Our Money Is Dying, Don't let your wealth die with it

Stock-Markets / Fiat Currency Jul 11, 2012 - 04:02 AM GMTBy: Dr_Martenson

A question on the minds of many people today (increasingly those who manage or invest money professionally) is this: How do I preserve wealth during a period of intense official intervention in and manipulation of money supply, price, and asset markets?

A question on the minds of many people today (increasingly those who manage or invest money professionally) is this: How do I preserve wealth during a period of intense official intervention in and manipulation of money supply, price, and asset markets?

As every effort to re-inflate and perpetuate the credit bubble is made, the words of Austrian economist Ludwig Von Mises lurk ominously nearby:

There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner, as the result of a voluntary abandonment of further credit expansion, or later, as a final and total catastrophe of the currency system involved. (Source)

Because every effort is being made to avoid abandoning the credit expansion process -- with central banks and governments lending and borrowing furiously to make up for private shortfalls -- we are left with the growing prospect that the outcome will involve some form of "final catastrophe of the currency system"(s).

This report explores what the dimensions of that risk are. It draws upon both historical and modern examples to try to shed some light on how the currency collapse process will likely unfold this time around. Plus, we'll address how best to avoid its pernicious wealth destroying effects.

When Money Dies

In the book When Money Dies by Adam Fergusson, which details Weimar Germany's inflation over the period from 1918 to 1923, the most riveting parts for me were the first-hand accounts from the people caught in the storm.

So many people left their wealth in the system only to watch it get eroded and utterly destroyed over time. The reasons were many: patriotism, inertia, disbelief, and denial cruelly fed by hope every time prices moderated or even retreated momentarily.

The simple observation is that many people had a blind belief in the money system. They lost their wealth because they were unable or unwilling to allow reality to challenge their beliefs. It's not that there weren't numerous warning signs to heed -- in fact, they could be seen everywhere -- but most willfully ignored them.

Most mysterious is the fact that in Austria and Germany, where the inflation struck most severely, there were numerous borders and currencies into which people could have dodged to protect their wealth. That is, protecting one's wealth was a relatively straightforward and simple manner. And yet…it did not happen.

The Many Types of Inflation

As always, the landscape of inflation needs to be carefully mapped before we can begin to hope to have a conversation with a destination. Where the symptom of inflation is rising prices – in fact, rising prices are the only things tracked by the Consumer Price Index, or CPI – the causesof rising prices are many, but they always boil down to the overexpansion of money and/or credit. Knowing the cause is essential to knowing what to do next.

Here are the main flavors of rising prices that we need to keep in mind:

Non-inflationary price increases – These are caused by demand exceeding supply. It happens all the time. A poor harvest driving up the price of corn is not inflationary, but it will show up in the Consumer Price Index (CPI). These sorts of price movements reverse themselves as markets respond by chasing the price and delivering more of whatever was in short supply. The only exception is when there is some essential, non-renewable natural resource in sustained depletion -- which means that demand will always exceed supply and prices will rise and then rise some more. Excessive speculation can also lead to price rises and, as long as the speculation centers on the item(s) involved and not on excessive money/credit expansion, it, too, can be (and eventually will be) reversed.

Simple inflation – This is the 'textbook' case of inflation where too much money and/or credit is created relative to goods and services. Print too much money or make credit too cheap/easy and prices will rise roughly in proportion to the excess. Simple inflation operates in the low single digit percentages. Central banks openly target simple inflation in the 2%-3% range as that level of expansion allows banks to have healthy profits, prevents past loan errors from swamping the system, and generally keeps the exponential money system operating well.

Loss of confidence in money – A more severe stage of simple inflation takes over when enough people lose faith in the money and seek to actively spend their money on something, anything, before that money loses value. This type of inflation operates in the high single digits to low double digits, somewhere between 8% and 15%. This is just simple inflation on steroids. Not everybody participates in this game yet, as the loss of confidence has not yet reached criticality, but enough people do to keep this process locked in a self-reinforcing spiral that requires aggressive money tightening to halt. Think 'Paul Volcker' and '21% interest rates' and you get the picture.

