Six Percent Interest Rate Can Draw Gold from the Moon

Commodities / Gold and Silver 2012 Jun 22, 2012 - 12:33 PM GMTBy: Richard_Mills

At the start of golden ages golden stories should be told

At the start of golden ages golden stories should be told

Following many years of net annual sales in the 400 to 500 tonne range, central banks, underweighted in gold and overweight in dollars and euro's, became net buyers of gold in 2009 - in 2002 central banks sold 545 tonnes of gold, in 2011 they bought 440 tonnes.

"Central banks continued to buy gold; net purchases recorded during the first quarter, 2012 amounted to 80.8 tonnes, accounting for around 7% of global gold demand. Central banks from a diverse group of countries added to the overall holdings of the official sector, with a number of banks making sizable purchases. Diversification requirements and growth in foreign exchange reserves of a number of countries point towards a continuation of this trend." World Gold Council (WGC) report

After having already purchased ten tonnes of gold so far, the National Bank of Kazakhstan said it plans to purchase an additional fifteen tonnes this year and as much as seventy tonnes per year in 2013 and beyond.

"World practice shows that holding up to 15% of gold is what should be done, depending on the performance of the dollar and the euro." Bisengali Tadhiyakov, Kazakhstan's central bank deputy chairman

"Central banks are justified in having high gold weightings. They are justified in having a 40-50 percent weighting in gold...It is not only about the dollar, not only about diversification, but also about future inflation." Marcus Grubb, WGC's managing director of investment, research and marketing

Bretton Woods

In July 1944, delegates from 44 nations met at Bretton Woods, New Hampshire - the United Nations Monetary and Financial Conference - and agreed to "peg" their currencies to the U.S. dollar, the only currency strong enough to meet the rising demands for international currency transactions.

What made the dollar so attractive to use as an international currency, the world's reserve currency, was each US dollar was based on 1/35th of an ounce of gold (35.20 US dollars an ounce), and the gold was to held in the US Treasury.

There's a lesson not learned that reverberates throughout monetary history; when government, any government, comes under financial pressure they cannot resist printing money and debasing their currency to pay for debts.

The Vietnam War was going to cost the US $500 Billion. President Lyndon B. Johnson's administration declared war on poverty and put in place its Great Society programs - more than four million new recipients signed up for welfare.

London Gold Pool

The US began to send larger and larger amounts of dollars overseas to fund their increasing trade deficits. The glut of US dollars held abroad began to threaten U.S. gold reserves - remember US dollars were redeemable for gold - and worldwide demand for gold was soaring. By the late 1950's US gold reserves had began to dwindle rapidly.

"Nineteen fifty-eight marked the first year in which foreign central banks exercised their convertibility rights in significant amounts and returned their dollars for gold. US gold reserves fell 10% from 20,312 metric tons to 18,290 that year, another 5% in 1959, and 9% in 1960." John Paul Koning, Mises.org, The Losing Battle to Fix Gold at $35

In October of 1960 panic buying caused gold's price to rise to over $40 per oz - a night time emergency call was made by the US Federal Reserve, the Bank of England was to immediately flood the gold market with enough supply to reduce and stabilize the price of gold.

The US made it abundantly clear stopping the drain of its gold reserves, and the depreciation of its currency against gold, was a huge priority.

The US, the Bank of England and the central banks of West Germany, France, Switzerland, Italy, Belgium, the Netherlands, and Luxembourg then set up a gold sales consortium to prevent the market price of gold rising above $US 35.20 per oz.

This consortium was known as the London Gold Pool. Member banks were to provide a quota of gold into a central pool, the US Federal Reserve would match their combined contributions ounce to ounce. This meant that the dollar would now be backed not only by the gold in Fort Knox but all the other Pool members gold as well.

By early 1962, the Bank of England, the consortium's buy/sell agent, through the London Gold Exchange, was buying gold on the dips and selling on the rise to cap its price. Until 1968 nearly 80 percent of newly mined gold passed through the London Gold Exchange, London being the world's premier gold market. The London Gold Fix had been a daily morning ritual since September 1919 - the 3pm Gold Fix was introduced in 1968 to coincide with the opening of the US markets.

Despite the Cuban Crisis and escalating tensions between Moscow and the US gold prices remained fairly stable, the London Gold Pool was a success.

The Beginning of the End

With the Gulf of Tonkin incident in late 1964 and the acceleration of the Vietnam war in 1965, US military spending exploded. This was compounded by President Lyndon B. Johnson's Great Society project spending and not raising taxes.

By 1965 the London Gold Pool was selling more gold suppressing the rise than it was buying back on the increasingly fewer, and shallower, dips.

