'Peak Gold' - Gold Production Collapse Continues In South Africa

Commodities / Gold and Silver 2012 Jul 13, 2012 - 09:37 AM GMTBy: GoldCore

Today's AM fix was USD 1579.00, EUR 1294.05 and GBP 1022.34 per ounce.

Today's AM fix was USD 1579.00, EUR 1294.05 and GBP 1022.34 per ounce.

Yesterday’s AM fix was USD 1565.50, EUR 1281.10 and GBP 1011.96 per ounce.

Gold fell by 0.3% in New York yesterday and closed down $4.90 to $1,571.70/oz. After a sharp drop and equally sharp bounce higher, silver rose 0.3% or 8 cents to close at $27.17/oz

South African Gold Production Continues To Plummet

After initial falls in Asia, gold traded sideways and then gradually ticked higher later in the Asian session and has seen further gains in European trading. Gold is currently set to finish the week marginally lower in dollar and sterling terms but higher in euro and Swiss franc terms.

South Africa's gold output continues to collapse and fell a further 2.9% in May, according to data from Statistics South Africa released yesterday. The decline in gold production comes despite a 0.8% rise in total mining output in the same month (see below).

Gold is being supported by euro zone currency and contagion risk and inflation hedging diversification.

Merrill Lynch predicted gold would reach $2,000/oz yesterday due to more astute investors fearing inflation due to ultra loose monetary policies. Francisco Blanch, Head of Global Commodity & Multi-Asset Strategy Research Merrill Lynch, said in a CNBC interview that Merrill believe “that $2,000 an ounce is sort of the right number. We believe that ultimately the Fed will be forced to do quantitative easing.”

“If it happens in September, as our economists expect, we will get a rally sooner in gold,” Blanch added. ”If it happens after the election (in November), we will get the rally a little bit later; probably we will touch $2000 an ounce sometime next year.”

Demand and supply factors remain in gold’s favour.

There is strong demand from store of wealth buyers in Europe, China, the Middle East and the rest of Asia – not to mention strong demand from institutions and central banks.

A new trend seen in recent weeks is that of an increase in demand for corporates in the euro zone who are diversifying deposits in order to reduce bank, currency and systemic risk.

While some attention has been paid to the robust, broad based global demand for gold, less attention has been paid to the supply side and in particular the important gold production data.

Supply remains anaemic with the cash for gold craze seeming to have run its course, with central banks now net buyers and with mine supply not increasing sufficiently to meet demand.

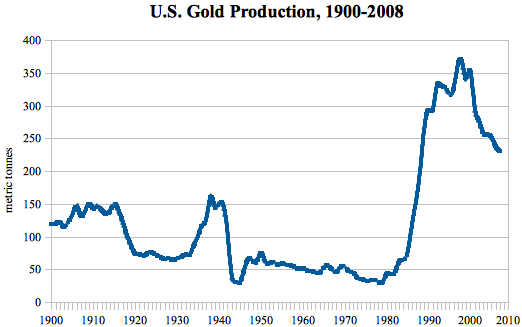

With regard to global gold production, China, the world’s largest gold producer and now the world’s largest gold buyer, has been the only major producer to see an increase in production in recent years.

The massive increase in Chinese mining supply has raised some eyebrows with some questioning whether the figures are being exaggerated by Chinese mining companies and Chinese bureaucrats.

More recently, there is a concern that gold production in China may actually be declining as older mines reduce production.

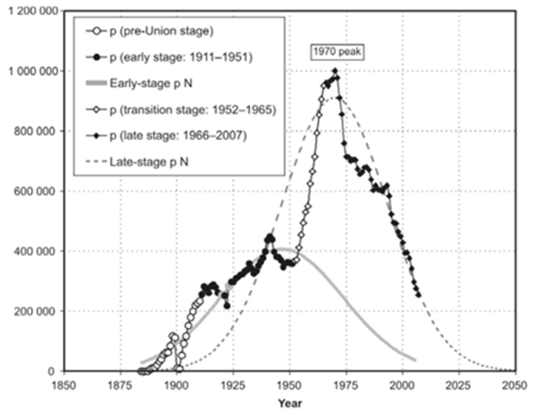

South Africa produced over 1,000 tonnes of gold in 1970 but production has fallen to below 250 tonnes in recent years (see chart above). This is a collapse as these are levels last seen in 1922 and happened despite the massive technological advances of recent years and more intensive mining practices.

