Financial Collapse End Game, Operation Twist Deception, Infinite QE

Interest-Rates / Global Debt Crisis 2012 Jun 27, 2012 - 12:13 PM GMTBy: Jim_Willie_CB

Many are the events, signals, and telltale clues of a real live actual systemic failure in progress. Until the last several months, such banter was dismissed by the soldiers in the financial arena. But lately, they cannot dismiss the onslaught of evidence, a veritable plethora of ugly symptoms of conditions gone terribly wrong and solutions at best gone awry and at worst never intended in the first place. My theory has been steady from the TARP Fund scandal and the Too Big To Fail mantra of deceit. The plan all along since the breakdown began in September 2008 has been to preserve power, to maintain intact the insolvent banks an operational crew of zombies, to aid the financial sector bound in Wall Street, to pay benign neglect to Main Street and businesses (expect for symbols like General Motors), to expand the propaganda of a fictional recovery, and to maintain the endless wars. The wars serve two purposes, to enable significant fraud from overcharged services, and to hold open the gateways for sizeable money laundering flows into the Wall Street banks, those hollow structures that closely resemble a coke addict with dark teeth, wretched bones, wasted organs, lost attention, and a listless gait. The Greek showcase is coming to a neighborhood near you in Western Europe and Great Britain, soon to feature debuts across North America. No, the United States is not immune from the horrors of ruin since its marquee billboards read Zero Percent. It only means the wrecking ball works from the inside out, serving as the central needle in the Black Hole. An outline of the End Game can be written. This article is not comprehensive by any means. But it serves as a decent posting on an outhouse wall. Consider the following as musings in observation of Uncle Sam on death row. They bear no logical flow, just random concepts.

Many are the events, signals, and telltale clues of a real live actual systemic failure in progress. Until the last several months, such banter was dismissed by the soldiers in the financial arena. But lately, they cannot dismiss the onslaught of evidence, a veritable plethora of ugly symptoms of conditions gone terribly wrong and solutions at best gone awry and at worst never intended in the first place. My theory has been steady from the TARP Fund scandal and the Too Big To Fail mantra of deceit. The plan all along since the breakdown began in September 2008 has been to preserve power, to maintain intact the insolvent banks an operational crew of zombies, to aid the financial sector bound in Wall Street, to pay benign neglect to Main Street and businesses (expect for symbols like General Motors), to expand the propaganda of a fictional recovery, and to maintain the endless wars. The wars serve two purposes, to enable significant fraud from overcharged services, and to hold open the gateways for sizeable money laundering flows into the Wall Street banks, those hollow structures that closely resemble a coke addict with dark teeth, wretched bones, wasted organs, lost attention, and a listless gait. The Greek showcase is coming to a neighborhood near you in Western Europe and Great Britain, soon to feature debuts across North America. No, the United States is not immune from the horrors of ruin since its marquee billboards read Zero Percent. It only means the wrecking ball works from the inside out, serving as the central needle in the Black Hole. An outline of the End Game can be written. This article is not comprehensive by any means. But it serves as a decent posting on an outhouse wall. Consider the following as musings in observation of Uncle Sam on death row. They bear no logical flow, just random concepts.

OPERATION TWIST IS Q.E.

Operation Twist cements ZIRP and closes the door on any Exit Strategy. Nothing exists in the twist of substance, a mere shift of the shell game movement. The most powerful effect of a maintained Zero Percent Interest Policy is that it ensures a systemic failure with capital destruction, rising costs, falling profit margins, and deterioration in the USEconomy. It guarantees growing federal deficits without any potential of resolution, and finally a USGovt debt default. Just one year ago, the travesty of political failure was in full view with the Super Committee charged with spending reduction. It folded like a cheap tent. Deficits have been written in stone. The nation has moved from a permanent housing decline and lost legitimate income (factory exodus to China) as principal cause for systemic failure, to a failure based upon capital decay and absent profitability. Absent legitimate income fostered rot from within. The USFed in its growing desperation (hardly infinite wisdom) has been attempting to control the rising cost structure by means of a steady concerted effort to render deep harm to final demand through economic damage. They will succeed, but cause a downward spiral that cannot escape the powerful clutches of capitalism gone into reverse. The central bank clowns will win a USTreasury Bond rally to bring about the final collapse all in a Black Hole. As the 10-year TNX yield zips below 1.5% and heads toward 1.0% in the future months, as the recession gallops along and enjoys recognition, the systemic failure will be more evident.

