Gold Price Triple Bottom

Commodities / Gold and Silver 2012 Jul 01, 2012 - 11:13 AM GMTBy: Clive_Maund

The European Union is a creation of global elitists, the Bilderberg et al, in pursuit of their long-term goal of a world government. Whether this is a good thing or not depends in large part on whether politicians in positions of great power can be trusted to behave fairly and responsibly. In deciding if this is the case you have plenty of empirical evidence to assist you in making up your mind, based on their activities and antics of the past several years and their consequences for the global populace.

The European Union is a creation of global elitists, the Bilderberg et al, in pursuit of their long-term goal of a world government. Whether this is a good thing or not depends in large part on whether politicians in positions of great power can be trusted to behave fairly and responsibly. In deciding if this is the case you have plenty of empirical evidence to assist you in making up your mind, based on their activities and antics of the past several years and their consequences for the global populace.

The core problem of the European Union, that has led to the major crisis that it now faces is that it is, or has been up to now structurally dysfunctional. When the European Union was created the levels of integration and cooperation necessary to make it run smoothly were simply not possible because the citizens and electorates of the individual states within it refused to cede sufficient sovereignty to achieve this, and many politicians were similarly inclined - it would take a "back to the wall" steadily intensifying crisis such as we have seen over the past several years to make them yield. Here we should note that many politicians in Europe are as much in the dark as those they rule with regard to the master plan of the elites, and they have dug their heels in defending what they view as their national interest, a prime example being Mrs Merkel of Germany - but the situation had become so extreme that she and others like her have finally been forced to give significant ground.

The kind of crisis that we have witnessed in Greece over the past several years would be unthinkable in the United States, which is, in comparison, truly united. Imagine say Alabama or Kentucky going bankrupt - would the rest of the country just stand by and watch and do nothing to assist? - of course not. This is why Thursday night's agreements were such a watershed - they represent a giant stride towards true union in Europe which should prevent individual states being abandoned to their fate in the future.

Once you grasp what is written in the paragraph above, and the markets certainly did yesterday, you will also understand that the immediate fiscal crisis in Europe is set to ease substantially, as the Union is now committed to step in to support bond markets to keep interest rates under control. THAT is the reason markets rallied so strongly yesterday and why the rally looks set to continue. Could this have been anticipated before last Thursday? - on the basis of precedent probably not, as there had been something like 18 European summits preceding this latest one which achieved little or nothing. The COTs and sentiment, however, did show extreme levels of pessimism that should have set more alarm bells ringing. We were of the view that the summit would probably achieve little and that we would see one last plunge into a low that would promote drastic action. Such did not prove to be the case. What we have repeatedly referred to as the "discordant buffoons" in the recent past showed a rare "cordancy" on Thursday night -- perhaps simply because they to get the whole thing over with and get to bed. What about the fact that the debts and liabilities in Europe will turn out to be far in excess of the woefully inadequate €500bn war chest of the European Stability Mechanism? - that is a problem which they will attempt to solve by means the printing press, and when Europe gets printing in earnest, the US Fed is not going to be outdone. Now we come to the practical matter of how significant this reversal is. The short answer is very significant, as pressure will now come off the European bond markets - this is why the euro soared and the dollar tanked yesterday. With a major fundamental roadblock suddenly removed, the current COT structure in many markets and the extremely negative sentiment going into Thursday's momentous agreements have created the conditions for a really powerful rally.

Action is gold and silver was comparatively anemic given what happened to the dollar, and to other commodities like copper and oil, but this is not considered to be a reason to doubt their upside potential over the medium-term, because the COT structure, particularly for silver, and sentiment are at levels that typically precede a powerful rally, and with the crisis in Europe now set to ease following Thursday's summit breakthrough, markets at last have a green light to advance. This is not to say that there isn't plenty to worry about - there is, of course, but markets looks set to climb the wall of worry, the principal driver being the easing of pressure on European bond markets. The derivative problem won't go away - it will continue festering away in the background until one day it explodes and brings the whole system crashing down, but markets don't care about that, that's too far off.

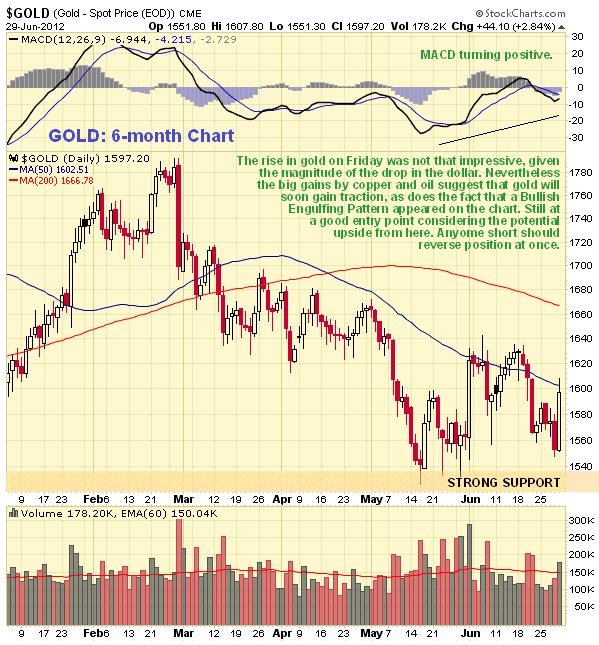

Now let's turn to the charts. On its 6-month chart we can see that while gold certainly had a good day on Friday, its gains were relatively modest given the huge rallies in copper and oil, and the big plunge in the dollar. What can we infer from this? - we can infer that it is going to gain traction and rise a lot more, that's what. The big rallies in copper and oil point to reflation, courtesy of forthcoming largesse from Europe as it tries to save itself.

