Central Bank Alchemists Attempting to Turn Paper Into Gold

Commodities / Gold and Silver 2012 Jul 17, 2012 - 07:47 AM GMTBy: John_Mauldin

In today's Outside the Box, the ever-philosophical Grant Williams introduces us to the ancient and profound art and science of alchemy – "the original 12-step program," as he calls it, the avid pursuit of übernerds from Hermes Trismegistus to Isaac Newton to (believe it or not) John Maynard Keynes, who referred to certain early works of econometrics as statistical alchemy (and some still are!). And we should not forget Carl Jung, who wrote the seminal work Psychology and Alchemy (for those who do not sleep or are looking for something to put you to sleep: http://en.wikipedia.org/wiki/Psychology_and_Alchemy).

In today's Outside the Box, the ever-philosophical Grant Williams introduces us to the ancient and profound art and science of alchemy – "the original 12-step program," as he calls it, the avid pursuit of übernerds from Hermes Trismegistus to Isaac Newton to (believe it or not) John Maynard Keynes, who referred to certain early works of econometrics as statistical alchemy (and some still are!). And we should not forget Carl Jung, who wrote the seminal work Psychology and Alchemy (for those who do not sleep or are looking for something to put you to sleep: http://en.wikipedia.org/wiki/Psychology_and_Alchemy).

Grant notes that, in contrast to the mechanically and spiritually laborious (not to mention ultimately futile) process of transmuting lead into gold, the steps to convert paper into money are only two: (1) Plugging and (2) Pushing. Nevertheless, he says, the fervid attempts by latter-day magi to concoct a successful outcome to our present economic crisis are proving no more successful than the Alchemical Work. Where alchemists got hung up, says Grant, was in the final, climactic step of the process, Projection.

Projection "was the moment when, despite all the work that went into getting to that last point in the program, hope and faith took over as the alchemist found himself having to rely on just a little bit of magic in order to get the outcome he so desperately wished for."

And Projection has much in common with Pushing. Whether it is Ben Bernanke pushing the outlandish assertion that "subprime is contained" or Spanish Prime Minister Mariano Rajoy hopefully projecting that Spain would "... stop being a problem and instead form part of the solution [to the debt crisis]," the economic alchemists have struggled. (I have a mental image of Ben Bernanke as the Sorcerer's Apprentice, with about the same results – forced to try and clean up the mess he made and ultimately being swept away in it!)

Grant wishes to speed the economic magicians in their arduous task by offering a new, slimmed-down transformational schema – it only has seven steps: Greecification, Backtrackification, Transmission, Restatigence, Bullyfication, Renegotiation, Realization. The outcome might not be any more satisfactory than it was for the conjurers of old, but at least they may learn something as they kick the Holy Economic Vessel down the road.

(See, I don't call this letter Outside the Box for nothing.)

Grant, by the way, is the best "new" wordsmith/storyteller I have seen in a dozen years. I am a huge fan. (If you want to be a Hmmm…’er too, you can subscribe for free at http://ethreemail.com/subscribe?g=bdc736be.) And I get to see him tomorrow in Singapore, where he works at Vulpes with master hedge fund manager Steven Diggle, who was with us in Tuscany for a few nights. (I am not supposed to mention how much he lost on Italian soccer, betting against Newt Gingrich, so I won't. But then, Newt has to fund his campaigns somehow. Might as well take it from a hedge fund guy who thinks he understands soccer.)

I have been in New York today (I'm writing this note from the Virgin Lounge at JFK) and did media hits all morning. Two hours of air time and never had to repeat myself. A great deal of fun. We started off at 7 a.m. with two segments with the super-serious and wicked-smart Tom Keene and crew at Bloomberg, then three segments with Matt Nesto at Yahoo Breakout (where I surprised him by agreeing with President Obama, kind of), and then finished off the trifecta with old fishing buddy and always-fun (where does he get all those obscure facts?) Mike McKee for an hour on Bloomberg Radio. You can listen on or watch at:

http://www.bloomberg.com/video...

(Bloomberg Radio has not posted yet, but I assume it will be there when you get this. Look for the Bloomberg Radio 10 a.m. show with Mike McKee.)

They will call the first leg of my 24 hours to Singapore in a minute, so time to sign off. The next letter will come from Singapore. Have a great week.

Your still seeing Mickey Mouse and Ben Bernanke in my head analyst,

John Mauldin, Editor Outside the Box subscribers@mauldineconomics.com

Things That Make You Go Hmmm...

Grant Williams 15 July 2012

"Finally, after the matter has passed from ashen-colored to white and yellow, you will see the Philosopher's Stone, our King and Dominator Supreme, issue forth from his glassy sepulcher to mount his bed or his throne in his glorified body . . . diaphanous as crystal; compact and most weighty, as easily fusible by fire as resin, as flowing as wax and more so than quicksilver . . . the color of saffron when powdered, but red as rubies when in an integral mass..."