TRILLION$ AS POCKET CHANGE

From December 2011 to April 2012, the Dollar Swap Facility released $3.2 trillion for European bank aid. It accomplished nothing, since their banks are a field of Greek-like ruins still. The money went into the LTRO funds, the ill-planned knucklehead Draghi plan. The banks bought overpriced government bonds, lifted in value by the Euro Central Bank itself. The same banks are worse off than before the application of LTRO funds. What irony! Draghi has no credibility left. Harken back to 2009 when a similar Dollar Swap Facility released over $1 trillion to the same European banks. It solved nothing either. The tragedy is accentuated by the realization that central bank clowns learn nothing, attempt the same vacant solutions, only to repeat their errors at a later date. The public seems incapable to recall the past failures, holding out hope. Now we hear of a possible $2 trillion plan to recapitalize the European banking system. In Weimar terms, this is pocket change. Counting the US fixes, the London fixes, and the previous DSFacility, the total is closer to $6 trillion already wasted in a massive debasement series of whiffs. So another $2 trillion is pissing in the wind of Weimar flatulence, the stench to be noted by next year.

When the paper mache artisans start talking about a total of $10 to $12 trillion for Western Europe, the United Kingdom, and the United States combined, then they will be seriously planning a banking system recapitalization. They prefer the futile incremental approach, with the proviso of not liquidating the big banks. The hilarious factor is that even $10 trillion would not work, but it would indeed buy another couple years, maybe three years. So if an alcoholic has the Delirious Tremens, the consensus stupidity calls for feeding him a higher proof Jack Daniels whisky and from a vat for intravenous application, which will revive him, when a mere few liters would not. It is utterly amazing that Bernanke and Draghi are given any respect at all. This is utterly absurd, since the wrong-footed solution is going to be simply higher volume of what does not succeed in reviving the system. WHEN THEY START TALKING ABOUT BIG BANK LIQUIDATION AND A NEW GOLD-BACKED MONETARY SYSTEM, THEN EXPECT SOME TRACTION. But such a plan would involve plowing the system under and removing the bankers from power. Until then, plan for a bigger killing field. The great tragedy is that the killing field is the entire Western monetary system, attached at the hip to the Western Economic system. Witness the gradual collapse.

BASEL RULES LOOKS TO GOLD

If the Basel castle dwellers decide to make Gold a Tier-1 asset, banking capital adequacy ratios would be adjusted by a dictated order. In response to the global banking crisis, based upon paper foundation turned toxic, the Basel rule changes have aggravated the banking woes. As rules are tightened according to assets held and their type, the move could potentially be favorable toward Gold. New encouraging rules that declare Gold to be a reserve asset could result in between 1700 and 2000 tons in purchase. Think of it as bank ballast in a storm of toxic seas. The issue is the so-called Basel III rules. The ultimate central bank is on the verge of declaring Gold to be a Tier-1 asset for commercial banks with 100% weighting. Curiously, it is currently a Tier-3 category with just a 50% risk weighting. Like gold is only half money, how absurd!! It took a 50% downgrade of sovereign bonds to bring about such progress. They are set to increase the amount of capital banks also must set aside, a double win potentially. The incentive away from Gold toward risky assets such as stock, currency, and debt-related assets resulted in disasters. A category upgrade in Gold would effectively drive up its value relative to other competitive qualifying assets. By elevating Gold to a bank reserve asset, stability would enter the equation, since the yellow stable metal moves inversely to the risky paper assets that have crumbled. Gold is ideal as it bears no credit risk, and has no counter-party risk, only theft risk (due to desirability) and shell game risk (from certificate games).

