Surprise Strength in Gold

Commodities / Gold and Silver 2012 Jun 22, 2012 - 12:38 PM GMTBy: Adrian_Ash

Given the challenges it faces, gold so far in 2012 has in fact proven strong...

Given the challenges it faces, gold so far in 2012 has in fact proven strong...

"Gold Price Plummets" is the obvious headline right now. But fact is, the gold price has in truth been surprisingly strong so far this year.

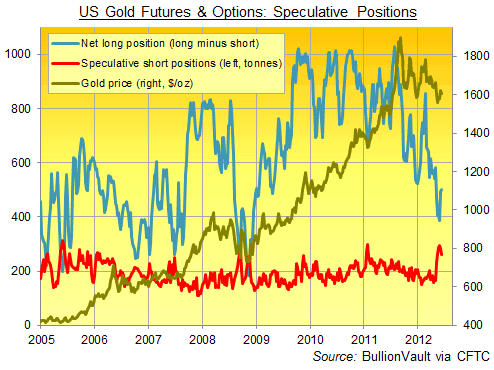

First up, the US gold futures and options market. These contracts rarely run to physical settlement, but still they wag the dog of physical prices near-term. Because the price of gold for future delivery of course affects how much people ask or bid for metal today.

That future price, whether being set by hedge funds or chased by doctors and dentists (private traders risk getting "filled and drilled" by retail brokers, or so goes the joke), is bet on with borrowed money. So credit is a big factor. And credit has vanished since last summer's big peak in the gold price, just as did when Lehmans collapsed.

Next up, the world's heaviest physical buyers - Indian households. Now overtaken by Chinese consumers, India buyers are always quiet this time of year (what with the monsoon season, a lack of auspicious festivals, and the post-harvest wedding and Diwali season still four months off). But New Delhi's active policy of trying to stem gold bullion imports in 2012, plus the record-high prices set by the fast-sinking Rupee, have chewed up this massive support for global demand by perhaps 30% or more on best estimates.

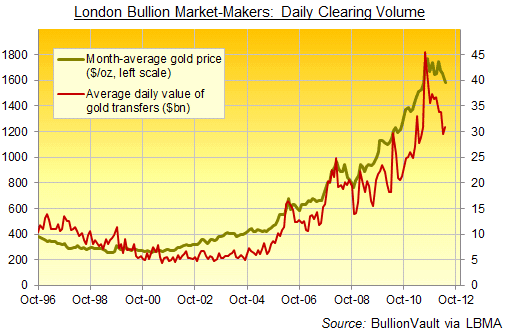

That's had a big impact on the wholesale physical market - still centered in London, more than 80 years after Britain abandoned its Gold Standard. Physical investment demand from the big institutions has clearly eased off as well.

Here's what the market-making bullion banks say they're turning over each day on average between themselves. You can size it up by 5 times or more to get the true market-wide volume.

As you can see, London's volume by value has sunk one-third by value since last summer's peak. Yet the gold price has lost only 11% on its monthly average.

Now, perhaps that gap will be closed. Some speculative traders in the futures and options market certainly think so - and they think the gap will be closed by prices falling still further, as well.

See the red line in our first chart above. Speculative traders haven't held this big a short position in gold since the price was down at $400 or so. But given these factors all weighing on price, "plunging gold" in fact looks pretty hardy. Existing sellers are refusing to slash their offers, and new buyers are still paying historically strong prices to acquire metal today.

Lucky for them, gold's unique mix of inflation and default insurance is currently cheaper than its peak price of 12 months ago.

By Adrian Ash

BullionVault.com

Gold price chart, no delay | Buy gold online at live prices

Formerly City correspondent for The Daily Reckoning in London and a regular contributor to MoneyWeek magazine, Adrian Ash is the editor of Gold News and head of research at www.BullionVault.com , giving you direct access to investment gold, vaulted in Zurich , on $3 spreads and 0.8% dealing fees.

(c) BullionVault 2012

Please Note: This article is to inform your thinking, not lead it. Only you can decide the best place for your money, and any decision you make will put your money at risk. Information or data included here may have already been overtaken by events – and must be verified elsewhere – should you choose to act on it.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.