Markets Liquidity Cycle Reaches A Turn

Stock-Markets / Stock Markets 2012 Jul 17, 2012 - 06:56 AM GMT It appears that FXE may be finished with its corrective bounce, or nearly so. There are a couple of ways to label this pattern and the chart shows the most conservative wave pattern. I am tempted to re-label, but we have time to evaluate what transpires over the next three weeks. Tomorrow is day 43 of the liquidity cycle and a turn date. Remember, I had mentioned that we have been seeing significant turns on or near dates divisible by 43. This may be one of them.

It appears that FXE may be finished with its corrective bounce, or nearly so. There are a couple of ways to label this pattern and the chart shows the most conservative wave pattern. I am tempted to re-label, but we have time to evaluate what transpires over the next three weeks. Tomorrow is day 43 of the liquidity cycle and a turn date. Remember, I had mentioned that we have been seeing significant turns on or near dates divisible by 43. This may be one of them.

My apologies for calling for a pivot today. Indeed there is, but a lesser one. You may recall that I discussed the probability that SPY is now on the same Liquidity Cycle (dominant cycle) as FXE. Tomorrow is day 43 for SPY as well. The same discussion holds for SPY as FXE. We may expect a quick probe to 136.68, where wave 5 equals wave 1. Then a turn sometime during the day tomorrow.

It is uncertain whether VIX is attempting yet another decline, which may mean a new low. If it does make a new low, it appears to be in the form of a quadruple zigzag, which is virtually unheard of. On the other hand, the current wave structure is sloppy and overlapping, which leans more toward correctiveness than impulsiveness. If it chooses to go lower, the most likely support would be Cycle Bottom support at 15.98.

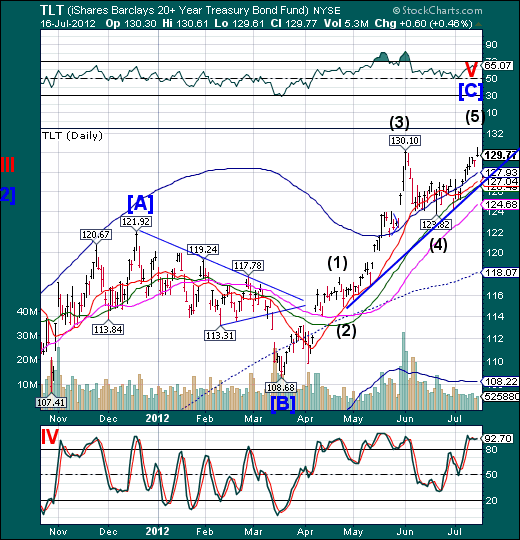

TLT made a nominal new high today. Today is day 26 (25.8) of its new Master Cycle, so if the new MC is dominant, we may have already seen the decline begin today. There is a lesser possibility of another move higher, but I remain neutral for TLT until clarity emerges.

I am convinced that TLT will come under the influence of the Liquidity Cycle very soon.

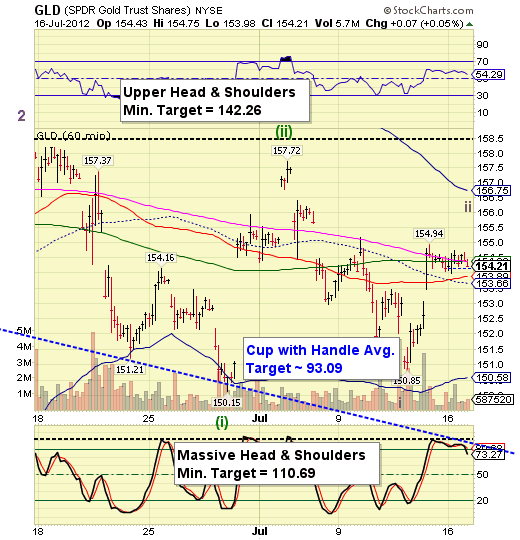

GLD appears to have one more probe to 155.46, where wave (v) of [c] equals wave (i) of [c]. GLD’s pivot day happens to be on Wednesday, but I would not be surprised to see an early turn, due to the influence of the Liquidity Cycle.

That’s all for now.

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.