An upgrade to Tier-1 asset would make a triple win: 1) An endorsement of wealth preservation and store of value from the syndicate penthouse, 2) inducement for significant gold purchases by major financial institutions, and 3) reappraisal of gold's value with respect to other Tier-1 capital such as quality sovereign debt. Under the new rules, Gold could find a significantly larger proportion of a reserve pool pushed into sudden growth. The Bank For Intl Settlements might turn chicken, as time will tell. The calculus is appealing. If 2% of total current Tier-1 capital held by commercial banks globally were to be converted into gold, a suggested 2% of the $4,276 billion would amount to $85 billion in gold purchases. That comes to the neighborhood of 1700 tons of gold bullion. Hence banks would be encouraged to hold gold with similar motives to central banks, which hold 16% of reserves in gold. One might wonder if the BIS is tightening slowly in order to swing the wrecking ball left and right, with more technocrats in wait to fill prime minister posts like Monti in Italy. But politics is not an area for the Jackass to wander.

EFFECT OF ABSENT GOLD ON BIG U.S. BANKS

A hidden massive sinkhole effect like seen many times in Florida could be close at hand. The financial press reports absolutely nothing on the tremendous loss of gold bullion in Western banks since February. Heck, the gold community seems largely unaware also that around 6000 metric tons of gold bullion have departed Western banks (mostly London) in recent months. The effect will be felt somewhere and soon, by sheer laws of nature. The big US banks might have only one asset of undeniable value, Gold. As they lose that asset during the process by which Eastern entities strip gold via forced demands during margin calls in off-exchange transactions with extreme pressure applied, some big US banks are being pushed closer to a death event. A string of bank failures could be nearby. These banks are far more hollow as structures than perceived. Continued television advertisements, sports sponsorship, and billboard lights do not demonstrate solvency, only zombie activity that lacks vigor. Begin the death watch for Morgan Stanley, which has endured the debt downward. As is the usual mantra by shamans, it was not as bad as expected. All hail.

To prevent the sinkholes from causing the next damage, in a hidden desperate maneuver, many cartel banks will attempt to move gold bullion from private executive accounts to save themselves. They will surely continue the illicit practice of raiding allocated accounts, replacing them with gold paper certificates. They will complete the trifecta by draining the SPDR Gold Trust, removing inventory by privileged shorting practices. The entire migration of gold creates an extreme risk for the Western banks, the true asset evacuated. They have many assets on their balance sheets, mostly toxic paper from USTreasury Bonds, Euro sovereign bonds, mortgage bonds, mortgage loan assets, corporate bonds, commercial paper, and commitments tied to derivatives. The great majority of such assets on balance sheets is toxic paper, in a fast-paced process of imploding in value. Those balance sheets also used to contain gold bullion in high volume. That is no longer the case, the bullion having been leased & sold in past years and raided in a massive systematic scale in recent months. The bank balance sheets have been thus hollowed out, leaving their structures to stand on toxic paper, and much less on sturdy inert gold metal. Recall that insolvency plus illiquidity forces bank failure. The many bank runs are like a grand final hollowing process that affects the entire banking sector in lost reserves, large and medium sized banks alike. The absent reserves remove liquidity, amplified by the fractional system.

The big US banks are left vulnerable to failures. The event is coming. Continue the death watch on Morgan Stanley despite their continued walking status. Zombies walk too, but they look funny and have ugly skin with many ghastly blemishes. The extreme risk for Morgan Stanley is two-fold, never having gone away. 1) They are a primary executor of the high-risk Interest Rate Swaps that defend the USTBond artificially low yields. 2) They have significant European sovereign bond exposure. They extended a huge private USDollar swap to big European banks until the USFed stepped in a few months ago.

STRANGE EXTREME STORIES AS WARNING WIND

Numerous stories are circulating of vast cyber bank thefts. The locations appear initially to be European. The volume is reported as EUR 2 billion so far. The authorities will not discuss it in the open. The bank glitches might be more about kiting of funds at best, or cover for internal raids of accounts at worst. The much juicier story pertains to 600 highly paid accountants on a Wall Street assignment. It is too large to be kept a secret, since it is draining the sector of its accounting staff for hire. The rumors are as thick as black clouds. They are busily attempting to determine the financial status of a large Wall Street bank loaded with a mountain of complex derivative contracts. The toxicity is openly mentioned. No secrets can be maintained. It is surely Morgan Stanley. The next Lehman Brothers event is just around the corner. One is reminded of an incident several years ago, where Ashanti Gold had to hire a battalion of financial accountant experts in order to assess the value of their crippled balance sheet overloaded by complex gold forward sale derivatives. In other words, they needed to conduct a formal study to determine if they were indeed dead. The same is happening with Morgan Stanley, dragged down by a mountain of financial derivatives. The better question is who ordered the accounting to be done, to determine if a Wall Street firm was dead? And why?

