Fed Downgrades U.S. Economic Outlook and Buys Insurance

Economics / US Economy Jun 21, 2012 - 06:29 AM GMTBy: Asha_Bangalore

Of the Fed's three options available today (do nothing, engage in QE3, extend Operation Twist), it has chosen the diplomatic route. It appears the Fed was concerned that if it took the path of using only language to indicate support it could rock a fragile global financial system. Given that emergency aid could not be justified, QE3 was out of the question at the present time. The Fed has chosen an extension of Operation Twist as it provides insurance and has fewer avenues of criticism. The Fed indicated that an extension of maturities of its Treasury security holdings will not expire as of June but will remain in place until the end of 2012. The expectation is that this action would exert downward pressure on long term interest rates.

Of the Fed's three options available today (do nothing, engage in QE3, extend Operation Twist), it has chosen the diplomatic route. It appears the Fed was concerned that if it took the path of using only language to indicate support it could rock a fragile global financial system. Given that emergency aid could not be justified, QE3 was out of the question at the present time. The Fed has chosen an extension of Operation Twist as it provides insurance and has fewer avenues of criticism. The Fed indicated that an extension of maturities of its Treasury security holdings will not expire as of June but will remain in place until the end of 2012. The expectation is that this action would exert downward pressure on long term interest rates.

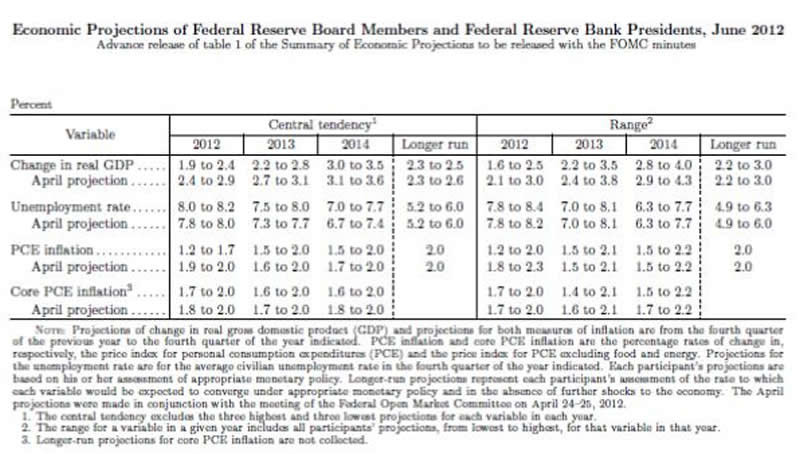

The Fed lowered its forecast of GDP, raised the unemployment rate, and reduced inflation for the forecast period (2012-2014) compared with the projections published in April (see table below).

Source: http://www.federalreserve.gov/newsevents/press/monetary/20120620b.htm

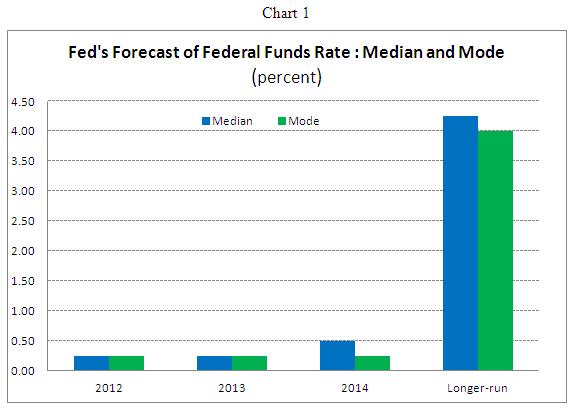

The FOMC also updated its predictions about the course of the federal funds rate for the forecast period. In April, roughly 24% of the FOMC (voting and non-voting members) deemed it appropriate to hold the federal funds rate at the current level in 2014, while in the latest projection nearly 32% predicted an unchanged federal funds rate in 2014. The median and mode of the federal funds rate (0.25%) for 2012 and 2013 were unchanged from the April projection, but the median forecast of the federal funds rate for 2014 dropped to 0.50% in today’s summary of projections from 1.00% in the April publication. The high for the federal funds rate in 2014 is 3.00%, slightly higher than the 2.75% forecast presented in April.

In the policy statement, the Fed moved away from indicating that it would review the “size and composition of its securities holdings and it prepared to adjust these holdings,” to the “Committee is prepared to take further action as appropriate to promote a stronger economic recovery and sustained improvement of labor market conditions in a context of price stability.”

The labor market was depicted to be showing improving conditions in the April policy statement; the Fed stated today that employment growth has slowed. The unemployment rate was seen to have declined but remained elevated in the April policy statement, this rendition was changed to one of more concern by eliminating the downward trend of the jobless rate. Household spending is now viewed to be growing at a slower pace than previously. The housing sector’s description was not changed, it continues to be seen as depressed despite improvements. The downside risk from global financial strains was not changed in today’s statement. Inflation is predicted to hover around levels considered consistent with price stability.

Asha Bangalore — Senior Vice President and Economisthttp://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2012 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.