Two Myths That Stocks Bulls Continue to Cling To Were Just Rendered Moot

Stock-Markets / Stock Markets 2012 Jul 12, 2012 - 06:14 AM GMTBy: Graham_Summers

Two myths that the Bulls continue to cling to were rendered moot yesterday. Those myths are:

Two myths that the Bulls continue to cling to were rendered moot yesterday. Those myths are:

1) That the Fed will engage in more QE.

2) That Spain is saved.

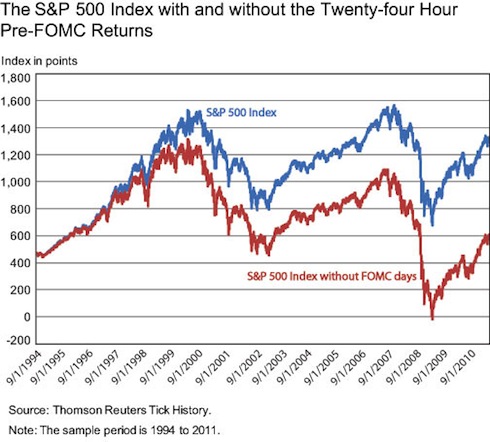

The Federal Reserve has admitted that it targets the stock market. It’s not surprising given that the stock market is the only real “positive” outcome that the Fed can claim resulted from its policies. Whether or not we needed to spend several Trillion Dollars on this is up for debate however, as the Fed itself admits in its research that ALL of the stock market gains over the last three years occurred due to market moves around Fed FOMC days.

Put another way, the Fed could potentially have gotten the same results (S&P 500 at 1,300+) just by staging FOMC meetings in which it announces that it’s ready to act at any time.

This ties in with one of my dominant themes: that the Fed is tapped out and will not engage in aggressive monetary policy unless we have a systemic crisis or a major bank fails. As far back as May 2011, Bernanke was admitting that the consequences of QE were no longer outweighing the benefits. It’s not coincidence that since then the Fed has largely resorted to symbolic interventions (promises to maintain ZIRP) or verbal interventions “we stand ready to act at any time.”

Speaking of systemic risk, details are beginning to surface regarding the Spanish bailout. While everyone views this as a sign that Spain is “saved” I’m curious about the following…

1) If Spain was drawing €300+ from the ECB in May… how does €100 billion solve its problems?

2) If Spain’s prime minister admitted himself that Spain’s capital needs are more in the ballpark of €500 billion… why are people acting as though €100 million solves Spain’s problems?

3) Where will the money come from? The EFSF is essentially tapped out and SPAIN contributes 12% of the ESM’s funding (combined with Italy you’re looking at 30% of the ESM’s funding)… so Spain is essentially bailing itself out?

The reality is that Spain needs much more money and it needs it fast. The idea that handing the country a couple tens of billions of Euros every few months will cover its capital needs is absurd.

Indeed, the far more important question to be asked is: WHY weren’t the EFSF or ESM made larger during the recent EU leader meeting?

The answer? Europe, specifically Germany, is tapped out.

First off, the country is only €328 billion away from reaching an official Debt to GDP of 90%: the level at which national solvency is called into question.

Moreover, that €328 billion has already been spent via various EU props. Indeed, when we account for all the backdoor schemes Germany has engaged in to prop up the EU, Germany’s REAL Debt to GDP is closer to 300%.

In Euro terms, Germany now has €1 trillion in exposure to the EU via its various bailout mechanisms. That’s EQUAL TO roughly 30% of German GDP.

If even a significant portion of that €1 trillion goes bad (which it will as this money has been spent helping the PIIGS), Germany’s financial system will take a MASSIVE hit.

This will guarantee Germany losing its AAA status, which in turn makes its funding costs much higher (see what happened to France in the last year: that country is now facing bank runs and its own solvency Crisis which you’ll be hearing about in the coming weeks).

Angela Merkel is up for re-election next year. There is no way on earth she’ll opt to let Germany get dragged down by the EU. She’s even said she will not allow Eurobonds for “as long as [she] lives.”

So… is Spain really saved? Or is this just another “hope and pray” move from EU leaders who realize that the money tap has run dry (the ECB hasn’t bought an EU sovereign bond in nearly four months).

Those investors looking for actionable investment ideas could also consider our Private Wealth Advisory newsletter: a bi-weekly detailed investment advisory service that distills the most important geopolitical, economic, and financial developments in the markets into concise investment strategies for individual investors.

To learn more about Private Wealth Advisory… and how it can help you navigate the markets successfully…Graham Summers

Chief Market Strategist

Good Investing!

PS. If you’re getting worried about the future of the stock market and have yet to take steps to prepare for the Second Round of the Financial Crisis… I highly suggest you download my FREE Special Report specifying exactly how to prepare for what’s to come.

I call it The Financial Crisis “Round Two” Survival Kit. And its 17 pages contain a wealth of information about portfolio protection, which investments to own and how to take out Catastrophe Insurance on the stock market (this “insurance” paid out triple digit gains in the Autumn of 2008).

Again, this is all 100% FREE. To pick up your copy today, got to http://www.gainspainscapital.com and click on FREE REPORTS.

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2012 Copyright Graham Summers - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.