– H. Khunrath, Amphitheatrum

"Alchemy is the art of manipulating life, and consciousness in matter, to help it evolve, or to solve problems of inner disharmonies"

– Jean Dubuis

"If you owe the bank $100 that's your problem. If you owe the bank $100 million, that's the bank's problem"

– JP Getty

Fans of J.K. Rowling's Harry Potter books will be vaguely familiar with the name Nicolas Flamel, though, unlike the book's eponymous hero, his wizardly sidekicks and characters such as Professor Dumbledore, Hagrid and, of course, He-WhoMust-Not-Be-Named, Flamel has one rather extraordinary (at least in the context of the stories) distinction: He actually existed.

Flamel's birth is steeped in confusion, but the later years of his life are well-documented due, in large part, to a book he wrote which was finally published in Paris in 1613, some 200odd years after his death. The book, Livre des Figures Hieroglypiques or Exposition of the Heiroglyphical Figures contained an introduction that documented Flamel's search for a legendary substance that contained the most magical of properties including the ability to cure any illness known to man, and to turn base metals into gold through the process of alchemy.

The substance – sought fervently by men throughout history, not just Messrs. Potter and Flamel – is known as lapis philosophorum; The Philosopher's Stone:

(Wikipedia): According to alchemical texts, the philosopher's stone came in two varieties, prepared by an almost identical method: white (for the purpose of making silver), and red (for the purpose of making gold), the white stone being a less matured version of the red stone. Some ancient and medieval alchemical texts leave clues to the supposed physical appearance of the philosopher's stone, specifically the red stone. It is often said to be orange (saffron colored) or red when ground to powder. Or in a solid form, an intermediate between red and purple, transparent and glass-like. The weight is spoken of as being heavier than gold, and it is said to be soluble in any liquid, yet incombustible in fire.

The physical properties of the Philosopher's Stone remain shrouded in mystery and some of the more esoteric descriptions of its appearance throughout the years tend to make it even more so:

(Wikipedia): Alchemical authors sometimes suggest that the stone's descriptors are metaphorical. It is called a stone, not because it is like a stone. The appearance is expressed geometrically in Michael Maier's Atalanta Fugiens. "Make of a man and woman a circle; then a quadrangle; out of the this a triangle; make again a circle, and you will have the Stone of the Wise. Thus is made the stone, which thou canst not discover, unless you, through diligence, learn to understand this geometrical teaching."

Right then. So let me get this straight: we turn a man and a woman into a circle, then a quadrangle, then into some kind of a triangle and finally back into a circle again? Thanks Mike. Your seat in the European Parliament awaits.

Leaving aside whatever the hell Michael Maier was trying to explain to us, the Philosopher's Stone was long believed to be the key to the mythical process of alchemy; the science of turning base metals into gold.

According to legend, the Philosopher's Stone is created through the alchemical method known as Magnum Opus (Great Work) and this process is widely-held to consist of a series of four very distinct stages which between them number twelve individual steps (the original 12-step program). These have become known as the Twelve Gates of George Ripley – a famed 15th century alchemist whose twenty-five volume work on the subject contained the Liber Duodecim Portarum, a tome that brought him considerable notoriety.

The means to transform base metal to precious metal that man has searched for since the beginning of recorded time was laid out in simple and concise terms in the progression through George Ripley's 'gates':

1. Calcination 2. Solution (or Dissolution) 3. Separation 4. Conjunction 5. Putrefaction 6. Congelation 7. Cibation 8. Sublimation 9. Fermentation 10. Exaltation 11. Multiplication 12. Projection

This convoluted process would drive many men to distraction – including amongst them, one Isaac Newton, 'physicist, mathematician, astronomer, philosopher, theologian and alchemist' who, as Britain's Master of the Mint managed alchemy of a slightly lower quality when he moved the Pound Sterling from the silver standard to the gold standard by adjusting the bimetallic relationship between the two.

Newton suffered a nervous breakdown during an extended period of alchemical work which had nevertheless resulted in his producing substantive written research. That written research was later purchased by none other than John Maynard Keynes who, after studying it, proclaimed Newton "...was not the first of the age of reason, he was the last of the magicians".

But I digress.

Twelve distinct steps seems an awful lot of work just to turn lead into gold. It's far easier these days to just turn paper into money which only takes a couple of steps:

1. Plugging 2. Pushing

Now, I am certain that there are those amongst you who, based on past performance, would, at this point, feel extremely confident in placing a sizeable wager that we are about to go wandering off down a path strewn with references to attempts by central banks to turn paper into gold through the process of alchemy but I am afraid I am going to surprise/disappoint you by taking a turning of a different kind altogether and will concentrate my efforts – believe it or not – on the last of Ripley's twelve steps; Projection.

