Sorry Stock Market Bulls, The Fed Will Not Engage in More QE.

Stock-Markets / Quantitative Easing Jul 16, 2012 - 10:28 AM GMTBy: Graham_Summers

For well over a year now, I’ve been stating that the Fed will not be able to engage in Quantitative Easing (QE) unless systemic risk hits (think another 2008). My reasons for this are as follows.

For well over a year now, I’ve been stating that the Fed will not be able to engage in Quantitative Easing (QE) unless systemic risk hits (think another 2008). My reasons for this are as follows.

First off, the political consequences of hitting “print” (inflation) have made themselves evident to everyone. Indeed, Bernanke was talking about this point as far back as May 2011. The below quote is from a Q&A session with Bernanke during that month.

Q. Since both housing and unemployment have not recovered sufficiently, why are you not instantly embarking on QE3? — Michael A. Kamperman, Waco, Tex.

Mr. Bernanke: “Going forward, we’ll have to continue to make judgments about whether additional steps are warranted, but as we do so, we have to keep in mind that we do have a dual mandate, that we do have to worry about both the rate of growth but also the inflation rate…

“The trade-offs are getting — are getting less attractive at this point. Inflation has gotten higher. Inflation expectations are a bit higher. It’s not clear that we can get substantial improvements in payrolls without some additional inflation risk. And in my view, if we’re going to have success in creating a long-run, sustainable recovery with lots of job growth, we’ve got to keep inflation under control. So we’ve got to look at both of those — both parts of the mandate as we — as we choose policy”

http://economix.blogs.nytimes.com/...

The significance of Bernanke’s admission went largely unnoticed by the financial media. How many times has CNBC and Bloomberg and the like put on various “gurus” who guarantee that QE 3 is just around the corner?

Yet, here we are one year and over 10 Fed FOMC meetings later and the Fed hasn’t launched any new QE programs. Think about that. For over a year now the financial media has been awash with “experts” saying “QE is just around the corner, the Fed will launch QE any minute now, etc” Every time stocks rally. But. No. QE.

Instead the Fed has largely resorted to simply shuffling its portfolio around (Operation Twist 2) or issuing verbal/symbolic interventions e.g. promising to maintain ZIRP for a prolonged period.

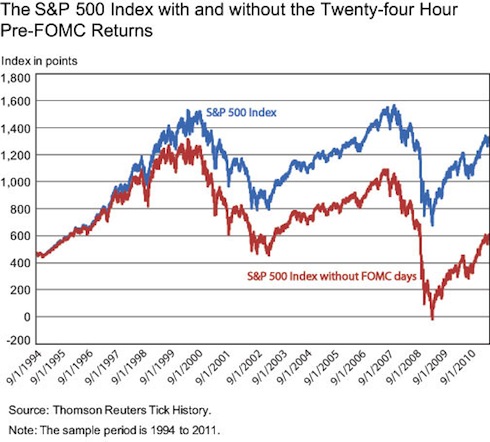

Heck, the Fed has even admitted it doesn’t want to engage in more QE. Just last week the NY Fed released a study revealing that the Fed has managed to double the value of the S&P 500 just by holding regular FOMC meetings.

As the above chart shows, when you remove for the market moves that took place around Fed FOMC meetings, the S&P 500 would be around 600 today.

Thus, I ask… why bother implementing QE when you can get the same effect (higher stock prices) simply by issuing verbal interventions?

We get more evidence that the Fed doesn’t want to engage in more QE from the fact that the Fed has clearly gone into damage control mode. Bernanke has staged townhall meetings, opened the Fed to Q&A sessions, and even had his favorite Wall Street Journal reporter (Jun Hilsenrath) pen articles depicting him (Bernanke) as an average guy who drives a Sebring and reads a Kindle.

Remember, we’re talking about a man who openly lied to Congress (Bernanke’s famous “I won’t monetize the debt” statement) … a man who basically told reporters to get stuffed regarding the Fed’s secret loans during the 2008 Crisis… now staging townhall meetings with the public. If that doesn’t tell you that the Fed is feeling some major political heat, nothing will.

Again, the Fed cannot and will not engage in more QE. It doesn’t need to. It gets the same effect without actually spending any money. Moreover, the Fed is in the political hot-seat. You don’t go from lying to Congress and telling the media to get stuffed to staging townhall meetings unless you’re very very worried about the public’s perception of you.

Which means… the Fed is on hold right now… which means the primary prop that has held stocks up is being slowly removed… which means… the markets are extremely vulnerable right now.

Those investors looking for actionable investment ideas could also consider our Private Wealth Advisory newsletter: a bi-weekly detailed investment advisory service that distills the most important geopolitical, economic, and financial developments in the markets into concise investment strategies for individual investors.

To learn more about Private Wealth Advisory… and how it can help you navigate the markets successfully…Graham Summers

Chief Market Strategist

Good Investing!

PS. If you’re getting worried about the future of the stock market and have yet to take steps to prepare for the Second Round of the Financial Crisis… I highly suggest you download my FREE Special Report specifying exactly how to prepare for what’s to come.

I call it The Financial Crisis “Round Two” Survival Kit. And its 17 pages contain a wealth of information about portfolio protection, which investments to own and how to take out Catastrophe Insurance on the stock market (this “insurance” paid out triple digit gains in the Autumn of 2008).

Again, this is all 100% FREE. To pick up your copy today, got to http://www.gainspainscapital.com and click on FREE REPORTS.

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2012 Copyright Graham Summers - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.