CHINA RECASTS GOLD BARS

China is well along an ambitious plan to recast large gold bars into smaller 1-kg bars on a massive scale. A major event is brewing that will disrupt global trade and assuredly the global banking system. The big gold recast project points to the Chinese preparing for a new system of trade settlement. In the process they must be constructing a foundation for a possible new monetary system based in gold that supports the trade payments. Initally used for trade, it will later be used in banking. The USTBond will be shucked aside. Regard the Chinese project as preliminary to a collapse in the debt-based USDollar system. The Chinese are removing thousands of metric tons of gold bars from London, New York, and Switzerland. They are recasting the bars, no longer to bear weights in ounces, but rather kilograms. The larger Good Delivery bars are being reduced into 1-kg bars and stored in China. It is not clear whether the recast project is being done entirely in China, as some indication has come that Swiss foundries might be involved, since they have so much experience and capacity.

The story of recasting in London is confirmed by my best source. It seems patently clear that the Chinese are preparing for a new system for trade settlement system, to coincide with a new banking reserve system. They might make a sizeable portion of the new 1-kg bars available for retail investors and wealthy individuals in China. They will discard the toxic USTreasury Bond basis for banking. Two messages are unmistakable. A grand flipped bird (aka FU) is being given to the Western and British system of pounds and ounces and other queer ton measures. But perhaps something bigger is involved. Maybe a formal investigation of tungsten laced bars is being conducted in hidden manner. In early 2010, the issue of tungsten salted bars became a big story, obviously kept hush hush. The trails emanated from Fort Knox, as in pilferage of its inventory. The pathways extended through Panama in other routes known to the contraband crowd, that perverse trade of white powder known on the street as Horse & Blow, or Boy & Girl.

MONEY & DEBT ARE FAILING

The rabid rapid creation of new money and new debt are failing in the system finally. The perpetual Quantitative Easing has arrived, with failed traction. It is failing just like perpetual 0% and the slipped stimulus, which has no traction since the USEconomy lacks a critical mass of industry and factories, those value added centers forfeited eagerly to Asia for three decades. Diminishing returns on bond yield support dictates that bond monetization must accelerate more quickly. The effects are turning nil on short maturity bonds, but still minor on effect with long maturity bonds. The concept perversely goes parallel to negative returns on Gross Domestic Product from new debt application to the system. Not only is debt failing, but debt monetization is failing. Slippage is broad and becoming worse. Quantitative Easing like the ZIRP are tools to apply sparingly since they are toxic tools. The 0% policy wrecks capital broadly and alters all pricing models. The bond monetization discourages creditors, inducing them to leave the room. As both are needed in increasing exponential quantities, the paper shamans cannot keep pace. They lose the battle from inability to apply ever growing magnitude, while attempting to conceal their high volume activity. In time, like now, traction is lost and benefits vanish. The USFed is stuck, and cannot stop expanding the money supply to cover bond sales. The USFed intervention in the form of bond monetization can never stop, period. Arguments on the other side as illusory, meaningless, and distracting. To claim that the size of their balance sheet is irrelevant, whether 10 billion or $10 trillion, is truly contaminated thinking. However, almost all teachings and dogma from the central bank has been toxic since 2007, founded in pure heresy, acclaimed by all authorities.