Britain devalued the pound sterling in late 1967.

The ramping up, in early 1968, of the Vietnam war - because of the Tet offensive and US President Lyndon B Johnson's agreeing to General Westmoreland's proposed troop surge - brought renewed pressure on the dollar.

Since Johnson refused to raise taxes to pay for A. the social welfare reforms undertaken earlier and B. the war in Vietnam, the US was now running massive balance of payment deficits with the world.

In a little over a month London sold close to 20 times its usual amount of gold, over a 1000 tons.

France dropped out of the pool to send it's dollars back to the US - for gold rather than Treasury debt.

Gold demand was skyrocketing. London sold 100 ton of gold in one day, up 20 times the average.

The consortium said "the London Gold Pool re-affirm their determination to support the pool at a fixed price of $35 per oz".

Fed chairman William McChesney-Martin said the US would defend the $35 per oz gold price "down to the last ingot".

Several planeloads of gold were emergency airlifted from the US to London. Gold demand continued to escalate with the London Gold Pool selling 175 tons one day and the very next day selling an additional 225 tons.

This broke the back of the London Gold Pool, members were tired of draining their countries gold reserves to pay for the US's Vietnam war and social reform policies.

At the request of London Gold Pool members the Queen of England declared Friday, March the 15th a bank holiday - the London gold market remained closed for two weeks and the London Gold Pool was disbanded.

Johnson was forced to reverse his decision to send hundreds of thousands more U.S. troops to crush the Vietnamese resistance - instead he opened up peace talks.

An official "two-tiered" price for gold was announced to the world - the official price of $35.20 would remain for central banks dealings, the free market could find its own price.

"...there came the March 1968 run on gold, which led to the collapse of the London Gold Pool. The U.S. government and Federal Reserve System, seeking to stave off the complete collapse of the dollar-gold exchange standard, felt obliged to take deflationary measures. The fed funds rate, which on October 25, 1967, had fallen to as low as 2.00 percent, rose to 5.13 percent on March 15, 1968, the day the gold pool collapsed.

As the Federal Reserve System's deflationary measures took effect, the fed funds rate rose to as high as 10.50 percent during the summer of 1969. Long-term interest rose too, if to a lesser extent. On September 6, 1967, the rate on U.S. government 10-year bonds fell to 5.20, still well above the level of around 4 percent that prevailed during the first half of the 1960s...

On December 29, 1969, the yield on the long-term government bond hit 8.05 percent. With interest rates, both long term and short term, at such high levels, the demand for gold bullion was finally broken, and the dollar price of gold fell to around $35 an ounce by 1970. For the moment, the dollar-gold exchange standard had been saved." The Industrial Cycle and the Collapse of the Gold Pool in March 1968, critiqueofcrisistheory.wordpress.com

In February of 1970 the closing dollar price of gold on the London market averaged $34.99.

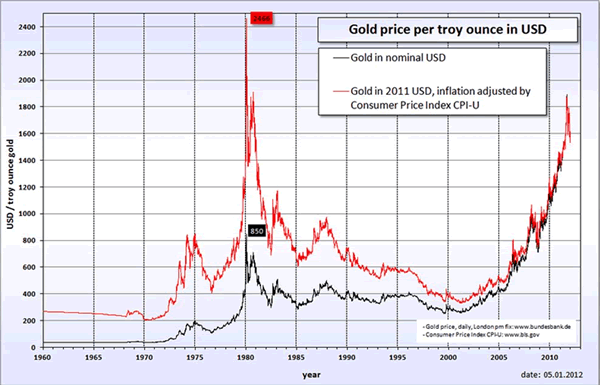

On August 15, 1971, U.S. President Nixon ended the convertibility of the dollar into gold. With gold finally demonetized the US Federal Reserve (Fed) and the world's central banks were now free from having to defend their gold reserves and a fixed dollar price of gold.

The Fed could finally concentrate on achieving its mandate - full employment with stable prices - by employing targeted levels of inflation. The great experiment had begun - the objective being a leveling out of the business cycle by keeping the economy in a state of permanent boom - gold's "chains of fiscal discipline" had been removed.

By the end of August 1971, the dollar price of gold exceeded $42 and was rising.

The effort by the London Gold Pool to cap the price of gold was as unsuccessful as central bank efforts were the years preceding 2009. Why were the world's most powerful central banks so spectacularly unsuccessful, not once but twice, in capping gold's price rise? The answer is definitely something you'll want on your radar.

