China Aims To Be "Major Gold Trading Center" With Interbank Gold Trading

Commodities / Gold and Silver 2012 Jul 19, 2012 - 04:22 AM GMTBy: GoldCore

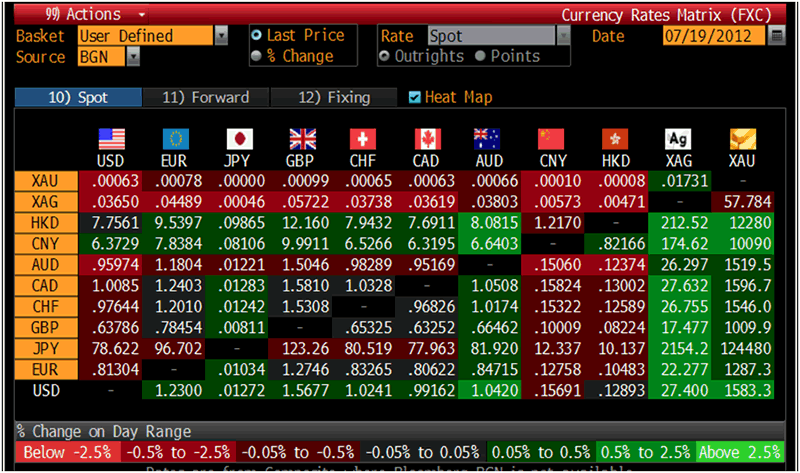

Today's AM fix was USD 1,580.00, EUR 1,287.06, and GBP 1,009.33 per ounce.

Today's AM fix was USD 1,580.00, EUR 1,287.06, and GBP 1,009.33 per ounce.

Yesterday’s AM fix was USD 1,579.50, EUR 1,288.65 and GBP 1,012.57 per ounce.

Silver is trading at $27.55/oz, €22.51/oz and £17.54/oz. Platinum is trading at $1,429.20/oz, palladium at $580.80/oz and rhodium at $1,190/oz.

Gold dropped $4.40 or 0.28% in New York yesterday and closed at $1,577.70/oz. Gold investors in Asia bought on the dip pushing gold over $1,580/oz to $1,584/oz, then it dropped off and hovers at $1,580/oz at the open of European trading.

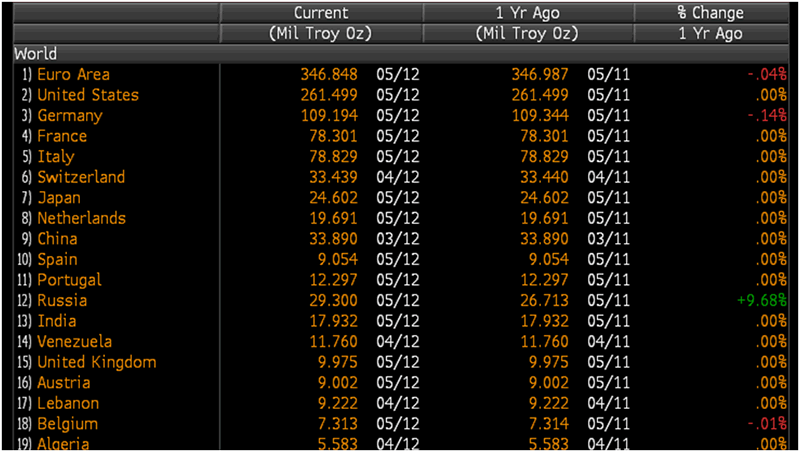

World Gold Reserves (Bloomberg)

Gold has gained this morning after two straight days of Bernanke testimony related slight losses and gold is testing resistance at the 50-day moving average at $1,586/oz.

US economic data showed the job market is still slow and the results of groundbreaking on new US homes rose in June at its fastest pace in the last 3 years, which saw risk appetite increase.

Today US unemployment claims are at 1230 and existing home sales at 1400.