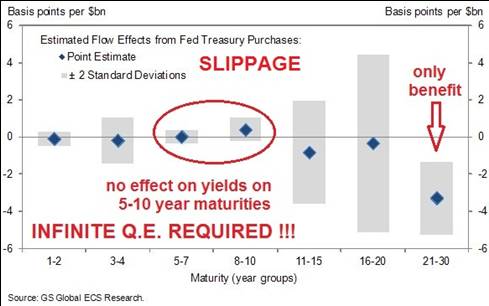

Consider a Goldman Sachs analysis of the benefits of Quantitative Easing along the yield curve. An analysis was done to identify the effect at individual maturities, using a flexible approach to protect from other marginal effects. See the graphic for the results, which should send shivers to readers. An insignificant effect is seen on short and intermediate maturities, like up to 20 years, but negative and statistically significant estimates at the ultra-long end of the curve with 21-30 years maturity. Flow effect from bond monetization is felt only on the ultra-long end. The results suggest that a $1 billion purchase at the ultra-long end of the curve tends to lower bond yield by 3.3 basis points at that part of the curve. Robustness checks resulted in similar results with a simple split of 1-10 year maturities and 11-30 year maturities in two test groups. Another check was done that removed the 1-3 year maturities since so bound by FedFunds control and guidance language. The results were unchanged.

OPERATION TWIST DECEPTION

An asterisk is required for the analysis. Results are somewhat confounded (mixed, confused) with stock market shifts and European crisis developments. Lastly, do not be fooled by arguments that QE has targeted the long maturities in Operation Twist, scheduled to phase out at end June. The QE program never ended, as it went global. The QE to Infinity has been ON for over a year. It affects all bond maturities and does so month in and month out, even if only to provide replacement demand. The twist story painted a phony billboard, as usual. The real story is that Operation Twist was designed to help the Asians diversify in risk decisions on their massive portfolios. The Chinese and Japanese wanted to shift their long-dated USTBonds into shorter maturities. Also, a solid argument can be made that Operation Twist was designed to buy ALL of all auctioned 30-year USTreasurys ever issued, from inception. Cute trick! A review of the volume for bond buys and past bonds issued bears this out, as the figures are almost exact. Prior to the Oliver Twist fast hand chicanery, the invisible hand was buying most of them in a visible manner anyway. The program merely made the task official. The actions have turned more bold, with official bond purchases done by the USFed immediately before auctions on the same day. That reeks of pure desperation.

USDOLLAR BACKWARDATION

A fascinating but challenging concept has been put forth. A USDollar backwardation might soon show itself. It would precede and preview a violent removal of the USDollar as global reserve currency. Contract commitments might be avoided and shunned, in favor of hard cash. Demand for the physical paper bills is likely to reach acute levels, as the USDollar approaches the day of actually losing its privileged global reserve currency status. That privilege has been abused in historically unprecedented manner, with a climax of bond fraud, central bank hidden loan grants, a financed endless war, even construction of underground cities (see Virginia, Denver).

Keith Weiner is senior advisor at the Gold Standard Institute. He anticipates an important and highly disruptive split between physical USDollars (paper) and electronic USDollars (computer or contract), a very plausible development. His opinion has merit. As people begin to panic and exhibit desperation, they will attempt to cope with the enormity of a collapse. At first, sellers of real goods may accept electronic credit money, but demand a higher price in compensation for the inherent US$ risk. An unusual price spread on the electronic USDollar might then widen, with the bid from real goods falling. At the same time, a fast growing demand for the real paper might cause the bid on the paper USDollar to rise. Refer to paper currency folded into wallets. Demand should grow on an unlimited basis as the crisis peaks, and the recognition of the US$ losing its prized global supremacy is widely known. People might continue accepting paper USDollars out of longstanding habit. An unstable situation will eventually lead to collapse. Unlike Gold, the paper USDollar has no value other than the promises, most of which have been broken with protected impunity. Weiner dubbed the concept with differentials building with the name USDollar Backwardation. The concept is well understood in the metals world, but has never been extended to the currency world. It will as the tangible paper is demanded out of growing distrust. Contracts like savings accounts in banks will do vanishing act.

LTRO: DRAGHI STILLBORN BABY

The story not told adequately is the extreme failure of the LongTerm Refinance Operation installed by Mario Draghi as his first act and deed at the Euro Central Bank. He has in the process lost all credibility before his first year of tenure is over. The Southern European sovereign bonds did not take well to the LTRO solution at all. It caused an immediate vomiting episode that continues to this day. The solution wrecked the banks further, applying a supposedly better quality elixir of fiat paper bonds to replace a dismissed toxic bond. The Draghi solution of LTRO funding was a stillborn baby. The Spanish Govt Bond yield is stuck at alert levels. The Italian Govt Bond is fast approaching the panic levels, while experts attempt to explain that Italy is in much better condition. The failure of bond auctions in Rome will put aside such silly notions. The bond yield in Spain will remain near 7% to keep the pressure on. The bond yield in Italy will push past 6% to apply renewed pressure. Nothing changed, nothing fixed, and worse, no real attempt to remedy or reform. As long as big bank liquidation is avoided, the supposed solutions are all empty cans of hope and heretic games.