Projection, in alchemic terms, was the coup de grace, the final step in a long process whereby a small amount of the Philosopher's Stone would be cast into a molten base metal – most commonly the 82nd element in the periodic table, Lead and, hey presto, that lowly element would be transmogrified into its near-neighbour just three steps higher in the table; #79; gold.

Projection was the moment when, despite all the work that went into getting to that last point in the program, hope and faith took over as the alchemist found himself having to rely on just a little bit of magic in order to get the outcome he so desperately wished for.

Throughout history, in all the annals of recorded time, every single alchemic projection ever attempted has turned out to be unsuccessful – a track record which gives alchemists only a marginally less-successful record than the Fed, the BoE, the Troika, the EC, the Eurogroup, the US Congressional Budget Office, the combined governments of the UK, Greece, Spain.... I could go on, but we've all got things to do so I won't.

Over the last five years, there have been so many 'projections' from the economic and political glitterati that have failed spectacularly as to be almost unbelievable. In fact, as I sat and thought about what to write this week, I struggled to think of a single major projection that hasn't come in on the bad side of good.

From Chairman Bernanke's confidently-delivered projection that "subprime is contained" in March 2007, to Mariano Rajoy's promise upon being elected last November that Spain would "...stop being a problem and instead form part of the solution [to the debt crisis]" the hits have just kept on coming, so today we are going to look at the modern version of alchemy whereby finances are turned to farce and examine a few of the most outrageously poor projections of recent times. If time allows, I will even make a couple of 'projections' of my own (thereby setting me up for ridicule at an as-yet-to-be-determined point in the future).

Ladies and gentlemen, in place of The Twelve Gates of George Ripley – and using Greece and Spain as examples – I give you The Seven Fates of Grant Williams, a series of steps that are certain to take place one after another, in sequence, once the primary stage has been initiated:

1. Greecification

This is the process whereby ordinary people are given estimates of important economic metrics by impressive-looking politicians who, when delivering said figures, sound confident and assured:

(CNN, September 21, 2011): The Greek government announced budget cuts Wednesday aimed at securing additional aid from its European partners as the debt-stricken nation struggles to dig itself out of a deep hole.

Elias Mossialos, a government spokesman, said in a statement that the cuts demonstrate Greece's commitment to meet its obligations and remain a member of the European Union.

The measures will enable Greece to achieve its budget targets for this year and next, "and allow the full implementation of the support of the Greek economy by 2014," said Mossialos.

(Bloomberg, November 17, 2011): Spanish Finance Minister Elena Salgado said the economy will grow about 0.8 percent this year, less than the government's target, and it's too early to know if the regions will meet their deficit goal this year.

The new forecast is below the 1.3 percent government target that Salgado had said since August would be hard to meet, and is in line with the estimate of 0.7 percent published by the European Commission last week.

Salgado said that while the central government will meet its budget-deficit target, it's not clear whether the regional governments will do so, casting doubt on the overall budgetdeficit goal of 6 percent of gross domestic product.

"I maintain 6 percent as the priority," Salgado said in an interview.

"Mariano Rajoy of the opposition People's Party, the favorite to win a majority in the vote, has pledged not to stray from the deficit goal of 4.4 percent of GDP next year "under any circumstances."

2. Backtrackification

This is the process whereby, shortly after the Greecification process has been completed and , often, the promise of a bailout secured, the forecasts made in the first stage are altered to reflect a new and 'completely unexpected' reality. The process can take anywhere from a matter of weeks to a matter of hours:

(CNN, October 2, 2011): The Greek cabinet announced late Sunday that it adopted a draft budget for 2012, but the debt-ridden nation will miss key deficit targets for this year and next.

According to this preliminary budget, Greece's budget deficit will be 18.69 billion euros, or 8.5% of gross domestic product, in 2011. Greece had originally agreed to a deficit of 17.1 billion euros, or 7.8% of GDP, with the International Monetary Fund, European Commission and the European Central Bank.

The Greek cabinet said in a statement that the main reason it would miss the deficit target is due to a deeper-than-expected recession.

The Greek economy is now expected to contract by 5.5% this year, according to the statement. That's worse than projections of a 3.8% decline in May.

(Fundweb, March 2, 2012): Spanish prime minister Mariano Rajoy has warned that the country will miss the deficit reduction target it agreed with the European Union (EU).

Rajoy says the government will seek to bring its deficit down from 8.5% of GDP in 2011 to 5.8% this year. The Spanish government previously agreed to a target of 4.4%.

The news comes after all but two of the EU's 27 members signed a fiscal treaty to prevent countries from running up the kind of large debts that pushed Greece, Portugal and Ireland into needing bailouts from the international community.

The Spanish prime minister said he has not discussed the deficit with fellow EU leaders at the first session of the European Council.