Hyperinflation – Further along the inflationary spectrum is what happens when a critical mass of people within a society lose faith in their money and the monetary authorities are incapable of reducing the money/credit supply, either because there’s already too much of it out there to ‘call in,’ or because they lack the political will to do anything but print more money in response (i.e., there are no Volckers around). Once this critical mass is reached, every corner of society is participating, and it is no longer socially taboo to talk about the hyperinflation or how to escape its effects. Everyone is wheeling and dealing, speculation runs rampant in everything from stocks to pineapples, and you cannot possibly spend your money fast enough to avoid the ravages of inflation. The annual percentage rates for hyperinflation range from medium double-digits into the hundreds of millions.

Currency destruction – There is another type of inflation that happens when your state currency is shunned by the rest of the world. While there may be no additional money creation and credit may even be dropping, inflation is still a very serious problem as everything imported goes up in price. There are many reasons that a currency may be shunned. It could be that other countries lose faith in the currency due to mismanagement and overprinting. It could be due to acts of war. Or it could happen at the end of a very long period of excessive credit and money expansion, when that bubble finally bursts and confidence in the associated currency unit(s) is lost. There is really very little that local authorities can do to fix things unless the country imports nothing, a condition that applies to exactly nobody. Prime candidates to experience this form of inflation are the US and Japan; the former because of massive imbalances fostered by its several decades of reserve currency status, and the latter because of persistent and massive over-printing enabled by domestic savings and a once-robust export surplus. The dynamic of currency destruction is for imported items to rise sharply in price first, with everything else soon following in upward price spirals. Policy responses are quite limited and are usually ineffectual at preventing a massive amount of economic destruction and wealth loss for the holders of the stricken currency.

It is this last type of inflation – currency destruction – that we’ll explore here, because it represents a severe risk and is very rarely talked about or analyzed.

Spinning in the Water

A modern case study of a shunned currency is Iran.

For a variety of reasons, Iran finds itself the subject of a sustained effort by the US to subjugate its nuclear program to international inspection and curtailment. Already the target of many overt and covert efforts to bring it to heel -- ranging from two highly destructive and invasive computer worms (Stuxnet and Flame), to stealth drone overflights, to an international ban on oil exports -- Iran now finds that its currency is being internationally shunned.

The impacts are obvious and the lessons instructive.

Already Plagued by Inflation, Iran Is Bracing for Worse

Jul 1, 2012

TEHRAN — Bedeviled by government mismanagement of the economy and international sanctions over its nuclear program, Iran is in the grip of spiraling inflation. Just ask Ali, a fruit vendor in the capital whose business has been slow for months.

People hurried by his lavish displays of red grapes, dark blue figs and ginger last week, with few stopping to make a purchase. “Who in Iran can afford to buy a pineapple costing $15?” he asked. “Nobody.”

But Ali is not complaining, because he is making a killing in his other line of work: currency speculation. “At least the dollars I bought are making a profit for me,” he said.

The imposition on Sunday of new international measures aimed at cutting Iran’s oil exports, its main source of income, threatens to make the distortion in the economy even worse. With the local currency, the rial, having lost 50 percent of its value in the last year against other currencies, consumer prices here are rising fast — officially by 25 percent annually, but even more than that, economists say.(Source)

There are several factors feeding into the current Iranian currency crisis, including mismanagement of the economy that has left Iran even more exposed to imports than it otherwise could or should be, and Iran's currency is on the cusp of tipping over into outright hyperinflation. Ever since the Revolutionary War, when the British printed and distributed cartloads of Continental scrip, currency debasement has been a useful tool of war. All is fair in love and war, and whatever corrodes your opponent’s strength is a potentially useful tool.

Note that in the above quotes, we find that both the speculation already in evidence plus the 25%+ price increases support the idea that Iran has already tipped past simple inflation. Whether it can prevent a worsening condition is unclear at this point, regardless of whether or not international sanctions are soon lifted.

