Markets Turning Against QE, What About the Gold Price?

Stock-Markets / Quantitative Easing Jul 18, 2012 - 06:21 AM GMTBy: Jan_Skoyles

For many months now we have been writing about Quantitative Easing (QE) and disregarding it pretty quickly. As with the gold price manipulation debate, few people were eager to join us on our side of the sound money fence.

For many months now we have been writing about Quantitative Easing (QE) and disregarding it pretty quickly. As with the gold price manipulation debate, few people were eager to join us on our side of the sound money fence.

However, it now seems that we no longer have to use basic economic theory and continuous arguments to explain why QE is so useless and dangerous. People and organisations are working it out for themselves. Several reports and studies have been released of late reiterating our beliefs with solid evidence. Even better, we are now seeing an interesting change in the mainstream media. I note that many British journalists this weekend were less than impressed with recent decisions to inject a further £50bn into the UK economy.

As Louisa Bojesen wrote earlier this week, markets are now reacting very little to various policy announcements from central banks. In recent weeks three central banks, the ECB, the Bank of England and the PBC each announced further stimulus and monetary policy changes. ‘What did the markets do?’ asks Ms Bojesen, ‘Nothing’.

In its most recent annual report, the BIS expressed its concern over the effects of these on-going monetary policy moves. They report, ‘Failing to appreciate the limits of monetary policy can lead to central banks being overburdened, with potentially serious adverse consequences. Prolonged and aggressive monetary accommodation has side effects that may delay the return to a self-sustaining recovery and may create risks for financial and price stability globally.’

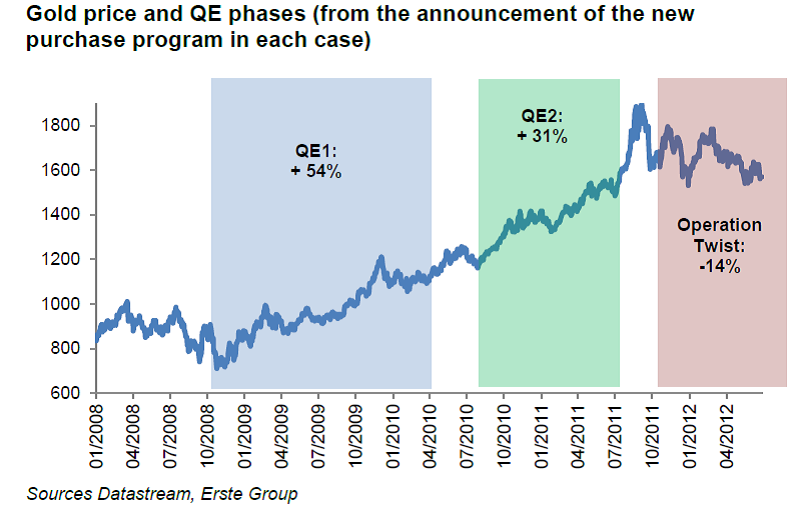

Credit Suisse released a report last week which found that QE1 in the US was more effective than QE2. They also note that negative effects from the unconventional monetary policies currently being implemented had ’received scant attention’ in research literature and ‘are not well understood’.

In early July, the WSJ Europe, presented the results of a reader poll which asked ‘will the ECB’s rate cut help restore confidence in the bloc’s economy? 81 per cent of readers answered ‘no’ whilst 19 per cent said ‘yes’.

So, if the markets have no confidence, the media have no confidence and the public have no confidence, then what is it all for?

Even the journalists are worried

David Smith of the Sunday Times, a long time measure of my perception of the mainstream media, has long supported the first round of QE which took place between March 2009 and November 2009; a series of asset-purchases totalling £200bn, but does not agree with the further rounds, ‘The economy was falling off a cliff…stopping the slide was essential. There was a genuine fear that prolonged deflation – falling prices was a serious risk. The second round [in October 2011] was different.’