"We will present our proposals according to what we consider to be reasonable and sensible, but this is not closed here, nor negotiated here nor discussed here," he told reporters.

"Nobody has asked me about the public deficit in Spain."

3. Transmission

The third part of the process is the conveyance of blame onto either external parties or a set of conditions that were 'completely unforseeable' at the time Greecification commenced:

(BBC, October 3, 2011): The [Greek] government, which on Sunday adopted its 2012 draft austerity budget, blamed the shortfall on deepening recession.

(WSJ, October 3, 2011): The missed target was "mainly the result of the deeper-thananticipated recession of the Greek economy that affected tax revenue and social security contributions," the Greek government said in a statement...

(Huffington Post, February 23, 2012): Last Thursday, Spain's minister of economy admitted that the 2011 budget deficit had missed the 6% of GDP target by about 2 percentage points and doubted that Spain could comply with the EU-imposed deficit target for 2012. With its debt risk still at high levels, the strategy of the new Spanish government is to shift the blame to the regional governments, like Catalonia, and at the same time use the crisis to grab back the power that was devolved to the regions in the 1980s.

(UK Guardian, April 30, 2012): Rajoy had insisted that all of Spain's economic troubles were the fault of his predecessor, the Socialist José Luis Rodríguez Zapatero. So now what? You can't change horses in a storm, but you can change scapegoats, the politician's favourite pet. Another culprit had to be found, and there we have it: Spain's regions and their "reckless over-expending".

4. Restatigence

The fourth stage is the announcement of a new, improved estimate that will undoubtedly prove to be the very worst-case scenario now that all problems are in the past and a completely realistic set of estimates have been made. It is the basis upon which the continuation of the process is underpinned:

(Marketall, February 22, 2012): Greece revised its 2012 budget targets in a draft bill which was submitted to parliament. The new estimates include the full impact of the 53.5% haircut on Greek government bonds.

Budget deficit target is revised to 6.7% of GDP from 5.4% before. The government now looks for a 2012 primary deficit of 0.2% of GDP from a primary surplus of 1.1% of GDP previously. Budget revenues are seen at 56.16 billion euros compared to 59.19 billion euros before, on deeper than expected recession. Interest payments are expected to reach 13.05 billion euros, up 300 million euros from November's estimates.

(WSJ, May 18, 2012): Spain's Budget Ministry said late Friday it has revised its budget deficit estimates for last year to a wider 8.9% of gross domestic product, largely because of more red ink reported by four regional governments.

In a press release, the ministry said it is maintaining its budget deficit target of 5.3% of GDP for 2012.

Spain initially reported a budget deficit equal to 8.5% of GDP for last year, far in excess of the 6%-ofGDP target it had committed to with the European Union and international investors. Much of the overrun was the fault of the regions, which have moved to the center of the country's fiscal crisis.

Spain's regions control almost half of spending, including socially sensitive areas like healthcare and education, and have a long history of budget overruns. They are now grappling with plummeting tax revenue in a weak economy after the collapse of a taxrich housing boom and have encountered increasing difficulties to obtain financing from international capital markets, and more recently, even from local banks.

The revised budget deficit estimates released on Friday are mostly linked to higher debt reported by the regional governments of Madrid, Valencia, Andalusia and Castille-Leon.

The Budget Ministry said that the higher level of debt was uncovered by a program the central government launched this year to help the regions pay an estimated €35 billion in overdue bills to their suppliers. In exchange for credit lines to help them to pay the bills, the government required a full accounting of their outstanding debts. Many business leaders and economists had long suspected there were hidden debts at Spain's regions.

Under intense pressure from European authorities to slash spending, Spain has also pledged to cut its deficit to the 3%-of-GDP limit for euro zone countries in 2013.

5. Bullyfication

This stage occurs when, having added a sufficient amount of OPM (pronounced 'Opium' but standing for Other People's Money, this compound is critical if the chain reaction is to continue to its end point), the politicians involved use the leverage already built up in the first four stages to alter the dynamics of the process:

(UK Daily Telegraph, May 8, 2012): Stock markets around the world fell sharply as fears grew that Greece was moving towards a euro exit following Sunday's general election, where parties rejecting internationallyimposed austerity measures made major gains.

Alexis Tsipras, the head of Greece's radical Left-wing Syriza party, said that the result "nullified" bail-out deals with the European Union and International Monetary fund... Greece has received £190 billion in aid. In exchange, it is required to make deep cuts in public spending. Mr Tsipras called the loan agreement policy "barbaric".

(Bloomberg, May 30, 2012): Tsipras tells voters he has no desire to bring back the drachma. But neither does he believe that staying in the euro requires the massive cuts in government spending to which Greece's leaders have agreed as a condition of receiving international assistance over the last two years.

