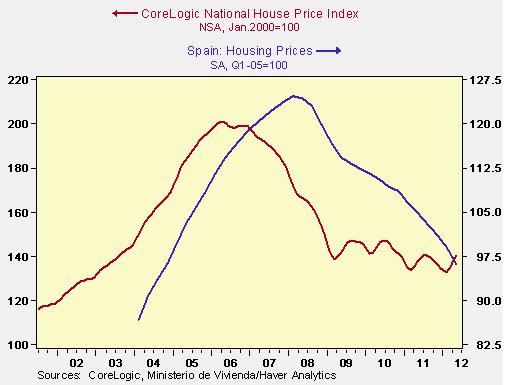

As the crisis in peripheral Europe spreads from smaller countries to larger ones, the consequences grow commensurately. Spain’s economy is about five times larger than Greece’s, and its commercial and financial linkages are proportionately deeper. While Spain has many of the same structural challenges that other countries have, its plight has been deepened by a property market crash that rivals the one in the U.S.

Much of the Spanish property bubble was fueled by a network of cajas, financial institutions with business models that recall the U.S. savings and loan industry of twenty years ago. And the political connections between the government and key institutions challenges resolution, just as it did here.

Over much of the past year, Spanish leadership repeatedly defended the solvency of its financial institutions. By the time a € 100 billion bailout package was announced last month, the investment community had lost patience. Today, 10-year Spanish bond yields are trading well above 7%, and bonds offered by regional governments are yielding almost twice that.

Meeting this debt service, and the requirements of debtors like the IMF, requires harsh austerity measures. In Spain, where the official unemployment rate is close to 25%, the prospect of more government belt-tightening has led crowds to the streets in protest.

Will European policy makers have the means and the will to address this seemingly intractable situation? Budget cuts may make financiers happy, but countries in recession typically need policy stimulus…which could ultimately reduce public deficits if growth improves.

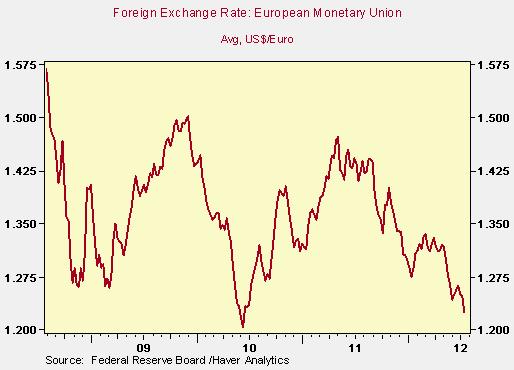

Further, Spain’s trauma is casting a pall over the whole of the Eurozone. Exports from Northern Europe to the periphery have slowed, failure of Spanish financial institutions could create losses for banks in other European nations, and the negative sentiment has taken quite a toll on the value of the euro.

Whether they like it or not, European nations are all in this together. Unfortunately, this may not be immediately apparent to all stakeholders, especially voters in local elections. For more on the situation, please take a look at my colleague Victoria Marklew’s excellent note on What’s Next for the Eurozone?.

In the meantime, we’ll do our (very little) bit to help by purchasing imported Spanish manchego, chorizo, and rioja. Perhaps you could go out for tapas this weekend to do your fair share.

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2012 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.