European Debt Crisis "Imagine the Worst and then Double It"

Interest-Rates / Eurozone Debt Crisis Jun 21, 2012 - 04:14 PM GMTBy: EWI

We've all heard the line: Let me give it to you straight.

We've all heard the line: Let me give it to you straight.

And in speaking to his counterparts in Spain, an Irish economist did just that.

Ireland has this banking advice for Spain: imagine the worst and double it. [emphasis added]

Like Ireland, Spain sought a bank bailout after being felled by a real-estate crash. Now, just as the Irish did, the Spanish are awaiting the results of outside stress tests gauging the size of the hole in the banking system.

Bloomberg, June 14

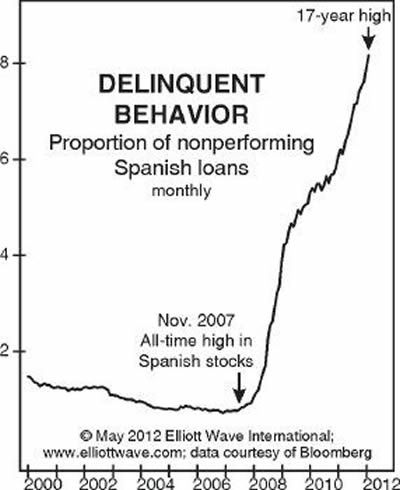

Stress test or no, EWI's Global Market Perspective has known that Spain's banking system is frail. In May, the publication gave its subscribers this chart-supported insight:

A 17-year high in the percentage of non-performing Spanish loans is merely one illustration of the Continent's illness. After falling to a four-decade low of less than 1% in 2007, delinquencies have spiked eightfold in the past five years. The percentage stands at its highest level since 1994.

Global Market Perspective, May 2012

By itself, a subsidiary of Spain's largest bank, Banco Santander, absorbed Q1 bad loan losses of 475-million euros.

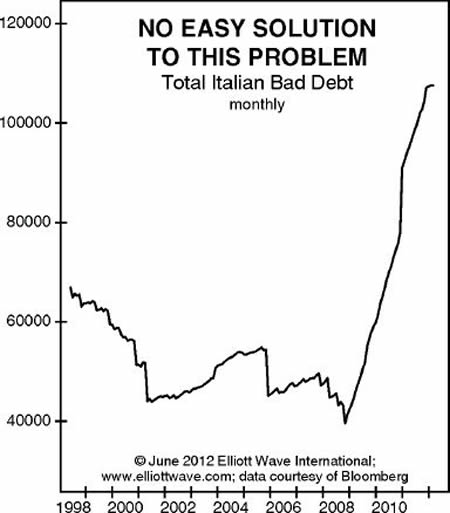

Italy is in the same sinking economic boat. The June Global Market Perspective showed how much the eurozone's third largest economy is also drowning in bad debt.

The Italian and Spanish economies are in shambles as borrowing costs have skyrocketed for both countries.

But the recent spotlight has been on Greece. Now that the Greek election is over and voters appear ready to embrace austerity, should we be optimistic about the future of the euro zone?

You owe it to yourself and your investments to find out. Remember, even if you believe you're not directly invested in Europe, there's a very good chance that some of the companies in your portfolio are.

Get Ahead of What Is Still to Come in This FREE Report from Elliott Wave International The debt crisis in Europe continues to play out in the political, social and financial worlds. What will be next? With commentary and analysis from February 2010 through today, this timely report gives you an important perspective on the European debt crisis and what it could mean for your portfolio. Read Your Free Report Now: The European Debt Crisis and Your Investments >> |

This article was syndicated by Elliott Wave International and was originally published under the headline European Debt Crisis: "Imagine the Worst and Double It". EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.