The case that Tsipras and his colleagues make is that it's those austerity measures – known in the country as "the memorandum" – that are the biggest threat to Greece's membership in the euro. By crippling the economy, Tsipras contends, austerity has brought Greece closer to insolvency and default, heightening the risk of a financial catastrophe throughout the European periphery, as panicked markets bring down country after country.

(AP, July 3, 2012): Greek government spokesman Simos Kedikoglou told reporters on Tuesday that Greece intended to present troubling data to EU debt inspectors meetings this week.

throughout the course of "We will present information that is astounding. It is alarming in terms of the recession and unemployment, and it shows beyond any doubt that the current policy does not bring results. It brings the opposite results," Kedikoglou said.

(Bloomberg, June 1, 2012): Economy Minister Luis de Guindos said late yesterday that the future of the euro is at stake, as data showed a net 66 billion euros ($81 billion) of capital left Spain in March. "I don't know if we're on the edge of the precipice, but we're in a very, very, very difficult situation," he said at a conference in Sitges, Spain.

(UK Daily Telegraph June 2, 2012): Mr Rajoy has become the latest European politician to call for countries to, in effect, abandon their sovereignty in a last-ditch attempt to save the beleaguered currency.

Mr Rajoy said a new central authority would go a long way to alleviating Spain's economic crisis as it would send a clear signal to investors that the single currency is an irreversible project.

He said: "The European Union needs to reinforce its architecture. This entails moving towards more integration, transferring more sovereignty, especially in the fiscal field.

"And this means a compromise to create a new European fiscal authority which would guide the fiscal policy in the eurozone, harmonize the fiscal policy of member states and enable a centralised control of [public] finances."

6. Renegotiation

Step six is when the power generated by the intensifying heat that is a by-product of the process switches sides, leading to a substantial shift in the molecular structure of the compound:

(Al Jazeera, June 23, 2011): Greece's new government has said it wanted to review several austerity measures that the debt-ridden country agreed as part of bailout packages.

The government on Saturday said it wanted to bargain for a two-year fiscal adjustment extension as it prepared for an EU-IMF audit next week.

A policy document released by the conservative-led coalition said efforts to "revise" Greece's bailout deal in talks with creditors starting on Monday include "the extension of the fiscal adjustment by at least two years," to 2016.

The aim would be to meet fiscal goals "without further cuts to salaries, pensions and public investment" and new taxes, it said, announcing a freeze on further civil-service layoffs, sales-tax cuts and longer unemployment benefits.

"The aim is to avoid layoffs of permanent staff, but to economise a serious amount through non-salary operational costs and less bureaucracy," the three-party coalition document said.

(Firedoglake July 10, 2012): Finance Ministers meeting in Europe agreed on a series of measures for Spain. First, they authorized a first installment of 30 billion euros for lending to Spanish banks, subject to approval from Eurozone governments. The money will be distributed by the end of the month, a faster schedule than previously considered. The real question is who is held responsible for the lending, the Eurozone bailout facility or the sovereign government. The assumption at the EU summit was the former, but talk that governments are actually ultimately responsible caused Spanish debt yields to soar, leading to this emergency action.

Second, the finance ministers agreed to slow down the austerity demands for the Spanish government. At the same time, Spain's targets for cutting its gaping budget deficit will be eased as the country sinks deeper into its second recession in three years, with an unemployment rate of almost 25 percent. But the ministers demanded that Spain squeeze its austerity budget even tighter to meet the new targets.

"I would expect that some additional measures will have to be taken rather soon," the European Commission's vice president, Olli Rehn, said at the news conference.

For its part, the European Commission had proposed that Madrid's deficit target this year be relaxed to 6.3 percent of gross domestic product, from 5.3 percent earlier. Madrid also would get an additional year – until 2014 – to bring the deficit below 3 percent of G.D.P., which is the target for all euro zone countries.

7. Realization

Now we reach the part where the truth finally dawns that the words spoken long ago by JP Getty are actually not just an amusing motif fit for the front of a t-shirt or a fridge magnet:

"If you owe the bank $100 that's your problem. If you owe the bank $100 million, that's the bank's problem."

The sum total of bailouts offered to Europe's prodigal offspring is mounting daily, but the Achilles Heel of the entire construct continues to be the Target2 payment system which has been so assiduously ignored by most observers yet followed so closely by my friends at Zerohedge for many months now.

This problem remains below the radar of most observers but, I suspect, will turn out to be the straw that breaks the camel's back.

(Zerohedge, 6 July, 2012): We have some good news for our German readers: in the month of June, your implicit cost of preserving the Eurozone (read the PIIGS) via TARGET2 funding of current account and various other public sector deficits and imbalances amounted to only €1 billion/day, down from €2 billion in June. We also have some bad news, which is that Europe's negative convexity ticking inflationary time bomb, which guarantees that with every month in which nothing is done to undo the Buba's onboarding of liquidity risk, the risk for an out of control implosion of German, and implicitly all European monetary institutions, rises exponentially, and just hit an all time high of €729 billion.