Clearly to anybody with a good solid mental pulse, Italy is next on the big bailout trail. My German banker source assured me back in February that it was the failing prospect of Italy, and its totally unmanageable volume of debt, that led the German bankers to obstruct all additional aid to Southern Europe. Italy is next, and even the Austrian finance minister Maria Fekter admitted as such. Her words angered Monti in Italy, a confirmation of their validity. The stakes in the European debt crisis are rising fast. Italy is the EuroZone's third largest economy. Reality bites, as Europe is far from ending its credit crisis turmoil.

BANK RUNS SPREAD, NOT YET LIKE WILDFIRE

Europeans are seeing scattered and growing bank runs, in at least four nations. The United States and London have not seeing anything similar. The bank run phenomenon has hit Great Britain though, in their colonial bastion of Northern Ireland. The three identified locations of bank runs, complete with anecdotal evidence, can be delineated. It includes Bankia in Spain, which is a well-publicized story of halted withdrawals, followed by a nationalization plan, then an absurd display of honesty. The bank revised the full 2011 fiscal year to overturn a small profit, and announced instead a gargantuan loss in the $billions. One should suspect all big Spanish bank balance sheets as a shelf of dishonest accounting, hiding their grotesque insolvency and wreckage, with deep rot in the cupboards. Banks in Central America shine by comparison.

Reports circulated a couple weeks ago of blocked withdrawals from Banque Postale in France. Online bank wire transfers were completely halted. The Hat Trick Letter reported in May that high wealth accounts had been vacating Paris in search of Scandinavian safer grounds. The run has continued. Other reports have come that BNI depositors in Italy were told of blocked withdrawals. The bank went bust, without any decency to give any warning to its own clients. Instead it cut off its depositors from accessing their money. The Bank of Italy (cental bank) authorized the suspension of payments by Bank Network Investments without communicating anything to the depositors. They are mere pawns in the process, whose interests are secondary to supplying banks. The Bank of Italy extended receivership of the bank. Compulsory clean-up exercises followed. In addition to BNI, depositors of Banca MB were also affected.

Bank runs have finally begun in Spain, Italy, and Greece in earnest. The savings accounts are being depleted within a broad vanishing act. Argentina is the lesson few learn. The latest is a report that NatWest within the RBS Group in the UK has suffered computer meltdown. Millions of customers had been unable to move or withdraw money from their accounts. A widening suspicion has come that the supposed technical glitch was instead a disguised kiting scheme designed to save the big bank conglomerate million$ in delays while clients were denied access to their money. It is theft by another name. The Ulster and Belfast bank interruptions blocked over 100 thousand account holders from access in Northern Ireland.

GREEK FLASH POINT FUSE

The Greek debt default is inevitable. It lies somewhere between tragic and funny to watch the futile extraordinary measures to stave off the day when big European (and London) banks must suffer their losses. The tragic comedy continues to turn pages. The Germans will not fund anything more, period. If another bailout is fashioned, it will be a pure shell paper game concocted in Brussels. When the inevitable Greek default comes, it will be like a Lehman Brothers crash times ten. A default is best for the Greek nation, unless they prefer to see the entire national wealth shipped to foreign lands. A default is a dreaded event for the bankers, naturally. So they spin the story about popular benefit, stated in pure backwards form. The extreme risk is being recognized for its contagion across borders, a process begun. To think that Greece would topple the larger nations of Southern Europe was a laughable concept two years ago, but that was the Jackass forecast clearly stated without hesitation, only early.

