Factories Across the World Shift Gears

Economics / Economic Recovery Jul 03, 2012 - 05:20 AM GMTBy: Asha_Bangalore

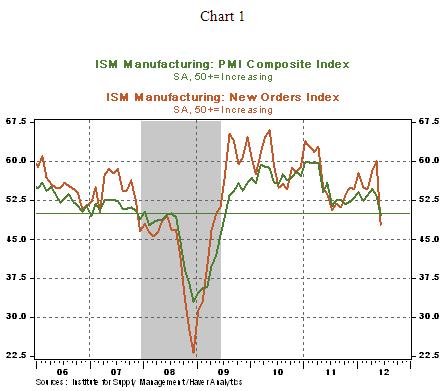

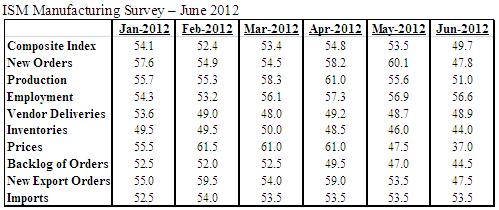

The US Institute of Supply Management (ISM) manufacturing survey results for June were disappointing; with the Purchasing Managers’ Index (PMI) at 49.7 in June, down from 53.5 in the prior month. This is the first monthly reading below 50.0 since July 2009 (see Chart 1). Index readings above 50 denote an expansion, while those below 50.0 point to a contraction in activity.

The US Institute of Supply Management (ISM) manufacturing survey results for June were disappointing; with the Purchasing Managers’ Index (PMI) at 49.7 in June, down from 53.5 in the prior month. This is the first monthly reading below 50.0 since July 2009 (see Chart 1). Index readings above 50 denote an expansion, while those below 50.0 point to a contraction in activity.

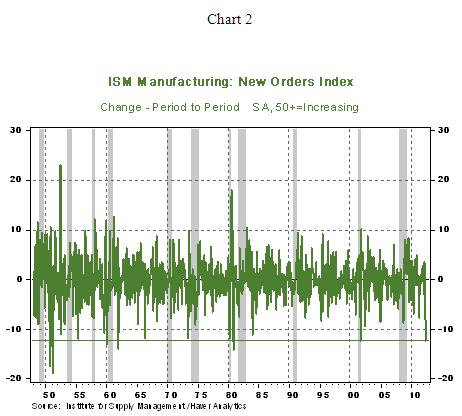

The index tracking new orders plunged 12.3 points to 47.8 in June from 60.1 in May. The June mark for new orders is the lowest since April 2009 and the size of the decline in June is one of few in the history of the index (see Chart 2). Indexes tracking production and employment slipped in June but they are holding about the critical 50.0 mark.

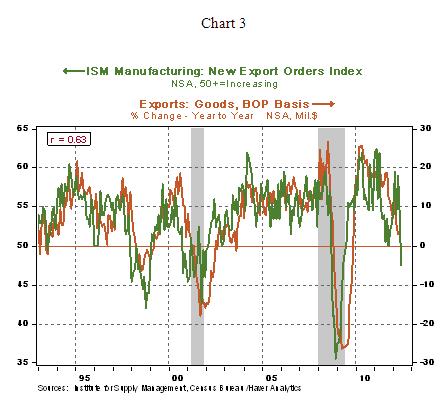

The index measuring exports (47.5 vs. 53.5 in May) fell below 50.0 and augurs poorly for exports in the second quarter. The year-to-year change in exports of goods has a strong positive relationship with the Ism index of exports (see Chart 3). Survey respondents noted that adverse economic developments in China and Europe are reflected in the weakness of the export orders index.

The Markit PMI, a new survey of factories in the United States, also shows a slowing of factory activity but the level of the index remains above 50 (52.47 vs. 54.0 in May) and the new orders gauge (53.7 vs. 54.06 in May) of this survey also slipped but by a smaller magnitude compared with the ISM survey.

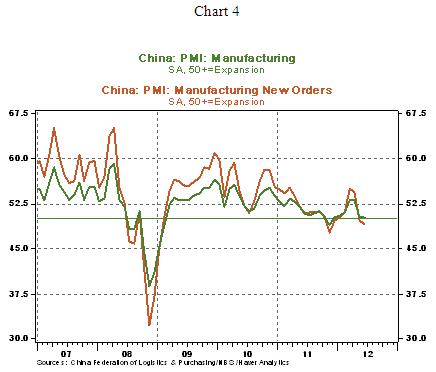

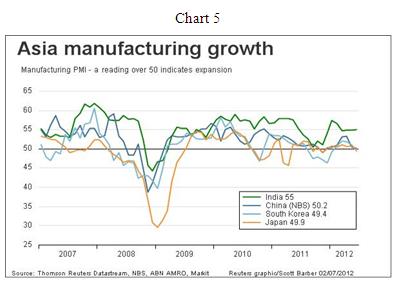

Overseas, the official PMI of China was virtually steady at 50.2 in June vs. 50.4 in May. The official new orders index has held below 50.0 for two straight months (see Chart 4). The message from an alternate factory survey suggests a weaker factory sector. The HSBC Purchasing Managers' Index (PMI) fell to 48.2 after seasonal adjustments, the lowest since November 2011. As per the HSBC survey, the June reading is the seventh straight monthly mark below 50.0. The PMI’s of Japan and South Korea are moved to the contraction territory (see Chart 5), while that of India maintains an expansionary trend.

Source: http://fingfx.thomsonreuters.com/2012/04/23/1008486def.htm

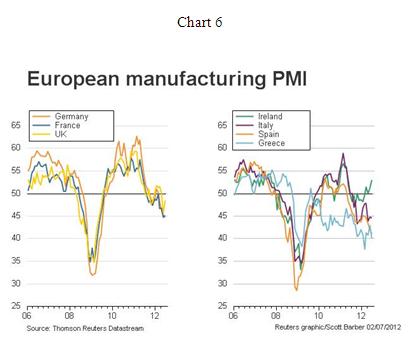

The news from Europe remains gloomy, with factories showing a declining momentum in July. The PMI’s of Germany (45.0), France (45.2), UK (48.6), Spain (41.1), Italy (44.6) and Greece (40.1) were reported to below the critical mark of 50; Ireland is the only exception (see Chart 6). The main conclusion of the factory sector reports is that growth is weak across major economies of the world – US, Europe, and Asia.

Source: http://fingfx.thomsonreuters.com/2011/10/03/07590605e8.htm

Q2 Private Sector Construction Spending Looks Promising

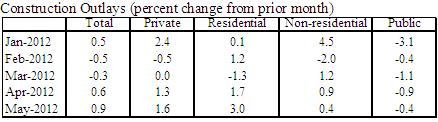

Overall construction spending rose 0.9% in May after a 0.6% increase in the prior month. The entire gain was due to a 1.6% jump in private sector construction outlays compared with a 0.4% drop in public sector construction spending. The 3.0% increase in residential construction spending during May is impressive, after a 1.7% increase in April. The April-May numbers point to strong growth in residential investment expenditures in the second quarter possibly stronger than the 20% annualized gain in the first quarter, based on data presented in the table below. Also, the April-May data of non-residential construction spending points to a positive contribution to second quarter GDP.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2012 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.