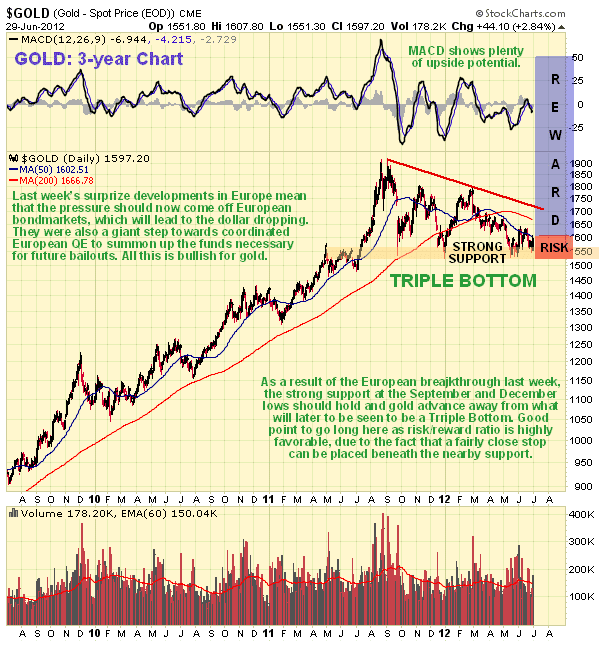

The 3-year chart for gold reveals that it now has the capacity to make great gains rising off the Triple Bottom of the lows of last September, December and the low of recent weeks. If last week's summit had produced little like its predecessors, then gold would have crashed its lows and plunged, but the summit ended with a "sea change" as Angela Merkel of Germany finally realized that if Germany didn't concede it would go down with the ship. Despite the significant gains on Friday, we can see that we now have an excellent risk/reward ratio for going long gold here, as stops can be set beneath the lows of the Triple Bottom and gold could make strong gains from here as Europe gets pumping.

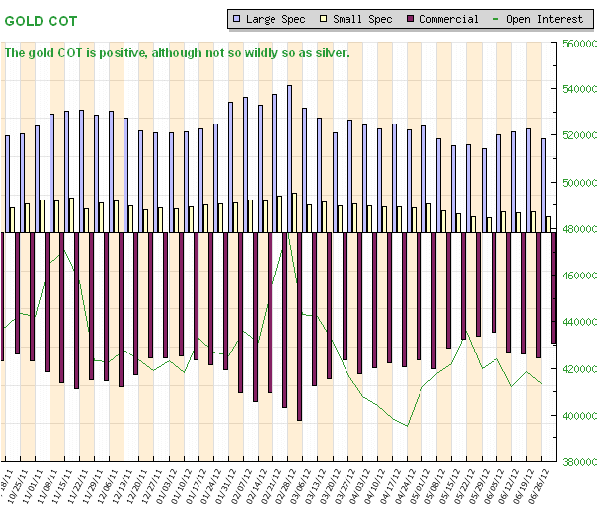

Gold's COT structure shown below is bullish, nowhere near as bullish as silver's, which is wildly bullish, but solidly bullish nonetheless.

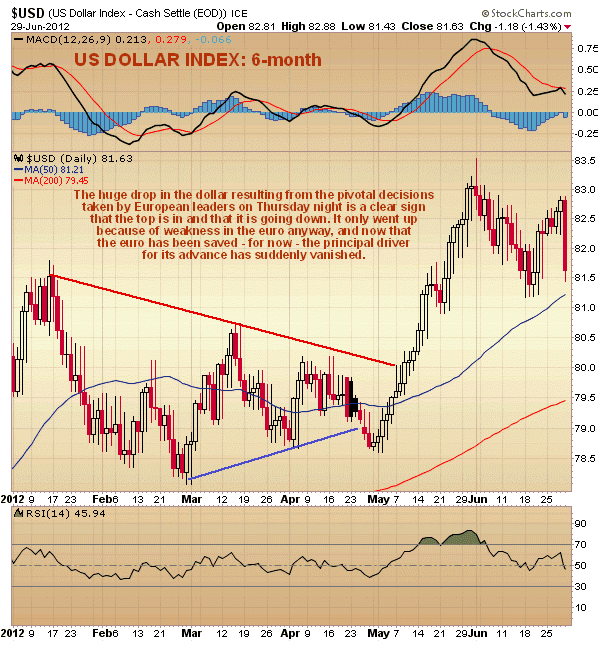

The dollar's plunge on Friday signaled that it is "game over" for this currency, which has been feasting on Europe's misfortunes for many months - it had only been going up because of the euro's plight anyway, and now that the euro has been "saved" it has lost its principal driver. The massive plunge after a weak rally to approach the early June highs that we can see on the 6-month chart for the dollar index shown below is a sign that it is reversing to the downside. We can expect it to continue lower and this will be a factor fuelling the rally in commodities and stocks. You might well ask "If Europe is clearing the way to do a massive Fed style QE, won't this undermine the euro? - of course it will, but this is a longer-term consideration, shorter-term it should rally having just been saved from oblivion, and we should remember anyway that the Fed is not going to stand by and let Europe take the "blue riband" for QE away from it.

By Clive Maund

CliveMaund.com

For billing & subscription questions: subscriptions@clivemaund.com

© 2012 Clive Maund - The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maunds opinions are his own, and are not a recommendation or an offer to buy or sell securities. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications.

Clive Maund Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.