Companies must be cautious not to enter into binding contracts, thereby aggravating the recession in Greece. If not the poison pill of austerity to satisfy bailout demands, then caution on contracts will send the nation into a halt. The government deficits recorded in Athens are making the history books. And a strange footnote, businesses are springing up in Bulgaria across the border, owned by Greek interests, simply to avoid the toxic Euro currency. A smooth transition with a Greek Govt debt default would cause a 20% to 25% devaluation in assets in Greece, from bank accounts to home values to business value. That level of downgrade is what the new Drachma would require upon conversion from Euros. A disorderly transition could result in a 50% devaluation. Expect disorder. Thus the motive for capital flight, bank runs, and smuggling cash across borders. No officials are pursuing solutions in the best interest of the citizens. The other larger PIGS nations are not strong. France is an unrecognized PIGS nation. It is a PIGS dancer falsely posing in Teutonic clothing. It has been acting like a strong German banking resource, in a pretender’s role. By extending so deeply in PIGS loans, it became a PIGS nation.

DEBT CONTRADICTED AS WEALTH

The Western monetary system is built upon debt. That debt is crumbling, the process having begun with mortgage bonds, and extended to sovereign bonds. Recall the nitwit USFed Chairman Bernanke’s words in 2007, that the bond contagion was contained. It was not, and it spread to an absolute bond fiasco exactly as the Jackass forecasted. Debt is not wealth. The wealth of Western nations is evaporating. The illusion easily promotes a fantasy. Recall the 1980 decade where access to credit was perversely considered wealth. It ended in ruin and tears and bad health. The United States is on the verge of being plowed under, just like Greece, just like Spain. The dominos are lined up to fall, including Italy and England.

The industrialized nations are the primary abusers of debt, in order to sustain their standard of living even as they have discarded or forfeited their industrial base. No need to work, just invest and speculate, all clean industry. It is no coincidence that Germany remains wealthy, since it made a concerted effort not to lose its industry to Asia. Important deals were struck in the 1990 and 2000 decades, to preserve jobs, to cut pay, and to refuse outsourcing and offshoring. The United States embraced both practices, and has suffered a systemic failure as a result. The final chapter is playing out. The financial markets perversely treat debt as an asset, trading it actively in many forms, like sovereign bonds, corporate bonds, mortgage bonds, and municipal bonds. Now enter LTRO bonds, more toxic junk paper. The process of downgrading the bond paper is well along, not yet having hit climax. The home foreclosure chapter will be followed by a sovereign debt default chapter, complete with numerous debt restructure events. It will play out in a series of falling dominos.

The climax will be the fall of the House of Morgan, as JPMorgan fails and the USGovt debts default. Many regarded the concepts as unthinkable in 2008. Not anymore. The JPMorgan fortress of USTBonds and Interest Rate Swap supporting structure will surely topple, as the Credit Default Swap contract shop floor erodes and disintegrates, as the sovereign debt tied to it crumbles. The JPMorgan episode will bring down the house of cards, with the Interest Rate Swap machinery caving in. The wreckage process started with the weakest nations in Greece, Portugal, and Ireland. It will end in France, London, and the United States.

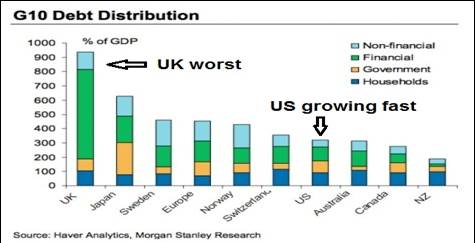

The advanced nations carry between three and ten times as much total debt as they have economic activity, as measured by Gross Domestic Product. The worst offender is the United Kingdom, whose debt is about 9.5 times its annual economic activity. With a string of bank welfare programs and endless empty economic stimulus (little more than reshuffling taxes and extending doles), the UK piles more debt upon debt without a remote hint of remedy and solution. The United States is piling up debt at an extremely rapid rate, as is Europe. Notice the Japanese debt at over six times GDP after two decades of Quantitative Easing and endless stimulus. The cost of 0% policy is heavy but hidden. The pervasive systemic problem is founded in the misconception that debt is wealth. Debt can be used as collateral. Debt is securitized into bonds that are avidly traded on exchanges as items of value. With such transfer of debt to securities, the cancer is spread from the banking industry under its regulatory oversight. To support debt valuations, and to prevent massive writedowns during the global financial crisis in its fourth year, the central banks of the world have been willing to swap out bad debt for good money. The counter-party risks have been overlooked and shoved under the carpet. As conversion of debt to hard assets continues, with a gold wave included, the asset downgrade will be conducted until its conclusion.