To everyone who naively believes that a deus ex can come out of stage left and somehow reverse this guaranteed loss to German taxpayers in the form of even more guaranteed inflation down the road, we suggest you short this chart:

(For good measure, the chart below shows the debits on the peripheral side of the balance sheet versus Germany's credits).

And so you can see that the steps are the same in every crisis. They really are. Poor projections are made and in every case, as is the wont of human nature, the most palatable estimate is always given because it is far easier to keep people as happy as possible in the present. After all, maybe they don't actually need to be disappointed in the future. Things may just work out, and if they don't, well it can always be played off as an 'unseen set of circumstances' that led to the poor projection and the painful adjustment necessary to meet reality.

Unfortunately, as the events in Greece and Spain are proving, one such situation can be masked and dealt with, but multiple situations occurring simultaneously – each bigger than the last – is guaranteed to bring the house of cards tumbling down.

Along time ago now, I promised you a look at some of the more feeble projections of the last several years so, leaving aside those of Greek and Spanish politicians, let's kick things off with the US Congressional Budget Office (CBO).

The CBO's projection record is second-to-none in terms of its ineptitude and the distance away from the mark that they regularly manage to achieve is nothing short of wondrous; particularly for a body which is described thus on its own website:

Since its founding in 1974, the Congressional Budget Office has produced independent, nonpartisan, timely analysis of economic and budgetary issues to support the Congressional budget process. The agency's long tradition of nonpartisanship is evident in each of the dozens of reports and hundreds of cost estimates its economists and policy analysts produce each year. CBO analyses do not make policy recommendations, and each report and cost estimate discloses our assumptions and methodologies. All CBO employees are appointed solely on the basis of professional competence, without regard to political affiliation.

That's 'professional competence'.

(WSJ, August 30, 2001): In 1993, the CBO predicted that the deficit would soar to $653 billion in 2003. This week, they said that same budget will be in surplus by $172 billion. Little of that $825 billion revision can be explained by legislation or luck. Nearly all of it reflects the magnitude of past forecasting blunders.

Errors are unavoidable, but perpetual bias is another matter. CBO errors always tilt in a specific direction. Aside from the first year of recessions, the CBO always exaggerates future budget deficits and underestimates surpluses.

Past forecasts often overstated deficits by huge amounts even for the current year -by $78 billion in 1992 and $102 billion in 1997. In early 1998, the CBO thought the next year's surplus would be $2 billion, but it turned out to be $125 billion. Looking further ahead, CBO errors have been staggering. Next year's budget, now estimated to be in surplus by $176 billion, had once been expected to show deficits of $579 billion (per the CBO's 1993 forecast), $349 billion (1995 forecast), and $188 billion (1997 forecast).

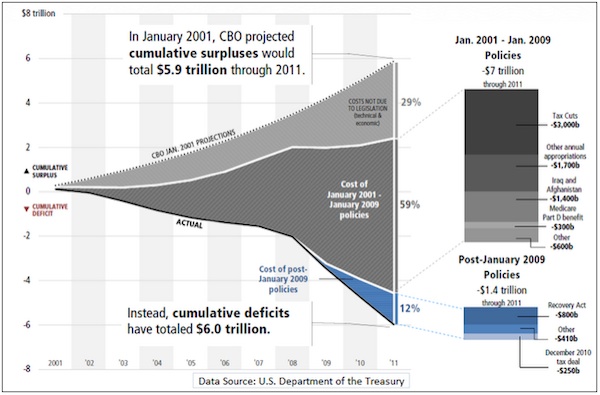

In January 2001, the CBO famously projected that cumulative surpluses in the United States would be $5.9 trillion through 2011. Instead, the United States ended up with cumulative deficits of $6.0 trillion during this period.

Yes, I know, "who could have seen the GFC coming in 2001?", right? Well take a look at the chart below to see just how off the mark the CBO has been since the very day it made the projection:

But it's not just the 2001 projection that is 'off'. As Casey Research's Bud Conrad pointed out late last year, some people just never learn:

Looking at the future of government deficits, the Congressional Budget Office (CBO) starts with a baseline projection of the expected government budget deficit based solely on laws already enacted. In other words, the baseline doesn't account for new laws, which invariably expand spending. Not surprisingly, as you can see in the chart [below] of previously published baseline forecasts, the CBO's deficit projections are always optimistic about the expected deficit.

Well at least we can take solace in their professional competence.

How about our old friends in the UK? Specifically Her Majesty's Treasury, who have some wonderful 5-year projections all of their own as we discussed in these pages a short while ago by picking the brains the marvellous Greg Weldon ( http://www.weldononline.com):

(TTMYGH): ... UK government spending will increase, every year, including an expansion of +2.8% scheduled to be implemented this year.

