Leading U.S. Economic Indicators and the Yield Curve, Where’s All That Money Going?

Economics / Global Debt Crisis 2012 Jun 24, 2012 - 03:46 AM GMTBy: John_Mauldin

I have often said that when someone is appointed to be a member of the Federal Reserve, they are taken into a back room and given a complete DNA change. They simply are not like you and me once they step out of that room, with the exception of Fisher and Lacker and a few colleagues who seem to be able to resist the infection. This week we will look at the recent action of the Fed and use that as a springboard to think about how effective Fed policy can be in an age of deleveraging. And if there is time, we simply must look at Europe. I started this letter in Texas and will finish it this morning in Spain.

I have often said that when someone is appointed to be a member of the Federal Reserve, they are taken into a back room and given a complete DNA change. They simply are not like you and me once they step out of that room, with the exception of Fisher and Lacker and a few colleagues who seem to be able to resist the infection. This week we will look at the recent action of the Fed and use that as a springboard to think about how effective Fed policy can be in an age of deleveraging. And if there is time, we simply must look at Europe. I started this letter in Texas and will finish it this morning in Spain.

But first, and quickly, most of you are aware of my annual Strategic Investment Conference, co-sponsored with my partner, Altegris, which we held last month. This year's David Rosenberg (and many attendees!) said this was the best conference ever, featuring a lineup of world-class economic and financial leaders. Our very enthusiastic attendees created a room full of energy that the speakers seemed to feed off of, and everyone brought their "A" game. It really was quite special. And now we have the videos.

For those of you who are members of my special program for accredited investors, called the Mauldin Circle, you can access the conference videos by going to the "My Information" section at the bottom of your personal home page, when you log into www.altegris.com. I can't think of a better way to sharpen your investment outlook than to partake of some of the best minds in the world, including Dr. Lacy Hunt, Niall Ferguson, David Rosenberg, Jeffrey Gundlach, Mohamed El-Erian … and even your humble analyst.

In order to view the videos, you must be a member of the Mauldin Circle. This program has replaced our Accredited Investor Newsletter Program. My partner Altegris and I have worked hard to enhance the program, which now includes access to webinars, conferences, special events, videos, accredited newsletters, and presentations featuring alternative investment managers and other thought leaders and influencers.

The good news is that this program is completely free. The only restriction is that, because of securities regulations, you have to register and be vetted by one of my trusted partners, which in the United States is Altegris, before you can be added to the subscriber roster. This will be a quite painless process (I promise). Once you register, an Altegris representative will call you to provide access to the videos, presentations, and summaries from selected speakers featured at our 2012 Strategic Investment Conference.

Click here to initiate your membership in our exclusive Mauldin Experience Program. After you have talked with the Altegris representative, you'll be able to view the first set of five videos, featuring Dr. Lacy Hunt, Jeffrey Gundlach, Niall Ferguson, David Rosenberg, and Mohamed El-Erian. We will have the rest of the conference lineup for you in a few weeks. And now, let's scrutinize the Fed.

Daddy's Home

This week the FOMC of the Federal Reserve announced that they would extend Operation Twist through the end of the year by buying $267 billion in longer-dated bonds while selling shorter-dated bonds. The idea is to lower the interest rate of the longer bonds, which in turn is supposed to lower interest rates for borrowers on mortgages, cars, and business loans. The only dissenting vote was from Jeffrey Lacker (Federal Reserve Bank of Richmond President) who said he believes the move would spur inflation and not significantly help the economy. (Fisher is not a voting member this year). Lacker remarked,

"I do not believe that further monetary stimulus would make a substantial difference for economic growth and employment without increasing inflation by more than would be desirable."