GOLD, THE LAST ASSET STANDING

In no way can the current ambushes and nasty schemes conclude quickly within the Gold market. The desperation of the gold cartel and their partner big bankers is visible. The naked shorting of Gold & Silver is done more openly. Their oversized positions cannot stand simple scrutiny as being hedges. The timing of attacks is clear, to coincide with vast expansions of the money supply or USFed public appearances with speeches made. The imbeciles that cry outward about Deflation are pathetic, as they fail to comprehend much of any of the formidable factors at work. They observe but one table, while at least seven are bustling with movement. The time honored correlation between the Gold price and the money supply is being strained, much like the USTBond tower and its supporting Interest Rate Swap buttresses. The game is futile. The bankers will play it to the end. They will soon be forced to play without much of any gold in their arsenals. Not until the Western banking and bond system is fully wrecked will the new Eastern Coalition system of trade settlement be put into place with trumpets blasting to herald arrival. The Eastern architects do not want the blame of ruining the Western fiat paper system. Until that day, the Gold price will be subjected to openly criminal activity, fully permitted illegal steps to keep the game going, and nothing but lipservice to maintain the rule of law. Some powerful events are coming, which will provide such incredible disruption, that they will make history. Do not expect justice to handle the criminals. Expect the new gold-based system to sweep them aside. They will vanish with a dragon’s breath. When the new day dawns, the Gold price will be multiples higher, as will the Silver price. A grand divergence between the paper Gold price and the physical Gold price is happening exactly now, with great forces at work to pull them apart. The events in between contain the mystery and intrigue and confusion. A day will come before long when the paper discovery Gold price will not be reported at all, because their market will contain no gold, as in zero gold!

THE HAT TRICK LETTER PROFITS IN THE CURRENT CRISIS.

From subscribers and readers:

At least 30 recently on correct forecasts regarding the bailout parade, numerous nationalization deals such as for Fannie Mae and the grand Mortgage Rescue.

"In my 40 plus years of business experience that includes stints in public and private companies as well as entrepreneurial ventures, I have read numerous newsletters in an effort to stay abreast of a rapidly changing world. In my opinion, you seem to be tying the pieces together better than any other source."

(BobT in Maine)

"Your monthly reports are at the top of my list for importance, nothing else coming close. You are the one resource I can NOT do without! You have helped me and countless others to successfully navigate the most treacherous times one can possibly imagine. Making life altering decisions during tough times means you must have all the information available with direct bearing on the decision. Jim Willie gives you ALL the needed information, a highly critical difference. You cant afford to be wrong in today's world."

(BrentT in North Carolina)

"You have warned over and over since Fall of 2009 that Europe would come apart and it sure looks like exactly that is happening. You have warned continually about the COMEX and now the entire CME seems to be unraveling. You must receive a lot of criticism regarding your analysis, trashing the man, without debate. Your work is appreciated. I do not care how politically incorrect or how impolite your style is. What is happening to our economy and financial system is neither politically correct or polite."

(DanC in Washington)

"The best money I spend. Your service is the biggest bang for the buck."

(DaveJ in Michigan)

by Jim Willie CB

Editor of the “HAT TRICK LETTER”

Home: Golden Jackass website

Subscribe: Hat Trick Letter

Use the above link to subscribe to the paid research reports, which include coverage of several smallcap companies positioned to rise during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by compromised central bankers and inept economic advisors, whose interference has irreversibly altered and damaged the world financial system, urgently pushed after the removed anchor of money to gold. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy.

Jim Willie CB is a statistical analyst in marketing research and retail forecasting. He holds a PhD in Statistics. His career has stretched over 25 years. He aspires to thrive in the financial editor world, unencumbered by the limitations of economic credentials. Visit his free website to find articles from topflight authors at www.GoldenJackass.com . For personal questions about subscriptions, contact him at JimWillieCB@aol.com

Jim Willie CB Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

B.

01 Jul 12, 16:14 |

$12 trillion

$12 trillion to recapitalize European and American Banks? How to you come up with this number? On what do you base it? |