More from the same article:

Increasingly, the economy centers on speculation. In this evolving casino, the winners seize opportunities to make quick money on currency plays, while the losers watch their wealth and savings evaporate almost overnight.

At first glance, Tehran, the political and economical engine of Iran, is the same thriving metropolis it has long been, the city where Porsche sold more cars in 2011 than anywhere else in the Middle East. City parks are immaculately maintained, and streetlights are rarely broken. Supermarkets and stores brim with imported products, and homeless people are a rare sight on its streets.

But Iran’s diminishing ability to sell oil under sanctions, falling foreign currency reserves and President Mahmoud Ahmadinejad’s erratic economic policies have combined to create an atmosphere in which citizens, banks, businesses and state institutions have started fending for themselves.

“The fact that all those Porsches are sold here is an indicator that some people are profiting from the bad economy,” said Hossein Raghfar, an economist at Al Zahra University here. “Everybody has started hustling on the side, in order to generate extra income,” he said. “Everybody is speculating.”

Some, like Ali the fruit seller, who would not give his full name, exchange their rials for dollars and other foreign currencies as fast as they can. More sophisticated investors invest their cash in land, apartments, art, cars and other assets that will rise in value as the rial plunges.

For those on the losing end, however, every day brings more bad news. The steep price rises are turning visits by Tehran homemakers to their neighborhood supermarkets into nerve-racking experiences, with the price of bread, for example, increasing 16-fold since the withdrawal of state subsidies in 2010.

“My life feels like I’m trying to swim up a waterfall,” said Dariush Namazi, 50, the manager of a bookstore. Having saved for years to buy a small apartment, he has found the value of his savings cut in half by the inflation, and still falling.

“I had moved some strokes up the waterfall, but now I fell down and am spinning in the water.”

(Source)

All of the important lessons you need to avoid a currency destruction are contained in those passages above.

- Savings are for losers.

- The more exposure you have to food and fuel price hikes, the worse off you are.

- First movers have the advantage. Get your wealth out of the afflicted currency as fast as possible and then trade back in when needed to make purchases.

- Paralysis is a wealth destroyer.

- Fending for oneself is a wealth saver, so faith in authority is best shucked as fast as possible.

Be prepared to follow those rules and you will do better than most.

Barter, speculation, and prices that gyrate wildly as formerly expensive things are traded for basic necessities are all typical features of the end stages of a currency. Crime, social unrest, and sometimes war are handmaidens that accompany the death throes of money.

The basic strategies to protect one’s wealth are deceptively simple. As soon as the process of money destruction has begun, if not before, all savings have to be moved out of the afflicted currency and into things, especially things that others with wealth or barter items are most likely to want.

Turning our attention back to the Weimar episode for a moment, the Amazon summary for When Money Dies reads:

When Money Dies is the classic history of what happens when a nation’s currency depreciates beyond recovery. In 1923, with its currency effectively worthless (the exchange rate in December of that year was one dollar to 4,200,000,000,000 marks), the German republic was all but reduced to a barter economy.

Expensive cigars, artworks, and jewels were routinely exchanged for staples such as bread; a cinema ticket could be bought for a lump of coal; and a bottle of paraffin for a silk shirt. People watched helplessly as their life savings disappeared and their loved ones starved. Germany’s finances descended into chaos, with severe social unrest in its wake.

The parallels to the Iranian situation are obvious.

Those without the gift of foresight to identify what is coming, coupled with an inability to take decisive action that cuts against the social grain (at least early on), will simply lose their wealth and not be in a position to buy or exchange anything but their own time and labor in the future. This leads to the assessment that owning or producing things that people need or want is a good strategy.

Food is always a good play. In the early stages, we’d also lean towards highly socially desirable real estate and away from middle- and lower-income housing, as ability to pay always get shredded from the bottom up. Gold performs well in terms of protecting purchasing power. According to the article above, Porsches work too. In other words, owning things that wealthy people will desire is a very good idea.