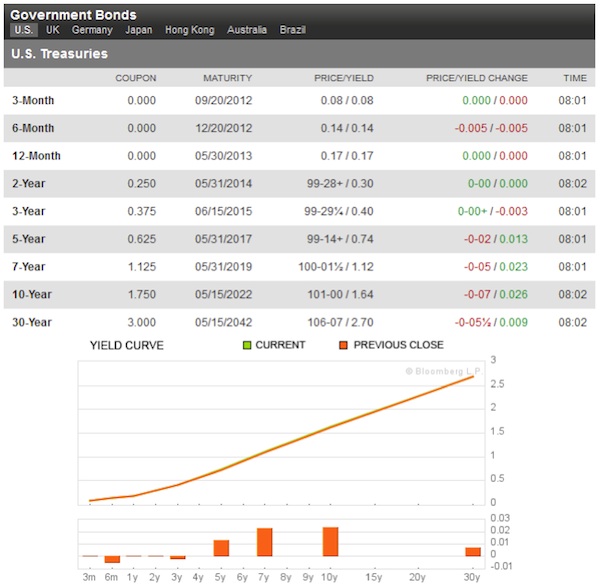

Let me offer a few quick thoughts. First, $267 billion in a "twist" will really not do all that much. Look at this chart from Bloomberg. At first glance it looks like rates really do rise as the duration of the bonds increases. But when you look at the actual numbers, you see that you have to go out to seven years to get a measly 1% (more on that pitiful rate later).

The market had already taken yields on the ten-year down to 1.43% a few weeks ago, although rates have since risen slightly. The drop was a reaction to the very poor jobs report for the month of May, which suggested the economy was getting softer. If we continue to get poor unemployment reports for the summer, which I think is likely, then the market will take long rates down on its own.

The Fed actually expects rather weak economic performance. Quoting from their release, at the conclusion of the meeting:

"The Committee expects economic growth to remain moderate over coming quarters and then to pick up very gradually. Consequently, the Committee anticipates that the unemployment rate will decline only slowly toward levels that it judges to be consistent with its dual mandate. Furthermore, strains in global financial markets continue to pose significant downside risks to the economic outlook."

The translation: The economy is not going to get much better than what we have today, for the rest of the year. Growth is not going to get much better than the sub-2% that we have seen recently; and if anything else bad happens in Europe, it could get a lot worse. And if growth goes any lower, and inflation numbers continue to come in as they have recently, then rates are going down anyway.

So why did the Fed continue Operation Twist? Because the market (that amorphous, omnivorous blob) expected something from the Fed. This summer's version of Twist and Whisper was about the least they could do.

This is the economic equivalent of walking into a room full of your anxious children, patting them on the head, and saying "Daddy's home; everything will be OK now." It was basically all they could do short of another full-blown quantitative easing, and I believe they think they really need to save the QE psychological bullet for another time, when we may be in even more serious straits. (Which if you buy their rationale is the correct thing to do.)

But given their forecast, another QE is likely this year. That is really the only tool they have left in their bucket. How much lower can rates go? Even economists who think that deflation is the base case over the next few years don't think rates can go much lower than another half of one percent on the long end of the curve. For those keeping score, that would be a 2% thirty-year bond and a 1% ten-year bond.

Where's All That Money Going?

For all the work that central banks around the world are doing to force liquidity into the markets, we are not seeing the results in terms of prices. Higher prices are of course what inflation hawks and gold bugs expect. For them, a rising Fed balance sheet is a sure sign of impending inflation. They have been warning of the demise of the dollar for years. I get some serious heat in question and answer sessions when I talk about a much stronger dollar. But that is based on a different understanding of what causes inflation. It is not just the supply of money; it is also the velocity of money, or how fast it goes through the system. I have done several e-letters on the concept and formula first developed by Irving Fisher in the 1930s. Here are links to a couple:

http://www.mauldineconomics.com/frontlinethoughts/the-implications-of-velocity-mwo031210

http://www.mauldineconomics.com/frontlinethoughts/the-velocity-factor-mwo120508

As I wrote a few weeks ago, we will see inflation in our future, but it will be preceded by the velocity of money rising. Until then we have other things to concern us.

