Corporate Earnings Growth Spotlight: Novartis AG

Companies / Corporate Earnings Jun 22, 2012 - 02:22 AM GMTBy: John_Persinos

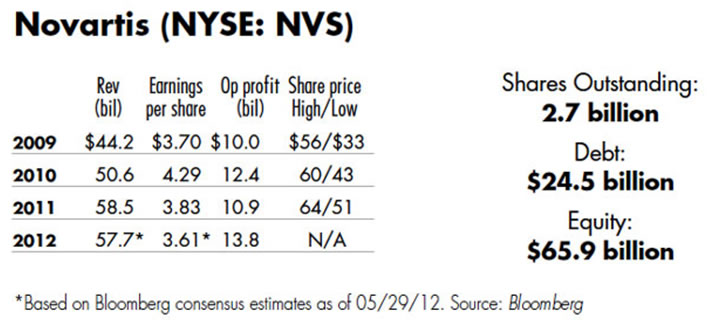

Swiss drugmaker Novartis AG (NVS) in April reported first-quarter 2012 earnings per share (EPS) of $1.27, down from the $1.4 posted a year earlier. First-quarter revenue fell to $13.7 billion from last year’s $14 billion. Earnings dropped 18 percent, to $2.3 billion.

Novartis’ revenue was hit by generic drug competition and manufacturing problems at its factory in Lincoln, Nebraska. This year, Novartis faces additional challenges to revenue, as its top-selling drug Diovan for hypertension loses patent protection.

However, the company isn’t taking patent protection lying down. Its recent $50 billion acquisition of Alcon (ACL), a developer of eye-care products, as well as the launch of new drugs, will help offset any patent losses. The company expects 2012 revenue to be roughly in line with 2011.

Novartis’ portfolio contains plenty of proven, big-selling drugs. The company’s sales of Afinitor, for the treatment of advanced kidney cancer, leaped 60 percent in the first quarter to $143 million; sales of the chronic leukemia drug Tasigna jumped 39 percent to $209 million; and sales of eye drug Lucentis increased 30 percent to $567 million. Moreover, the company’s Gilenya, the first oral treatment approved for multiple sclerosis, continues to capture market share and generated sales of $247 million during the period.

Novartis’ Alcon unit also performed well, racking up a 5 percent increase in revenue to $2.5 billion. On the downside, the company’s Consumer Health segment endured a 20 percent drop in first-quarter sales to $932 million, stemming from the suspension of its troubled Lincoln manufacturing site. However, the company has now resolved these glitches and expects to resume full-throttle production by mid-year.

Novartis continues to funnel substantial resources into developing new product lines. The company spent $9.6 billion in research and development (R&D) last year, about 16.4 percent of revenue. This R&D commitment is paying off with a deep bench of potentially profitable products. The company recently announced plans to make regulatory filings for more than 60 new drug treatments through 2015.

Novartis also reached an agreement to acquire the Chinese vaccines company Zhejiang Tianyuan Bio-Pharmaceutical Co, as part of a strategic push into the fast-growing and potentially vast vaccine market in China.

In addition to its growth prospects, Novartis sports an attractive dividend yield of 4.49 percent. The company’s earnings yield is around 7 percent, which means it pays out nearly 65 percent of earnings as dividends

© 2011 Copyright John_Persinos - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.