The Record Breaking 1 Tonne Gold Bulllion Coin

Commodities / Gold and Silver 2012 Jun 28, 2012 - 04:15 AM GMTBy: GoldCore

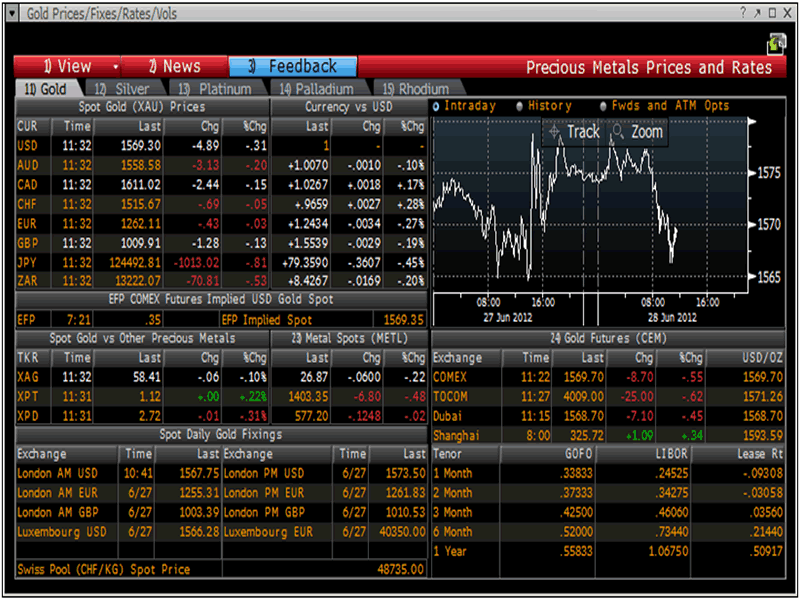

Today's AM fix was USD 1,567.75, EUR 1,261.47, and GBP 1,008.98 per ounce.

Today's AM fix was USD 1,567.75, EUR 1,261.47, and GBP 1,008.98 per ounce.

Yesterday’s AM fix was USD 1,567.50, EUR 1,255.31, and GBP 1,003.39 per ounce.

Silver is trading at $26.93/oz, €21.77/oz and £17.39/oz. Platinum is trading at $1,406.50/oz, palladium at $575.20/oz and rhodium at $1,190/oz.

Volatile trade yesterday saw gold surge nearly $20 after news that the ECB was considering entering the monetary twilight zone of NIRP or negative interest rate policies.

However, the gains were capped and prices quickly gave up those gains and gold dropped $16.00 or 0.99% and was last quoted in New York at $1,571.50/oz. Gold rose slightly in Asia but then fell soon after the European opening.

There was also chatter that the spike in gold may have been a reaction to a statement from the World Gold Council which said demand for gold in Asia is stronger than what the market is pricing in.

The market has been long under appreciating Asian demand.

Indian demand may be set to pick up again. Prithviraj Kothari, president of the Bombay Bullion Association, told Reuters in an interview this morning that gold imports could pick up in the second half of 2012.

Japan's exports of gold plunged to a 15-month low in May to 2.79 tonnes, down 67 percent from a year ago, as sales of gold bars and jewellery fell sharply and there was a steep fall in gold scrap sales by the public.

EU leaders remain divided as the meetings begin today in Brussels. The debt crisis is now in its third year since it began in Greece. The European Union summit will not produce a “magic” solution to the Eurozone’s deepening debt crisis. Indeed, there is the potential for serious disappointment which could lead to market volatility and increased safe haven demand for gold.

Gold coins sales at The Perth Mint have fallen in the past three months after the record breaking sales of recent months and as buyers await more clarity regarding the near term outlook for gold prices but staff at Australia's oldest producer of precious metal coins have reason to be happy.

The 2012 Australian Kangaroo One Tonne Gold Coin issued by The Perth Mint has been confirmed as the largest coin in the world by Guinness World Records and will be featured in the 2013 Guinness Book of World Records available in October.

It is also the world’s largest and heaviest gold bullion coin -made from 1 tonne of 99.99% pure gold.

Ed Harbuz, CEO of The Perth Mint, stands beside the massive

1 Tonne Australian Gold Kangaroo Coin

"We faced an incredible challenge to produce a coin of this scale, so this is a wonderful endorsement of the talent and expertise of those involved," said Ed Harbuz, Perth Mint Chief Executive Officer.

Cast from 99.99 percent pure gold extracted from Australian mines, the coin weighs a total of 1,012 kilograms and measures 80 centimeters wide and 13 centimeters deep. The coin was made earlier this year in the presence of experts from the fields of metal assaying, numismatics — or coin collecting — quality assurance, and scale calibration and weighing, who verified the specifications of the coin.

Key facts about Australia’s world beating gold coin:

• The coin is cast from 99.99% pure gold

• It weighs a whopping 1,012 kilograms

• It measures 80cm wide by 13cm deep

• And it’s official Australian legal tender!

Staff involved in the mammoth project, whose skills include designing, refining, assaying, casting, finishing and more, gathered together for this celebratory photo call on receipt of their official record certificate.

Perth Mint Staff and the 1 Tonne Australian Kangaroo Gold Bullion Coin

Australia's iconic national animal, "was a natural choice" for the giant coin as the marsupial has been a consistent feature of the Australian Kangaroo Gold Bullion Coin Series 1 kilo release for 25 years, Harbuz said.

The record-breaking coin's smaller and more affordable brethren have seen record sales in recent months as investors and savers internationally have bought the gold coin as a store of value.

While there has been a slight dip in sales recently, sales are expected to remain robust and even increase given the scale of the Eurozone debt crisis and risk of the debt crisis spreading to Japan, the UK and indeed the U.S.

Gold coin sales (bullion and collectible) from The Perth Mint totaled 32,094 ounces in May, down from 35,900 during the same month last year. April's sales fell to 18,915 ounces, their lowest since the 10,645 ounces recorded in August 2010. March sales hit 38,109 ounces, down 9.6 percent from the comparable month last year.

The record-breaking golden kangaroo coin is currently on display at The Perth Mint's Gold Exhibition but that doesn't necessarily mean it will remain a museum piece.

"The Perth Mint would consider selling it to an interested party at the right price," Ellis told CNBC. "This would include the spot price of the metal value, plus a significant premium for production. Terms would obviously need to be negotiated."

The coin is worth more than $51 million at current prices — not cheap but possibly a bargain for a store of value gold buyer concerned about currency debasement.

For those who cannot afford the $51 million, the Perth Mint 1 ounce gold coins and bars remain attractive and will reward the prudent buyer

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.