Headline inflation is down and now below 2%, and it has been falling for some time (which is also why interest rates are coming down). Energy prices are down and do not yet seem to have found a bottom. Oil is down 25%, which will soon show up in savings at the pump, giving everyone the equivalent of a small tax break (which, unless you own an oil well or energy shares, is not bad news).

Ditto for a whole host of commodities, even including gold of late. Don't get me wrong, I am still buying gold every month. If it goes down I am happy, because that means I get more of those shiny little coins for the same amount of my paper money.

Copper is at its six-month low, and Chinese stocks of the metal are said to be at all-time highs. There are reports from serious sources that Chinese commodity buyers (of coal, etc.) have lost their financing for long-term contracts at higher prices. Supposedly, there are some 30 large ships full of coal, sitting out of port waiting for the money to clear.

I got this note from good friend Simon Hunt (Hunt Strategic Services, www.shss.com), who has been visiting China 8+ times a year for decades to observe commodity consumption. He has particular expertise in copper, but he watches all the commodities.

"First, we were told from friends in Australia that China had suspended payments on coal contracts from Australia. Then from associates in Shanghai we were told that there are large stocks of coal at the big ports in northern China; that a significant tonnage of coal imports have either been postponed or importers have just defaulted on their purchases.

"There are two basic reasons for this impasse. First, underlying demand is weak – just as it is for other commodities that are heavily dependent on real estate and infrastructure – and, second, banks have become increasingly cautious in their lending. For many importers, their collateral has become impaired and banks are not prepared to either open LCs or extend loans to these companies.

"We get a similar message from the credit markets: liquidity is tight and banks are able obtain rates in the high double-digit numbers. We also hear that a similar situation is occurring in the iron ore market. We must think too that copper will soon be caught up in this network, especially when the material is being imported for financing purposes and not for furnaces."

But that is just what you would expect in a deleveraging, end-of-the-Debt-Supercyle world. Prices and demand fall. Without the Fed printing, we would see actual deflation. Since part of that DNA change I mentioned above is a visceral fear of deflation, I expect several more versions of QE (which stands for quantitative easing, or "printing money," as it is known in the less sophisticated circles I run in).

Leading Economic Indicators and the Yield Curve

The weekly ECRI index of leading economic indicators (WLI) is down yet again this week and month. But if you take out the stock market and the yield curve, two significant components of the WLI, then the index is even less optimistic and in overall negative territory. Heretofore, one could follow the yield curve and predict recessions with rather stunning success, as I have written about over the years. Serious academic studies show that a negative yield curve for 90 days, and with certain values, is the one reliable indicator when it comes to forecasting recessions.

That is why I was so confident in predicting the last two recessions (2001 and late 2007), though there were also numerous confirming data. I should note that in both instances I was told repeatedly that "this time is different" and the yield curve was not reliable because of (insert any of several reasons). (Note: a negative yield curve does not have the same predictive power in other economies.)

The yield curve is not suggesting a recession in the future of the US at the moment. It is quite positively sloped. It's nowhere near suggesting a recession in the next year. So what's to worry?

So now I am going to suggest that … this time is different. I will argue that the yield curve is currently meaningless in terms of forecasting, as it is totally manipulated by the Fed. We don't really know what short term rates would be if left to the market. I can't say when we will have the next recession, but I am fairly sure that the yield curve will still be positive one year in advance. Short-term rates (and interest rates in general) are not going to rise significantly any time soon.

I have never been a fan of the phrase "the market is a forward-looking indicator." What was it telling us the summer of 2007? It was certainly not signaling a recession within a few months. The NYSE index was only 3% off its low and climbing in 2000, and we were already in recession. Did we have a recession in 1998 or 1987 following those bear markets?

Maybe I don't have the volume turned up, but I just can't hear the market telling us anything about the future that we can hang our hats on. Over the shorter term it is very good about giving us clues about current emotional drivers and momentum investing, but for the direction of the economy we need to look elsewhere.

