Nat Gas Ready To Pop?

Commodities / Natural Gas Jul 17, 2012 - 11:12 AM GMTBy: Chris_Vermeulen

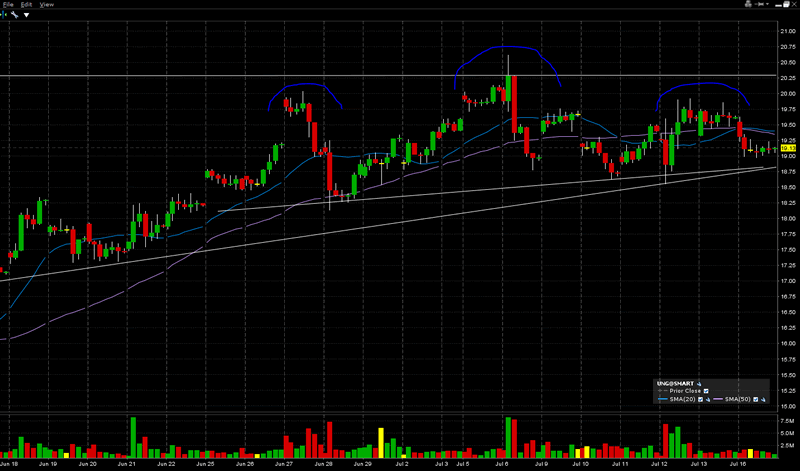

Nat gas (UNG) has recently caught my attention. While it was in a significant downtrend for the better part of a year it has recently been consolidating right under the $20 level. A look at the daily chart shows a long move down and then recently a sideways consolidation pattern. While this is typically a continuation pattern I am beginning to believe think that the next move may be up rather than an extension of the previous down trend.

Nat gas (UNG) has recently caught my attention. While it was in a significant downtrend for the better part of a year it has recently been consolidating right under the $20 level. A look at the daily chart shows a long move down and then recently a sideways consolidation pattern. While this is typically a continuation pattern I am beginning to believe think that the next move may be up rather than an extension of the previous down trend.

» Over the last two weeks there been significant support above $18 and significant volume.

» The $20/$20.50 level has been tested multiple times and the more tests it undertakes the more likely it is to break.

» Both the 20-day and 50-day moving averages have turned upwards and UNG is trading above both

Natural Gas Trading UNG

If we zoom in a bit and take a look at the hourly chart we are presented with two scenarios

1.The rising wedge holds and UNG breaks through the $20 – $20.50 resistance level on high volume and a new long term up trend is produced

2.The head and shoulders pattern within the wedge breaks downwards and the downtrend resumes

Natural Gas ETF Trading

I’m leaning towards option one but will be waiting for a breakout confirmed with volume in either case.

Find out more on gold cycles and trading at www.GoldAndOilGuy.com

By Chris Vermeulen

Chris@TheGoldAndOilGuy.com

Please visit my website for more information. http://www.TheGoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 6 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.