South Africa's gold output fell further 2.9% in May, according to data from Statistics South Africa released Thursday, despite a 0.8% rise in total mining output in the same month.

Recently, the decline in South African gold production has been attributed to national electrical issues and power outages, operational delays and safety issues. However, the scale of decline at a time when there has not been a corresponding decline in base metals mined in South Africa suggests that geological constraints may be leading to lower production.

Other large gold producing nations have seen similar sharp declines.

Peak oil is a phenomenon many will be aware of – peak gold remains a foreign concept to most.

Peak gold is the date at which the maximum rate of global gold extraction is reached, after which the rate of production enters terminal decline. The term derives from the Hubbert peak of a resource.

Unlike oil and silver, which is destroyed in use, gold can be reused and recycled. However, unlike oil gold is money, a store of value and a foreign exchange reserve and gold is slowly being remonetised in the global financial system and indeed may soon play a role in a new international monetary system.

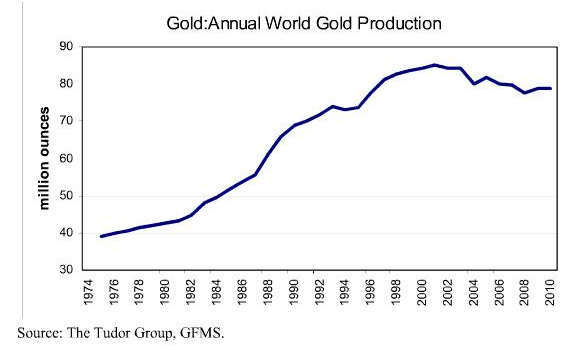

In 2001, the world saw what was believed to be record global gold production of 2,649 tonnes. Production then fell in the coming years despite the rising gold price.

In 2010, despite a 5 fold increase in the prices in US dollar terms, some estimates recorded gold production had risen 1.5% from the record in 2001 at 2,649 tonnes to a new record of 2,689 tonnes.

World Gold Council data for 2011 showed that production had increased by 4% from 2010 to 2,810 tonnes of gold. Much of the production increase was attributed to Chinese production data.

The Chinese production data may or may not be reliable but there is also confusion with regard to the data as there are discrepancies in the gold production data between the US Geological Survey and the World Gold Council.

The USGS has informed us that the discrepancies are due to different estimates of artismal mining data and that the USGS reports each country's reported data.

Paul Tudor Jones’ Tudor Group released a chart using GFMS data in 2010 that showed that global gold production had peaked in 2001 and was falling (see chart above and video).

In 2009, Barrick CEO Aaron Regent claimed that global production had peaked in 2000.

He told The Daily Telegraph at the RBC's annual gold conference in London that "there is a strong case to be made that we are already at 'peak gold'."

"Production peaked around 2000 and it has been in decline ever since, and we forecast that decline to continue. It is increasingly difficult to find ore," he said.

Ore grades have fallen from around 12 grams per tonne in 1950 to nearer 3 grams in the US, Canada, and Australia. South Africa's output has halved since peaking in 1970.

Peak gold may not have happened in 2000. Nor may it have happened in 2011. However, the geological evidence suggests that it may happen in the near term due to the increasing difficulty large and small gold mining companies are having increasing their production.

It is also signalled in the fact that most of the larger gold producing countries (such as Australia, the U.S., South Africa, Canada, Peru, Indonesia) have all seen production drops in recent years.

China and Russia are the two only large producers to have seen production increases.

Peak gold has yet to be considered and analysed by the international financial community but there is a risk that it has happened or will happen soon with a consequent impact on the gold mining industry and on gold prices in the 21st Century.

The fact that peak gold may take place at a time when the world is engaged in peak fiat paper and electronic money creation bodes very well for gold’s long term outlook.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.