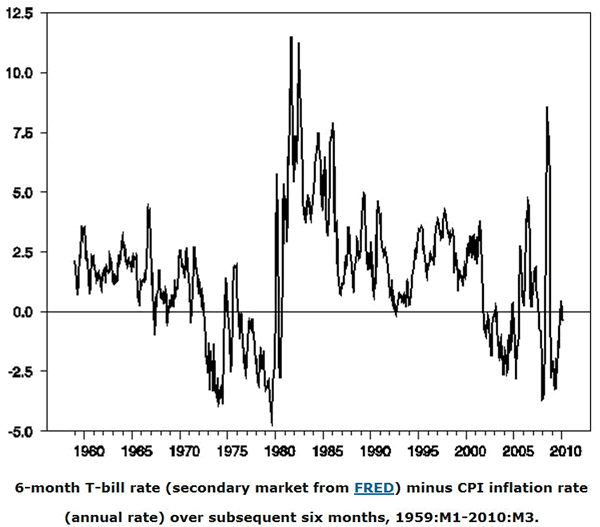

Real Interest Rates

The demand for gold moves inversely to interest rates - the higher the rate of interest the lower the demand for gold, the lower the rate of interest the higher the demand for gold.

The reason for this is simple, when real interest rates are low, at, or below zero, cash and bonds fall out of favor because the real return is lower than inflation - if your earning 1.6 percent on your money but inflation is running 2.7 percent the real rate you are earning is negative 1.1 percent - an investor is actually losing purchasing power. Gold is the most proven investment to offer a return greater than inflation (by its rising price) or at least not a loss of purchasing power.

Gold's price is tied to low/negative real interest rates which are essentially the by-product of inflation - when real rates are low, the price of gold can/will rise, of course when real rates are rising, gold can fall very quickly.

Dumping gold on the market, like the London Gold Pool, and until very recently modern central banks did, cannot dampen the demand for gold at low/negative real interest rates. They can temporarily be successful at capping or slowing gold's price rise but as long as interest rates are low to negative the demand for gold will grow and soon strips supply from their vaults.

There's a saying that "six percent interest can draw gold from the moon," undoubtedly true, but rates below two percent draw investors to gold.

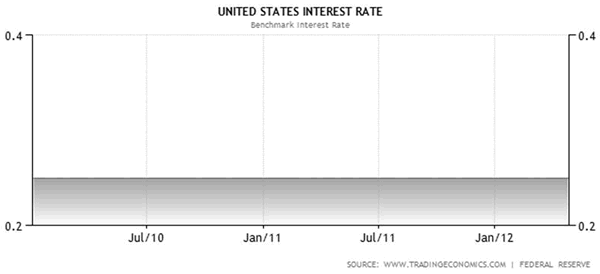

The Feds interest rate is 0.25 percent.

"the Committee expects to maintain a highly accommodative stance for monetary policy. In particular, the Committee decided today to keep the target range for the federal funds rate at 0 to 1/4 percent...at least through late 2014. The Committee also decided to continue through the end of the year its program to extend the average maturity of its holdings of securities...This continuation of the maturity extension program should put downward pressure on longer-term interest rates" U.S. Federal Reserve Reaffirms Low-Rate Policy, June 20th 2012

The benchmark US 10-year note currently yields 1.62 percent, yields on 30 year bonds are 2.69 percent.

The following is the inflation data for the first five months of 2012, the Inflation rate is calculated from the Consumer Price Index (CPI-U) which is compiled by the Bureau of Labor Statistics (BLS).

Jan 2.93%, Feb 2.87%, Mar 2.65%, Apr 2.30%, May 1.70%.

John Williams, author of the newsletter Shadow Government Statistics, takes issue with the statistical methodology used by the BLS.

Williams says if the BLS hadn't altered its statistical practices over the years, inflation would have been reported about seven percentage points higher each year.

Consider:

- Since 1913 the US dollar has lost over 95% of its purchasing power while gold has gone from US$20 an ounce to currently over US$1600.00 per ounce in the same time frame

- When people catch onto the fact that all government statistics are so massaged as to be useless, and actually start to think about how much more they are paying today over yesterday for the necessary everyday items they need to get by, than they will start to understand why gold is so important to a sound monetary system

- Continuing low interest rates, combined with higher inflation rates will equal low to negative real rates of return causing continued demand for gold

- Consistent, sustained, large-scale bulk gold purchases on the dips by central banks and governments buying a large part of the annual supply of gold will keep a floor under gold's price

Conclusion

Fact - as long as real interest rates are low gold is in a bull market, there are no plans to raise interest rates for at least two years, indeed the Fed is actively working to lower longer term rates, this should be on everyone's radar screen. Is it on yours?

If not, maybe it should be.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com

Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector.

His articles have been published on over 400 websites, including:

Wall Street Journal, Market Oracle, SafeHaven , USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2012 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.