What About Retiree Final Consumer Demand?

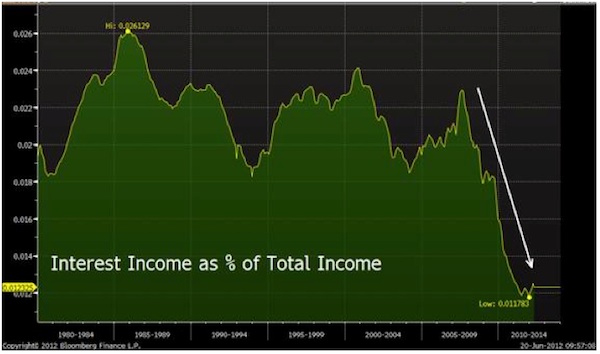

My last observation about Fed interest-rate policy is that it is punishing those who have worked and saved all their lives and had hoped to retire and be able to clip coupons. Unless you have a large amount of money, you can't live off the interest income you get on what used to be the standard bond portfolio that was recommended for those who were either retired or close to retirement.

And it is killing pension funds. The typical pension fund allocates about 60% to stocks and 40% to bonds. Pension funds still predict they will make a total 7-8% return over time. That was a seriously damaging assumption over the last 12 years, with the beginning of a secular bear market in 2000. (Next week we will look at a two-part update of the work that Ed Easterling and I did almost ten years ago in my book Bull's Eye Investing, where we outlined why stock market returns would be flat for a long time. This is something I started writing about in 1999. Typically, I was too early. Timing is not my forte.)

I wrote back then that government pension funds would soon have over $2 trillion in unfunded liabilities. I was my usual optimistic self, and it is now getting worse than I thought. But who knew that politicians would deliberately underfund pension plans so they could spend the money on other things? I am so charmingly naïve at times.

If bonds are only yielding 4%, then to get an 8% return in a 60-40 portfolio requires that stocks rise over 10% a year, compounded. Not going to happen for a few years, until we see the end of the secular bear market (these last on average about 17 years), by which time pension funds will be even more massively underfunded and baby boomers will be wanting to retire. Look back to 2000. What has the total stock market return been?

I should point out that I am not talking about your returns, because my readers are way smarter than average. I am simply referring to the typical pension fund holding. Only pension funds like the Yale Endowment (run by David Swensen), which put a serious portion of their funds into alternative investments, have managed to do well.

How badly have investors been hit? The chart below tells a very sad tale (hat tip to Dan Greenhaus of BTIG, who sent this as part of an email thread some of us were sharing). Interest income has been almost cut in half over the last few years of the Fed targeting interest rates.

Part of the reason the Fed cut rates was to stimulate the economy. Lower rates mean lower mortgages and credit-card and car payments. They give businesses access to cheaper capital and hopefully spurs profits and thus hiring. This puts more money into the hands of consumers. As an example, US 30-year mortgage rates recently hit a record low of 3.66%, down from 4.5% the same time last year. A number of mortgage holders will refinance, given the much lower rates, increasing disposable income. That almost makes me want to buy a house or two.

Part of the mantra of Keynesian economics is that it is imperative to stimulate final consumer demand in times of recession or slow growth. That rationale is why the "stimulus" package of a few years ago included so many government transfer payments and tax cuts, coupled with much larger deficit spending.

But low rates punish savers and leave them with less money, so that hurts retirees' final consumer demand – or that is the view from the cheap seats where I sit. And retiree income and spending is a growing portion of the economy. Hurt that, and it's a sector big enough to have consequences. I know that economists can argue that the trade-off is positive, but it seems to me we are defrauding a generation or two of hard-working savers. You did what you were supposed to do, and your reward is a ten-year bond at 1.5%. Since you paid off your mortgage a long time ago, the lower rates don't help you either! So you either cut back or move out the risk curve. While better yields can be had with some serious research and homework, it is not easy.

