Forget the PIIGS, The Whole of Europe Is Insolvent

Politics / Eurozone Debt Crisis Jun 26, 2012 - 03:16 AM GMTBy: Graham_Summers

Europe is heading into a full-scale disaster.

Europe is heading into a full-scale disaster.

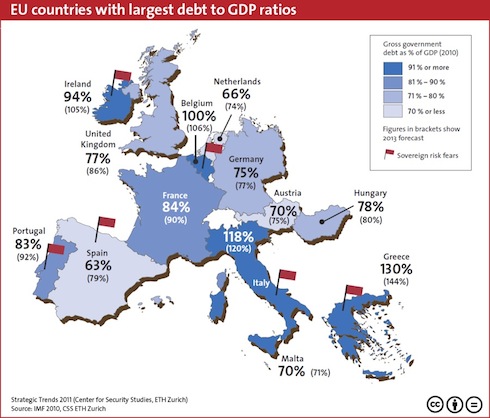

You see, the debt problems in Europe are not simply related to Greece. They are SYSTEMIC. The below chart shows the official Debt to GDP ratios for the major players in Europe.

As you can see, even the more “solvent” countries like Germany and France are sporting Debt to GDP ratios of 75% and 84% respectively.

These numbers, while bad, don’t account for unfunded liabilities. And Europe is nothing if not steeped in unfunded liabilities.

Let’s consider Germany. According to Axel Weber, former head of Germany’s Central Bank, Germany is in fact sitting on a REAL Debt to GDP ratio of over 200%. This is Germany… with unfunded liabilities equal to over TWO times its current GDP.

To put the insanity of this into perspective, Weber’s claim is akin to Ben Bernanke going on national TV and saying that the US actually owes more than $30 trillion and that the debt ceiling is in fact a joke.

What’s truly frightening about this is that Weber is most likely being conservative here. Jagadeesh Gokhale of the Cato Institute published a paper for EuroStat in 2009 claiming Germany’s unfunded liabilities are in fact closer to 418%.

And of course, Germany has yet to recapitalize its banks.

Indeed, by the German Institute for Economic Research’s OWN admission, German banks need 147 billion Euros’ worth of new capital.

To put this number into perspective TOTAL EQUITY at the top three banks in Germany is less than 100 billion Euros.

And this is GERMANY we’re talking about: the supposed rock-solid balance sheet of Europe. How bad do you think the other, less fiscally conservative EU members are?

Think BAD. As in systemic collapse bad.

Indeed, let’s consider TOTAL debt sitting on Financial Institutions’ balance sheets in Europe. The below chart shows this number for financial institutions in several major EU members relative to their country’s 2010 GDP.

| Country | Financial Institutions’ Gross Debt as a % of GDP |

| Portugal | 65% |

| Italy | 99% |

| Ireland | 664% |

| Greece | 21% |

| Spain | 113% |

| UK | 735% |

| France | 148% |

| Germany | 95% |

| EU as a whole | 148% |

Source: IMF

As you can see, financial institutions in Germany, France, Italy, Spain, the UK, and Ireland are all ticking time bombs.

Indeed, taken as a whole, European financial institutions have more debt than Europe’s ENTIRE GDP. Let’s compare the situation there to that in the US banking system.

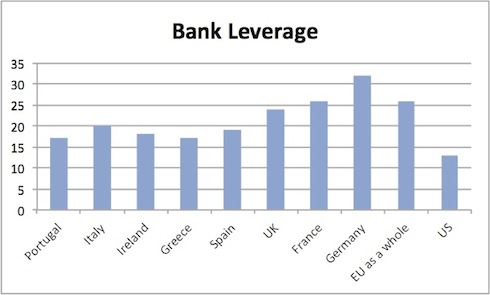

Taken as a whole, the US banking system is leveraged at 13 to 1. Leverage levels at the TBTFs are much much higher… but when you add them in with the 8,100+ other banks in the US, total US bank leverage is 13 to 1.

The European banking system as a whole is leveraged at nearly twice this at over 26 to 1. That’s the ENTIRE European Banking system leveraged at near Lehman levels (Lehman was 30 to 1 when it collapsed).

To put this into perspective, with a leverage level of 26 to 1, you only need a 4% drop in asset prices to wipe out ALL capital. What are the odds that European bank assets fall 4% in value in the near future as the PIIGS continue to collapse?

These leverage levels alone position Europe for a full-scale banking collapse on par with Lehman Brothers. Again, I’m talking about Europe’s ENTIRE banking system collapsing.

This is not a question of “if,” it is a question of “when.” And it will very likely happen before the end of 2012.

The reason that this is guaranteed to happen before the end of 2012 is that a HUGE percentage of European bank debt needs to be rolled over by the end of 2012.

I trust at this point you are beginning to see why any expansion of the EFSF or additional European bailouts is ultimately pointless: Europe’s ENTIRE BANKING SYSTEM as a whole is insolvent. Even a 4-10% drop in asset prices would wipe out ALL equity at many European banks.

On that note I believe we have at most a month or two and possibly even as little as a few weeks to prepare for the next round of the EU Crisis.

Those investors looking for actionable investment ideas could also consider our Private Wealth Advisory newsletter: a bi-weekly detailed investment advisory service that distills the most important geopolitical, economic, and financial developments in the markets into concise investment strategies for individual investors.

To learn more about Private Wealth Advisory… and how it can help you navigate the markets successfully…Graham Summers

Chief Market Strategist

Good Investing!

PS. If you’re getting worried about the future of the stock market and have yet to take steps to prepare for the Second Round of the Financial Crisis… I highly suggest you download my FREE Special Report specifying exactly how to prepare for what’s to come.

I call it The Financial Crisis “Round Two” Survival Kit. And its 17 pages contain a wealth of information about portfolio protection, which investments to own and how to take out Catastrophe Insurance on the stock market (this “insurance” paid out triple digit gains in the Autumn of 2008).

Again, this is all 100% FREE. To pick up your copy today, got to http://www.gainspainscapital.com and click on FREE REPORTS.

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2012 Copyright Graham Summers - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.