Gold Price Imminent Breakdown

Commodities / Gold and Silver 2012 Jun 23, 2012 - 08:58 AM GMTBy: Brian_Bloom

Below is a weekly chart of the gold price – courtesy stockcharts.com. This chart is reaching for a significant decision and the portents are bearish:

Below is a weekly chart of the gold price – courtesy stockcharts.com. This chart is reaching for a significant decision and the portents are bearish:

- Last week, the gold price failed to penetrate above the downward pointing resistance trend line notwithstanding all the chaos in Europe.

- The Fibonacci resistance level also held

- The gold price is now sitting on the first support line of the descending right-angled triangle

- The MACD histograms deteriorated. Further deterioration will cause downside penetration of that first support line

Conclusion:

Whilst the call cannot yet be made, if the second support line is penetrated on the downside, the gold price could fall anywhere between $100 and $300 in one week

Objectively, there are three “technical” reasons why it might break down:

- A descending right angled triangle is a bearish formation and the price is now close to the apex of the triangle

- An elongating MACD histogram in negative territory is not a cause for optimism

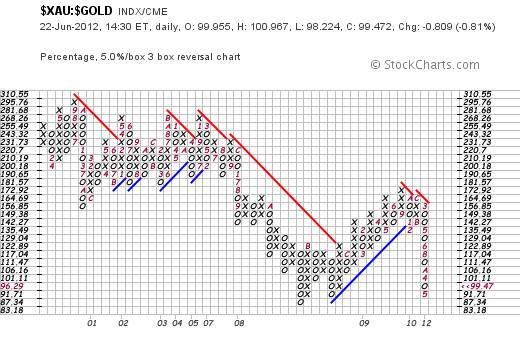

- The second chart below (a 5% X 3 box reversal chart of the ratio of the gold share index and the gold price) is telling a negative story

The “story” being told by the chart below is this:

The ratio of gold shares to gold price broke down in 2008 following an 8 year bull run in gold. It then rallied for a year or two, failed to penetrate above the old resistance level, and has since broken down again. It can be argued that because of rising mining costs the “nexus” between gold and gold shares has been broken but this seems to me to be a rationalisation. Logic dictates that the profits (losses) of gold mining companies are leveraged to the gold price. Gold in a rising trend should lead to relative over-performance by the gold mining index and gold in a falling trend should lead to relative under-performance by the gold mining index. The story below is one of expectations of deteriorating gold mine profitability.

Author Note: Given that the emotionally charged news in the days ahead seems likely to overwhelm people’s predisposition to think rationally, I have decided to delay for a week or two the publication of Part 3 of the trilogy of articles entitled US vs Europe; Deflation vs. Inflation. Part 3 will take a balanced look at the risks and opportunities facing the world economy. There are some risks that have not been examined in sufficient depth by market analysts. However, in contrast, there are some significant counterbalancing positive developments that are still flying below the media radar.

Author, Beyond Neanderthal and The Last Finesse

Beyond Neanderthal and The Last Finesse are now available to purchase in e-book format, at under US$10 a copy, via almost 60 web based book retailers across the globe. In addition to Kindle, the entertaining, easy-to-read fact based adventure novels may also be downloaded on Kindle for PC, iPhone, iPod Touch, Blackberry, Nook, iPad and Adobe Digital Editions. Together, these two books offer a holistic right brain/left brain view of the current human condition, and of possibilities for a more positive future for humanity.

Copyright © 2012 Brian Bloom - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Brian Bloom Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.