The Fed is not going to change its policy to help retirees and pension funds, so you are left to fend for yourselves. Sadly, the recent vote by the citizens of San Jose to dramatically cut their fire and police pension benefits, which they felt was necessary because their city council had for years promised more than the tax base could afford, is going to become normal over the next few years.

Part of the problem is simply promising too much in the way of benefits, but an equally big part is pension-fund consultants making assumptions based on the bull market of the '80s and '90s. And now, low interest rates make those assumptions look even worse. To the point where local and state governments cannot afford what was contractually promised.

I should note that the vote in heavily Democratic San Jose, California was 2-1 in favor of those pension cuts. Not just a slim majority, and certainly unusual for a municipal election. Something similar happened in San Diego. It was not just in Wisconsin that voters said Tuesday a week ago that deficits matter. I think those municipal votes are highly indicative of a tectonic change, as voters look to the future of government deficits and start to say "Enough! Stop!" It can't happen too soon, as our train chugs on toward the debt cliff.

It is not just a few cities here and there. Illinois is massively underfunded, to the tune of about $85 billion, if I remember right. They have funded less than 45% of what should be in their pension fund. Even if they devoted 1/3 of their budget for the next ten years to funding their pensions, they could not get the job done, except under very rosy projections.

And if we really do have another five years of a secular bear market? Coupled with low interest rates? Ugly does not begin to describe what the citizens of Illinois who are dependent on that pension fund will face. And that is just one state.

And speaking of failed states, let's return our attention to Europe. Joan McCullough sent a note this afternoon that made me smile, but that really did capture the essence of what is going on over there.

"This morning we briefly touched on the lack of clarity that is dominating the European crisis. We will. We will not. We are in the process of. We have not yet proposed. We have agreed. We have not discussed. We are open to. We reject. There will be a grace period. There will be no delay. Greece will have to comply with the terms agreed by its predecessors. We are willing to reconsider the terms. We back Eurobonds. We reject Eurobonds. We are considering Eurobonds. There is no discussion of Eurobonds. The loans/credit/paper will be distributed thru the ESM. They will be distributed thru the EFSF. We don't know, but we think it will be the ESM. Publicized meeting in Rome, quiet meeting in Luxembourg, another summit at month-end. You get the picture. You don't get the picture. Let's have a meeting and see what we all think about the picture. Next year."

Germany is at a crossroads. They must make a decision, and soon. Either start moving toward full fiscal union and oblige the German taxpayer to pony up for the debts of Club Med, or allow the eurozone to break up. (By the way, 69% of Germans want Greece to leave the eurozone. So much for solidarity.)

Spain and Italy are going to cost trillions to backstop. Once they lose access to the market, they will have to default unless the rest of Europe is willing to allow the ECB to buy their bonds, in some form. The pain will not be over in a year or two; it will drag on for many years, once the process starts. That is why it will cost trillions and not just the several hundreds of billions that it will take for the remainder of this year. In for a dime, in for a dollar, my Dad taught me. Once they start they can't stop, unless they want to lose all they have put in. There is no going back and asking for a refund.

For what it's worth, I think they will eventually allow the ESM to become a bank so that the fund can go to the ECB for leverage. With typical European leverage, that could be worth up to €10 trillion. Now THAT is a tidy sum.

Is that legal within the strict rules of the treaty? Probably not, but so far when there is a crisis European elites are quite willing to overlook the niceties of adhering to some old musty document drawn up last century. I mean, what was it, something like over 12 years ago?

Hard and Soft Options

The "smart" money is betting on Germany deciding to bite the bullet and go along . If they don't, they are courting economic disaster. Of course, if they do, it will still be an economic disaster, just with a different source for the losses.

My great Irish friend (I do so love the Irish!) and writer David McWilliams (he was at my conference this year) penned the following thoughts earlier this week. He writes the most-read economic column in the Irish papers. I'll quote a few of his remarks, but you can read the whole column at this link: www.davidmcwilliams.ie/2012/06/19/hard-and-soft-options. It is short but a great read.