Yesterday’s comments from German Chancellor Angela Merkel sent the euro down and reignited Eurozone fears. "We have not yet shaped the European project so that we can be sure that everything will turn out well, we still have work to do," Merkel was quoted in a media report as saying. Spanish bond yields are hovering near 7% again.

The German chancellor also reiterated her belief that the euro will survive, saying she was "optimistic that we will succeed."

UBS have warned of the risk of hyperinflation in the UK and U.S.

China has proposed to broaden trading of precious metals in its local market in order to help China become a "major gold trading centre" (see News).

The Wall Street Journal was briefed about China's plans by "a person involved with the matter." The paper reports that "the move could increase liquidity and help Beijing gain stronger pricing power for key commodities like gold".

China is the largest consumer and now the largest producer of gold in the world and has aspirations to become a major gold trading center on a par with London and New York. China is also the fifth largest holder of gold reserves in the world after the U.S., Germany, France, Italy (see table).

Chinese officials have spoken of China’s aspirations to have gold reserves as large as the U.S. in order to help position the yuan or renminbi as a global reserve currency. Indeed, it would be only natural for China to aspire to have their currency become the global reserve currency in the long term.

In the longer term, being a major gold trading center would make China a more powerful financial and economic player and indeed could allow them to influence commodity and other important market prices. Indeed, Reuters reported that becoming a major gold trading center "would boost the country's clout in setting global prices".

The journal reports that “Beijing's tight grip on commodities trading and rigid capital controls are among the obstacles in the way.”

The move is also part of the broader financial reforms that Beijing has launched in recent weeks, loosening some of the restrictions on securities investment and allowing banks to price loans at cheaper rates than in the past, that seek to grant market forces a bigger role in both the economy and the capital market.

The moved proposed by market officials would expand trading of precious metals from designated exchanges to the country's vast interbank market, according to the person involved. The Shanghai Gold Exchange has released draft rules for such interbank precious metals trading, which will include spot, forward and swap contracts for the commodities, said the person.

At the moment, producers, consumers and investors can trade only spot and futures contracts in gold and silver on the Shanghai Gold Exchange and the Shanghai Futures Exchange, respectively.

Due to limited membership on the two exchanges, many investors, including banks, aren't able to directly trade the precious metals on the exchanges.

The draft rules were jointly developed by the Shanghai Gold Exchange, which is the world's biggest marketplace for spot gold trading, and the China Foreign Exchange Trading System, a central bank subsidiary that oversees onshore currency trading.

According to the draft rules, the authorities are aiming to launch the interbank trading on Aug. 31, starting with gold contracts, said the person.

That would make gold the first commodity to trade on the interbank market.

The authorities will introduce a "market maker" system for the planned precious metals trading—the first time the system will be used to trade a commodity on the interbank market—with transactions done on an over-the-counter basis as compared to the exchange-based pricing mechanism.

Market makers are firms that stand ready to buy and sell a product at a publicly quoted price to facilitate trade.

An over-the-counter market would allow investors, in this case banks, to trade in large quantities that far exceed the Shanghai Gold Exchange's current trading volumes, analysts said.

According to the draft rules, banks are allowed to use the new precious metals contracts in the interbank market for proprietary trading only.

The Shanghai Gold Exchange is inviting banks, mostly members of the exchange, to submit applications to take part in the trading, said the person, who expects most major and midsize banks to participate.

The move to let banks become market makers also shows the authorities' desire to give such better-established and more sophisticated institutions more power in setting prices for major commodities, a common practice in developed markets, said Jiang Shu, senior precious metals analyst at Industrial Bank Co.

Current restrictions and capital controls remain an obstacle to China becoming major gold trading center and to the renminbi becoming an accepted global reserve currency.

The move by China to expand precious metals trading to their growingly important and vast interbank market is important and another step towards China becoming an economic power on the world stage and one that will rival European nations and the U.S.

Cross Currency Table – (Bloomberg)

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.