The UK government is 'banking on' growth in Revenue that will exceed the rate of growth in Expenditures, including growth of +3.5% cooked-into-the-books for this year.

But, the margin for error is slim, with yearover-year Revenue forecast to grow by more than the growth in year-over-year Spending, by a mere £1.4 billion.

Over the next five years things get even more interesting.

In order to 'support' a sizable EXPANSION in SPENDING over the next five years (pegged at +12.7%), the UK Treasury is RELYING on an astronomical rise in Revenue over that same five year period, pegged at +33.4%.

Revenue is forecast to rise by +£184.2 billion over the next five years, or by nearly +£40 billion per year.

Ahem, excuse me ... perhaps the UK Treasury overlooked the FACT that Revenue in February, pegged at £38.631 billion was (-) 1.9% BELOW the year-ago February revenue of £39.381 billion.

A decline of nearly £1 billion is FAR from the projections calling for a near +£40 billion per year increase over the next five years.

Oh Boy.

Moving right along we reach more topical ground with JP Morgan's recent CIO loss which, on April 13 was famously described by CEO Jamie Dimon as "a tempest in a teacup". In the space of two weeks it ballooned to a $2bln loss that Dimon projected could possibly grow further to $3bln during the quarter.

(Bloomberg, July 13, 2012): Botched trades by a JPMorgan Chase & Co. unit that Jamie Dimon had pushed to boost profit were masked by weak internal controls and may ultimately saddle the bank with a $7.5 billion loss.

JPMorgan's chief investment office has lost $5.8 billion on the trades so far, and that figure may climb by $1.7 billion in a worst-case scenario, Dimon, the bank's chairman and chief executive officer, said yesterday.

Not great, Jamie, not great.

This most recent example is the perfect illustration of the point I have so laboriously been trying to make.

At the very moment the potential loss was announced as "possibly as high as $3bln", commentators began speculating as to the REAL magnitude of that loss. Projections as high as $9bln were mooted in the blogosphere and so, when the loss came in at a 'mere' $5.8bln (or, put another way, roughly double the worst-case estimate of a mere 8 weeks ago), it didn't look quite so bad and the stock rallied. Oh so quietly, the total loss projection was increased from $3bln to $7.5bln 'in a worst-case scenario'.

Worst-case, folks. More worst than the previous worst-case, admittedly, but definitely worst-case.

And so, with time and space running short, I could hardly take pot-shots at all and sundry for their poor projections without making a couple of my own so that my feet may also be held to the fire in the months to come and I shall begin with my friends in France and M. Hollande's recent projections about the amount of money his new tax increases will generate for the country's coffers.

Hollande's recent moves to raise income taxes, taxes on foreign-owned second homes, rental income and capital gains on property sales were instantly projected by the French Treasury to add a significant amount to their income:

(UK Daily Telegraph): The tax rises are part of a wider package of increases that are intended to raise €7.2 billion (£5.8 billion) to meet a budget deficit target of 4.5 per cent after the government of Nicolas Sarkozy left the French exchequer with an expenditure black hole.

An additional €2.3 billion (£1.8 billion) will be raised from a levy on those whose net wealth is €1.3 million (£1 million)...

The French finance ministry said the new rule would affect about 60,000 rental properties in France whose owners made an average profit of £12,000.

It said this would add €50 million (£40 million) to French revenue this year and €250 million in 2013.

My projection? This scheme will fail miserably and will end up reducing the overall amount of tax collected in France.

I base my own projection upon many similar efforts that have been tried over the years, but will pick on two specific examples; the ill-fated Crude Oil Windfall Profits Tax Act, signed into law by Jimmy Carter on April 2, 1980 and, most recently, in Britain where a new 50p top tax rate was 'projected' to increase tax revenues by more than £1 billion. The outcome?:

(UK Daily Telegraph): The Treasury received £10.35 billion in income tax payments from those paying by self-assessment last month, a drop of £509 million compared with January 2011... The self-assessment returns from January, when most income tax is paid by the better-off, have been eagerly awaited by the Treasury and government ministers as they provide the first evidence of the success, or failure, of the 50p rate... Although the official statistics do not disclose how much money was paid at the 50p rate of tax, the figures indicate that it is falling short of the money the levy was expected to raise.

But why were the projections so errant, I wonder? Well, it appears that human nature is far more reliable than government projections:

(UK Daily Telegraph): Senior sources said that the first official figures indicated that there had been "manoeuvring" by well-off Britons to avoid the new higher rate. The figures will add to pressure on the Coalition to drop the levy amid fears it is forcing entrepreneurs to relocate abroad... A Treasury source said the relatively poor revenues from selfassessment returns was partly down to highly-paid individuals arranging their affairs to avoid paying the 50p rate.