"Should we focus on what Angela Merkel says and ignore what she actually does? Or should we ignore what she says and focus on what she actually does? This is important, because the difference between what the German chancellor says and what she actually does is widening by the day.

"We hear from the German government that it is ready to do whatever is necessary to save the euro, but actually it is doing as little as possible. Every time the Germans are asked to clarify what they mean when they talk about taking actions to save the euro, they spoof and bluster – but do very little.

"This raises the question whether Germany actually wants to save the euro in its present form. And if it doesn't, what does it want?

"The working assumption of the European elite and Europhiles here in Ireland is that Germany will eventually subjugate its own interests for the greater good of European solidarity.

This means in reality that the Brussels mainstream view is that Germany will ultimately accept the responsibility for paying all or part of the debts of the rest of the eurozone. Such a prospect chills many millions of German people. The assumption of the europhiles is that Germany remains, in the words of the great chancellor Willy Brandt in the 1970s, 'an economic giant but a political pygmy'.

"What if Germany 40 years later in 2012, is a bit less of an economic giant and also a bit less of a political pygmy?

"The europhile elite seem to be stuck in the 1970s or 1980s, when a divided Germany did not have either the 'permission' or the 'confidence' to stand up for itself. Germany has changed, but the European elite has not. The new Germany has moved on."

He goes on to describe what the proposed union looks like from the perspective of the typical hard-working German. (Let me just say for the record I have never met a Greek who was also not hard-working, but then they mostly were running businesses of their own.)

And it doesn't really add up. The German works hard, gets a weak currency (the euro) for his efforts, and then has to pick up the tab for Club Med. Never mind that Germany has been selling Club Med and others massive amounts of goods, and that is the source of German prosperity. That calculation is hard to make and even harder to sell.

McWilliams concludes by suggesting,

"It seems reasonable to suggest that what Germany wants is a stronger, tighter euro to protect it from the implications of continuous infusions of cash to the periphery. This is a core euro centred around Germany. Then the EU can let the Italians and others revert to devaluations, which will work.

"This solution makes perfect sense if you are German. As for chancellor Merkel, this approach – moving towards a core hard euro and a periphery soft euro – could explain her behaviour of the last few weeks. Putting Germany first might leave Merkel isolated in Europe, but she would be very popular at home.

"You decide what is the priority for an elected politician who is facing an election next year and who wants to get voted back into office."

Darrell Royal, football coach of the University of Texas back in the day, used to say, "The opera ain't over till the fat lady has sung."

I don't see a fat lady on-stage as yet, but I think I hear someone giving us a few lines of Wagner from the wings, getting warmed up.

Some Thoughts From Madrid

I just landed and have a few minutes to scan my sources for what is happening in Europe. I get to be part of some very serious real-time analysis. Some of the people in the loop are quite wired into official circles, gain real insights into what is going on, and offer counsel. I get to look over their shoulders.

A summary of the latest (hat tip, Kiron Sarkar, whose work I am really starting to like – very deep thinker):

"Germany (Mrs. Merkel) agreed to a E130bn plan to stimulate growth, which has been pressed by Italy, France and Spain – no significant development. Her opposition parties supported the move. No other material agreements were achieved at the meeting in Rome yesterday, which by all accounts pitted the 3 leaders of France, Italy and Spain against Mrs Merkel;

"A recent poll (Infratest survey for ARD public TV) suggests that 55% of Germans want the Deutschmark back, up 9% on the previous month. This is getting serious, but the real problem is that German politicians have not explained the consequences of such a move (the DM would become a supercharged Swissy) to their public. 62% of Germans supported Mrs Merkel's insistence on imposing austerity measures. Support for Greece was ebbing fast. (Source FT);

"Questions are being raised as to whether the ESM can raise the full amount of E500bn. Portugal, Ireland, Spain and Greece (and Cyprus soon) are due to contribute just above 19% of the E500bn, which must be considered uncertain. If Italy faces a problem, another 18% would disappear. It does not look as if the EZ leaders will agree to granting the ESM a banking licence at the 28/29th meeting, in part due to the recent German Constitutional court issues. However, as the size will prove insufficient, it is a near certainty that the ESM will have to be granted a banking licence in due course.

