Gold Parabolic Rally on Monthly Chart Flashes Warning to Gold Bulls!

Commodities / Gold & Silver Jan 29, 2008 - 08:40 PM GMTBy: Ned_W_Schmidt

Pleased to announce that votes are in. Ineptness Award for first century of Federal Reserve's existence goes to Bailout Bernanke and his Buckaroos. Last week's interest rate cut cinched it for them. Did the FOMC cut U.S. interest rates because of falling global financial markets or was it pure politics? Reports suggest that FOMC was not even aware of Societe Generale's selling of portfolio problems.

Pleased to announce that votes are in. Ineptness Award for first century of Federal Reserve's existence goes to Bailout Bernanke and his Buckaroos. Last week's interest rate cut cinched it for them. Did the FOMC cut U.S. interest rates because of falling global financial markets or was it pure politics? Reports suggest that FOMC was not even aware of Societe Generale's selling of portfolio problems.

Was the fix in, as they say? To answer these questions, think about the day on which they acted. For you see, Tuesday, day of the rate cut, was third Tuesday of January. On third Tuesday in January 2009, exactly a year away, U.S. will inaugurate a new President. With Congress involved in massive vote buying scheme, sending Treasury checks out in election year, Bernanke's Buckaroos had to help out. Think they want to lose their jobs next year? This rate cut was pure politics, the FOMC had received their marching orders previously. No wonder price of Gold has moved to a record high.

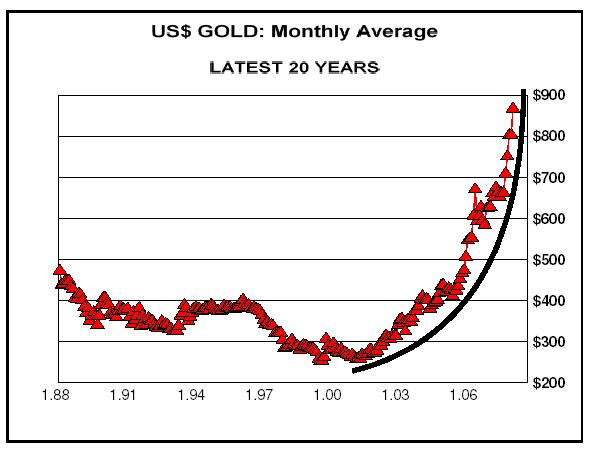

Cannot be a person left in world that does not now understand the need for Gold in a portfolio when politics might be determining U.S. monetary policy. Long-term target of US$1,466 will likely continue to rise given these Federal Reserve policies. While government are source of long-term bullishness, we can not ignore market of today. This week's chart is of monthly average price of $Gold.

Parabolic nature of the recent rise is suggested by the curve overlaid on the graph. These curves are unnatural, and should not be ignored. Failure of this pattern is usually inevitable and painful. Suggest investors review chart of AAPL to understand the ramifications of such a curve. $Gold is extremely over bought. It has been pushed higher by speculative and leveraged momentum buyers. Investors in Gold should hold their positions, but avoid buying at this time and price juncture.

By Ned W Schmidt CFA, CEBS

Copyright © 2008 Ned W. Schmidt - All Rights Reserved

GOLD THOUGHTS are from Ned W. Schmidt,CFA,CEBS, publisher of The Value View Gold Report , monthly, and Trading Thoughts , weekly. For a subscription go to http://home.att.net/~nwschmidt/Order_Gold_EMonthlyTT.html

Ned W Schmidt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.