Back in 2009, Sir Mervyn King, told Radio 4 that the first scheme of QE was designed purely to boost the economy’s money supply. Yet people continue to think that this and the most recent injections of cash were to boost lending in the economy. But Mr King, the money supply, measured in M4 will not increase if the cash stays with the banks and is not lent out. Worryingly there is now talk of the governor flexing his muscles and forcing banks lend money. And why wouldn’t he? Such muscles were shown in the Bob Diamond debacle.

The (fiat) drugs don’t work

The BIS write in their most recent annual report they are concerned Central Banks are (as also written by David Smith) ‘getting hooked on the drug of printing money’ Pretty worrying , as this was exactly what led previous economies to their downfall, with a big bang of hyperinflation.

Most mainstream economists believe that the first round of QE was necessary. This is a monetarist approach. Milton Friedman, the modern father of Monetarism, was an advocate of money injections BUT TO A POINT.

And it seems that public opinion is that we have reached that point, in fact we have gone past that point, and this is now a cause for concern.

Friedman’s most famous contribution showed that an increase in the supply of money, in order to increase output, would only work up to a certain point. The situation after this point would hold inflationary consequences, i.e. any nominal gains would be inflationary, not real. Whilst a central bank can print money to produce real growth, there is a limit to how much can be produced from this excess cash.

Friedman also showed that the negative effects of an increase in the money supply, i.e. inflation, would be derogatory on the economy. He believed this could be controlled if the velocity of money was able to be kept constant. But this is not something which can be fine-tuned and controlled according to a federal policy. As Jim Rickards writes ‘Velocity is a behavioural phenomenon, and a powerful one.’

It seems that the central bankers and policy makers have forgotten what Milton Friedman found; that quantitative easing is for emergencies only and is not to be used as an everyday monetary policy instrument.

Yet, yesterday Bernanke seemed to delay QE3 once again, saying he remained guarded over deploying further rounds of stimulus. He acknowledged that ‘economists differ on how effective the tools have been.’ Yet as the eurozone crisis pushes on, the markets still believe that Helicopter Ben and his Federal Reserve will implement further stimulus later on in the year.

The QE addicts also seem to have forgotten that both Friedman and Keynesian theories in regard to QE and stimulus spending are thought to only work when the economy is already in possession of a balanced budget. The impact of Keynesian stimulus cannot be gauged when the deficit is the starting point.

What about the gold price?

It seems that as the markets began to react less aggressively upon each announcement of QE, the gold price is also reacting less and less positively.

This gives the likes of Krugman much cause for mocking and laughter in regard to the gold investment experts and the gold bugs.

However they are most certainly the ones with eggs on the faces. What is the one thing which keeps fiat money strong? Confidence. What has the market demonstrated as the months and years of QE have dragged on? That it is losing confidence in the money men, who controls the fiat system. As Detlev Schlichter wrote earlier this week ‘printing money will not make people more confident.’

In his 2012 ‘In Gold We Trust Report’, Ronald Stoerferle explains that real interest rates, since 2011, have been negative for 51% of the time. Thanks to growing inflation levels from various loose monetary policies across the Western world, this trend is expected to continue. According to Stoerferle ‘this constitutes an optimal environment for gold.’

Any form of intervention, whether medical intervention, parental intervention or physical intervention will come with a range of unintended consequences: perhaps addiction, a lost fractured relationship with a loved one, perhaps a broken nose. The injection of money and the easing of monetary policy in an economy is no different. This economy is on its way to a fiat printing addiction which will end up more disjointed and broken than before the addiction was fuelled.

Want to invest in gold as an insurance against central banks’ money printing? Invest in gold like a professional in minutes…

Jan Skoyles contributes to the The Real Asset Co research desk. Jan has recently graduated with a First in International Business and Economics. In her final year she developed a keen interest in Austrian economics, Libertarianism and particularly precious metals.

The Real Asset Co. is a secure and efficient way to invest precious metals. Clients typically use our platform to build a long position and are using gold and silver bullion as a savings mechanism in the face on currency debasement and devaluations. The Real Asset Co. holds a distinctly Austrian world view and was launched to help savers and investors secure and protect their wealth and purchasing power.

© 2012 Copyright Jan Skoyles - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.