"There is, of course, the EFSF (which continues till July 2013) and which, to date, has lent just under E250bn of its E440bn lending capacity. Given existing commitments, the total future lending capacity of the EFSF/ESM is estimated (optimistically) at approximately E400bn (following the E100bn to be provided to recap Spanish banks), insufficient for the likely needs, suggesting, once again, that the ESM will have to be granted a banking licence – the maths simply does not work otherwise. As a backstop, the ECB could buy peripheral debt in the secondary markets, but the ECB (quite rightly) remains reluctant .…"

Trequanda, Cincinnati, New York, and Singapore

This letter is already long, so I will be merciful and stop. There is just so much going on. The problem I have writing in such times is to figure out what not to write about. It is all so #$%2 interesting. And important. Oh well, there is always next week!

I am in Madrid and getting ready to meet up with Alberto Dubois. We first met at a ten-day executive program at Singularity University and became good friends. He is picking me up for a long, leisurely Madrid lunch and has a group of people coming, so it will be quite fun. I look forward to getting the story of what's happening here from a local perspective.

Tomorrow I am off to Rome, where I will hook up with David Tice (who ran the Prudent Bear fund). He is bringing his daughter. We will catch the train up to Tuscany together and then spend a week relaxing in a very small, sleepy village called Trequanda. Two weeks in one place, now that is heaven. And Tiffani and my granddaughter Lively will be there! And lots of other friends. Good times ahead.

I get back in two weeks, stay home a week, and then catch an overnight for meetings in Cincinnati, jet on to New York for a few more meetings, and then catch a night flight to Singapore on Singapore Air, in one of those well-reputed first-class cabins. I have always wanted to do that; but SA is not part of One World Alliance, so I take AA or Cathay to Asia, which are also quite nice. I got lucky and was upgraded to first on AA coming over to Europe this time, and it was a very nice flight. Very pleasant staff.

I do so hope American Airlines can fend off the US Airways takeover bid. I know many of us Exec Platinums are really worried about having to fly US Airways. I hear nothing but horror stories, and my experience with them has not been good. Lost bags, oversold planes where I was denied a seat, with a ticket and seat assignment bought months in advance. The outright lies I got from them about the rebooking were scandalous. Long story – but not now, on one of my better travel days.

The weather is great here. And the afternoon is going to be even better. Now, you have a great week, and I will drop you a note next week from Trequanda, with an update on secular bears. Look at it this way: we are 12 years closer to the end than when we started. The only downside I see is that I have also aged 12 years, but all things must pass.

Your wondering how he will avoid the Italian wines (sigh) analyst,

By John F. Mauldin

Outside the Box is a free weekly economic e-letter by best-selling author and renowned financial expert, John Mauldin. You can learn more and get your free subscription by visiting www.JohnMauldin.com.

Please write to johnmauldin@2000wave.com to inform us of any reproductions, including when and where copy will be reproduced. You must keep the letter intact, from introduction to disclaimers. If you would like to quote brief portions only, please reference www.JohnMauldin.com.

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2012 John Mauldin. All Rights Reserved

Note: John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA registered broker-dealer. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private investment offerings with other independent firms such as Altegris Investments; Absolute Return Partners, LLP; Plexus Asset Management; Fynn Capital; and Nicola Wealth Management. Funds recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor's services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staffs at Millennium Wave Advisors, LLC and InvestorsInsight Publishing, Inc. ("InvestorsInsight") may or may not have investments in any funds cited above.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.