"It's true that SA revenues are a bit disappointing – it's still early, but it looks like there's been quite a lot of forestalling and other manoeuvring to avoid the top rate," said the source.

Worse still was the money spent on increased taxation projects in the UK that failed to deliver the projected returns:

(Huffington Post): A public spending watchdog has found two projects costing £98 million that were set up to boost tax collection rates failed to help rake in any extra cash.

The new systems at HM Revenue and Customs (HMRC) were expected to bring in £743m by the last financial year but had not delivered "any additional benefits"...

"Two projects Caseflow and Spectrum received £98m of programme funding and were originally forecast to achieve net yield increases of £743m by 2010/11.

"At the end of 2010/11, the two projects had not delivered any additional benefits."

Carter's attempts to increase revenues through taxation were even farther from projections as this one, simple graph demonstrates:

If Monsieur Hollande thinks things will be any different in France he is, as they say in that neck of the woods, "en désordre".

Projection number two is that, when QE3 finally arrives (and arrive it will), it will mark the top of the S&P500 for a VERY long time and its positive effects will be far shorter-lived than many – including the Fed – are projecting.

Far from an overwhelming rising tide that will float all boats, QE3 will be a dismal failure and the last bullet in the Federal Reserve's gun will turn out not to be the hollowpoint that many are projecting, but instead a simply a 'bang flag'.

In the course of the conversations I have whilst performing my day-job, I am constantly searching for anybody who is buying and holding stocks as an asset class because they offer tremendous long-term value, but I have yet to find them. Yes, there absolutely are some wonderful companies out there that offer tremendous long-term value. Corporate balance sheets have, by-and-large, never been healthier, companies are sitting on a heap of cash and, at ground level, businesses are doing extremely well. The problem comes with the fact that 99% of the people I speak to and 99% of the commentaries I read are either holding 'stocks' per se or recommending doing so for one reason and one reason only; they are terrified of missing out on the projected strong rally that will undoubtedly come once QE3 is unleashed by Ben Bernanke's Merry Band of Brothers.

That is a terrible, terrible reason to hold stocks and, when the correction comes, those good companies with strong, healthy balance sheets will be sold right alongside all the overpriced, overvalued stocks that take turns as the darlings of the analyst crowd (you know who you are, stocks). The only difference will be that the better companies' share prices will recover far faster once appetite for value and risk returns.

2008 is still too fresh in the collective minds of investors for there to be any other reaction to another major market swoon and, as the world nears the closest thing we have ever seen to a truly global recession, it's incredibly hard to see where the growth is coming from to justify buying stocks on 2% yields on multiples in the teens.

The 1982 bull market began with the S&P500 trading on 7x earnings and yielding 6.3% (green dotted line, below). It ended in the tech blow-off at 30x earnings and a 1% yield (red dotted line, below).

As we stand today, the S&P is yielding 2.5% and is trading at roughly 11x earning (blue dotted line, above). Expensive? Maybe not, but hardly the stuff dreams are made of.

So there we have it, folks; a wander through the process that both begins and ends in projections of one kind or another. History will either look upon the two I have made kindly or with the type of scorn usually reserved for Central Bank governors or the CBO, but the one thing that gives me comfort in making them is that I have gone for the darkest end of the projection spectrum which will keep me nicely distant from those I desire NOT to emulate.

Be nice. After all, they're only projections.

I will leave you with a story, beautifully told by David Stockton that was culled from the transcript of an FOMC meeting in September 2005 and demonstrates the absurdity of projections (particularly in government-run institutions).

During World War II, [Nobel laureate, Ken] Arrow was assigned to a team of statisticians to produce long-range weather forecasts. After a time, Arrow and his team determined that their forecasts were not much better than pulling predictions out of a hat. They wrote their superiors, asking to be relieved of the duty. They received the following reply, and I quote "The Commanding General is well aware that the forecasts are no good. However, he needs them for planning purposes."– David Stockton,

By John F. Mauldin

Outside the Box is a free weekly economic e-letter by best-selling author and renowned financial expert, John Mauldin. You can learn more and get your free subscription by visiting www.JohnMauldin.com.

Please write to johnmauldin@2000wave.com to inform us of any reproductions, including when and where copy will be reproduced. You must keep the letter intact, from introduction to disclaimers. If you would like to quote brief portions only, please reference www.JohnMauldin.com.

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2012 John Mauldin. All Rights Reserved

Note: John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA registered broker-dealer. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private investment offerings with other independent firms such as Altegris Investments; Absolute Return Partners, LLP; Plexus Asset Management; Fynn Capital; and Nicola Wealth Management. Funds recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor's services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staffs at Millennium Wave Advisors, LLC and InvestorsInsight Publishing, Inc. ("InvestorsInsight") may or may not have investments in any funds cited above.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.