US Fed Printing Money to Avoid Immediate Banking Collapse = Higher Long-term Rates

Interest-Rates / Credit Crisis 2008 Jan 30, 2008 - 07:20 PM GMTBy: Paul_Lamont

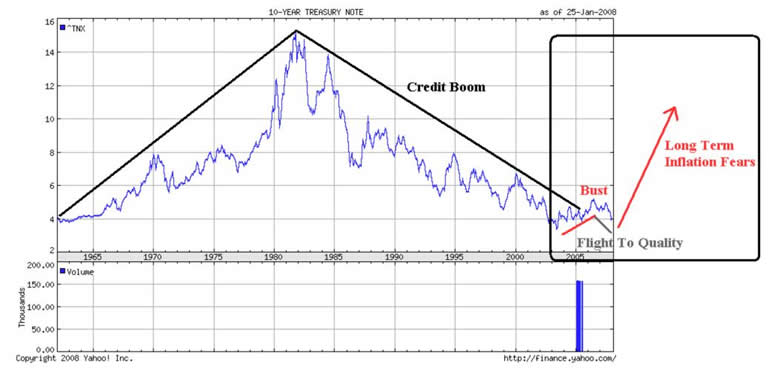

Two Billionaires Describe Our Outlook - Financial speculator and billionaire, George Soros states in his FT.com commentary : “the current crisis is the culmination of a super-boom that has lasted for more than 60 years.” In June's Higher Rates Reflect Default Risk we described the end of the last credit boom: “In 1928, the U.S. Treasury Bond similarly broke out of the channel and rose to a higher yield. This coincided with the end of ‘easy' money which forced the deleveraging of the economy and concluded with the financial crisis of 1929-1932.” Compare the two Treasury Bond Yield charts below. In 2005-2006 higher bond rates “broke out of the channel” and inflicted damage on the housing market. This marked “the end of ‘easy' money.” Similarly since 2006, there has also been a flight to quality.

Two Billionaires Describe Our Outlook - Financial speculator and billionaire, George Soros states in his FT.com commentary : “the current crisis is the culmination of a super-boom that has lasted for more than 60 years.” In June's Higher Rates Reflect Default Risk we described the end of the last credit boom: “In 1928, the U.S. Treasury Bond similarly broke out of the channel and rose to a higher yield. This coincided with the end of ‘easy' money which forced the deleveraging of the economy and concluded with the financial crisis of 1929-1932.” Compare the two Treasury Bond Yield charts below. In 2005-2006 higher bond rates “broke out of the channel” and inflicted damage on the housing market. This marked “the end of ‘easy' money.” Similarly since 2006, there has also been a flight to quality.

(Chart above from Longwaveanalyst.com)

George Soros explains what happens next: “if federal funds were lowered beyond a certain point, the dollar would come under renewed pressure and long-term bonds would actually go up in yield. Where that point is, is impossible to determine. When it is reached, the ability of the Fed to stimulate the economy comes to an end.” As we described last June, we expect 10 year Treasury Bonds to be sold for cash in the panic, just as occurred at the end of the last credit cycle. Billionaire investor Julian Robertson agrees. As he revealed to Fortune : “the biggest bet that Robertson has in his own portfolio at the moment” is “long the price of two-year Treasury and short the price of the ten-year Treasury.”

Printing Money to Avoid Immediate Banking Collapse

According to the Federal Reserve Board website , U.S. non-borrowed bank reserves have gone from $37B to $199M (nope, that's not a typo) in the last month. We have been discussing this with Sitka Pacific Capital's Mike ‘Mish' Shedlock for the last two weeks. He concludes: “Banks in aggregate have now burnt through all of their capital and are forced to borrow reserves from the Fed in order to keep lending.” Simply put, the U.S. banking system has no reserves. In addition, the FDIC has recently begun modernizing large-bank insurance rules . We hope this is a wake-up call to everyone as to the extent of the credit crisis. Bank account balances should be used only for transactions. Instead cash should be held in the form of U.S. Treasury Bills at a conservative brokerage or trust. Under the mattress is also perfectly acceptable (your parents or grandparents had to do it!). For investors, we advised last year to sell the banks . Banks will be soon forced to sell assets (yes, even 10 year Treasury Bonds) at deeply discounted prices to pay depositors.

By Paul Lamont

www.LTAdvisors.net

Lamont Trading Advisors, Inc. is an investment management firm that specializes in the preservation of wealth. Visit www.ltadvisors.net for more information. This Investment Flash can be freely distributed with proper attribution. Our monthly Investment Analysis Report provides a more in-depth look at the markets and requires a subscription fee of $40 a month.

***No graph, chart, formula or other device offered can in and of itself be used to make trading decisions.

Copyright ©2007 Lamont Trading Advisors, Inc. Paul J. Lamont is President of Lamont Trading Advisors, Inc., a registered investment advisor in the State of Alabama . Persons in states outside of Alabama should be aware that we are relying on de minimis contact rules within their respective home state. For more information about our firm, or to receive a copy of our disclosure form ADV, please email us at advrequest@ltadvisors.net, or call (256) 850-4161.

Paul Lamont Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.