I know this sounds harsh, elitist, and not terribly egalitarian, but it also happens to be how things tend to work out. Since I have a desire to be in a position to be helpful and of assistance in the future, protecting my wealth is a matter of both self and selfless interest. So I study what works and begin there, while also seeking a better future.

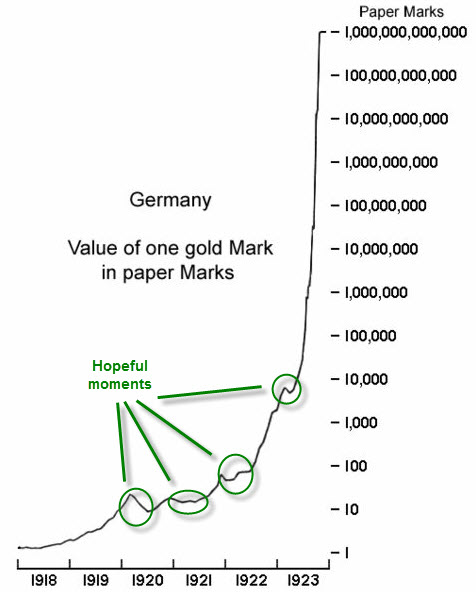

The cruelest part of a currency destruction is that it will sneak up on most people, their baselines will shift, and they will be confused by false hopes along the way. This is completely understandable and to be expected. There's a good chance you're well acquainted with the chart of the value of German Marks against gold during the Weimar hyperinflation. I want to take a closer look at it by focusing on the wiggles instead of the rise:

Imagine yourself there at that time, getting all of your information from the newspapers and your personal rumor network. Note that from the early part of 1920, prices fell by a lot over the next six months (note that this is a log chart, so even a little downward movement in the line represents a big price drop).

Headlines reported that the corner had been turned and that the government programs had been successful in bringing inflation under control. People wanted to believe that story and so they did.

It wasn't until the end of 1921 that prices began to rise again, spiking into early 1922 before stabilizing again for approximately eight months. Again people were calmed by the apparent success of the authorities in controlling the inflation.

Because there were three pauses and rescues along the way, the price spike from late 1922 and into 1923 caught many off guard. It was truly shocking. This is when the critical loss of faith finally happened. Yet far too many remained paralyzed, certain the government would again get things under control soon. After all, three times before there had been a recovery, why not this time too? One must have hope, after all...

In the middle of 1923, with very aggressive government intervention, there was a three-month dip in prices and a pause in the hyper-inflationary process. Again, another hopeful moment, but it was the final trap for the unwary.

To put this in context, imagine if next month (August) gasoline prices shot up by 300% to roughly $10/gal. But then, between August 2012 and May of 2013 the price of gasoline fell back to $5/gal. I'd be willing to wager that many of your friends would be telling you that everything was fine and that "they" have everything under control. Perhaps your continued concern would be ridiculed or dismissed.

Then, when prices finally did again breach the old $10/gal highs, some 19 months after the first price spike (in February 2014, in this example), many would have been habituated to the new prices, routines would have been altered, and many would have already inserted a rationalization process into their thinking that would have all of this make perfect sense, albeit uncomfortably.

While not tracking the percentages closely, this example tracks the time frame.

An important insight here is that baselines will shift, rationalizations will be formed, and explanations adopted, principally by those unable to accept that their money is in the process of dying. Avoiding this yourself will require tuning those people out and trusting yourself.

In Part II: Positioning Yourself for When Our Money Dies, we identify the most probable markers for identifying when a full-blown currency collapse is imminent.

What indicators should you watch for? Where should you place your capital to best preserve its purchasing power? What will a collapse of the US dollar look like and what will the likely aftermath be? These and other implications are explored.

Click here to access Part II of this report (free executive summary; paid enrollment required for full access).

© 2012 Copyright Dr Martenson - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.