Gold Price Some Way Off 2011's Bubble

Commodities / Gold and Silver 2012 Jun 25, 2012 - 10:20 AM GMTBy: Miles_Banner

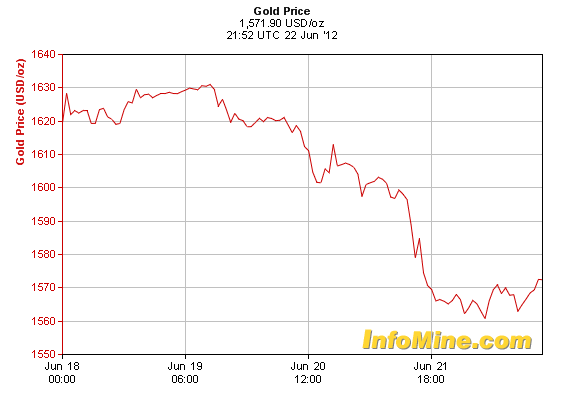

The gold price started steady last week with good news for the euro, the Greek pro bailout party, New Democracy, won the elections. And the eurozone members of the G-20 party agreed to drive down borrowing costs across the single currency area, according to the communiqué from the summit in Mexico.

The gold price started steady last week with good news for the euro, the Greek pro bailout party, New Democracy, won the elections. And the eurozone members of the G-20 party agreed to drive down borrowing costs across the single currency area, according to the communiqué from the summit in Mexico.

In a round of TV interviews at the Los Cabos summit, George Osborne, UK chancellor, said: “I think there are signs that the eurozone are moving towards richer countries standing behind their banks and standing behind the weaker countries.”

The news wasn’t enough to see a sell off of gold and a drop in the gold price. Investors are still concerned with the eurozone, particularly as Spanish 10-year bonds broke through the dreaded 7% yield. If investors had gained confidence in the euro, gold, which is used as a safe haven when investors are uncertain over the future of paper currency, could have seen a sharp drop in value.

Then came Wednesday, the Feds announced that instead of quantitative easing three, they were going to prolong Operation Twist by a few months. Sparking investors worries over disinflation and a possible period of deflation.

“The downward move yesterday solidifies that most investors into gold are for inflationary concerns. With the Fed announcing on Wednesday that there will be no QE3 in the short-term, inflationary concern traders decided to take profits and/or reduce their holdings,” said Jimmy Tintle, president, Greenkey Alternative Asset Services.

Next week might see some book-squaring and a limited amount of new positions as it is the end of the second quarter and for some firms, the end of their fiscal year.

The biggest event this coming week will be the EU Summit, which is scheduled to occur on June 28 and 29.

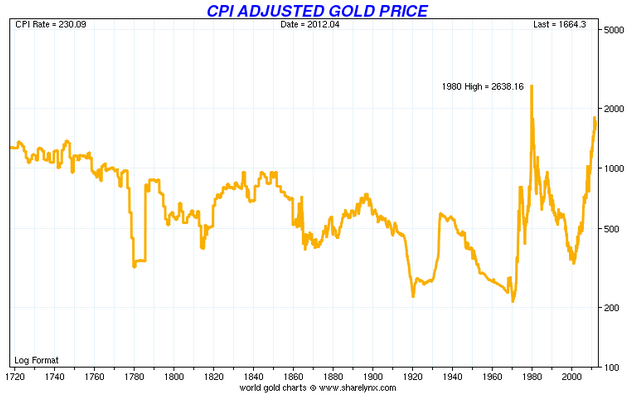

Measuring the true price of gold

The chart below shows the Consumer price index adjusted gold price. It’s the commonly used inflation adjusted gold price. Investors use the CPI adjusted figures to get a better view of how prices of commodities and other assets change in value compared to prices of other goods.

As you can see todays gold price is nearing the peak of the 1980 gold bubble. An alarming site for investors. Considering this alone, you might come to the assumption that the gold price is nearing its summit.

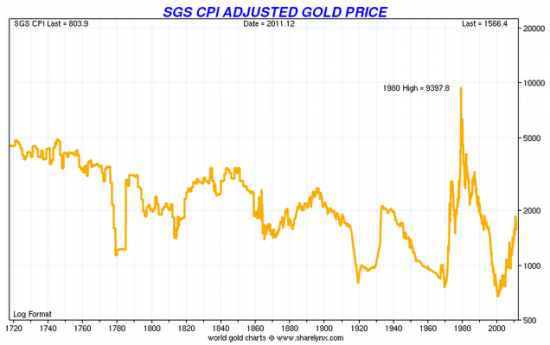

Now consider the Shadow Government Statistics Inflation Adjusted Gold Price chart below. According to John Williams Shadow Government Statistics (SGS) this graph gives a much fairer view of the gold price.

The reason… the way CPI is calculated has changed over the years.

If the SGS CPI adjusted gold price chart is anything to go by, gold could be set for a bull run.

For more on SGS CPI adjusted gold price see John Williams blog

That’s all for this week, sign up to my free gold price today email to receive the latest edition.

Until next week,

By Miles Banner Gold Price Today

We leave you this week with a fascinating article forwarded to us by one of our readers, James. It’s a Bloomberg story that reveals the insatiable appetite for gold amongst central banks – Central Bank Gold Holdings Expand at Fastest Pace Since 1964

© 2010 Copyright Gold Price Today - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.